The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

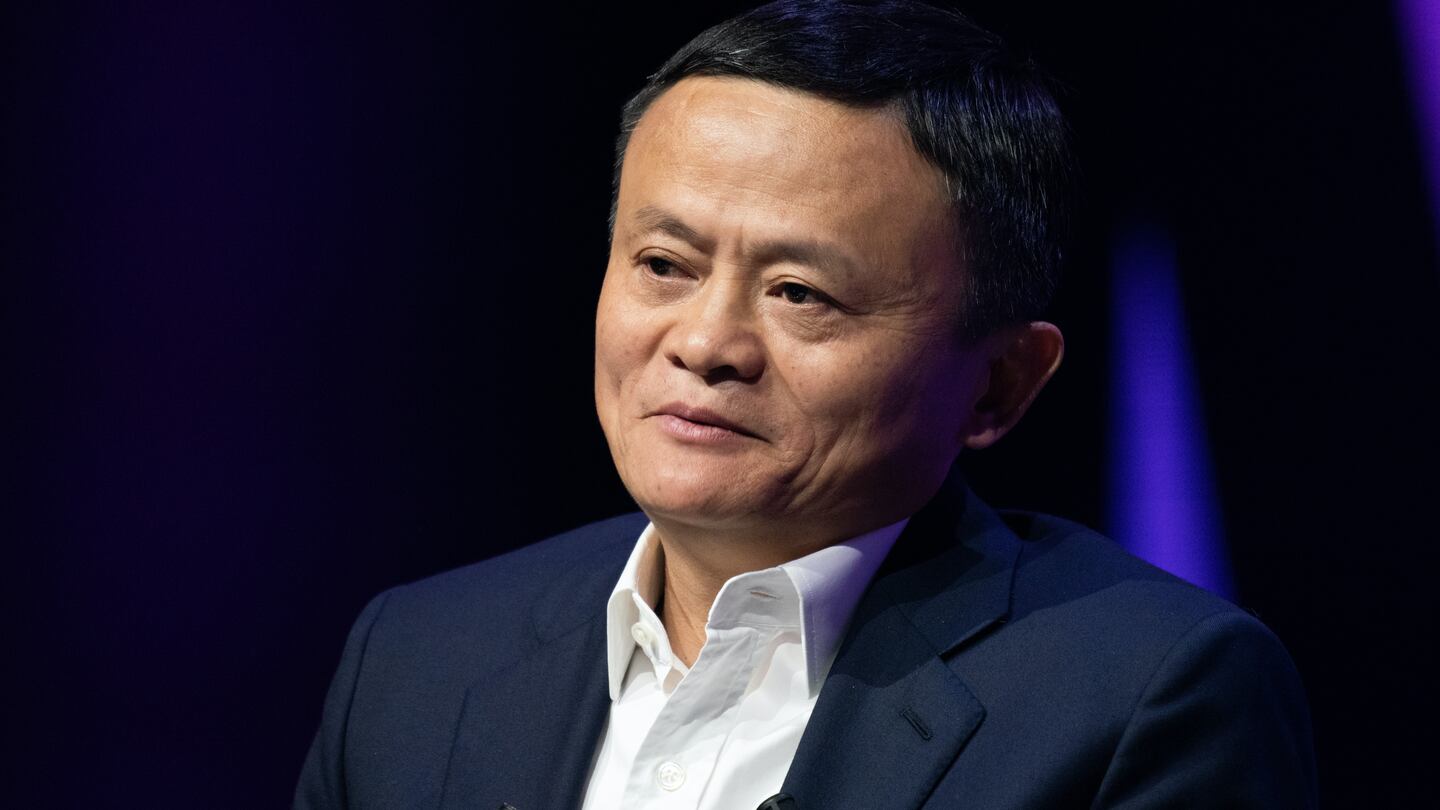

A video of Jack Ma addressing teachers on Wednesday spurred the biggest stock rally in six months for Alibaba Group Holding Ltd., the retail behemoth he co-founded two decades ago.

The stock rose as much as 11 percent in Hong Kong, adding the equivalent of about $63 billion to Alibaba’s market value. More than 85 million shares had changed hands by 3:00 pm, or about 2.5 times the three-month average for a full day. Alibaba Health Information Technology Ltd., which is controlled by Alibaba, surged as much as 18 percent.

Here’s how investors and analysts reacted to the news:

Alex Wong, director of asset management of Ample Capital Ltd.

ADVERTISEMENT

It just takes one catalyst to spark a surge in Jack Ma-related shares when the broader market sentiment in Hong Kong is this good. We bought shares of Alibaba yesterday so we won’t buy more right now. The main concern is regulation targeting Ant Group — as long as the policy risk doesn’t change significantly, Alibaba will be fine. The downside risk is mostly priced in but we don’t see a limit to the upside, especially as Alibaba is yet to be added to the stock connect links that are attracting a lot of cash.

Justin Tang, head of Asian research at United First Partners in Singapore.

The annual event is the perfect setting for Jack to reappear in the public spotlight. The backdrop sees Jack in his roots as a humble school teacher versus being a haughty entrepreneur that doesn’t know his place. The whole scene allows Jack to show contriteness without being scripted.

Wei Wei Chua, a portfolio manager at Mirae Asset Global Investments Hong Kong Ltd.

His reappearance can only be a good thing. But it’s unhelpful to speculate on the viability of an Ant Group listing at this point.

Jackson Wong, director of asset management at Amber Hill Capital Ltd.

The video shows that politically, Jack Ma is allowed to resurface. At the very minimum this proves he’s not in prison or banned from appearing in the public, but it could also be a sign that Ma’s companies may have reached a deal with the government to settle their antitrust issues. That’s what investors are waiting for.

Ma’s appearance will help Alibaba’s stock reach at least HK$275, its previous high. The overhang on Alibaba’s shares is not completely removed though — the antitrust regulations on the sector were triggered by him.

ADVERTISEMENT

Zhang Fushen, senior analyst at Shanghai PD Fortune Asset Management.

Alibaba is not out of the doghouse, but at least it’s clear that the current anti-monopoly drive is not about punishing Jack Ma. We’re not in a hurry to add Alibaba shares yet because the regulation hammer will still fall on these firms. By now it’s evident that the incident — and questions regarding his whereabouts — is inconsequential to Alibaba’s business operations.

Paul Pong, managing director at Pegasus Fund Managers Ltd.

Now we are convinced that Jack Ma is fully collaborating with regulators. I didn’t think he’d be in jail, so I hadn’t sold any of my Alibaba shares. The stock will face resistance near HK$300 — the previous record where investors were pricing in the valuation of Ant Group. It’s obviously hard to surpass that level for now.

Alvin Cheung, associate director at Prudential Brokerage Ltd.

What Jack Ma said during his appearance was quite uncontroversial. He wasn’t as aggressive as before, which is also a boost for investor sentiment. Alibaba’s stock has declined a lot since the crackdown on Ant Group, lagging other Chinese tech firms like Tencent, Meituan and Xiaomi. I see a good entry time now as his appearance removes a key overhang for the company.

Brock Silvers, managing director at private-equity fund Kaiyuan Capital in Hong Kong.

Jack Ma’s unexpected re-emergence — just as sudden as his earlier disappearance — is likely a sign that his relationship with Beijing’s regulatory authorities has stabilised. That doesn’t necessarily mean that Ma’s corporate empire is free from worry. A path acceptable to all parties may have been identified, but Ant Group still looks likely to be dis-aggregated and regulatory restrictions will almost surely take a significant bite out of Ant’s former valuation.

By Bloomberg.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.

Four years ago, when the Trump administration threatened to ban TikTok in the US, its Chinese parent company ByteDance Ltd. worked out a preliminary deal to sell the short video app’s business. Not this time.

Brands are using them for design tasks, in their marketing, on their e-commerce sites and in augmented-reality experiences such as virtual try-on, with more applications still emerging.

Brands including LVMH’s Fred, TAG Heuer and Prada, whose lab-grown diamond supplier Snow speaks for the first time, have all unveiled products with man-made stones as they look to technology for new creative possibilities.