The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

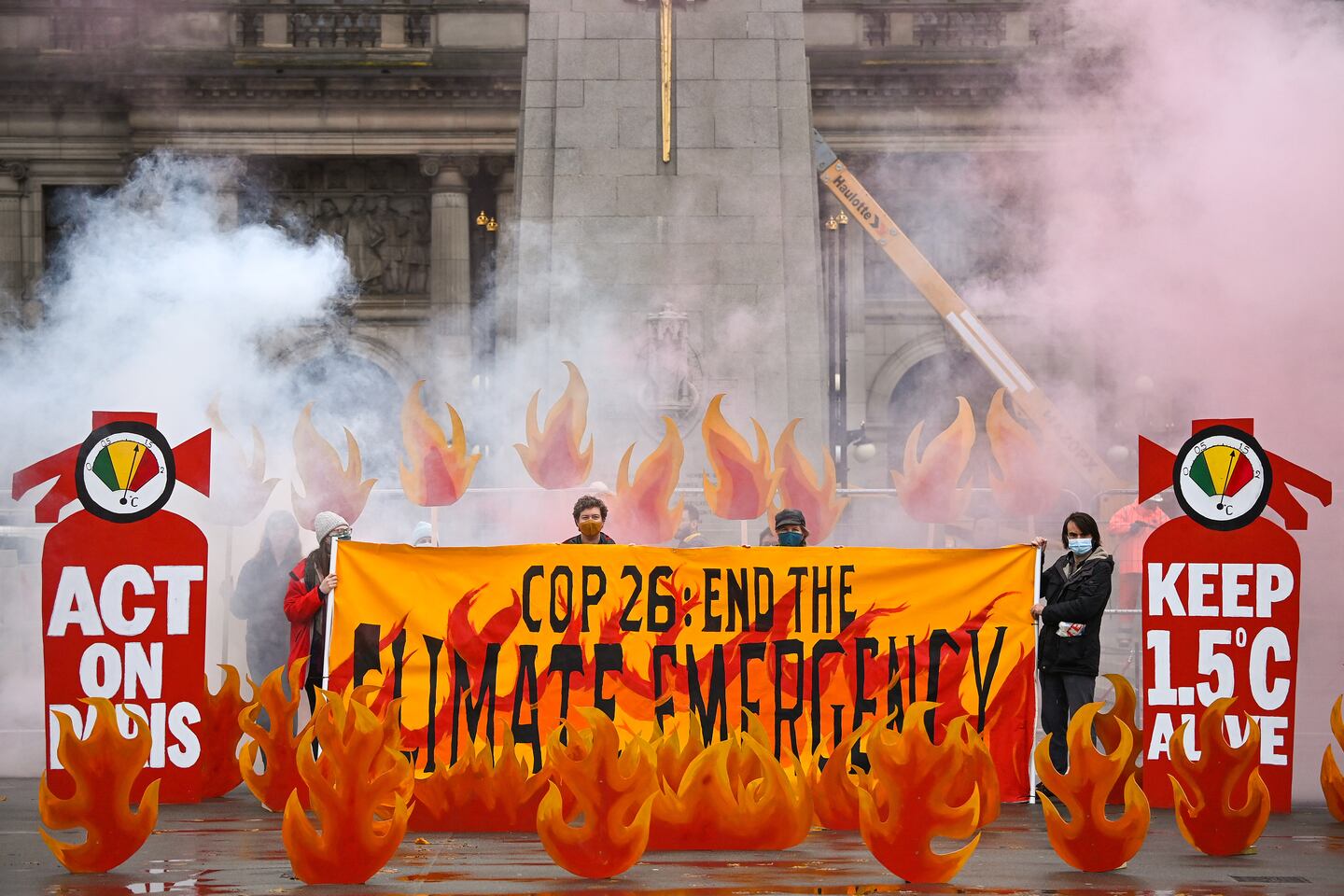

Climate Talks

Over the next two weeks, the world’s top leaders will attempt to hammer out new agreements to tackle climate change. COP26 is widely seen as the most important climate summit since Paris six years ago, when world leaders agreed to a goal to limit global warming to well below 2 degrees Celsius above pre-industrial levels. Things aren’t going well. Without drastic emissions cuts, the world is on track for climate catastrophe. Fashion companies and consortia will also be in attendance and will be emphasising the steps they’re taking to address the industry’s part in climate change, while also making a case for the policies and incentives they’d like to see going forward. Expect to see companies deepening their commitments to cut emissions, while advocacy groups are already pushing for more concrete regulation to make brands responsible for their impact further down the supply chain.

The Bottom Line: The fashion industry has long been accused of more talk than action when it comes to climate change. The next two weeks are likely to result in a flurry of more ambitious commitments for brands and plans for wider government intervention that could start to shift that landscape.

New Blood at Capri

ADVERTISEMENT

New faces are rare at Capri, the luxury conglomerate that owns Michael Kors, Versace and Jimmy Choo. It’s been nearly two decades since someone other than John Idol was at the helm of Michael Kors; Capri itself is an Idol invention. His successor, Joshua Schulman, was elevated to the top job at Coach during another executive shakeup at rival Tapestry, where he kicked off a turnaround that has brought new buzz to the brand. Schulman is joining a company already on its way back from the fashion wilderness. For much of the last decade, American accessible luxury brands like Michael Kors relied on discounts, outlets and other down-market tactics to draw customers in an increasingly crowded market, a move that hurt their image and made it harder to justify high prices. These brands now have the wind at their backs, as supply chain difficulties and soaring demand have made it possible to pull back on promotions and raise prices for the first time in years. Idol says they’ve been able to “reset the business,” and the prices on Kors’ website speak to that: the brand’s mid-priced handbags top out around $800 today, up from under $400 a year ago.

The Bottom Line: Schulman’s challenge is to complete the transformation of Kors, cementing its upscale branding so customers will continue to pay higher prices for bags and dresses even after the brand’s rivals return to discounting.

Cruising to Dubai

Luxury brands are hitting the road again. The pandemic put a temporary end to the practice of choosing a new global city to debut each collection or collaboration, and even spurred talk of doing away with the hectic schedule of product releases that necessitated so many far-flung events. But brands didn’t need long to return to their old habits, and nothing says “back to 2019″ like a Chanel cruise show in Dubai. The Emirates’ economy suffered last year amid a global halt in tourism and business travel. Now, luxury sales are rebounding, in part because locals unable to take shopping trips abroad are spending more at home. High vaccination levels and low infection rates have also drawn high-net-worth individuals looking to stay longer than the typical tourist visit. Tourism is creeping back up, and events like the recently opened Dubai Expo are expected to draw more international visitors.

The Bottom Line: Fashion shows can help ensure that wealthy locals continue to shop their local Chanel or Armani boutique even as they plan their first post-pandemic trip to Paris.

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Brian Baskin is Executive Editor at The Business of Fashion. He is based in New York and oversees BoF's beauty, retail, direct-to-consumer, technology, marketing and workplace verticals.

Sarah Kent is Chief Sustainability Correspondent at The Business of Fashion. She is based in London and drives BoF's coverage of critical environmental and labour issues.

The fashion industry continues to advance voluntary and unlikely solutions to its plastic problem. Only higher prices will flip the script, writes Kenneth P. Pucker.

The outerwear company is set to start selling wetsuits made in part by harvesting materials from old ones.

Companies like Hermès, Kering and LVMH say they have spent millions to ensure they are sourcing crocodile and snakeskin leathers responsibly. But critics say incidents like the recent smuggling conviction of designer Nancy Gonzalez show loopholes persist despite tightening controls.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.