The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The current decade marks a critical inflection point for the fashion industry to transform in line with global ambitions to curb climate change and establish more responsible business practices.

Last year, The Business of Fashion created The BoF Sustainability Index, examining public disclosures from 15 of fashion’s largest players to benchmark the industry’s progress towards achieving ambitious environmental and social targets by 2030. The results demonstrated a substantial gap between major brands’ public commitments and meaningful, measurable actions.

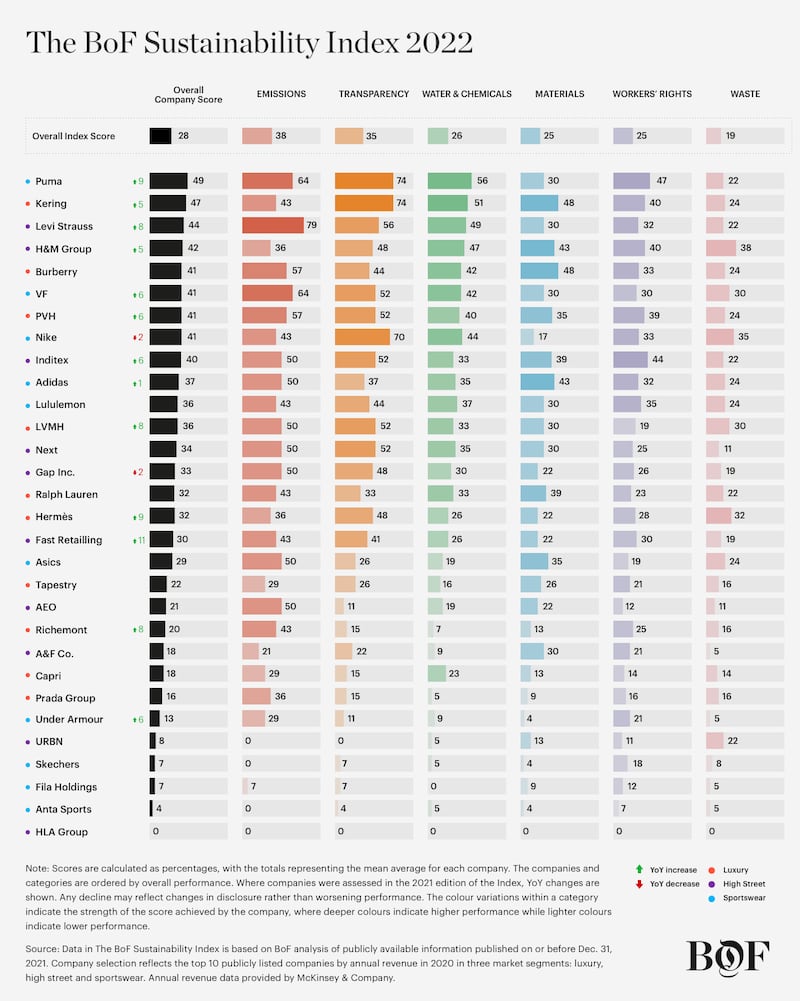

This year, the Index has expanded in scope to examine the performance of the industry’s 30 largest publicly traded companies by revenue across three market segments: luxury, sportswear and high street. Our research team at BoF Insights assessed each company on more than 200 different data points across six impact categories: Transparency, Emissions, Water & Chemicals, Waste, Materials and Workers’ Rights.

With just eight years left to reach targets, the results are stark: performance in five out of six impact categories has worsened as incremental progress among the original cohort of 15 companies assessed last year was eclipsed by inaction across many of the new additions.

ADVERTISEMENT

While technological innovation, policy cues and standardised reporting frameworks are helping to prompt action, limited accountability within the sector, poor-quality data and a lack of investment are holding back real transformative change.

Download the full report from BoF Insights for in-depth analysis of sustainability advances to date, key challenges facing the industry and the landscape for the year ahead.

Transformation, Interrupted

The window for the fashion industry to transform its business practices in line with global sustainability goals is rapidly closing, yet change remains incremental. The biggest players in the original cohort of 15 companies from last year have largely emerged as frontrunners, but they are still moving much too slowly to achieve targets by 2030. Meanwhile, several companies among the new additions have yet to meaningfully engage publicly with issues related to sustainability at all.

Overall, progress remains uneven, opaque and above everything, too slow:

The Index Methodology:

The BoF Sustainability Index examines the 10 biggest public companies by annual revenue in 2020 across three distinct fashion industry verticals: luxury, high street and sportswear. It assesses performance across six impact categories: emissions, transparency, water & chemicals, waste, materials and workers’ rights.

Within those categories, the companies are benchmarked against 16 ambitious environmental and social targets established by The Business of Fashion in consultation with a group of respected global experts. Each of the targets contains a series of binary metrics (201 in total) that were scored “yes” or “no” based on information that was publicly available on or prior to December 31, 2021.

ADVERTISEMENT

Year-on-year, the methodology has been updated and condensed; companies’ 2020 scores have been updated accordingly in this year’s report.

The companies assessed in The BoF Sustainability Index 2022 are: Abercrombie & Fitch Co., Adidas, American Eagle Outfitters, Anta Sports, Asics, Burberry Group, Capri Holdings, Fast Retailing, Fila Holdings Corp., Gap Inc., H&M Group, Hermès, HLA Group Corp., Inditex, Kering, Levi Strauss & Co., Lululemon Athletica, LVMH, Next PLC, Nike Inc., Prada Group, Puma, PVH Corp., Ralph Lauren Corp., Richemont, Skechers USA, Tapestry, Under Armour, Urban Outfitters Inc. and VF Corp.

More information on the methodology is available in our FAQs, or download the report from BoF Insights to review it in full.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until Dec. 31, 2021. It should be viewed as a proxy for sustainability performance and not an absolute measure. BoF accepts advertising arrangements from a range of partners, some of which may appear in The Sustainability Index. Such advertising arrangements and the Index are handled by separate parts of the business. LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

The fashion industry continues to advance voluntary and unlikely solutions to its plastic problem. Only higher prices will flip the script, writes Kenneth P. Pucker.

The outerwear company is set to start selling wetsuits made in part by harvesting materials from old ones.

Companies like Hermès, Kering and LVMH say they have spent millions to ensure they are sourcing crocodile and snakeskin leathers responsibly. But critics say incidents like the recent smuggling conviction of designer Nancy Gonzalez show loopholes persist despite tightening controls.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.