The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When it came to shopping in 2020, when much of the world’s global population was homebound during the pandemic, the year may be best remembered for the jump in popularity in sweatpants. But few categories were as resilient last year as skin care.

Facial creams and oils had already eclipsed foundation and mascara in popularity in recent years, and now with fewer public engagements to justify eyeshadows and lipsticks, public fascination with smoothing wrinkles and erasing pimples has only intensified. For the uninitiated, there had never been so many online forums and “skinfluencers,” or amateur experts with large digital followings, to turn to for advice and recommendations.

Skin care is now the largest business within beauty, representing 30 percent of the global market in 2019, according to McKinsey & Company, growing 6.4 percent year-over-year in 2019 to $140 billion globally, according to Euromonitor.

But brands that want a slice of those sales are having to radically adjust their pitch to consumers. Aspirational language — think Olay’s “because younger-looking eyes never go out of fashion” campaign from a decade ago — is out, and technical-sounding jargon is in.

ADVERTISEMENT

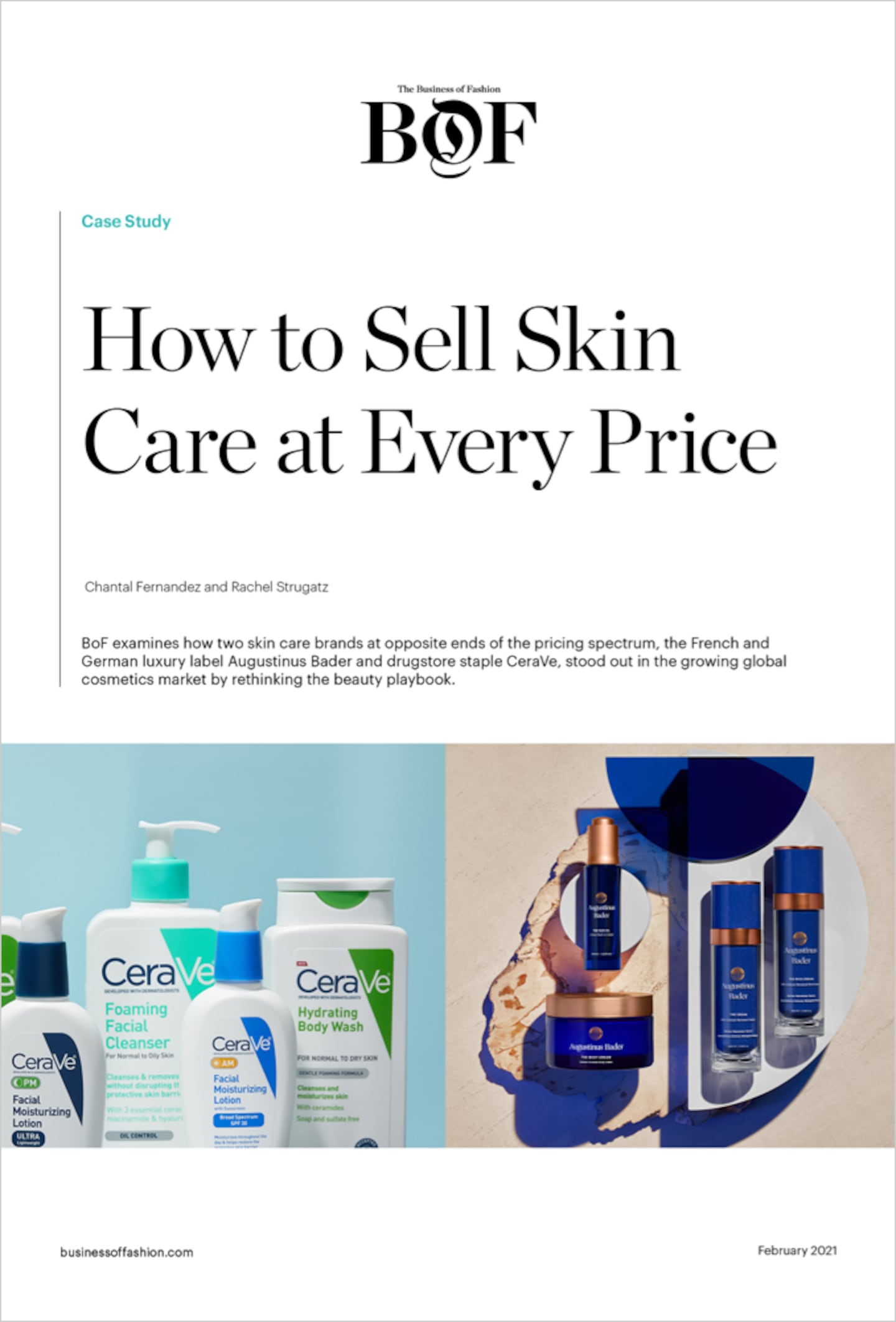

Amid all this activity, two skin care brands stood out in the market, albeit with very different approaches. Both Augustinus Bader, the ultra-luxury French and German brand co-founded by a stem cell researcher, and CeraVe, the drugstore and dermatologist office mainstay turned Gen-Z favourite, took off because their strategies reflected how consumers’ expectations and relationships with skin care brands have evolved.

After several years in which “clean” and “natural” brands were on the upswing — drawing consumers in with their pledge to avoid certain ingredients they deem toxic — the momentum has shifted to “clinical” brands. These companies offer products containing ingredients more likely to be found in a lab than a garden, such as retinol and peptides, and often have ties to the medical or pharmaceutical worlds.

Beauty products have always had a complex relationship with science: cosmetics aren’t regulated like medicine. But the more brands embrace the language of science and turn influencers and consumers into believers who recommend their products to others, the larger an audience they will find.

In this case study, we examine how Augustinus Bader and CeraVe found their customers, and in the process helped shift the centre of the beauty world from natural to clinical products. Through smart approaches to product development, marketing and distribution, they achieved success in an increasingly competitive and digitally driven beauty sector.

Click below to read the case study now.

Landing a retail partnership is often seen as a major milestone for beauty founders — but it brings a bevy of new challenges, from the logistical complexities to setting a marketing budget. Black entrepreneurs, who typically have far less capital to work with, often face tough choices.

The firm has been working on a listing since at least 2022, with previous attempts buffeted by volatile markets.

In a three-part series, The Business of Beauty explores how Black founders Monique Rodriguez, Danessa Myricks and more built, launched and scaled their multi-million-dollar businesses. In part one, a look at how these entrepreneurs found their niche and harnessed early lessons that were critical to their growth

There’s something both innocent and concerning about 13-year-olds’ obsession with skincare. Kids will always want to find new ways to express themselves, but the beauty industry has a responsibility to protect its youngest customers.