The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

It’s no secret that the fashion industry has a massive supply chain problem. A relentless lowest-cost mindset over the years created fissures between buyers and suppliers, which deepened amid the global pressures of Covid-19. The outcome is a trail of imbalances and one-way practices imposed by brands and retailers on supplier networks to cut their own costs and risks, squeezing factories and their workers. The overhang of lost or damaged trust between buyers and suppliers is still with us, a concern that is a major obstacle to a more sustainable future.

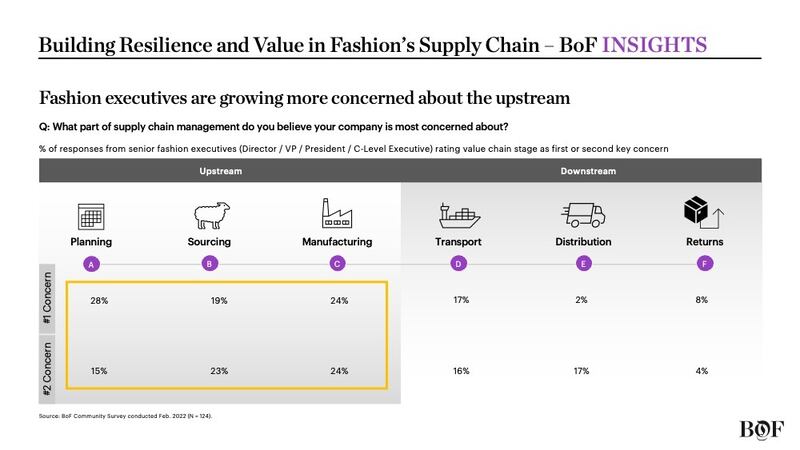

Industry leaders are ready for change. Survey results published in a new report from BoF Insights, Building Resilience and Value in Fashion’s Supply Chain found that some 70 percent of fashion industry executives polled said strengthening supplier relationships was one of the top supply chain priorities. Senior executives also said they are shifting more attention to the upstream rather than the downstream landscape of their value chain, according to the report. That is significant change in industry behaviour that is notoriously adversarial in its bargaining and buying history.

BoF’s survey data is encouraging and matches my own work within the industry. It leads me to believe that in 2022 a tipping point for fashion is upon us.

Malcolm Gladwell describes the phenomenon in his bestseller “The Tipping Point” as a moment when an idea or vision that is embraced by a small group of people or organisations scales, transforming the thinking and behaviour of even more people. Fashion’s tipping point is one of awareness, a shift toward system transition by both buyers and suppliers.

ADVERTISEMENT

Why is this happening now? The Gen-Z consumer crescendo for sustainability has changed everything. The context today is generational demand for end-to-end transparency, trust and accountability, superseding operational language for efficiency alone.

But incremental and ad hoc adjustments to individual parts of a supply chain aren’t enough if buyers truly want to build new ways of partnering and growing with their suppliers. Executives must ensure that their business models go beyond seasonal, transactional contracts. The alternative is to be more “relational” — that is, inclusive of end-to-end, mutual incentives for long term investment.

The ever-wishful planning formula of “sell 5 percent more next year, at 5 percent less cost” has died. Put another way, suppliers can no longer absorb the manufacturing, logistics and capital risks of retailer uncertainty; rather, these risks must be quantified and shared equitably between suppliers and buyers.

How Did We Get Here?

Fashion’s supply chain dysfunction isn’t new. Let me offer my journey over two decades through industry change, or lack of it. My mentors along the way were Ramchandran Jaikumar, a Harvard production expert who inspired a standard of 10-day lead times anywhere in the world, and Warren H. Hausman, the Stanford guru of supply chain metrics, who quantified the benefits of speed and risk-sharing versus traditional focus on cost alone. Each brought rare outsider insight to insular fashion.

Over the course of global research and case studies, my mentors and I encountered indifference among fashion chief executive officers to primary drivers of market value, such as speed-to-market, order cycles, working capital and forecast accuracy. These were of scant interest to merchants insistent on volume, lowest prices and highest incoming margins. The favoured C-suite perspective was demand creation, not supply flexibility.

Meanwhile, software designed to optimise global lead times did not disrupt order systems designed to minimise ex-factory costs, terms and inventory.

Surely then, the path to supply chain enlightenment was financial, identifying upstream levers that enabled merchandise decisions to be made closer to season, thus improving margins with far less inventory risk. Inarguable, perhaps, but numbers alone did not alter legacy systems and buyer relationships based on cost.

ADVERTISEMENT

What were we getting wrong in an industry that consistently under-performed and disappointed investor expectations for profit, growth and innovation? If manufacturing, technology and finance were not obstacles, what is holding the industry back?

The short answer: culture. The hard part is the soft part. The internal values of a brand hold the key to a tipping point. Cultural leadership is the prerequisite for meaningful, non-incremental change.

Commitment

To understand why, consider the auto industry, notably Toyota in the 1980s. Toyota’s just-in-time production system — which sees the company only make what is needed, when it is needed at each phase in production — emerged in a culture that eschewed waste because of scarce capital. It promoted manufacturing transparency by empowering workers to participate in continuous improvement. The result was a cultural commitment to higher quality at less cost, with long term suppliers fully integrated. Toyota’s process is regarded as the most significant business innovation of the 20th century — and the activator of an industry tipping point. What is the equivalent innovation in fashion?

There are fashion companies that have the requisite values to make a tipping point meaningful. Malcolm Gladwell’s “law of the few” only requires a handful of exceptional people — or cultures — to tip fashion’s unsteady equilibrium. My own variation of that law is “the new and few.” That means new ventures unencumbered by outdated culture, and the few incumbents committed to change a business model to become more attuned to sustainability.

The tipping point thesis is that culture determines success. Values create value. A consequence may be that well-known retailers are no longer globally competitive because of over-reliance on lowest cost supply chains. Rather than adopt essential process innovation, once-prominent brands are consumed with shedding assets; that is, withdrawal from international cities, downsizing stores and staffs, and gaming their real estate and online assets.

Too many retailers appear to regard the industry challenge as marketing more than deeper commitment to social and market impact. Europe is far ahead in seeking and regulating compatible green and digital goals. As with Japan’s commitment to high quality at low (not lowest) cost, Europe’s leading standards for sustainability will define the value chain for the next generation of consumers.

Toyota, endlessly studied but never duplicated, teaches us that culture matters more than strategy and marketing. It is the basis of a sustainable business model. Like Toyota, fashion must strive for continuous learning, seek and adapt knowledge outside of its industry, and partner in the spirit and reality of value creation with suppliers. Buyers and suppliers, together, create a new equilibrium.

John Thorbeck is the chairman of supply chain analytics firm Chainge Capital LLC.

Opens in new window

Opens in new windowThe pandemic exposed the weakness of the global manufacturing and distribution networks adopted by most big fashion brands. Executives need to change how they think and talk about supply chains to replace a culture of cost.

As the pandemic wreaked havoc on global logistics, investors poured $65.6 billion into supply chain start-ups last year that promise to revolutionise everything from warehouse automation to shipping.

Ethical denim-maker Saitex’s automated facility in California is a sign that localised, just-in-time manufacturing may be poised for widespread adoption.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.