The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Last month, Jonathan Akeroyd was poached from Versace to replace Marco Gobbetti at Burberry. But the real surprise was Gobbetti’s June decision to walk away from a successful partnership with Burberry designer Riccardo Tisci to join Salvatore Ferragamo.

If companies are only as good as their leaders, there is an additional layer of complexity in luxury, where the magic of creation and the realities of business must come together in the right configuration of creative and commercial leadership to deliver results.

CEO-Designer Duos

The most common configuration is the pairing of a designer and a chief executive, the archetype being Yves Saint Laurent and Pierre Bergé. A generation later, Tom Ford and Domenico de Sole at Gucci gave the fashion industry a lesson in how to transform a brand on the brink into one of the world’s most successful luxury businesses.

ADVERTISEMENT

Harvard Law School alum De Sole was initially hired by Gucci as a lawyer in 1983 to help Aldo Gucci with a tax evasion case in the US, but made himself so useful that he was asked to run Gucci America on a part-time basis, which is how he met Tom Ford and allegedly rescued him from being fired by a tempestuous Maurizio Gucci. When Investcorp bought out Maurizio Gucci in 1994, the fund appointed (partly out of desperation) De Sole to rescue the company, which at the time was heavily loss-making on a turnover of around $200 million.

With no budget for advertising, De Sole turned to fashion as a spring-board for publicising the new Gucci. This was the beginning of a dream partnership with Ford, whose design talent was complemented by a branding savvy second to none. Ford was given the freedom to push the boundaries of what was considered acceptable in high fashion and advertising, allowing him to churn out bold jet-set collections complemented by erotically charged advertising, thus defining the fashion of the ‘90s and ‘00s.

Within the space of one year, Gucci’s turnover had grown to $500 million and the company was making a profit of $88 million. De Sole ploughed the profits back into the brand, spending on advertising, then the retail network, then upstream integration. By the time the pair exited the company in 2004, Gucci had become a stable of brands, then called Gucci Group, including Yves Saint Laurent, Bottega Veneta, Balenciaga and others, with a total turnover of $3.2 billion.

After the departure of Ford and De Sole, the Gucci brand struggled to find relevance for years until a new match made in heaven came along. Marco Bizzari took the helm as Gucci CEO in 2014, replacing Patrizio di Marco, whose exit prompted then creative director Frida Giannini to walk, meaning Bizzari was faced with a key hiring decision very early in his tenure. It was a chance meeting with Michele, a backroom designer not on Bizzari’s shortlist, that led to the young Michele’s appointment as creative director. “Intuition and instinct are more important than rationality,” said Bizzari of his decision.

Bizzari gave free rein to Michele’s creativity — it is said that he never discusses budgets or sales targets with the designer — and the brand was literally turned on its head away from a minimalist sex-driven aesthetic to a maximalist, more inclusive look. This was a high-risk strategy, and not just aesthetically. It also meant investing in refurbishing Gucci’s vast retail network. Of course, the strategy paid off, sending sales growth into high double digits. In the period since Bizzari took over at Gucci, parent Kering’s market capitalisation outperformed the SLI by 27 percentage points.

Meanwhile, at Burberry, Marco Gobbetti hired Riccardo Tisci in 2018 to repeat the success they had at Givenchy, where the duo breathed new life into the brand. Gobbetti endeavoured to elevate Burberry’s positioning and price points, while Tisci injected a streetwear quotient into the mix so as to make the brand more relevant to today’s young luxury consumer. While it is clear that the British brand is in a better position today in terms of positioning, product mix and geographical exposure, Burberry’s turnaround remains a work in progress. Revenues and profits have flatlined during Gobbetti’s tenure (excluding the impact of the pandemic); Burberry’s market cap increased by about 60 percent from the announcement of Gobbetti’s arrival to that of his departure, but this pales in comparison with the SLI’s growth of 228 percent over the same period.

Dual-Role Leaders

The CEO-designer duo isn’t the only way to configure top luxury leadership, however. Some brands have tried to address the potential conflict of interest between chief executive and creative director by merging the roles, although the jury is out as to whether one individual can ever really have the wherewithal to manage both the commercial and creative sides of a business. Christopher Bailey gave it a try: when CEO Angela Ahrendts left in 2014, Bailey took her place but retained his role as chief creative officer.

ADVERTISEMENT

But this proved the wrong move for Burberry. For one, the new role seemed to undermine Bailey’s ability to focus on product with predictable consequences on sales and profits. Then, there was the controversy around his pay package, which was rejected in a non-binding vote by shareholders in 2014 but nevertheless maintained by the company, only to suffer a 75 percent cut in 2016 as the company’s profits declined for a second year running. Bailey handed the reins to Marco Gobbetti in 2016 and left Burberry in 2018. From Bailey’s appointment as CEO in October 2013 to his resignation in July 2016, Burberry lost roughly 17 percent of its market value (albeit amid the stock market swings of late 2015 to early 2016).

And yet let’s not forget Giorgio Armani who took over the role of CEO at his namesake label after the death of his partner Sergio Galeotti over 30 years ago and who is still running strong in the dual role of designer and chief executive. Perhaps it helps that Armani, being a private company, is out of the financial limelight and thus immune to quarterly public reporting and the short-term decision-making mindset that can often come with this.

One CEO, Multiple Creative Directors

Some brands install multiple creative directors working under a single CEO. Sydney Toledano used this approach while chairman and CEO of Christian Dior. Following the exit of John Galliano in 2011, he recruited Raf Simons as creative director of womenswear, followed by Maria Grazia Chiuri. Toledano relaunched Dior Monsieur as Dior Homme, appointing Hedi Slimane as creative director in 2001, followed by Kris Van Assche. (Today, the line is designed by Kim Jones). Toledano also developed Dior’s jewellery business, notably appointing Victoire de Castellane as creative director of Dior Fine Jewellery in 1998 and opening dedicated fine jewellery stores shortly thereafter.

The benefit of having separate creative directors across separate product categories is that each category can have its own voice and market segment. One only has to see the difference in style between Dior womenswear and Dior menswear to see the appeal (and risk) of the approach. The strategy also allows for much greater creative output as the task of creating up to six womenswear collections, a minimum of two menswear collections as well as a plethora of money-making accessories each year is challenging for even the most creative and energetic designers.

At Burberry, will the CEO-designer duo of Akeroyd and Tisci deliver results? Only time will tell. Akeroyd is an experienced luxury goods executive who is credited with turning around Alexander McQueen, propelling the brand to profitability and appointing Sarah Burton as creative director following Lee McQueen’s death in 2010. Akeroyd also accelerated growth during his five years at Versace and oversaw the sale of the house, known for its opulent, ostentatious style to Michael Kors owner Capri. He certainly has what it takes to work with creative talent. Stay tuned.

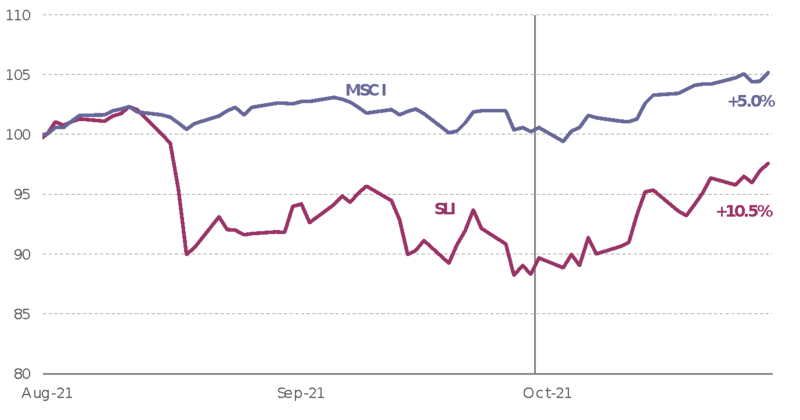

The Savigny Luxury Index (“SLI”) gained over 10 percent in October on the back of strong quarterly results notably with Hermès and LVMH trading above pre-pandemic levels, whilst the MSCI gained 5 percent.

SLI vs. MSCI

ADVERTISEMENT

Going up

Going down

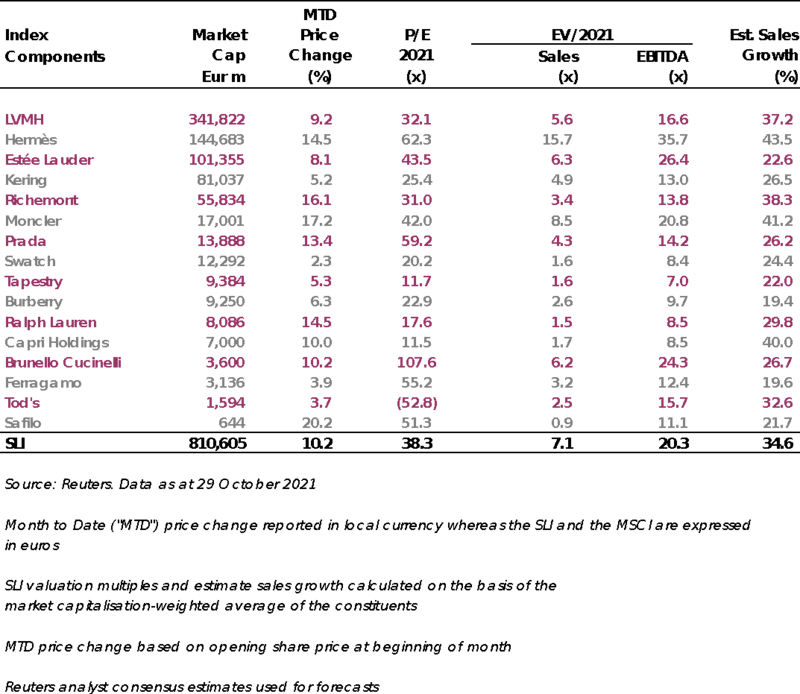

All SLI constituents posted gains in October. This last happened in December 2017 although April 2021 all constituents bar Prada posting gains, with Prada’s share price slipping less than half a percent.

What to watch

Schiaparelli is amping up its revival, having recently opened a corner at Bergdorf Goodman and a series of pop-up shops at Dover Street Market. In recent years, the brand slowly rebuilt its couture credentials, notably helped by reclaiming the lease on its original Place de Vendôme headquarters and salon. Since the arrival of American designer Daniel Roseberry in 2019, Schiaparelli’s creations have adorned the likes of Beyoncé, Cardi B, Lorde, Adele and Lady Gaga. Now, expectations are high given Schiaparelli’s iconic status as one of the leading designers of the early 20th Century alongside Coco Chanel and Paul Poiret.

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

Related Articles:

The Challenges Facing Burberry’s Next CEO

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.