The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hair care company Ceremonia has all the hallmarks of a brand launched in the social media age, from chic packaging and colourful ingredients to an influencer network that quickly drove followers to the company’s Instagram account.

But when it comes to finding customers, Ceremonia isn’t really an Instagram brand. Instead, it increasingly relies on a relative newcomer to the customer acquisition game: Google Shopping. Appearing on the search engine’s utilitarian grid of billions of product choices under its Shopping tab has proven so effective at driving sales that Ceremonia plans to devote more of its budget to the platform this year.

“Google Shopping is cheaper than Facebook and Instagram in general,” said Babba Rivera, the brand’s founder. “It’s an untapped opportunity for young brands.”

Google’s shopping function isn’t exactly new. The company has operated various iterations of its e-commerce site since 2002, when it launched Froogle (a pun on frugal), which was rebranded to Google Product Search five years later. The original Froogle existed separately from Google.com, and did not have the sort of comprehensive product data available on Google Shopping today.

ADVERTISEMENT

But it was in spring 2020, after the search engine made it free for brands to list products on its Shopping tab, that the service began to really take off (previously, brands had to pay for each individual listing). This drew in many small brands with the promise of appearing on equal footing in searches with bigger rivals. Ceremonia, for instance, can see its hair oil appear alongside larger rivals sold by Bed Bath & Beyond.

It’s an untapped opportunity for young brands

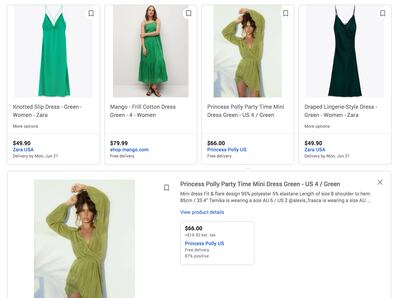

For consumers, Google Shopping offers the promise that they can type in a search term and expect to find a comprehensive selection from the site’s enormous database. A query for “yellow T-shirt” turned up a $5.50 option from Zara, a $350 Off-White garment sold by Farfetch, and hundreds of other options in between. The site also makes it easier to comparison shop; a similar Off-White T-shirt was available for $100 less at several other retailers. Clicking on a listing will pull up basic product information and a link to the seller’s website. Some brands allow users to buy via Google Shopping directly.

In the past year, Google said it saw 80 percent growth in the number of merchants that use Shopping and a 70 percent increase in products listed. Over 1 billion Shopping sessions occur on a daily basis. The tool is helping Google compete for fashion marketing dollars with Facebook and especially Amazon, which has gained market share in digital advertising at the search giant’s expense.

As search traffic rises, the lure for brands grows more powerful. Many now use a combination of free listings and paid ads, which appear on the top panel as the first results but are marked as “ads.” Emme Parsons, a luxury sandal maker, said her return on ads purchased on Google Shopping is nearly 800 percent, compared with 136 percent and 30 percent on Instagram and Facebook, respectively. Clearbanc, a lending firm that funds digital marketing for hundreds of direct-to-consumer companies, said its clients’ spend on Google increased more than 110 percent in the second half of 2020, compared to 29 percent with Facebook, though the large majority of marketing spend is still dedicated toward the latter in 2021.

Larger brands also haven’t been as quick to shift their spending because they have less developed direct-to-consumer channels and prioritise brand awareness marketing over conversions, according to Girish Ramachandra, chief executive of Shopalyst, a firm that helps build digital ads for big consumer-product companies such as L’Oréal Paris and Estée Lauder.

“Google Shopping has become a huge win for brands,” said Aaron Edwards, chief executive of digital creative agency The Charles. “It’s a genius user enhancement that Google has made over the years and ultimately it’s changed the behaviour of the consumer.”

Last month, Google reiterated its offering of free product listings indefinitely, and said it would also work with e-commerce backend providers like Shopify, Square and GoDaddy to make the process of listing easier and more automated.

Facebook and Google

ADVERTISEMENT

The rise of Google Shopping has escalated its rivalry with Facebook and Amazon. The three companies are the leading channels for digital advertising. In recent years, all have attempted to expand beyond their core strengths to capture more of the shopping experience: Amazon has opened physical stores and stepped up its fashion partnerships. Instagram launched in-app checkout in 2019 and added a Shopping tab last November.

Google’s answer is its “Shopping Graph,” a database that tracks products, brands and customer reviews. In addition to powering the Shopping search function, Shopping Graph connects with information collected by Google’s other services. Users can now see if a product is available at a specific store location, for instance.

“Google is the directory of the internet. Facebook can’t really compete with Google in that sense,” said Edwards.

Brands say Google Shopping still has its limitations. There are only so many ads that can appear on the site before returns would theoretically start to trail off, while Facebook seems to have a higher ceiling, said Ceremonia’s Rivera. Instagram also offers more ways to showcase products beyond the standard e-commerce grid. On Google Shopping, a luxury gown may be displayed next to fast fashion pieces. Google is adding features to address some of these concerns, including a recently launched ability for brands to curate their own shop pages with video and other content, as well as an augmented reality beauty try-on plug-in.

Brands rely on both Google and Facebook. A brand that sees more sales from Google ads might have only acquired those customers thanks to sponsored posts on Instagram.

Google is the directory of the internet. Facebook can’t really compete with Google in that sense.

“Facebook and Instagram are more for brand awareness than getting people to actually convert,” said Amira Rasool, founder of The Folklore, a marketplace featuring African designers. “With Google, people are looking for specific things.”

Rasool said The Folklore will reallocate about 30 percent to 40 percent of cash previously intended for Facebook ads toward Google.

Another variable in the Google-Facebook rivalry is Apple’s recent update to its iPhone operating system, which allows users to put new restrictions on how apps track their activity, according to Ramachandra — a change that will likely benefit Google.

ADVERTISEMENT

Google is coy about its long-term e-commerce ambitions.

“We just want to continue levelling the playing field for online commerce and we want to give shoppers and our users as much choice in a digital world as they have in the offline world,” said Matt Madrigal, vice president and general manager of Merchant Shopping at Google. “[Google] Shopping is a big part of the democratisation of the internet.”

How Brands Use Google Shopping

Google Shopping doesn’t rely as heavily on slick visuals, but brands still need to think about how to stand out in a crowded grid.

Ceremonia’s Rivera said her best-selling products on Google Shopping are a padded headband and a scalp massager, likely because of their stark visual components.

“The Frida [headband] is a statement piece with big brands and the colours just work really well,” Rivera said. “Even if customers don’t end up buying, the most colourful option will get their attention.”

If the product isn’t colourful, brands could consider using a colourful background instead. Rasool shoots all of the Folklore’s products on a warm brown backdrop, which is a contrast to the typical white of most luxury brands, she said.

Timing also matters, Parsons said. In the past, she has put more money into Google listings for certain products ahead of a big media appearance.

“Last year, we had a mention in The Wall Street Journal so when we knew that was coming out, we scaled up the budget against that style and it worked,” said Parsons.

Ultimately, brands should always be agile with their digital marketing strategies, Rivera advised.

“Very small tweaks can have a huge impact,” she said. “What’s interesting and also frustrating is that what worked three months ago is not what’s necessarily going to work today, so you have to be constantly experimenting.”

Related Articles:

Why Instagram Still Isn’t a Shopping Destination

The Golden Age of Instagram Marketing Is Over

How to Acquire Customers in a Crowded Digital Landscape

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.

The app, owned by TikTok parent company ByteDance, has been promising to help emerging US labels get started selling in China at the same time that TikTok stares down a ban by the US for its ties to China.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.

Four years ago, when the Trump administration threatened to ban TikTok in the US, its Chinese parent company ByteDance Ltd. worked out a preliminary deal to sell the short video app’s business. Not this time.