The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Luxury’s strong first half results were a welcome sign for the sector in the face of worrying economic headwinds, compounded by interest rate hikes, the war in Ukraine and escalating tensions over Taiwan.

Companies with exposure to the higher end of the luxury market did particularly well. Brunello Cucinelli upgraded its growth forecasts for the full year from 12 to 15 percent based on its strong performance in the first half, while Prada announced that its first-half results accelerated its progress towards its mid-term targets, which include annual revenue of €4.5 billion and an operating margin of around 20 percent.

In contrast to 2021, where growth was driven by middle-class consumers, it’s the big spenders who have opened their wallets so far this year. Less likely to be impacted by the cost of living crisis gripping Europe and North America, the “core” luxury consumer is also less price-sensitive. (According to Jefferies, luxury brands increased their prices on average by 10.7 percent in 2021 and have already increased their prices by 10.3 percent this year, with little pushback from shoppers).

Luxury’s first half sales were also helped by favourable comparisons to the first semester of 2021 during which much of Europe and Asia was still in lockdown while consumers were just beginning to return to stores in the US. The progressive unlocking of physical shopping in key markets has also helped revive the wholesale channel as multi-brand retailers such as department stores and specialty retailers still depend largely on brick-and-mortar.

ADVERTISEMENT

Sales growth in Europe, in particular, defied gravity, blessed by a cheap euro, a surge in tourist numbers and shops being open for business during the whole semester. The short to medium term outlook for this region will be dictated to a large extent by tourist flows which should continue to rise as international travel restrictions ease further and airlines and airports come to grips with their labour and capacity shortages. The risk here is that the euro strengthens versus the US dollar or that the Ukraine conflict spreads west.

The US saw strong double-digit growth this semester, with luxury brands expanding their footprint beyond the traditional American mainstays of New York and California to southern cities, such as Atlanta and Austin. The big luxury groups have reported significantly more sales growth over pre-pandemic levels in the US than in other regions. For example, Kering’s North America sales roughly doubled in the first half of 2022 compared to 2019 and the group plans to open more than 30 new US stores over the next couple of years, including Gucci boutiques in New Orleans and St. Louis and a Saint Laurent boutique in Detroit. The group opened a Gucci store in Columbus, Ohio this month, having recently opened another new store for the brand in Austin. LVMH, Prada, Hermès and Chanel have all announced plans to open new stores in new US markets.

China was missing in action this semester with Xi Jinping’s “zero-Covid” policy weighing heavily on sales performance: Richemont and Burberry disclosed sales growth figures in Mainland China for the quarter ending June 2022, posting declines of 37 percent and 35 percent respectively. LVMH confirmed this trend stating that sales in mainland China were down by heavy double-digits during the first half.

While both Richemont and Burberry maintained that sales were improving as stores started to re-open in June, the outlook for mainland China for the rest of the year remains a big question mark for the luxury sector as the threat of autumn lockdowns looms.

Other markets in the region, notably Japan, experienced strong growth as lockdown measures were relaxed, resulting in a boost to consumer confidence. Richemont saw sales grow by 83 percent in Japan, while Kering’s sales in this traditionally important luxury market increased by 26 percent.

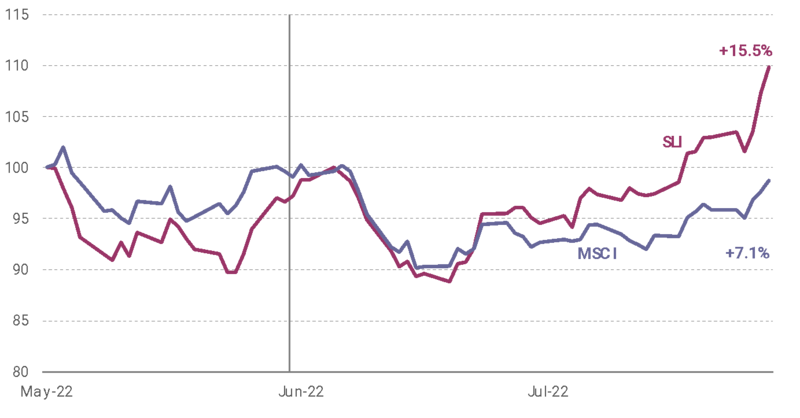

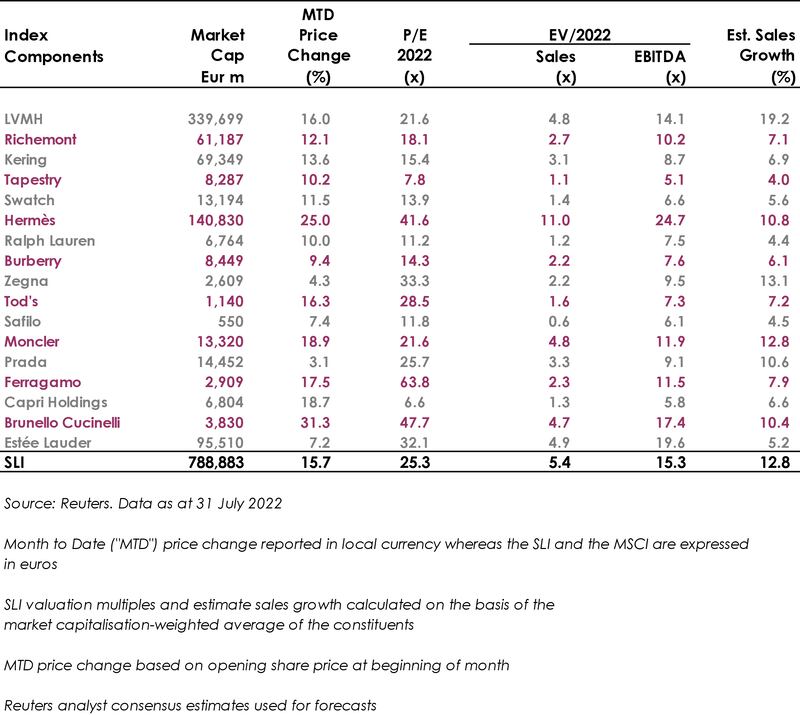

The Savigny Luxury Index (“SLI”) rallied 15.5 percent in July driven by better-than-expected first half results for the major players, outperforming the MSCI by over 8 percentage points.

Going up

What to watch

ADVERTISEMENT

While growth in the second semester will face tougher comparables, notably in the US and Europe where stores were open during the same period in 2021, there is cause for cautious optimism coming from the US, Europe, Japan and South Korea. Nevertheless, the luxury sector remains vulnerable to further lockdown measures in China, which could tip the world into a recession, not to mention the risk of geopolitical instability in Taiwan.

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.