The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

After bubbling up for months, speculation mounted during the recent men's fashion month that the Italian luxury goods maker was exploring a sale to Kering, LVMH or even Richemont. Reports also spread that designer Raf Simons was set to join Prada Group SpA in some capacity.

The rumours followed a small but notable change in the parent company's structure this past October, when it bought four key Prada brand stores in Milan that were previously owned by the Prada family and operated through franchise agreements. Any future acquirer would want these stores, especially its first location open since 1913. Was this consolidation a sign of something to come?

A representative for Prada denied a forthcoming sale and declined to comment on Simons' potential arrival. Representatives for Kering and Richemont declined to comment. At its annual results presentation this week, LVMH Chairman and Chief Executive Bernard Arnault brushed off the rumours when asked.

ADVERTISEMENT

Prada's Chief Executive Patrizio Bertelli, who controls 80 percent of the business with partner and designer Miuccia Prada, has for years rebuffed any intentions to sell the company.

Even if all the recent Prada related speculation is just that, the luxury brand's future may depend on plugging into one of the all-powerful luxury conglomerates.

Prada, the brand, is bigger than Prada, the business, making it an attractive asset for prospective buyers.

Prada, the brand, is bigger than Prada, the business, making it an attractive asset for prospective buyers. Prada's logo may not have quite the same name recognition as the Louis Vuitton "LV," but the brand is one of the oldest and most respected Italian houses in luxury. Miuccia Prada's men's and women's collections continue to earn praise from critics and creatives. And the company has potential to grow, as it is still much smaller than many of its heritage peers including Gucci and Louis Vuitton.

“It’s one of the biggest luxury brands in the world: If they make a phone call to Avenue Montaigne or to the headquarters of Kering, they will have an answer,” said Mario Ortelli, managing partner of luxury advisory firm Ortelli&Co. “But who decides the future are Miuccia Prada and Patrizio Bertelli.”

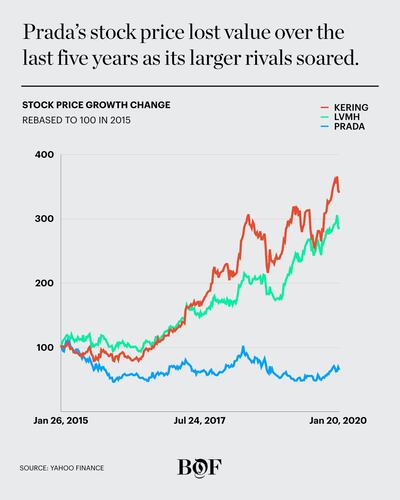

Indeed, the business is deeply personal to Prada and Bertelli, and they are not facing any external pressure to sell it. And with the share price down 35 percent over the last five years, the timing isn’t ideal now either.

But Prada has suffered from strategic missteps in recent years, and would benefit from the management muscle that a big conglomerate would bring.

Despite efforts to adapt to industry shifts in distribution and communications, Prada was too late to recognise these key changes, investing in additional stores when competitors started prioritising online sales.

Merchandising has also been a problem. Despite having the historical bona fides to lead the latest streetwear luxury wave — the 1990s hit Linea Rossa line established the movement then — the brand cut back on entry-level price point products just as competitors established themselves in the key sneaker and athleisure categories and courted Chinese shoppers.

ADVERTISEMENT

By the time Prada relaunched its Linea Rossa line in 2018 and partnered with Adidas in 2019, the luxury streetwear trend was already well-trod territory for Louis Vuitton and Balenciaga.

Prada’s recent challenges first became painfully apparent in 2016, when revenues decreased 10.3 percent on constant exchange rates to €3.2 billion, down from €3.5 billion in 2014.

A turnaround plan is ongoing, with focus on moving more sales from wholesale to direct retail, reducing markdowns and enforcing a greater control over prices. In 2018, Prada started an invitation-only pop-up club series called Prada Mode, as part of an effort to extend the community of creatives around the brand.

But the financial results are still underwhelming. Revenue in the first half of 2019 was flat year-over-year for the group and for Prada the brand, which represents more than 80 percent of sales. Retail sales decreased after the brand stopped all promotions and discounts in January 2019, but full-price retail sales grew slightly. Handbag sales were flat. Meanwhile, the company closed 10 stores and opened 11, and is planning about 50 store renovations and relocation projects.

Prada's wholesale revenue was more positive in the period, as it continues to work with multi-brand e-commerce players like MyTheresa and Net-a-Porter, partners only since 2016. But a wholesale rationalisation strategy kicked off in the second half of 2019, reducing the amount of product available via these retailers by 50 percent for the spring 2020 season, according to Bertelli's remarks to analysts in August 2019.

Some analysts have recommended an organisational refresh, including new leadership, as well as new approaches in merchandising and branding.

But regardless of what headway Prada is able to make, operating independently in the luxury business is an increasingly uphill battle as the industry continues to consolidate under the umbrellas of LVMH, Kering and Richemont, which wield greater negotiating power with outside partners and have strong networks of executives and designers.

Even Moncler, with its double-digit, Genius project-fueled growth, has been the subject of sale rumours.

ADVERTISEMENT

Surviving independently requires risk-taking, Ortelli said, and risks are harder to take when the competitors are so far ahead. “To take market share away from the other major brands like Gucci, Louis Vuitton and Saint Laurent is very difficult when, as in the last years, they are having a great momentum” he said.

With the support of LVMH or Kering as a parent company, however, Prada could accelerate its modernisation efforts, taking advantage of those companies’ more developed e-commerce capabilities and tapping into a network of trained luxury executives who would bring new leadership to the company. And it could benefit from less public exposure as it takes time to invest for long-term success.

What happens after Miuccia, whenever that may be?

All of these concerns are secondary to the main question looming over Prada: what happens after Miuccia, whenever that may be? The designer has been the creative force of the business since 1978 — its entire expansion into hit handbags, footwear and ready-to-wear. And historically, the transition at a namesake brand from the founding designer to successors is a turbulent one. Valentino Garavani’s first successor, Alessandra Facchinetti, butted heads with management and left after two seasons. In the years after Yves Saint Laurent’s death, the brand was challenged and ebbed and flowed under a series of different creative directors and chief executives.

“For [namesake] brands, the change of the founding designer is always the most complex phase, and it requires a long time to be realised successfully,” said Ortelli. “If you are an independent company you are in the spotlight. If you are part of a group you can more easily take time.”

Prada and Bertelli, now both in their 70s, have not publicly addressed succession plans and did not appear to have a strategy in place until their son Lorenzo Bertelli joined the company as head of digital communication in September 2018. His arrival signalled that the company may keep the business in the family moving forward, and he may be ambitious enough to lead a more effective turnaround independently.

“A brand like Prada has the size and the strength to survive independently,” said Ortelli. “It is a question of willingness.”

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Kobe Bryant unveiling his All-Star 2006 Nike Kobe I basketball sneakers on February 16, 2006 in Houston, Texas. | Getty Images

Kobe Bryant's unexpected death sends signature sneaker prices soaring on resale sites. Within minutes of reports of Bryant's death, a pair of his Slam Dunk Contest shoes sold on resale platform StockX for $1,199 — a 600 percent increase over the previous sale nine days earlier. This is creating a dilemma for resale platforms, who don't want to be seen as profiting off the death of a beloved celebrity but are reluctant to interfere in the marketplaces that drive their business.

Pucci to adopt Moncler's Genius model. Pucci, which has been without a creative director for almost two years, is planning to work with guest designers on its main collections, starting with Koché's Christelle Kocher. For Moncler, the strategy has helped introduce the brand to a younger demographic. But whether Pucci's approach will work depends on its ability to deliver desirable products and execute an effective marketing strategy.

Nordstrom launches secondhand clothing sales. The Seattle-based department store becomes the latest retailer to dabble in the burgeoning resale market, which grew to $28 billion last year. Nordstrom's resale experiment is only the latest effort by the company to breathe new life into the department store model. Since sales rose in 2018, Nordstrom has seen uneven progress in recent quarters. Multi-brand retailers are suffering as a group, as consumers can find many of the same products online, and brands drive more sales through their own websites and stores.

LVMH's sales growth slows slightly. The company, which posted record revenues and profits for the whole of 2019, missed analysts estimates by 1 percent in the fourth quarter due in part to ongoing political unrest in Hong Kong. In a presentation with analysts, Chief Executive Bernard Arnault said 2020 is likely to bring further disruptions. Key takeaways include that Tiffany is tasked with doubling in the next decade, and Hedi Slimane's Celine and Fenty are off to a slow start.

Canadian brands hope to cash in on the "Meghan Effect." Experts speculate that the Sussexes' move to North America could bolster the country's fashion industry by spotlighting homegrown labels. Canada could boost its C$30.6 billion ($23.3 billion) fashion industry, experts say, which is particularly welcome after a recent 2.1 percent decline in local retail sales of clothing and accessories.

Levi's shuts half its China stores on coronavirus outbreak. The American denim label, which gets about 3 percent of its revenue from China, will take a near-term financial hit as a result of the epidemic. This comes a few months after Levi's opened its largest store in the central Chinese city of Wuhan, the epicentre of the coronavirus epidemic which has killed about 170 people, marring its plans to tap into the city's 11 million-strong population.

Report: L Brands chief executive in talks to step aside and sell Victoria's Secret. The move comes as the nearly $6 billion company faced slumping sales at the lingerie giant for at least four quarters. L Brands has tried to update the marketing strategy for Victoria's Secret and cancelled its annual fashion show late last year after accusations of cultural appropriation, objectification of women and a lack of diversity on the runway.

Ferragamo's annual sales increased for the first time since 2015. The 1.3 percent year-over-year rise in 2019 is a sign that a turnaround plan under Chief Executive Micaela Le Divelec is starting to bear fruit. A former Gucci executive, Le Divelec started as chief executive at Ferragamo 18 months ago and has been working to rejuvenate the brand by investing in new products and digital marketing.

Swatch group braces for Hong Kong slump. The Swiss watchmaker's sales took a hit, dropping 2.7 percent to 8.24 billion francs (around $8.5 billion). Swiss watch sales have underperformed other luxury goods as political protests shook Hong Kong. Smartwatches have also taken market share from similarly priced Swiss watches. Changes in distribution also took their toll.

THE BUSINESS OF BEAUTY

LVMH Luxury Ventures is an investor in Versed, a "clean" skincare brand | Source: Courtesy

LVMH invests in Versed, a "clean" beauty brand. Versed recently closed an $11 million Series A, becoming a fast-growing mass label with most products priced at or below $17.99, and some under $10. At just eight months old, Versed is the youngest and least "luxe" company in the fund's portfolio, which also includes sneaker reseller Stadium Goods, Gabriela Hearst's luxury label and French beauty brand L'Officine Universelle Buly.

Estée Lauder announced leadership shakeup. Estée Lauder Companies has made a number of internal appointments across its brand portfolio, promoting Justin Boxford to global brand president, La Mer; Philippe Pinatel to global brand president, MAC Cosmetics; Deborah Royer to global brand president and chief creative officer, Le Labo; and Christopher Wood to president, North Asia for Dr Jart+ and Do The Right Thing.

PEOPLE

Karl-Johan Persson | Source: H&M Media Gallery

H&M chief executive steps down amid reshuffle. H&M President and Chief Executive Karl-Johan Persson is stepping down to succeed his father, Stefan Persson, as chairman. Helena Helmersson, previously chief operating officer at the Swedish retailer, replaces Persson as the company's first female chief executive as of January 30. She is also the first non-family member to assume the role at the company.

J.Crew names former Victoria's Secret head Jan Singer chief executive. The seasoned executive's appointment is the result of a search that took more than a year. J.Crew sales have plunged in recent years, and the brand is planning a spinoff of the more-successful Madewell. Before her time in the top job at Victoria's Secret, Singer was chief executive of the women's shapewear brand Spanx, and previously worked at Nike for over a decade. She will join J.Crew on February 2.

Levi's adds Apple data scientist to board of directors. Levi Strauss & Co. has appointed Yael Garten, director of Siri data science and engineering for Apple, to its board of directors. Garten is also an advisory board member at Northwestern University.

MEDIA AND TECHNOLOGY

Farfetch gets $250 million investment from Tencent and Dragoneer. The luxury online marketplace says it will use the money to expand in China as it looks to reach profitability. Farfetch is competing in a crowded market for luxury e-commerce, facing off with Net-a-Porter, MatchesFashion and potentially Amazon. Some analysts and investors are sceptical of Farfetch's growth plans, as the company has made a series of unexpected acquisitions and has yet to turn a profit.

H&M says data protection breaches are unacceptable. The company is cooperating with the local data protection supervisory authority in its investigation into security breaches found at its German unit. It has been reported that H&M collected information on illnesses and other personal circumstances of employees at the H&M Customer Centre for Germany and Austria.

UPS to double down on weekend deliveries. The package carrier aims to keep pace with Amazon, which itself delivered 3.5 billion packages globally last year. The average volume of overall US weekend deliveries doubled to 13.5 million units between 2013 to 2019 as online sales surged 127 percent to almost $591 billion in 2019. As a result, UPS added Sunday to its weekend services at the start of this year.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.