The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

PayPal is exploring an acquisition of social media company Pinterest, people with knowledge of the matter said.

San Jose, California-based PayPal has recently approached Pinterest about a potential deal, the people said, asking not to be identified because the talks are private. The companies have discussed a potential price of around $70 a share, the people said.

That would value Pinterest at about $45 billion for the entire company, including its Class B shares. A deal at that level would represent about a 26 percent premium to Pinterest’s Tuesday closing price of $55.58.

Pinterest shares surged 13 percent to $62.92 each at 2:09 p.m. in New York trading Wednesday, after earlier triggering a trading halt. Shares of PayPal were down 5.7 percent, giving the company a market capitalization of about $301 billion.

ADVERTISEMENT

A boom in online shopping has helped PayPal stock more than double since the start of last year, giving the company a strong currency it could use for acquisitions.

PayPal’s interest comes at a complicated time for Pinterest. The social media company announced this month that co-founder Evan Sharp, who oversaw its design and product teams, is stepping down. It’s also been dealing with a number of accusations from former employees that Pinterest discriminated against female workers.

Pinterest went public in an April 2019 initial public offering valuing the company at just over $10 billion.

Terms of a transaction could still change, and there’s no certainty the talks will lead to an agreement, the people said. A representative for PayPal didn’t respond to a request for comment, while a spokesperson for Pinterest couldn’t immediately comment.

Super App

PayPal has set its sights on becoming the world’s next “super app,” a one-stop shop for all things shopping and finance, akin to China’s Alipay or WeChat, India’s Paytm or Singapore’s Grab. In recent months, the firm has said it would add a bevy of new services to its revamped app, including high-yield savings accounts, check-cashing services and stock-investing capabilities.

With those changes, the payments giant has said it expects the number of active users on its sprawling platform to climb to 750 million, from 403 million, by the end of 2025. If Chief Executive Officer Dan Schulman is able to pull it off, the company could become an even more central part of consumers’ lives, like a Facebook or an Amazon.com.

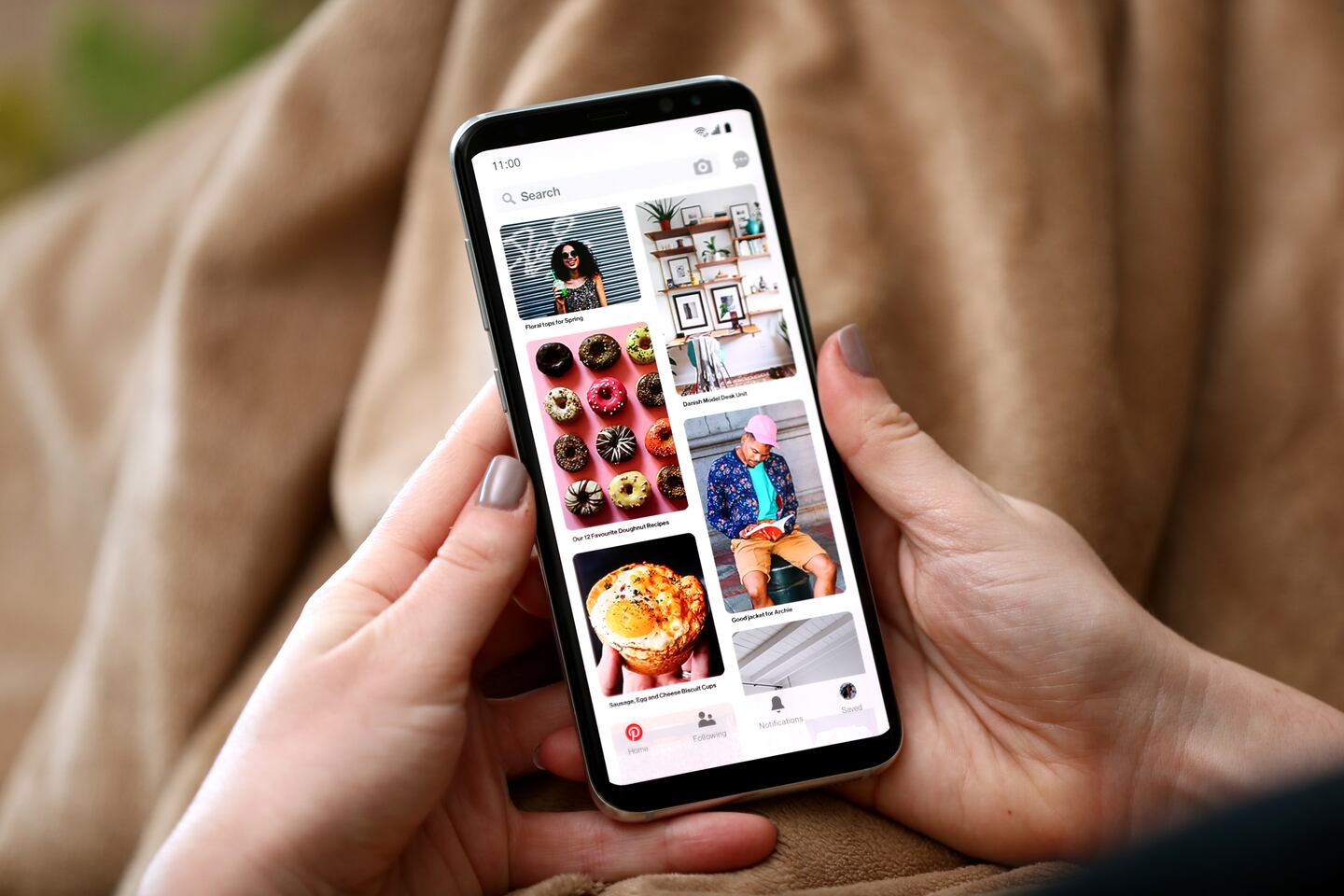

Pinterest offers a visual search and scrapbooking platform where users can save, collect and group images by themes. It benefited in the early stages of the pandemic as advertisers flocked to social media sites to woo a captive audience that embraced a shift to e-commerce.

ADVERTISEMENT

The company has been introducing new tools to help creators make their “pins” shoppable, drawing a more direct connection between content on Pinterest’s site and online purchases. Pinterest shares hit an all-time high in February, but they have since fallen as usage slowed with the easing of Covid-19 restrictions. In July, Pinterest reported monthly active users for the second quarter that missed the average analyst estimate and said it had a lack of visibility on key engagement drivers going forward.

“We see how it can make sense for the company,” Sanjay Sakhrani, an analyst at Keefe Bruyette & Woods Inc., wrote in a note to clients. “Pinterest could enhance engagement between consumers and merchants with PayPal being a central facilitator in the commerce journey, thereby feeding into the company’s vision of being a super app.”

PayPal’s appetite for acquisitions has been increasing in the past few years as it snapped up competitors and moved into new markets. It purchased European small-business commerce platform iZettle in 2018 as part of a bid to better challenge Square Inc.

The next year, PayPal bought price-comparison app Honey Science Corp. for $4 billion, gaining access to valuable data on consumer buying habits through its largest-ever deal. The company agreed in September to acquire Japanese startup Paidy Inc. for 300 billion yen ($2.6 billion) to deepen its push into “buy now, pay later” offerings.

By: Ed Hammond and Liana Baker

Learn more:

How to Work With TikTok Talent

Fashion has struggled with how to leverage influencers on TikTok. But the sooner brands let go of the playbook that works on other platforms, the better off they’ll be.

Join us for a BoF Professional Masterclass that explores the topic in our latest Case Study, “How to Turn Data Into Meaningful Customer Connections.”

Social networks are being blamed for the worrying decline in young people’s mental health. Brands may not think about the matter much, but they’re part of the content stream that keeps them hooked.

After the bag initially proved popular with Gen-Z consumers, the brand used a mix of hard numbers and qualitative data – including “shopalongs” with young customers – to make the most of its accessory’s viral moment.

At The Business of Fashion’s Professional Summit in New York last week, Sona Abaryan, partner and global retail and luxury sector lead at tech-enabled data science firm Ekimetrics, shared how businesses can more effectively leverage AI-driven insights on consumer behaviour to achieve a customer-centric strategic approach.