The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In the face of relentless inflation, sky-high interest rates, and ever-gloomy consumer sentiment, a clear picture of what’s working in retail — and what isn’t — emerged in 2023.

The winners? Active and outdoor brands such as Alo Yoga and Salomon-owner Amer Sports, benefitting from millions who adopted a more health-conscious lifestyle after the pandemic; e-commerce players agile enough to pivot to wholesale and retail as shoppers returned to stores; and the savvy retailers who have successfully conveyed a sense of value to the cash-strapped consumer. All the while, luxury has stalled immensely as the so-called aspirational shoppers ran out of disposable savings. Well-capitalised direct-to-consumer companies reckoned with a broken business model that favoured growth over profit — the consequences of which have finally caught up.

Unfortunately, dismal market conditions are here to stay. While economists doubt the likelihood of a recession in 2024, discretionary spending will continue to be challenged as we enter the new year.

Even so, the consumer has proven to be resilient time after time. Despite unfavourable circumstances, brands and retailers will shine when they show their best side: convenience, service, and a differentiated product.

ADVERTISEMENT

Where US Consumers Are Shopping and What They’re Buying: Luxury spending may be flagging, and Miami has lost some of its pandemic-era heat. But there are plenty of opportunities for fashion brands if they know where to look.

What Parade’s Sale Says About the State of DTC: The Gen-Z intimates brand’s sale to a little-known strategic is the latest in an ongoing series of less-than-desirable exits for unprofitable digitally-native start-ups.

Farfetch Found Its White Knight. What’s Next?: The South Korean e-commerce firm Coupang has saved Farfetch from potential bankruptcy, and could use its logistical and marketing might to solve some of the luxury e-tailer’s seemingly intractable problems. But “everything stores” have a spotty track record when it comes to high-end retail.

Hyper Growth Is Over for Sneakers. What’s Next?: As incumbents like Adidas and Nike grapple with a cooling market, niche players and newcomers have an opportunity to flourish.

Why Some Brands Are Thriving in a Tough Economy – and Others Aren’t: BoF analysis of dozens of publicly traded fashion and beauty retailers’ latest earnings shows companies that can make the most compelling case for value have been the most successful.

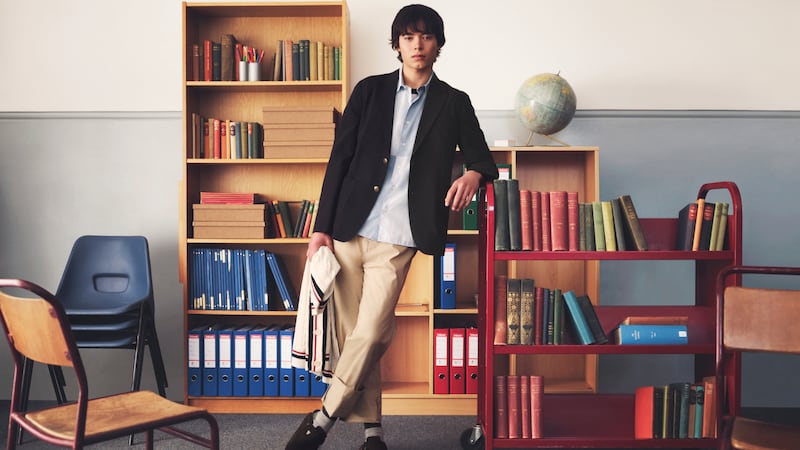

How Uniqlo Finally Won Over Gen-Z: Its viral cross-body bag and other TikTok favourites have helped the brand catch the attention of younger consumers. Now, the retailer wants to open more stores in the US and Europe.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.