The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The global economy is sailing into a perfect storm: Europe is grappling with Russia’s invasion of Ukraine and the implications for energy imports; China’s pursuit of “zero-Covid” is plunging cities like Shanghai into strict lockdowns; and the United States is staring down the barrel of the highest inflation rates in 40 years. The risk of a synchronised global downturn is rising by the day.

This would be the third global recession to strike since the beginning of this century, the other two being the Global Financial Crisis and ensuing “Great Recession” in 2008 and 2009 and the Covid-induced collapse of 2020. Whether luxury goods consumption is susceptible to recession remains a matter of debate, hinging as much on one’s definition of luxury as consumer behaviour.

The 2008-2009 crisis sent the world into a tailspin, mainly because it was the most significant contraction in the global economy since the Second World War and the last global recession was 18 years before this. Luxury stocks saw a mass sell-off. From the peak of its performance in May 2007 to its trough in March 2009, the Savigny Luxury Index (SLI) lost 62 percent of its value. (Kering was excluded from the sample as it was divesting from non-luxury businesses at this time).

Over the same period, the financial performance of companies making up the SLI paints a very different picture, however. Sales continued growing in 2007 (+5.7%), 2008 (+6.5%) and 2009 (+2.2%) although earnings before tax declined in 2008 (-9.6%) and 2009 (-6.1%).

ADVERTISEMENT

The 2008-2009 market correction is particularly pertinent in light of the current SLI trading multiples, which are close to historic highs. The recovery of the sector after 2008-2009 was quite a fairy tale with Chinese demand swooping in as a kind of prince charming. Sales at SLI constituents grew rapidly in 2010 (+17%) and 2011 (+21%) whilst earnings before tax grew by 58 percent and 23 percent, respectively. The SLI itself rallied by 218 percent from its trough in March 2009 to the end of 2010.

It’s difficult to draw parallels between 2008-2009 and 2020, given the unique characteristics of the Covid Crisis: abrupt global lockdowns, significant government spending to support economies, flipping the switch to digital, and rapid recovery in consumer spending once lockdowns were lifted. Nevertheless, SLI multiples reached stellar highs in 2021, with the index’s average EV/EBITDA multiple reaching 21.9x in June, fuelled by unbridled optimism on the outlook for the luxury sector.

History shows that heritage brands with a strong leather goods offer fare best during economic crises. Then comes makeup. Bottom of the leaderboard is affordable luxury and, paradoxically, high-end watches and jewellery. The table below shows the share price reaction of SLI constituents to the 2008 Global Financial Crisis and the 2020 Covid Crisis. The percentage changes in the MSCI and SLI are included for reference. Hermès and LVMH are clear winners in both instances, with Estée Lauder proving a top performer, too. This is no surprise as heritage leather goods, as embodied by Hermès and LVMH cash cow Louis Vuitton, are considered a safe bet at all times but particularly during downturns.

There is a litany of studies on consumer behaviour during economic downturns, some of which point to increased appetite for escapism that can lead to irrational purchases (for example, cinema ticket sales went up during the Great Depression in the US despite a 25 percent unemployment rate). Lipstick and makeup falls into this category of purchase even more so nowadays as the number of luxury brands offering makeup as an entry point grows.

Bottom of the leader board are “affordable luxury” brands. A 2008 study by consulting company Prince & Associates found that consumers worth more than $10 million in assets planned to increase their spending in luxury goods despite the financial crisis, while those with less planned to cut back. These higher net worth consumers are likely to gravitate towards the top of the luxury pyramid where Hermès and Louis Vuitton sit. However, the dynamics are more complicated than simply the ultra-rich continue spending and the rest of the world tightens its belt.

Perceptions on what constitutes “affordable luxury” versus “true luxury” may also indicate the future appeal of a brand to the mass affluent when the broader market starts to recover. If ultra-rich consumers are spurning Coach handbags, Burberry raincoats and Ralph Lauren polo shirts, aspiring luxury goods consumers may also, in time, lose interest in favour of less widely distributed brands. That has an impact on valuation.

The surprising outlier in the table above is Richemont. The company’s price points and the undisputed heritage of its flagship brand Cartier might suggest that Richemont is recession-proof. The issue here is likely to be distribution and a grindingly slow supply chain. The luxury watch sector is heavily reliant on third-party distribution, more so than any other segment of luxury, and has the longest production timeline in the industry which means that any operational changes can take over a year to flow through. At worst, this makes it particularly vulnerable to the grey market (Tag Heuer suffered greatly because of grey market sales of its watches in the aftermath of the 1997 Asian Financial Crisis); at best, it means the segment will lag behind other luxury categories when it comes to recovery.

Conventional wisdom dictates that people will try to hide their wealth during an economic downturn. During the Global Financial Crisis, anecdotes spread of shoppers coming out of Bergdorf Goodman with their purchases wrapped in discreet brown paper bags so as to avoid attention. But a 2010 joint study by the Marshall School of Business and UCLA’s Anderson School of Management put paid to the hypothesis underpinning these tales.

ADVERTISEMENT

The study focused on Louis Vuitton and Gucci’s leather goods offerings and how they changed during the 2008-2009 period, finding that both brands substantially trimmed their offering whilst simultaneously increasing price points, and that the revised offer featured a higher proportion of items with logos or other brand identifiers. In layman’s terms, Vuitton and Gucci were charging consumers more to flaunt their brands during the recession.

The authors of the study explained this by segmenting luxury consumers into “Patricians” and “Parvenus” or “insiders” and “outsiders” to the world of luxury. The need for Parvenus to confirm they were still wealthy during a recession by buying more items from the latest collections of easily recognisable brands created a market opportunity for more ostentatious luxury designs.

Should a global recession hit this year, expect polarised valuations, with heritage brands with a strong leather goods offer topping the leaderboard and affordable luxury lagging significantly behind.

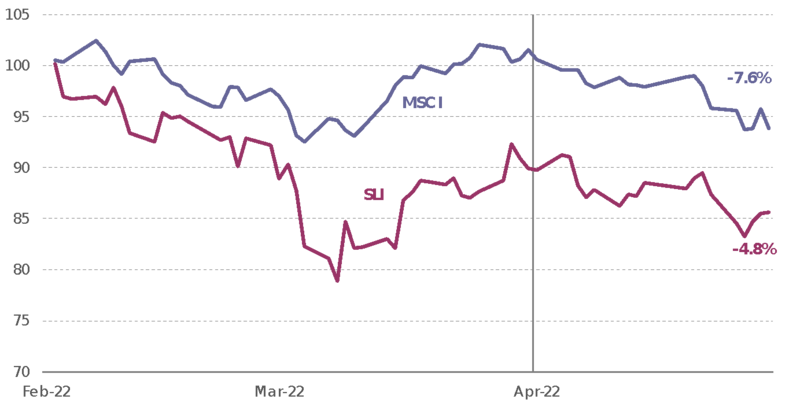

The SLI fell 5 percent in March driven by fears of an impending global recession. The MSCI fared worse, losing almost 8 percent this month.

SLI vs. MSCI

Going up

Going down

What to watch

ADVERTISEMENT

The 2008-2009 recession led to a rapid increase in excess inventory for luxury brands. Sample sales were a veritable treasure trove for those lucky enough to be invited. The internet created a business opportunity to sell excess inventory to a wider audience, and luxury flash sale sites such as Vente Privée and Gilt Group became household names overnight. The market for online flash sales is still vibrant but many luxury goods companies have upped their game on inventory management, so the brand offering on these flash sale sites tends to be less blue-chip luxury these days. Meanwhile, the 2020 recession was the kick in the backside the luxury sector needed to up its game in digital. If a recession is going to hit us in 2022, it is likely that the opportunity for growth and innovation will come from web3 and the nascent metaverse — in what shape exactly remains to be seen.

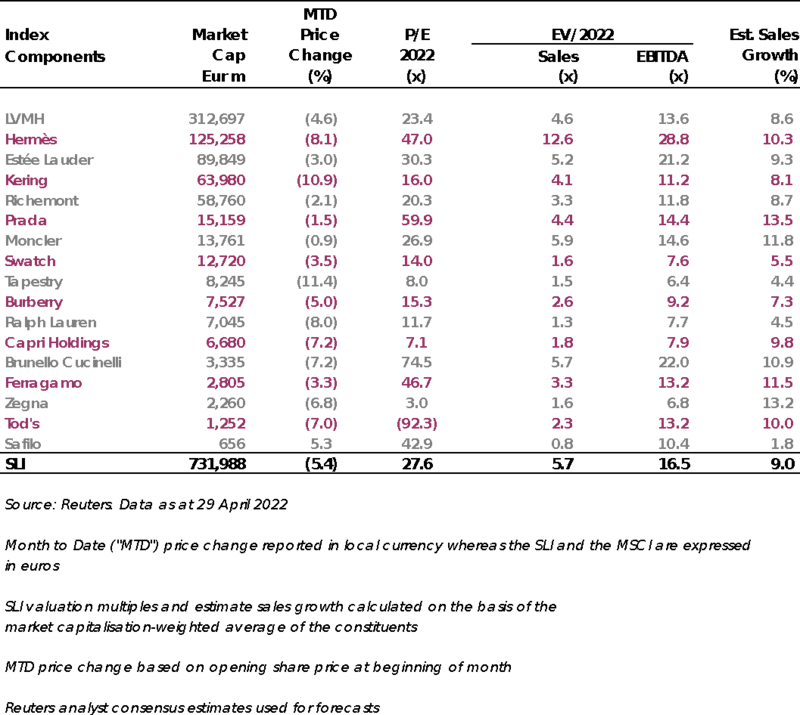

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

After preserving his fashion empire’s independence for decades, the 89 year-old designer is taking a more open stance to M&A.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.