The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI, China — China's tech giants Alibaba Group Holding Ltd and Tencent Holdings Ltd, worth a combined $1 trillion, are on a retail investment binge, forcing merchants to choose sides amid a battle for shoppers' digital wallets.

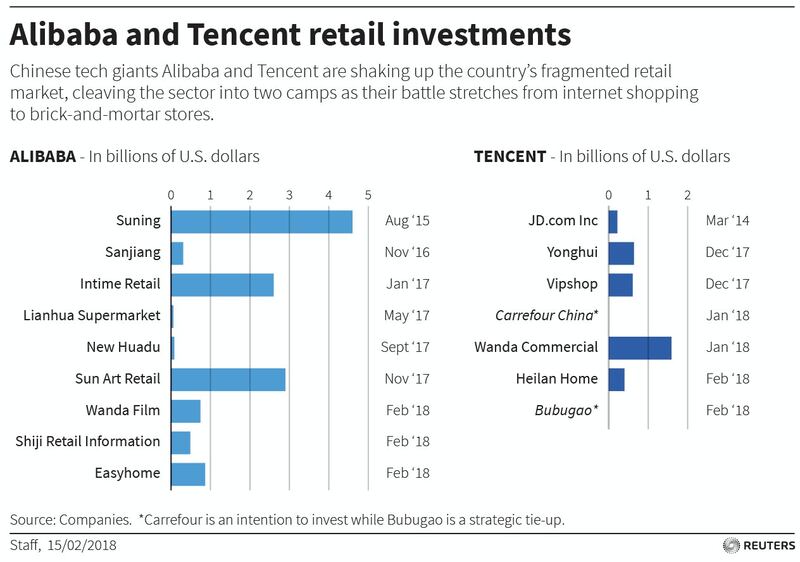

Since the start of last year, the two companies have between them spent more than $10 billion on retail-focused deals, boosting their reach online and in brick-and-mortar stores.

The aggressive drive, supported by large cash piles and soaring share prices, is part of a battle to win over consumers and store operators to the two firms’ competing payment, logistics, social media and big data services.

The result: fewer and fewer retailers left without allegiance to either Tencent of Alibaba.

ADVERTISEMENT

“All of the retailers in the brick-and-mortar world are very worried. They have to take a side,” said Jason Yu, Shanghai-based General Manager of market research firm Kantar Worldpanel. “Otherwise they are afraid they will be eaten alive in the future.”

Alibaba is China’s top e-commerce player and its affiliate Ant Financial leads in mobile payments. Tencent’s strengths lie in social media, digital payment and gaming. It also has a major stake in the second-largest online retailer, JD.Com.

Tencent and JD.com have a growing range of allies, including French grocer Carrefour SA, which has announced a potential investment from Tencent, and U.S. retail giant Walmart, which has a stake in JD.com.

Tencent also bought a stake in Yonghui Superstores Co Ltd, apparel retailers Vipshop Holdings Ltd and Heilan Home, mall operator Wanda Commercial, and this month snagged a strategic tie-up with grocer Bubugao.

In the other corner is Alibaba, which has invested even more heavily in Suning.com, Intime Retail, Sanjiang Shopping Club, Lianhua Supermarket, Wanda Film and IKEA-like home improvement store Easyhome.

There are few retailers left without allegiance to either Tencent of Alibaba.

Key to the battle is China’s nearly $13 trillion mobile payment market, where Alibaba and Tencent are going head-to-head. Alibaba took a 33 percent stake in its payment affiliate Ant Financial this month ahead of an expected mega IPO.

Ant operates China’s top mobile payment platform, Alipay, while Tencent’s payment system on its hugely popular Weixin chat app is catching up fast. Both firms are also making a big push in cloud computing and data.

“I think for payment (the retail push) is a very critical part because it’s almost a gateway,” said Yu. Brick-and-mortar stores in China account for about 85 percent of retail sales, creating a huge lure for tech giants.

ADVERTISEMENT

“That’s the pot that Alibaba, JD.com and even Tencent want a slice of,” Yu added. “That’s the majority of the business where they can actually look for future growth.”

In return, the physical stores get access to payment systems, logistics networks and other services - not to mention the reams of data on consumers that the tech firms control.

Alibaba invested $486 million this month in a retail-focused big data firm, saying the deal meant it could better “help brick-and-mortar retailers succeed in the digital age.”

By Adam Jourdan.

Though e-commerce reshaped retailing in the US and Europe even before the pandemic, a confluence of economic, financial and logistical circumstance kept the South American nation insulated from the trend until later.

This week’s round-up of global markets fashion business news also features Korean shopping app Ably, Kenya’s second-hand clothing trade and the EU’s bid to curb forced labour in Chinese cotton.

From Viviano Sue to Soshi Otsuki, a new generation of Tokyo-based designers are preparing to make their international breakthrough.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.