The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Fashion Start-Ups Report Results

For much of the last 18 months, e-commerce platforms and brands have had the wind at their backs. First, the lockdowns drove a boom in online shopping. Then, the lifting of lockdowns sparked a spending spree at retailers online and off. But that phase may be coming to an end, at least for online shopping platforms. Amazon and Shopify reported disappointing sales for their most recent quarters. The news hasn’t been all bad for e-tailers: Revolve’s sales surprised on the upside, and mostly online brands like Warby Parker and Allbirds saw huge appetite for their shares in recent IPOs.

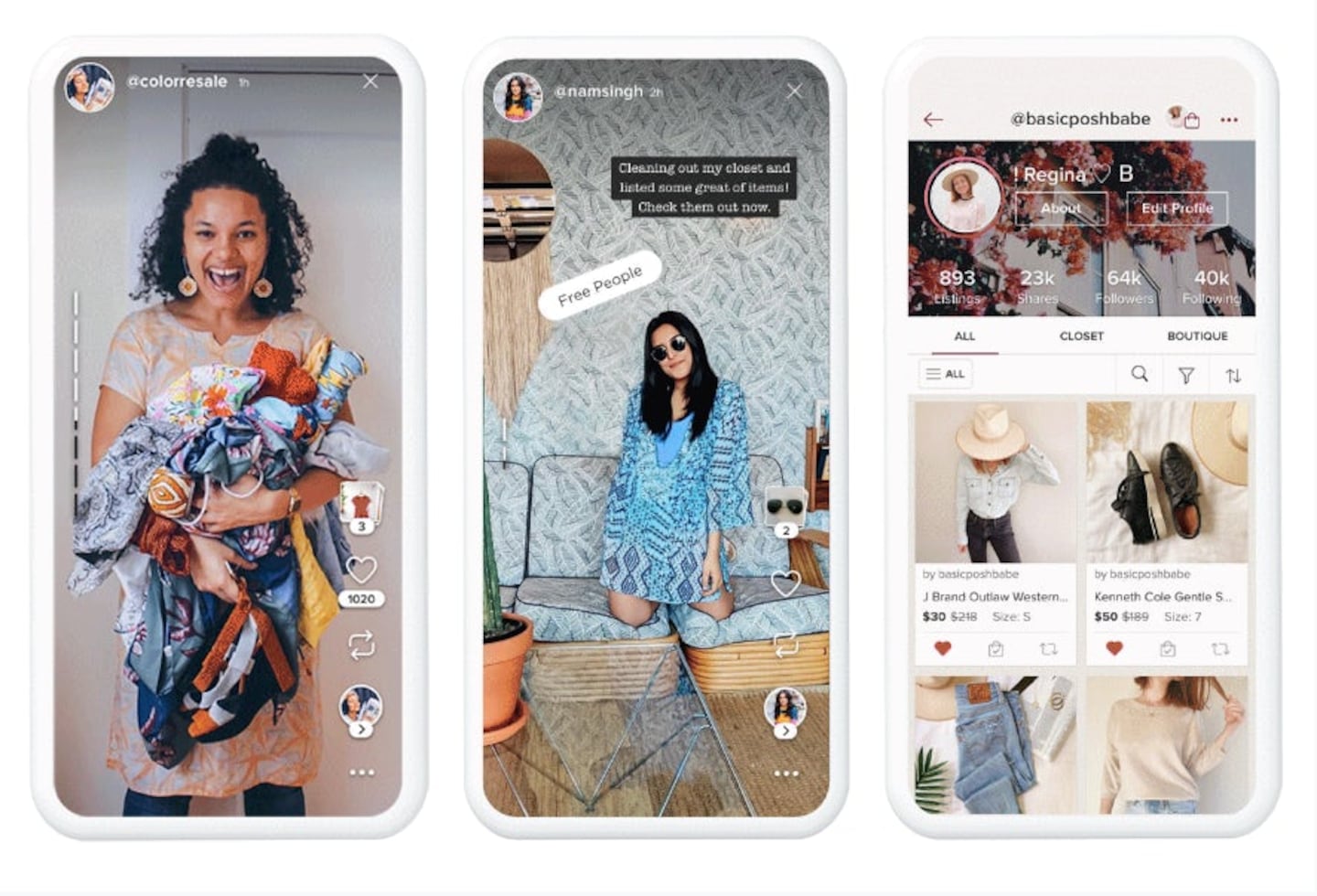

What’s this all mean for the brands reporting results this week? Warby Parker and Allbirds have sold investors on a long-term strategy where sales growth will increasingly be driven by a global network of hundreds of stores — whether they experience a few late-pandemic bumps is unlikely to change that narrative. The trio of resale platforms in the spotlight next week are a different story: like Shopify sellers or Amazon, they benefitted from always-online consumers. However, they should see renewed interest as customers shop for more varied post-pandemic wardrobes, and the long-term embrace of resale by younger consumers shows no signs of slowing down.

The Bottom Line: The question, as always, is how much they will need to spend to find those customers. Even Revolve reported escalating marketing costs, and Apple’s new privacy requirements make it harder to track consumer tastes.

ADVERTISEMENT

Change the Message

Alibaba invented the current iteration of the Singles Day holiday, a multi-week shopping extravaganza that generates over $100 billion for Chinese retailers. This year, it’s keeping an uncharacteristically low profile, or as low as an e-commerce giant with a half-trillion-dollar market cap can muster. According to Alibaba’s marketing, Singles Day is now all about sustainability and “supporting vulnerable populations.” Alibaba’s shifting priorities come as the company is in the crosshairs of China’s government, which is reining in its tech giants and cracking down on income inequality. Singles Day is in many ways the nexus of both, hence the new messaging (though Alibaba and its competitors are still going ahead with the weeks of promotions, celebrity endorsements and other staples of the event). Some analysts say the pressure on Alibaba, as well as rival behemoth JD, creates an opportunity for smaller retailers.

The Bottom Line: It’s also worth considering the sustainability message itself, independent of its possible origins. Retailers of all sizes, and all over the world, see green marketing as a tool to win customer loyalty. But consumers increasingly demand real action to reduce waste and fight climate change to back up the ad copy. A sustainable Singles Day may be a tough sell.

The CFDA Awards

It’s been a tough stretch for American fashion. Even before the pandemic, designers struggled to build their businesses in an international landscape dominated by European conglomerates and a crowd of online start-ups competing for customers at home. Last summer’s protests brought the industry’s diversity shortcomings to the fore. The CFDA, tasked with supporting designers and generally advocating for the industry, can’t fix these problems, but it does have a few levers it can pull. An in-person New York Fashion Week in September helped fashion move beyond the pandemic, and The CFDA Awards, back as a physical event for the first time since 2019, are another vehicle for that. Among the nominees are designers seen as possible future standard bearers (Telfar Clemens, Emily Adams Bode, Peter Do), Americans who have recently found a measure of international success (Jerry Lorenzo, Mike Amiri) and the veteran boldface names on the scene (Mary-Kate and Ashley Olsen, Gabriela Hearst, Thom Browne).

The Bottom Line: Physical events won’t save American fashion, but their rapid return is a sign of their continued value to the industry.

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Brands are using them for design tasks, in their marketing, on their e-commerce sites and in augmented-reality experiences such as virtual try-on, with more applications still emerging.

Brands including LVMH’s Fred, TAG Heuer and Prada, whose lab-grown diamond supplier Snow speaks for the first time, have all unveiled products with man-made stones as they look to technology for new creative possibilities.

Social networks are being blamed for the worrying decline in young people’s mental health. Brands may not think about the matter much, but they’re part of the content stream that keeps them hooked.

After the bag initially proved popular with Gen-Z consumers, the brand used a mix of hard numbers and qualitative data – including “shopalongs” with young customers – to make the most of its accessory’s viral moment.