The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

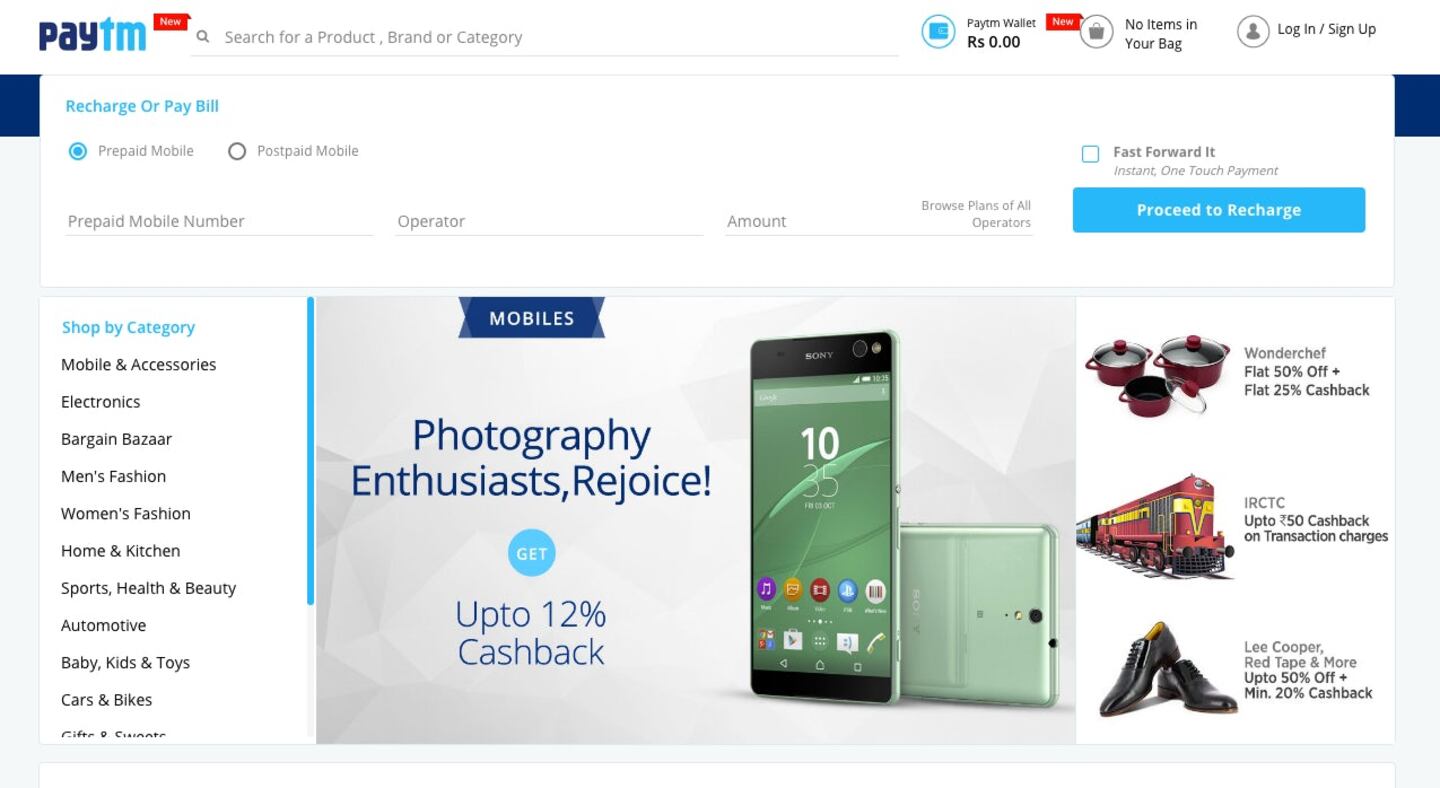

BEIJING, China — China's Alibaba Group Holding Ltd. will lead a $200 million round of investment in newly established Indian online retailer Paytm E-commerce Pvt, a person familiar with the matter said.

The investment by Alibaba and private equity firm SAIF Partners values the company at $1.1 billion, said the person, who did not want to be identified talking about a private deal. It deepens Alibaba’s investment in a burgeoning e-commerce market now dominated by Amazon.com Inc. and Flipkart Online Services Pvt.

Amazon, Flipkart and Jasper Infotech Pvt’s Snapdeal — also backed by Alibaba — are jockeying for position as online retail takes off alongside a boom in smartphone users. All three are spending heavily to build up their delivery capabilities and entice shoppers through discounts and promotions. Amazon alone has pledged to invest a total of $5 billion, betting the country will become a major online-shopping market as incomes rise.

Alibaba has thus far avoided any direct involvement in the fray, preferring for now to maintain passive stakes in startups. But it is seeking growth outside of China, a slowing market it already dominates. The company remains intent on a goal of getting half its revenue from outside its home country, from about 20 to 30 percent now. The company founded by billionaire Jack Ma envisions itself as a middleman connecting US and European brands with increasingly well-off consumers within China and around Asia. It bought Lazada SA in part to gain a beach-head in Southeast Asia.

ADVERTISEMENT

Paytm E-commerce was spun out of One97 Communications, the operator of the Paytm digital payments service of which Alibaba and its Ant Financial affiliate own a substantial stake. A valuation of over $1.1 billion makes the spinoff India’s newest unicorn, and its founder and chief executive officer Vijay Shekhar Sharma a unicorn-founder twice over. Calls to SAIF’s Indian offices went unanswered.

“India is an important emerging market with great potential. We are committed to working with local partners with the aim of developing a long-term, sustainable business,” Alibaba said in an e-mailed statement while declining to comment on specific deals.

By Saritha Rai and Lulu Yilun Chen; editors: Robert Fenner, Edwin Chan and Peter Elstrom.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.