The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

“What are the kids wearing these days?” is the perennial question fashion forecasters ask. The fashion industry, often out of necessity, is obsessed with chasing youth, especially as young consumers enter the workforce, inform new styles and shift buying behaviours.

Gen-Z — aged between 12 and 25 and accounting for approximately 25 percent of the world’s population — is now coming into its own. But Gen-Z is truly unique. As the first digital natives, their formative years have been unlike that of previous generations, creating a greater cultural chasm between Gen-Z and older generations. Social platforms have given Gen-Z tastemakers an unparalleled ability to convene and speak to audiences.

In the US, Gen-Z is particularly shaping the culture and moving the economy with a purchasing power of about $360 billion. Each generation experiences distinct events that shape its life outlook. Baby Boomers benefitted from an economic boom after World War II, living in an age of optimism. Gen-X matured as social mores changed and female labour participation jumped, living in an age of independence. Millennials, typically the children of more affluent Baby Boomers, benefitted from the advent of the internet, living in an age of idealism. Yet, Millennials are old enough to remember a less digital world.

Gen-Z is much more pragmatic, growing up under the lens of technology from the outset. The worsening climate crisis, pressing global movements such as “Me Too” and “Black Lives Matter” and the Covid-19 pandemic all serve as a backdrop for the current age — an age of realism.

ADVERTISEMENT

Gen-Z and Fashion in the Age of Realism is the newest report from BoF Insights, exploring Gen-Z’s relationship to fashion, identifying the distinct personality types, their sources of inspiration, their preferred brands, and their approach to sustainable fashion. This report is informed by in-depth analysis of social media behaviour, a survey of nearly 1,000 Gen-Zers as well as focus groups.

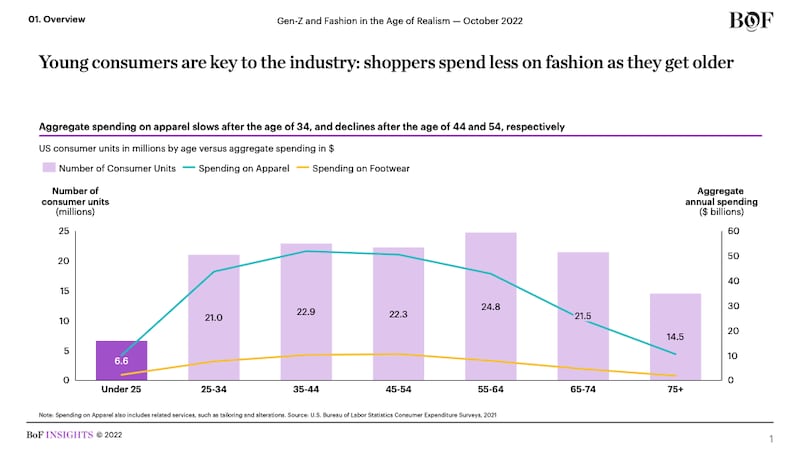

Fashion is the favourite entertainment category for US Gen-Zers to spend money on, outranking other categories like dining, video games and consoles, and music. Young consumers are critical to the fashion industry, not least because per capita spending on fashion declines as we age:

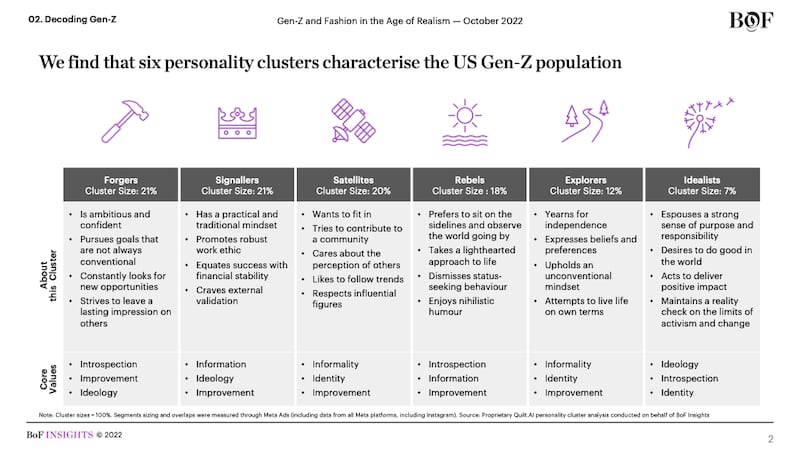

To best engage with and speak to young consumers, BoF Insights partnered with Quilt.AI — an AI-powered insights company — to canvass social media behaviour and profiles to identify six personality “clusters” that characterise the US Gen-Z population. While Gen-Z is like other generations in that they defy stereotyping, these clusters are a critical heuristic for executives to understand Gen-Zers’ shared affiliations, interests and perspectives:

BoF Insights has also collaborated with Juv Consulting — a company launched by three 16-year-old entrepreneurs in 2016 — to field a proprietary survey of nearly 1,000 US Gen-Zers. This survey reveals that 89 percent of the survey participants rate fashion as important for boosting confidence, while 82 percent say fashion is important for establishing their identities. For Gen-Zers, fashion is less about being trendy or denoting status.

Keeping up with fads has become more difficult than ever, as social media has accelerated trend formation. Moreover, Gen-Z has inverted the design process — aesthetics like Barbiecore, Cottagecore, Dark Academia and Coastal Grandma originated bottoms-up from social media and resale platform content instead of top-down from fashion brands and retailers. As a result, many Gen-Zers tend to adapt pieces representative of trends into their own personal styles, as opposed to following trends full-scale.

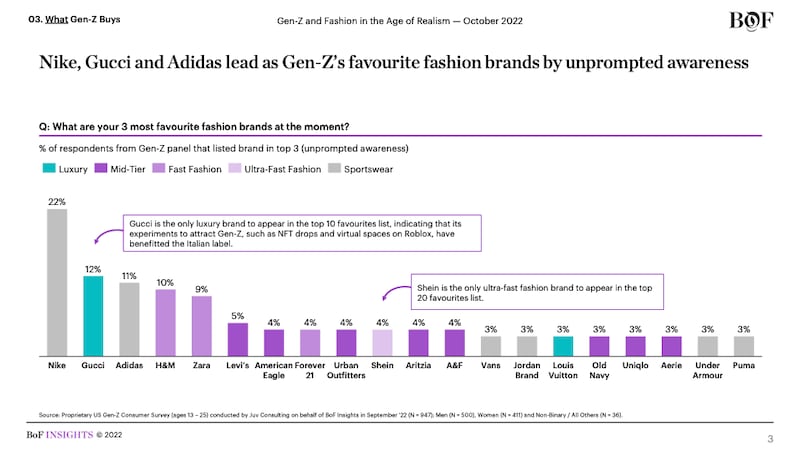

Brands like Nike, Gucci and Adidas have built the most ardent following among this generation as the leading favoured brands among our panel. Gucci is the only luxury brand to appear in the top 10 list of unprompted favourite brands, while Louis Vuitton appears further down among the top 20. Gucci is notable for its efforts to court young consumers early on within virtual gaming worlds like Roblox. In particular, BoF Insights reveals that the majority of Gen-Zers aspire to buy more luxury clothing and accessories as they gain purchasing power.

The report completes its analysis with a playbook for fashion executives, unpacking how your companies can best connect with Gen-Z through four pillars: communications, style, communities and brand evolution.

Companies featured in the report include: Abercrombie & Fitch, Adidas, American Eagle, Aritzia, By Rotation, Claire’s, Depop, Forever 21, Gucci, Guess, H&M, Levi’s, Louis Vuitton, Nike, Old Navy, PacSun, Patagonia, Pink, Princess Polly, Puma, Roblox, Shein, TikTok, Under Armour, Uniqlo, Urban Outfitters, Vans and Zara.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.