The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

As the deadly coronavirus continues its spread, the travel bans and social distancing rules adopted by governments around the world have already forced the cancellations of the June men’s fashion weeks in London, Milan and Paris, and the July haute couture shows. Fashion weeks in China, Japan, South Korea, Brazil and Russia have also been called off.

Countries are trying to flatten the growth curve of the epidemic, but for now the health crisis continues to escalate in fashion hubs around the world with no end in sight. Some still believe that fashion month will go ahead this September in the core fashion capitals of New York, London, Milan and Paris. Yet with continued outbreaks and restrictive measures likely to remain in place for some time — even after the pandemic reaches its peak — it’s looking increasingly likely that fashion shows will be cancelled for the duration of the year.

What would a year of no fashion shows mean for the industry?

ADVERTISEMENT

Creativity is still the beating heart of the fashion system. And each season it starts with the shows. They are the primary medium through which designers crystallise and convey their creative visions, which then inform the products that fill stores and the advertising campaigns that support them, as well as other creative content, from window displays to the editorial shoots that appear in glossy magazines.

These days, the shows are also major marketing spectacles. But rather than direct-to-consumer communications that can easily be digitised, these events depend deeply on the live, physical gathering of the “right” people — editors, buyers, celebrities, influencers and other tastemakers — to help conjure, capture and transmit the social, cultural and emotional value that turns mere bags and dresses into powerful objects of desire.

Of course, fashion week also serves as a kind of roving conference for industry professionals, who use the time they spend together each season to exchange information and ideas, make deals and have a collective conversation on the direction of the market. And to some degree, the shows (or, at least, the showrooms that follow) are still integral to the wholesale buying process.

Last week, Shanghai Fashion Week became the first to stage a digital showcase in lieu of physical shows. The event took place on Alibaba's e-commerce platform Tmall and was largely "see now, buy now." More than 150 labels took part, livestreaming small-scale runway shows from their studios, or simply presenting campaign videos shot pre-lockdown or asking friends and influencers to dial into the event wearing their collections. According to organisers, many of the presentations were watched by thousands of consumers. But ultimately this was no replacement for the deep, multi-faceted value created by a traditional fashion week.

To be sure, the more transactional elements of fashion week, like wholesale buying, can be easily done via digital platforms like Joor. Meanwhile, event producers like Alexandre de Betak are experimenting with innovative digital formats, including exclusive online events whose primary value, like traditional shows, ultimately stems from the presence of the "right" attendees. But clearly there's a huge amount that is going to be very hard to replicate digitally.

And, in any case, there is little point in staging fashion weeks (or their digital replacements) when stores are closed, consumer demand has crashed, and it may not make sense for many brands to produce collections in the first place. Shows, like the design and manufacture of the collections themselves, may need to go into what luxury analyst Luca Solca has called "hibernation" until the crisis eventually passes. Indeed, continuing to develop and show fashion in this environment would only result in excess inventory, heavy markdowns and brand dilution.

Many believe this hibernation may provide an opportunity to rethink, or at least optimise, the traditional fashion week system they see as old-fashioned and wasteful. Some have even suggested the seasonal fashion shows held in fashion hubs and secondary markets around the world could be replaced with an Olympics-like model, where the industry picks a single location to hold a major global event each year with interim interactions taking place digitally.

But there is currently no global body to organise such an event and local markets still benefit greatly from staging their own fashion weeks. More importantly, one or two lost seasons is unlikely to be enough to result in such a revolutionary change. When the crisis eventually ends, we may certainly see some brands forgoing shows. Others may opt for smaller shows, with fewer attendees in fewer locations — at least as long as the economic contraction constrains marketing budgets. Some of the smaller fashion weeks that were already under pressure before the epidemic may never resurface, resulting in a more streamlined calendar.

ADVERTISEMENT

But deep change typically happens slowly, and the shows ultimately play such a critical role in the modern fashion industry that, unless the coronavirus catastrophe continues into 2021 or beyond, a major reinvention of the system seems unlikely.

— Vikram Alexei Kansara

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

A closed Chanel store | Source: Stefano Guidi/Getty Images

Chanel to produce surgical masks for France. The Parisian house, which had temporarily closed production sites in France, Italy and Switzerland due to coronavirus, said it would start manufacturing protective gear once prototypes were approved. It joins the likes of Prada, Kering, Prada, Christian Siriano, Brandon Maxwell and Dov Charney in making masks to help with the shortfall; LVMH is sourcing 40 million facemasks from China. But although the items are easy to sew, the process isn't simple.

H&M's March sales plunged by 46 percent. The world's second-biggest clothing retailer reported heavy sales losses last month, as the pandemic forced it to close most of its stores, flag big layoffs and scrap its annual dividend for the first time since its 1974 listing. H&M said it will tap liquidity options and cut operating expenses.

Macy's joins a range of retailers furloughing employees. The American department store will stop paying nearly 130,000 employees as it plans to keep its stores shut, and will bring back employees on a staggered basis once business resumes. The retail sector is bracing for layoffs as store closures and economic turmoil hurt sales: other companies including Kohl's, Gap, Neiman Marcus, Sephora, Everlane and L Brands have also commenced layoffs and furloughs to mitigate large losses.

ADVERTISEMENT

UK businesses to rely on government support. According to a survey, almost half of British companies expect to furlough 50 percent or more of their workforce and therefore lean heavily on a government scheme that will pay up to 80 percent of employee wages. As the UK gets through the second week of a government-imposed lockdown, the survey showed 44 percent expect to furlough at least half their workers within a week, and 32 percent expect to furlough between three-quarters and all their workforce.

Bangladesh to lose $6 billion in export revenue. The second-largest apparel producer after China is set to lose billions in export revenue this year as the world's largest retailers cancel orders amid the coronavirus pandemic. This will jeopardise millions of jobs in the poor South Asian nation, which has already lost more than $3 billion due to the crisis according to Mohammad Hatem, vice president of Bangladesh Knitwear Manufacturers and Exporters Association.

India's migrant labourers face police backlash after defying Covid-19 lockdown. Hundreds of thousands of workers — many of whom work in India's now shuttered textile industry — were sprayed with tear gas by police as they attempted to head to their homes in the countryside on foot after losing their jobs. The country's humanitarian crisis was triggered by Prime Minister Narendra Modi's 21-day nationwide lockdown, leaving hundreds of thousands of poor without jobs and hungry.

Fashion executives brace for pain but remain optimistic for the long term. According to a recent survey of over 400 business leaders within BoF's community, senior managers have a nearly unanimously grim outlook on how the pandemic will affect business performance this year, with fifty percent of respondents saying it would affect their operations "very negatively." However, two thirds had confidence in their company's ability to withstand the shock and rebound when the current crisis eventually ends. Roughly a third were "very confident" in their longer-term outlook.

THE BUSINESS OF BEAUTY

Sephora make up and perfume store | Source: Shutterstock

Sephora announced layoffs. The retailer, which closed its stores last month, laid off 3,000 US employees who worked limited hours.

The coronavirus pandemic is hitting beauty service workers and businesses particularly hard. Hair salons, nail salons, aesthetic establishments and their employees face a unique set of challenges as these high-touch businesses are shut down indefinitely to protect both workers and customers from potential coronavirus infection and to contain its spread.

Rihanna announces Fenty skincare expansion. The musician and founder of the wildly successful Fenty makeup range, created under LMVH's Kendo division, told British Vogue that Fenty Skin will launch "imminently."

PEOPLE

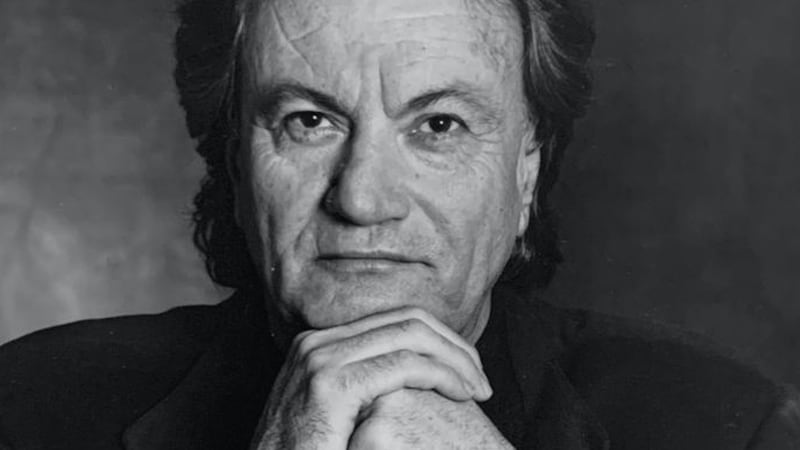

Sergio Rossi | Source: Sergio Rossi

Sergio Rossi dies at age 84. The acclaimed shoe designer passed away after contracting Covid-19 and being hospitalised in Cesana, Italy for days. Rossi started his own namesake footwear trade in 1968 and went on to become an iconic figure in the fashion industry, designing shoes for Versace, Dolce & Gabbana and Azzedine Alaïa in the 1990s. He is survived by his son, Gianvito Rossi, who launched his own business in 2006 after years working by his father's side.

Cosmopolitan names its new beauty director. Julee Wilson joins the title effective April 1 from Essence, where she was global beauty director, and formerly worked at Huffington Post and Real Simple. She reports to editor-in-chief Jessica Pels.

Ted Baker appoints permanent CEO. Initially joining the company in November 2019 as chief financial officer, UK retail veteran Rachel Osborne, who previously worked at John Lewis and Debenhams, has assumed the top job. She succeeds Lindsay Page, who stepped down in December 2019 after a string at profit warnings at the troubled retailer. In addition to navigating a challenging retail landscape, Ted Baker has been through several management issues, namely misconduct allegations against Founder Ray Kelvin, and a balance sheet error amounting to £58 million ($76 million).

EssilorLuxottica's Laurent Vacherot retires. The chief executive of Essilor, part of the eyewear giant that owns Ray-Ban and numerous luxury brand licences, is stepping down with immediate effect. Essilor Deputy Chief Executive Paul du Saillant has been named his successor.

MEDIA AND TECHNOLOGY

Amazon warehouse worker | Source: Amazon media library

Amazon comes under pressure to protect warehouse workers. New York legislators, unions and Amazon employees themselves were among those calling for the online retailer to close its warehouses until it could meet health and safety requirements, scrap productivity targets for staff and pay workers affected by warehouse closures. The e-commerce giant is one of several players in the sector to come under fire for the working conditions of its fulfillment centre staff during the spread of Covid-19, as sanitation and social distancing are a growing concern.

Highsnobiety announces layoffs. Founder David Fischer announced that one quarter of staff, including the e-commerce team, were laid off Tuesday as the streetwear media company is trying to manage the fallout of the coronavirus crisis. The news comes as the wider media industry braces itself for a significant cut in revenue as advertisers and affiliate partners, already reeling from shuttered stores and declining sales, slash their advertising budgets.

The Modist shuts down. Founder Ghizlan Guenez said in a statement posted to Instagram that "the global crisis that has hit the world has left our young business vulnerable with no option but to cease operating." Initially launched on International Women's Day in March 2017 with 75 brands, the luxury online retailer specialised in modest clothing, partnering with Farfetch in 2018 and releasing in-house line Layeur the same year.

Patek Philippe goes online. The luxury watchmaker allowed its stockists to sell select models on their websites, as lockdowns and social distancing rules leave offline-only brands little choice but to pivot to e-commerce.

Moda Operandi shutters its men's business. The luxury online retailer, which initially launched its menswear offering in June 2018, will focus on its core womenswear, fine jewellery and homeware business to weather the economic fallout of Covid-19. The company also said that staff who sit on the menswear side of the business will remain employees until the end of June.

Zalando cuts spending amid coronavirus. As widespread lockdowns hamper sales and profitability, Europe's biggest fashion retailer said it will cut back on investment, but plans to waive commission fees for all brick-and-mortar stores that sell through its site. Zalando also said it expects first quarter earnings to be significantly below analyst expectations and is unsure about meeting full-year projections initially set out in late February, but that its cash balance of over €1 billion ($1.10 billion) leaves it better-positioned than many industry players.

Next shutters e-commerce operations indefinitely. The British retailer, which previously said it could weather a £1 billion ($1.2 billion) hit to its business due to the coronavirus, said it had decided to temporarily close its warehouses and distribution facilities until further notice after careful dialogue with staff.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From where aspirational customers are spending to Kering’s challenges and Richemont’s fashion revival, BoF’s editor-in-chief shares key takeaways from conversations with industry insiders in London, Milan and Paris.

BoF editor-at-large Tim Blanks and Imran Amed, BoF founder and editor-in-chief, look back at the key moments of fashion month, from Seán McGirr’s debut at Alexander McQueen to Chemena Kamali’s first collection for Chloé.

Anthony Vaccarello staged a surprise show to launch a collection of gorgeously languid men’s tailoring, writes Tim Blanks.

BoF’s editors pick the best shows of the Autumn/Winter 2024 season.