The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MILAN, Italy — Shares in Danish beauty products retailer Matas and Italian sunglass retailer Italia Independent rose on their stock market debuts on Friday, underscoring investor demand for luxury goods stocks.

While Italy has seen a number of stock market listings or IPOs by luxury goods companies in recent years, the offering by Denmark's Matas is the first the country has seen in two years.

"This type of share has risen quite significantly leading up to the (Matas) IPO, as the market has good appetite for shares with high stability and high dividend potential," said analyst Michael Friis at banking group Alm Brand. "Investors are estimating that this will continue."

European luxury goods stocks have stayed relatively robust in recent months, underpinned by their brand appeal along with the durability of their earnings due to Asian buying and, more lately, a pickup in the United States. Hermes for instance has outperformed the French CAC 40 by some 70 percent over the past two years.

ADVERTISEMENT

Shares in Matas traded up 4 percent from an IPO price of 115 Danish crowns, which had valued the company at 4.7 billion crowns ($819.3 million) and was at the high end of an indicative range of 100 to 120 crowns.

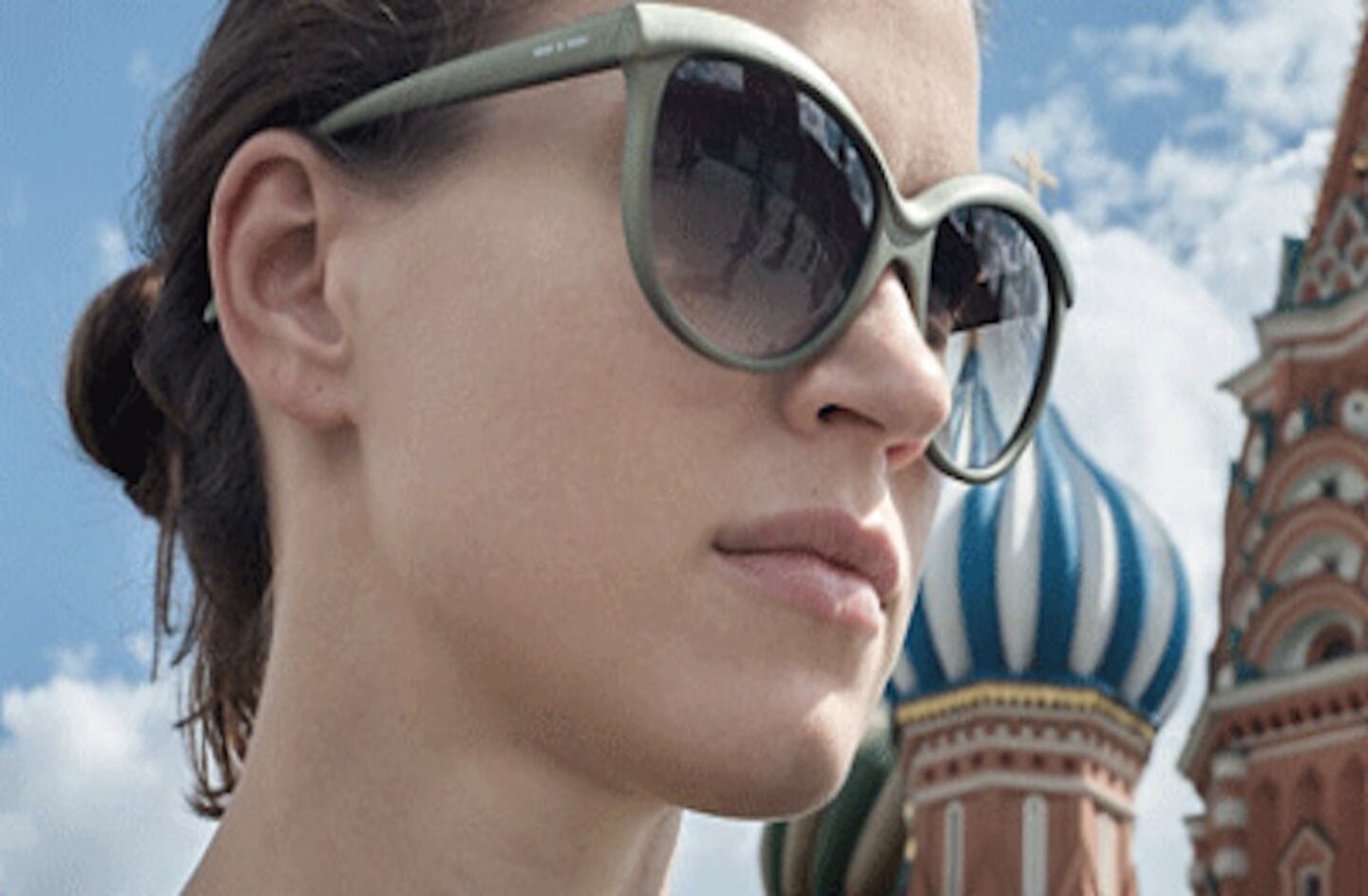

Italia Independent, founded by a grandson of the late Fiat patriarch Gianni Agnelli, priced its IPO at 26 euros, valuing the company at 57.5 million euros ($74.7 million).

The stock, listed on Milan's AIM platform for smaller companies, was trading at 29.9 euros by 0931 GMT, up 15 percent from its IPO price.

"Luxury, in this case eyewear, is the only sector that has being doing well over the past two years," said Davide Carelli, sales trader at brokerage Equita SIM, which acted as nominated advisor to Italia Independent in the IPO.

"If you look at the successful IPOs on the main Italian market in recent years, they are all in the luxury industry," Carelli said, referring to the likes of shoe-maker Salvatore Ferragamo and cashmere goods maker Brunello Cucinelli .

Beauty, Luxury in Demand

Shares in drug and beauty product retailers such as Walgreen in the United States and Sally Beauty Holdings Inc , a speciality retailer and distributor of professional beauty supplies, have risen 37 percent and 34 percent respectively since the start of the year.

Shares in Italia Independent rival Luxottica have risen 24 percent.

ADVERTISEMENT

While Turin-based Italia Independent sold new and existing shares in the offer, Matas only sold existing shares.

Matas had announced the IPO plan two weeks ago for majority owners, including private equity group CVC Capital Partners, to sell between 16.3 million and 21.3 million shares.

Jyske Bank analyst Jonas Guldborg said the stock's pricing and first-day premium showed good demand among investors, adding that he had a "buy" recommendation on the shares and a 12-month price target of 140 crowns.

Italia Independent, whose sunglasses compete in a market dominated by companies such as Luxottica and Safilo, has said it plans to target foreign markets, seeking to expand in Europe, the United States and Asia.

"We needed financing to fund our growth and getting money from the banks is very difficult, almost impossible," said the company's CEO Andrea Tessitore, adding part of the proceeds would be used to open between four and seven stores in Italy and abroad.

Lapo Elkann, founder of Italia Independent in which he has a 64 percent stake, said the aim was to list the company on Milan's main stock market at some point.

Matas said its focus would be on growth in Denmark as there were still opportunities to increase sales in existing stores around the country.

"We plan to continue growing at the level we have grown over the last five years, where we have managed to grow (revenue) by 3 to 5 percent despite the crisis," said Matas Chairman Lars Vinge Frederiksen.

ADVERTISEMENT

While the sunglasses company was more than three times subscribed, Matas declined to reveal how many times its shares had been oversubscribed.

Morgan Stanley and Nordea were joint global coordinators and joint bookrunners on the Matas IPO, while Carnegie, Danske Bank and SEB were co-lead managers.

($1 = 5.7365 Danish crowns)

Additional reporting by Teis Jensen, Stine Jacobsen and Shida Chayesteh in Copenhagen, with Silvia Aloisi in Milan; Editing by David Goodman and David Holmes.

Copyright (2013) Thomson Reuters. Click for restrictions

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.