The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

HONG KONG, Hong Kong — In the early days of Naga, a $60 million investment group that provides operational support for emerging brands in the jewellery, accessories and beauty markets, Hong Kong-based chief executive Damien Dernoncourt started interviewing "creative entrepreneurs" looking to turn small ventures — think $5 million to $25 million in annual revenue — into big companies.

To date, he has met with close to 400, many of whom are raising funds in the hopes of circumnavigating a common roadblock. While accessories — handbags, shoes and eyewear — can be a highly profitable business, with margins often far wider than apparel, scaling isn't so easy. That's because the once-reliable wholesale channel is contracting. Growing a direct business, either by opening physical stories or acquiring customers only, is increasingly expensive.

Many of these brands, which were built on the old way of doing things — i.e., establish a strong wholesale distribution network first, then figure out e-commerce and your own physical retail later — are not adapting quickly enough. So they need to raise money in order to accelerate their progress, sometimes from a strategic investor who can help manage operations, sometimes from a private investor or family office with a passion for the brand, sometimes from an institutional investor like a venture capital or private equity fund that will stay at arm's length. Some brands are looking for minority investments, others are ready to be majority-owned by another entity.

And strong accessories businesses are certainly attractive to investors: consumer patterns signal that demand for luxury accessories will continue to grow. The market for luxury shoes reached €18 billion ($20.5 billion at current exchange) in 2017, up 10 percent year on year, according to Bain & Company. Handbags reached €48 billion ($55 billion) in 2017, up 7 percent from the year before. Apparel sales, in comparison, increased by only 3 percent, despite taking up the largest slice of the luxury pie worth €61 billion ($70 billion).

ADVERTISEMENT

However, despite the fact that there is plenty of interest on both the buy-side and the sell-side, deals are slower than in, say, the beauty space, where significant transactions take place nearly every week. "There's a big disconnect between what the entrepreneurs want and what the investors want," said Dernoncourt, whose current bets include fine jewellery label Tamara Comolli and French beauty brand Talika. "The current distribution model is just not good enough."

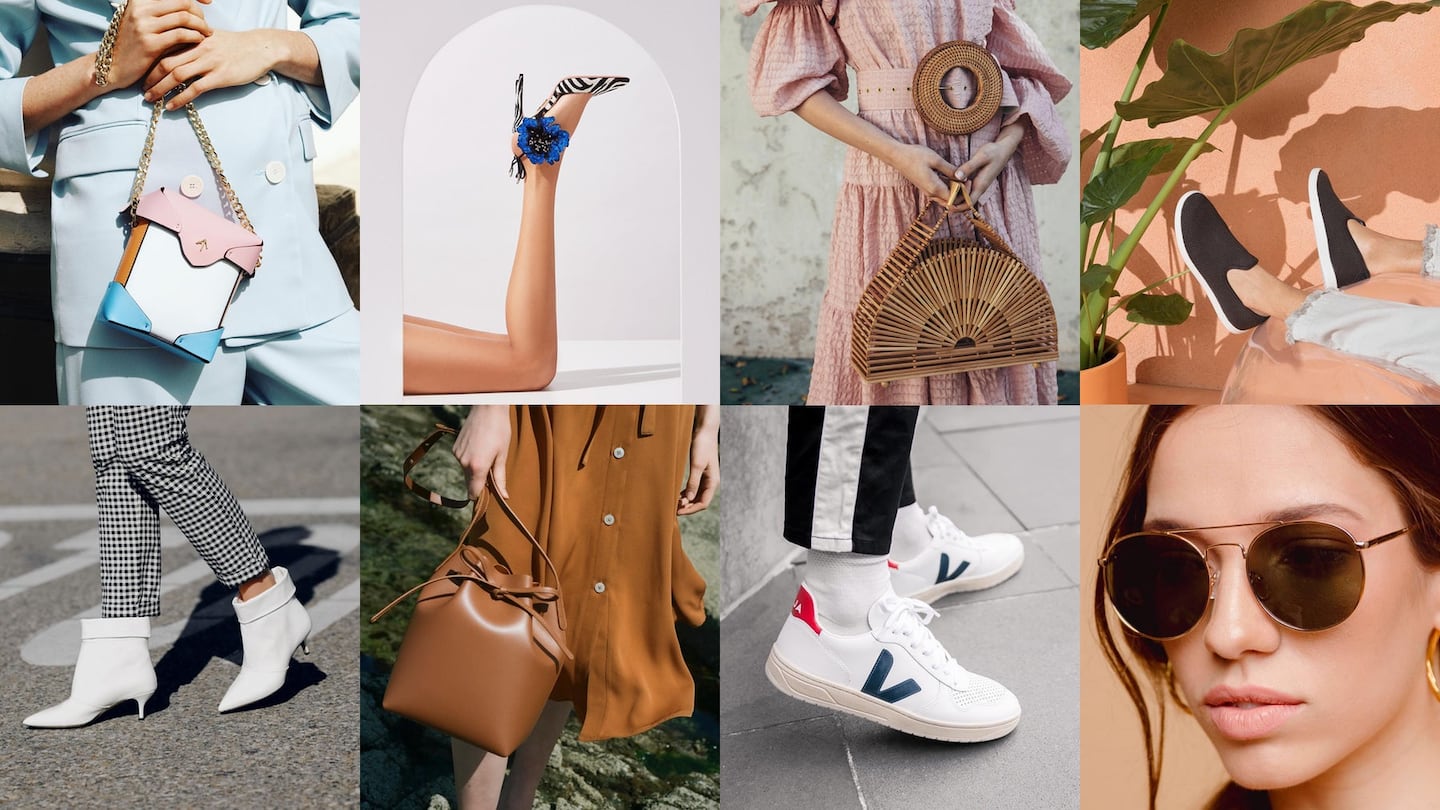

That being said, investors believe that certain accessories brands are poised to break through. BoF conducted internal research and analysis, and spoke with a number of industry experts, to identify the top 10 M&A targets in the space.

Aquazzura

Founded in 2011

Estimated 2018 Revenue: $120 million

Predicated on the idea that sexy-but-in-good-taste shoes will always sell, Aquazzura has managed to keep both consumers and investors keen. With plans to open nine new retail stores over the course of 2018, it's the brand on everybody's lips and the one market sources say is in the best position to be acquired by a strategic group. "In today's market, customers want energy and constant creativity," creative director and co-founder Edgardo Osorio told BoF earlier this year. "I believe that the future is a combination of retail and online. It's not one or the other."

Ace + Tate

Founded in 2013

Estimated 2018 Revenue: $40 million

US-based eyewear powerhouse Warby Parker disrupted the industry in 2010 when it began offering high-quality frames at a lower price than its competitors by selling directly to the consumer. But its (intentional) lack of international distribution has made room for dozens of copycats abroad.

One startup that has managed to adopt the pricing ethos of Warby Parker while developing a design style all its own is the Amsterdam-based Ace + Tate, a clever play on the word “acetate,” the material often used to create eyewear frames. With about 30 retail stores across Europe, chief executive Mark de Lange is aiming to open 10 more by the end of 2018.(In 2017, the company more than doubled its customer base.)

Given the operational challenges associated with scaling eyewear — many manufacturers are still controlled by the major conglomerates — Ace + Tate’s success has piqued investor interest. It also begs the question of whether Warby Parker, which has raised $215 million at a $1.75 billion valuation, will acquire international businesses on its road to an initial public offering. (The New York-based company has long said that while international expansion is part of its long-term plan, the headache of regulations associated with selling a medical product across regions, combined with continued growth in the US, hasn’t made it worthwhile yet.)

ADVERTISEMENT

Allbirds

Founded in 2015

Estimated 2018 Revenue: $100 million

First adopted by tech engineers in the Bay Area as complementary footwear to their trusty hoodies, Allbirds' original style — a Yeezy-esque lace-up sneaker made of wool — has become the comfort shoe of the era with cross-generational appeal. (It's also a popular alternative in the medical industry to orthopedic "nursing" shoes and clogs.)

But while investors are interested in Allbirds’ speedy adoption rate, what perhaps distinguishes it from similar concepts is its differentiated materials. Thus far, it has made shoes out of temperature-regulating merino wool, carbon-footprint-reducing tree fibre and most recently, sugar cane rendered into foamy soles for flip-flops. So far, founders Tim Brown and Joey Zwillinger have raised $27.5 million in funding from venture capital firms including Tiger Global Management, Maveron and Lerer Hippeau.

Mansur Gavriel

Founded in 2012

Estimated 2018 Revenue: upward of $25 million

Earlier this year, chatter around the possibility of Mansur Gavriel taking on a minority investor reached a fever pitch when founders Floriana Gavriel and Rachel Mansur, winners of the 2016 CFDA Award for Accessories Design, hired William Sussman at New York-based advisory service Threadstone Capital to assist with the potential sale.

According to market sources, the company, which catapulted into the industry’s conscience in 2013 with its blockbuster bucket bag, is looking to raise capital in order to fund more directly owned retail stores, streamline back-end operations and expand internationally. While it has been difficult to match the public fervour generated by its early handbag collections, its shoes have been a retail success, while ready-to-wear has been reviewed favourably by critics.

Paul Andrew

Founded in 2012

Estimated 2018 Revenue: $8 to $10 million

The namesake line from this well-regarded shoe designer has gained an international following at retail thanks to its sculptural designs, reliable fit and made-in-Italy quality. (For instance, the Rhea singback, a pointy-toe flat, is a consistent best seller for many department stores.)

ADVERTISEMENT

New York-based, British-born Andrew, who spent years designing for other labels including Donna Karan and Narciso Rodriguez, has reached a new level of prominence since joining Ferragamo to lead footwear design in 2016. In 2017, he was also named creative director of women's ready-to-wear at the struggling, family-owned Italian house.

Paul Andrew is self-financed and, according to market sources, profitable, although that success is currently reliant on wholesale. An outside investment could allow him to scale further by launching e-commerce and opening directly owned retail stores.

Cult Gaia

Founded in 2012

Estimated 2018 Revenue: $15 million

Cult Gaia designer Jasmin Larian's "Ark" bag, a bamboo-cage clutch inspired by Japanese picnic bags from the 1940s, is an Instagram sensation that has sustained popularity for multiple seasons. But while handbags continue to make up nearly 80 percent of the business — with sales in the wholesale channel up by 54 percent from last year — the Los Angeles-based label has seen early success with ready-to-wear, which it introduced in 2016 and is up 400 percent year-over-year.

Larian's item-driven design — and willingness to phase out products after that hit their peak, such as her once-popular flower crowns — has investors interested. She also uses her own e-commerce to test out new categories and styles. "Nobody picked up my first ready-to-wear collection, but I pushed it really hard [online]," Larian told BoF in July 2018. "We had to be successful on our own. If the buyer doesn't get it, we'll show them."

Le Specs

Founded in 1979

Estimated 2018 Revenue: projected to reach $100 million by 2020

Owned by Australian eyewear distributor Sunshades, which acquired the license for the name in 2005 from cosmetics company Australis, Le Specs has enjoyed late-in-life success after a 2016 collaboration with the American designer Adam Selman unexpectedly helped to catapult its sales, which increased by 150 percent in just one year.

"It feels like they are a pair of Yeezy's, or something from the Louis Vuitton x Supreme collaboration," creative director Hamish Tame told BoF in 2017. It also helps that despite its high-fashion aesthetic, a pair of Le Specs is priced well below $100. However, it seems unlikely that Sunshades would be willing to give up its fast-growing label even for the right price: it's more likely than the group, which now generates a significant amount of its sales from Le Specs, would be an acquisition target.

Clare V.

Founded in 2008

Estimated 2018 Revenue: approaching $15 million

Designer Clare Vivier’s first bag was a practical laptop case. Today, the LA-based designer is better known for turning out pop-y clutches, woven carryalls and pouf-like wristlets that nod to her French connection. (Her husband, whom she met while living in Paris, is from there.)

But it's Vivier's cleverly arranged retail stores — which are set up like a home library, with handbags displayed on shelves alongside artwork, magazines and products from her favourite brands including Caran d'Ache pens and Memphis Group-inspired socks — that have helped to advance her business and have even inspired other brands to imitate her approach. While a 2012 minority investment from Bedrock Manufacturing (a brand management firm backed by Shinola founder Tom Kartsotis) helped finance the opening of 7 stores across the US, she may be well-positioned to take on a strategic partner to help fuel further international distribution and category expansion. (The designer, who launched her first fragrance in 2017, will be hosting a pop-up at Le Bon Marche in Paris this fall.)

Veja

Founded in 2004

Estimate 2018 Revenue: $23 million

While plimsoll trainers have been overshadowed in recent years by chunkier, louder “dad sneakers,” the Paris-based Veja has managed to continue to steadily build its audience with retro-inspired styles that are made in what the company says is a sustainable, ethically minded fashion. (Uppers are made from organic cotton, while the soles are made from wild rubber harvested in the Amazonian rainforest.) Its global distribution — 1,500 retailers in 45 countries — indicates that the label has legs beyond its Euro-centric aesthetic.

Manu Atelier

Founded in 2014

Estimated 2018 Revenue: $8 million

Designed by a pair of Turkish sisters whose father is a leather craftsman, Manu Atelier has gained a global following through organic influencer marketing — Eva Chen, Instagram's head of fashion partnerships, was an early fan — and smart distribution, with 40 percent of sales stemming from its own e-commerce.

In 2017, sales at Merve and Beste Manastir's self-funded, Istanbul-based label were nearly $6 million, a 220 percent increase from a year earlier. In October 2018, the duo plans to launch footwear through its own e-commerce site. The goal, they told BoF in July 2018, is to increase Manu Atelier's international distribution, particularly in the US, where the label is underpenetrated. In a time when "Instagram-famous" brands are gaining significant traction among retailers, Manu Atelier stands apart thanks to the Manastir sisters' background in leatherworking and bold detailing that distinguishes it from its minimalist counterparts.

Related Articles:

[ The Top M&A Targets in JewelleryOpens in new window ]

[ The Top M&A Targets in StreetwearOpens in new window ]

[ The Top M&A Targets in ActivewearOpens in new window ]

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.