The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Ssōne Co-Founder and Director Christopher Suarez first felt a change in business back in January, long before anyone in the West was talking about the coronavirus with real seriousness. It was then that he noticed a "softening of consumer confidence," as well as signs of struggle from multi-brand retailers, which were having trouble acquiring — and keeping — customers amid increased competition and high marketing costs.

When Suarez, who is based in London, realised that stores were buying more conservatively for the Pre-Fall 2020 season, he immediately adjusted his sales for the year. “But we couldn’t do it quick enough, to be honest,” he said. Pre-pandemic, Suarez projected full-year revenue for 2020-2021 to reach £887,000 (about $1.1 million). Now, that figure stands at £392,000 (about $493,000).

How is Suarez — and Ssōne — faring now, months into the Covid-19 pandemic, which has threatened the existence of so many companies? Independent business owners across industries, including fashion, have struggled to secure the government assistance they need to stay afloat. And with no "new normal" in sight, they are also struggling to project what the post-Covid-19 iteration of their companies should look like.

What’s next, then? BoF spoke with the leaders of three very different businesses — a fledgling ready-to-wear label, a wholesale-reliant contemporary player and a venture capital-based direct-to-consumer swimwear startup, to better understand the challenges they’re facing, and the solutions they’re finding.

ADVERTISEMENT

The Fledgling Label

As Nicholas Kirkwood's former business partner, Suarez helped take the shoe designer's namesake brand from inception in 2005 to a minority sale to LVMH in 2013. He launched Ssōne, a slow-fashion label, with designer Caroline Smithson in September 2019.

Ssōne campaign imagery | Source: Courtesy

For Ssōne, the first thing to go was the funding. Smithson and Suarez used their own savings and contributions from an outside partner to get things up and running last year, plus additional financing to produce collections upfront for their own e-commerce, a store in London's Marylebone neighbourhood and orders from MatchesFashion, their retailer partner. Those loans were no longer easy to secure because Ssōne's lenders were rattled by slowing demand in Asian markets, and how this would affect global online retailers such as MatchesFashion. (Many major multi-brand retailers were already slow on payment in the last quarter of 2019, and some, like Neiman Marcus, were at risk of bankruptcy.)

Sales have also taken a hit, further reducing working capital, and making it harder to raise money from investors, which they had planned to do at the end of the first quarter of the year. The brand had initially planned to break even by the end of March 2021, but that was no longer realistic. “How can I, with certainty and with responsibility, write a business plan that’s going to show that we have a growing retail and e-commerce directness?” he said.

Pre-pandemic, Suarez had plans to expand Ssōne's wholesale distribution beyond MatchesFashion. But now, the same key retailers that were keen before have become less so. “We were never going to build a very broad wholesale base, but we were going to focus on three-to-five wholesale partners,” he said, “But all of that interest… began to evaporate.”

Instead of seeking new investors, Suarez decided to go to his existing investor, UK-based wholesale showroom Rainbowwave, which has a 16 percent stake in the business. He presented revised growth targets and a new plan to avoid external investment for the next six months.

No longer able to expand in the already-challenged wholesale landscape, Suarez pivoted his plans to focus on his direct and localised engagement with the consumer. Ssōne had officially opened a brick-and-mortar store on Chiltern Street in February 15, coinciding with London Fashion Week but also narrowly preceding strict lockdown measures across the UK, which required all non-essential stores to be shuttered.

ADVERTISEMENT

Ssōne's store on Chiltern Street | Source: Courtesy

The timing was less-than opportune for any business, but Suarez remains resolute about the broader, long-term importance of the brand’s physical retail presence. “The Chiltern Street location is absolutely crucial to our brand messaging, … consumer and community engagement,” he said. “It’s not an onerous lease in a sense, it’s not like having a shop on Bond Street or Sloane Avenue.” Even with shuttered doors, Suarez sees the store as “an asset and a liability at the same time… If we didn’t have retail, I probably would not be looking to fund the business any further at all.”

In addition to sharpening his retail model, the crisis has led Suarez to revamp Ssōne's entire approach to design, production and supply. By the end of January, he had to make a final decision on the brand’s second collection for June and ultimately held off on all raw material and factory orders, repurposing deadstock instead. He’s also changing up where the collection is produced. “Now, all our focus is actually going to be [on] producing locally, looking at more of a demand-led supply model,” he said. “If we need 15 dresses for our shop in November, we make those first, locally from repurposed or upcycled deadstock fabrics. But we’re not necessarily making the collection for wholesale... essentially, it’s a scarcity model.”

The Wholesale Darling

London-based luxury resort wear brand Three Graces London only started to feel the effects of the coronavirus in late March. In fact, the brand was one week into a three-week initiative donating 100 percent of net direct online sales to UK homelessness charity Crisis, for which it raised £22,000.

“There was the initial sense of, ‘Oh, my God,’ and then the calls came through almost one after another,” said Founder and Lead Designer Catherine Johnson, who has independently financed the business.

Johnson said it was the smaller retailers that first got in touch. “We've had everything from requests to, as you can imagine, outright cancel orders to 'Can we negotiate a discount? Can we negotiate terms?'” she said. “Some people [have] just [been] completely blanking me and not replying to emails, just saying ‘actually, [this is] your problem.’ But they are few and far between, to be perfectly honest.”

I can see that it's going to get more complicated.

Three Graces’ business is 90 percent wholesale, according to Johnson’s estimation, so even though the brand has seen direct online sales double compared to the same period last year, revenue is still heavily dependent on multi-brand retailers that carry it. (Johnson declined to disclose revenue figures or projections.) Fortunately, Three Graces’ two biggest stockists, MatchesFashion and Net-a-Porter, “have been incredibly loyal and have really tried to work with us,” said Johnson, “but if they can't photograph, if they can't ship, if their warehouses aren't open, I can see that it's going to get more complicated.”

ADVERTISEMENT

Three Graces has been successful because it sells a popular product at an affordable price. It takes a slimmer margin per item because of this approach, but it’s able to sell more items and has a higher full-price sell-through rate than many of its competitors. However, it’s also reliant on retail partners to pay for what they order. A lot of stockists have requested to move delivery dates, which is less than ideal for Three Graces, which manufacturers in Europe. Unlike resort wear brands with a manufacturing base in China, its next two collections were already produced when retailers started to cancel or delay deliveries.

Three Graces campaign | Source: Courtesy

Johnson, a qualified accountant, is keeping an eye on cash flow and profitability, which the company has achieved in the previous two financial years, but feels strongly about upholding contracts with suppliers and other external stakeholders. “[For] the pieces that weren’t ready, I actually didn’t want to cancel them… because I know that we work really closely with [our factories],” she said. “People are depending on those salaries, and I would feel very badly if somebody did that to me on the other side.” Some of Three Graces’ smaller boutique stockists, “have just outright said, ‘actually we’re in a pretty bad state ourselves and we just literally cannot take deliveries.' I’ve taken that quite hard… We’re being loyal to our supply chain; I expect the same from our stockists.”

However, there are limited ways for Johnson to slash overheads beyond rent. (After a brief unresponsive period, her studio’s landlord introduced rent reductions for everyone in the building.)

“There aren’t a hell of a lot of costs for us to cut away because the business is actually run quite lean,” she said. “There’s always lookbooks, photography, all of those things, but then that’s very difficult because if you take away the branding, you’ve cut the whole brand so far back to the bones.” Similarly, she continues to pay her PR agency, Aisle 8, in full. “They do a brilliant job and I think that they would be struggling as well. I don't think now's the time to ask [for reduced fees].” Plus, she added, “Now should be our biggest season. Maybe if this happened in November, I might feel [differently], but I need them to work for us regardless.”

Aside from putting one intern on furlough, Johnson has kept everyone on payroll while they work remotely, including seamstresses, and remains bullish about the brand’s key high summer and resort seasons ahead. “We have a collection that is 80 percent there and… will be ready to show [a new collection in] June, on-deadline.” What remains up in the air is how much product they will realistically be able to shift in the midst of a looming recession.

Obviously, sitting on inventory is the biggest worry [because] our production is ready to ship.

"For me, it's business as usual until I know something different," she said."Obviously, sitting on inventory is the biggest worry [because] our production is ready to ship."

The Venture Capital-Backed, DTC Start-Up

While it may be the time for digital-first brands selling loungewear and self-care products, the same can’t be said for swimwear. Not only are summer plans on hold indefinitely, but lockdowns and social distancing measures came into effect in the United States just as Millennials and Gen-Zs would normally hit the beach in droves for spring break.

“Obviously, Covid-19 took the wind out of our sails a bit,” said Melanie Travis, founder and chief executive of New York-based direct-to-consumer swimwear brand Andie. “But we’re hanging in there.”

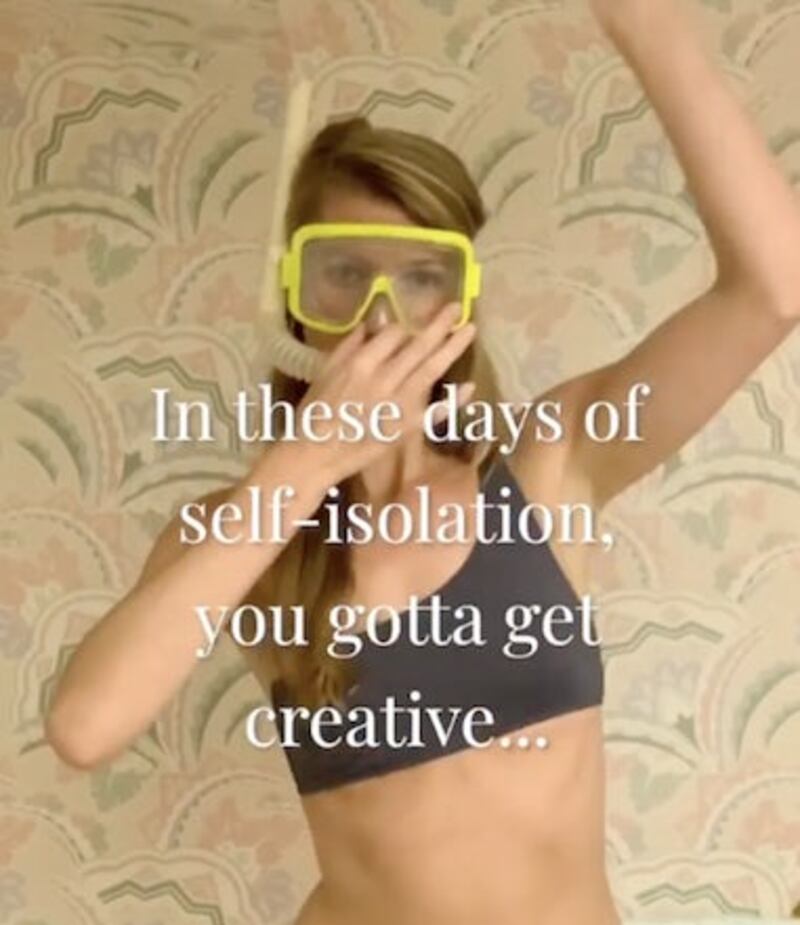

Still from Andie's at-home social media campaign | Source: Courtesy

January and February represented the first challenging phase for Andie, as the emerging virus led to a nationwide lockdown in China. “I was concerned about our supply chain operation because [our manufacturers in China] were making the product that we were going to be launching in May for our summer season,” Travis said. “It did not even occur to me at that time that maybe, you know, consumer demand and marketing would actually be a bigger headache.”

But in that moment, the business was able to avoid any significant supply chain disruptions, owing to its large and diversified factory network. "We navigated that very well," Travis said. "By early March, I was like, great, everything's good. We have nothing to worry about. Famous last words."

By mid-March, various US states were announcing lockdowns and social distancing measures “and we saw our revenue, frankly, plummet with that,” said Travis. “I would say that the first week that most people in the United States were on lockdown was pretty tough for us. Revenue was way down, marketing costs were way up, but that didn’t last very long… we started pivoting really quickly.”

Andie’s team pulled back on marketing spend immediately and changed messaging to better suit the age of quarantine and held-off summer plans. “There’s two elements to when the crisis hit, some good and some bad,” said Travis, citing the loss of revenue from hampered spring breaks and cruise season as the obvious downsides. “The good [aspect] is that, as an e-commerce business, we really ramp up our big awareness tactics.” While Andie had planned to spend a lot of money on media this year — including outside billboards — they were able to cancel those and preserve some cash. As a result, Andie hasn’t had to consider layoffs or furloughs for its staff of 13. Real estate, another significant overhead for most fashion companies, is also taken care of while lockdown remains in place, as Andie’s manufacturer is also one of its biggest investors and provided office space in its New York headquarters. The brand does not yet operate its own retail stores.

By early March, I was like, great, everything's good. We have nothing to worry about. Famous last words.

The company was also able to pivot its marketing quickly thanks to all operations — except for PR — staying in-house. While much of its marketing budget has been slashed, Andie is still communicating with customers (and potential customers) online, shifting its message to reflect the new stay-at-home mandates. "I'd say it was a matter of maybe 24 hours until all of our assets were completely different," she said.

As well as combing through a backlog of photoshoots and behind the scenes imagery to refresh the site, the Andie team itself is now featured. “We literally sent our suits to ourselves, to our staff, and we shot them on ourselves in our living rooms, in our backyards,” said Travis, arranging Zoom house tours with Andie’s creative director to pinpoint the best backdrops and lighting. “Part of the marketing message transition has been one of transparency and really showcasing who we are as a team and how we're handling this.”

For the first quarter of this year, “things were excellent in January and February,” said Travis, “and we obviously had really aggressive growth goals [but] we were actually ahead of schedule,” owing to low customer acquisition costs and high revenues. “Even with the crisis and the revenue strop-off in mid-March, we still actually landed the first quarter fully on plan.” Travis declined to disclose exact revenue figures, but said that Andie “does double-digit millions in revenue” and has grown 600 percent year-on-year since it launched in April 2017. Although Covid-19 will hamper the topline growth Travis initially projected, she remains bullish that the company “will continue to grow this year.”

Andie closed a $4 million Series A fundraising round in December 2019, bringing total funding to date to $10 million, but Travis says that she has not had to assuage investors, which include Sonostar Ventures and actress Demi Moore. “I’ve been fortunate to be somewhat picky with the investors that get involved with the company…,” she said. “[It’s] cheesy to say, but they are in it for the long-haul and not for a quick flash.”

From her end, Travis has been keen to keep everyone up to speed with company performance, even more frequently than usual. “I used to do quarterly investor reports,” she said. “Now, I do [them] weekly.”

The crisis has also sharpened Travis’ focus on reaching profitability. “In some ways the crisis makes it harder, you know, because obviously it's just not as many people are shopping for swimsuits,” she said. “But in other ways, it makes it more achievable because you really learn the efficiency of marketing spend. It’s like boot camp [for being] as efficient as possible.”

We’re tracking the latest on the coronavirus outbreak and its impact on the global fashion business. Visit our live blog for everything you need to know.

Related Articles:

[ Governments Have Promised Small Business Loans. Getting Them Isn’t Easy.Opens in new window ]

[ What to Do With All That Excess InventoryOpens in new window ]

[ How to Talk to Customers During the Coronavirus PandemicOpens in new window ]

The Los Angeles-based accessories label has been a well-kept secret in the industry, but founders Yang Pei and Stephanie Li are hoping to change that through new acquisitions, opening brick-and-mortar stores and using AI to speed up the design and production process.

Designer Carly Mark sparked conversation about what it takes to make it as an emerging designer in New York when she announced she was shutting her ready-to-wear line and moving to London. On Thursday she held her last sample sale.

To stabilise their businesses brands are honing in on what their particular consumer wants to buy, introducing new categories and starting conversations.

That’s the promise of Zellerfeld, a 3D-printing partner to Louis Vuitton and Moncler that’s becoming a platform for emerging designers to easily make and sell footwear of their own.