The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Chinese President Xi Jinping’s speech stressing the idea of “common prosperity” at a meeting of the country’s Central Committee for Financial and Economic Affairs this month spooked luxury investors, resulting in an estimated $120 billion being wiped off luxury goods company market capitalisations. Investors were rattled by Xi’s desire to curb “excessive incomes,” the prospect of new taxes on China’s rich and what this could mean for luxury’s most important market.

China has been the engine of growth for luxury ever since the 2008 global financial crisis tipped the scales of economic power from the West to the East. At that point, China accounted for an estimated 25 percent of the world’s luxury market. The coronavirus pandemic has further tilted the balance towards the Chinese market, which is set to account for an estimated 40 percent of the world’s luxury sales this year.

This is not the first time Xi Jinping has specifically targeted the luxury sector. In November 2012, when he became chairman of the Chinese Communist Party, he announced that he would crack down on gifting luxury goods to government officials as part of an anti-corruption campaign. This hit the luxury watch first — Swiss watch exports to China fell by more than 25 percent in the first quarter of 2013 — followed by high-end cognac, leading Rémy Cointreau, purveyor of the prized tipple of government officials, to forecast a fall of 35 to 40 percent in operating profit for the following year.

In 2016, the Chinese government launched a stealth attack on imports of luxury goods: import taxes on luxury watches doubled to 60 percent, while tariffs on bags and clothes went from 20 percent to 30 percent. Daigou were also targeted in 2019 with an obligation to formally register as businesses, obtaining licenses and paying taxes.

ADVERTISEMENT

Recently, the government’s focus has been to encourage Chinese luxury consumers to spend more money at their home market, with incentives such as an increased tax-free allowance on personal international e-commerce purchases and more generally by making it easier for luxury companies to operate locally in China, notably by the removal of animal testing requirements for certain cosmetic products this year.

So, why this sudden announcement and why have investors run for the hills?

Xi Jinping’s speech was not a declaration of war on wealth but rather an acknowledgement that wealth is concentrated in too few hands, much like in the rest of the world. Taken at face value, this would mean a larger middle class which could actually create revenue opportunities at entry level prices for luxury brands, much as when the exports of high-end watches to China tanked in 2013, more affordable watches witnessed a surge in sales. Depending on Xi Jinping’s definition of excessive wealth (this has yet to be determined along with how the balance is to be readjusted), there may not even be much of an impact on the wallets of the super-rich.

There is reason to be sceptical that the Chinese President’s speech would cause a real societal change. So far, luxury spending and outward displays of wealth have been socially acceptable — if not encouraged — as a means of conforming or identifying with a specific social grouping: the fastest and easiest way for the rich and successful to convey their role as a winner in society is through luxury consumption. It is possible that ostentation will gradually decline, but robust luxury goods consumption will continue, and the market correction Xi Jinping’s speech incited will likely correct itself back.

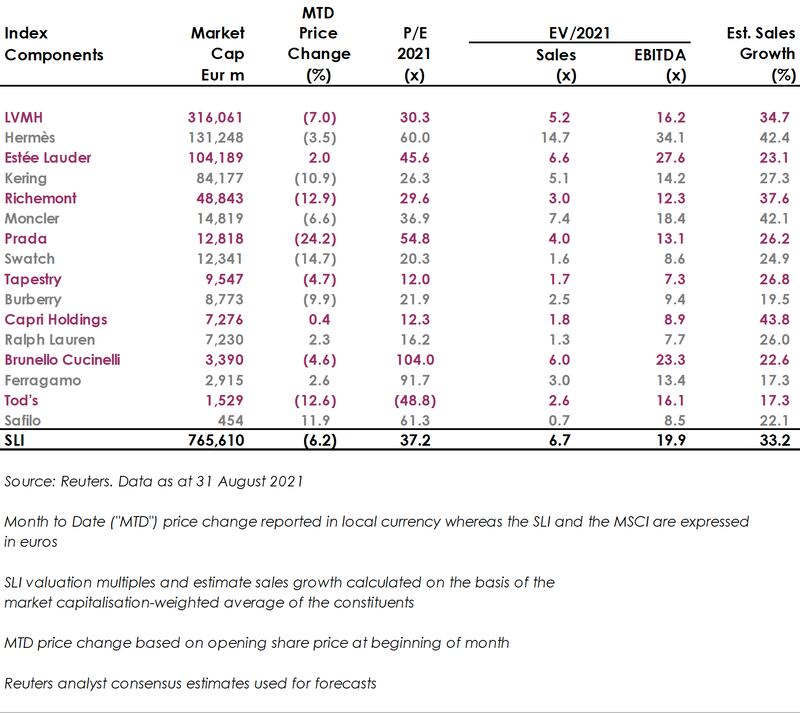

Nevertheless, luxury valuation multiples are high, really high. Here’s some context. The SLI forward EV/EBITDA multiple has been trading pretty consistently within a range of 13x to 15x in the few years prior to Covid. This year, it has shot up to an average of 20x, with a peak of 21.9x in June, only to come back “down” to 19.9x at the end of August. There is still a long way to go if the SLI were to trade back to its pre-Covid level.

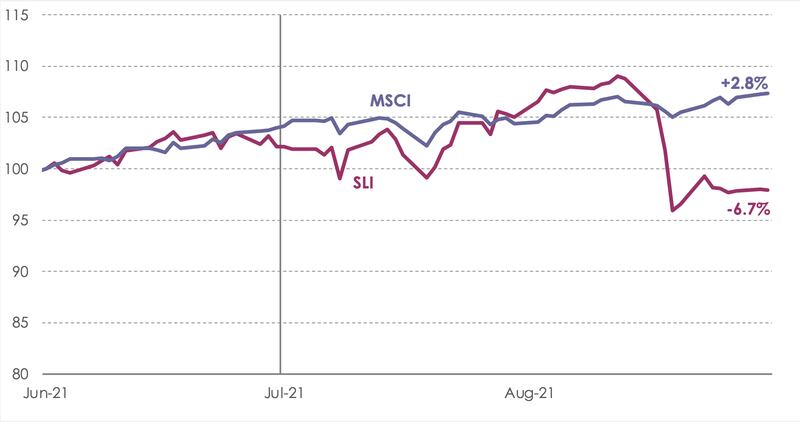

The Savigny Luxury Index (“SLI”) fell almost 7 percent in August, recording the largest monthly fall since March 2020, while the MSCI gained almost 3 percent. Xi Jinping’s speech on 17 August triggered a mass sell-off although there has subsequently been evidence of investors buying the dip.

SLI vs. MSCI

Going up

ADVERTISEMENT

Going down

What to watch

There are other, potentially more sinister, threats to luxury sales performance in China than Xi Jinping’s stated wish for a more egalitarian society. The boycotting of Burberry in response to the company’s condemnation of the use of forced labour in Xinjiang; the cutting of ties by Chinese star Lu Han with Audemars Piguet over a “one-China” dispute after the resurfacing of an interview in which the watch company’s chief executive referred to Taiwan as “an ultra-modern, high-tech country;” the ongoing tensions between Hong Kongers and the Chinese Communist Party on the subject of democracy all shed light on the pitfalls facing luxury brands wishing to do business in China as the country becomes more powerful and more assertive. The luxury sector is dominated by foreign brands and foreign interests. Will it always be so?

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

Related Articles:

Could a Chinese Crackdown on ‘Excessive Incomes’ Damage Luxury Sales?

New Taxes on China’s Rich Would Be Bad News for Luxury, But How Bad?

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.