The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

WeChat’s mini-programmes, a tool many of the world’s fashion, beauty and luxury brands already use as part of their direct-to-consumer e-commerce operations in China, are now accessible via the Xiaohongshu social commerce platform.

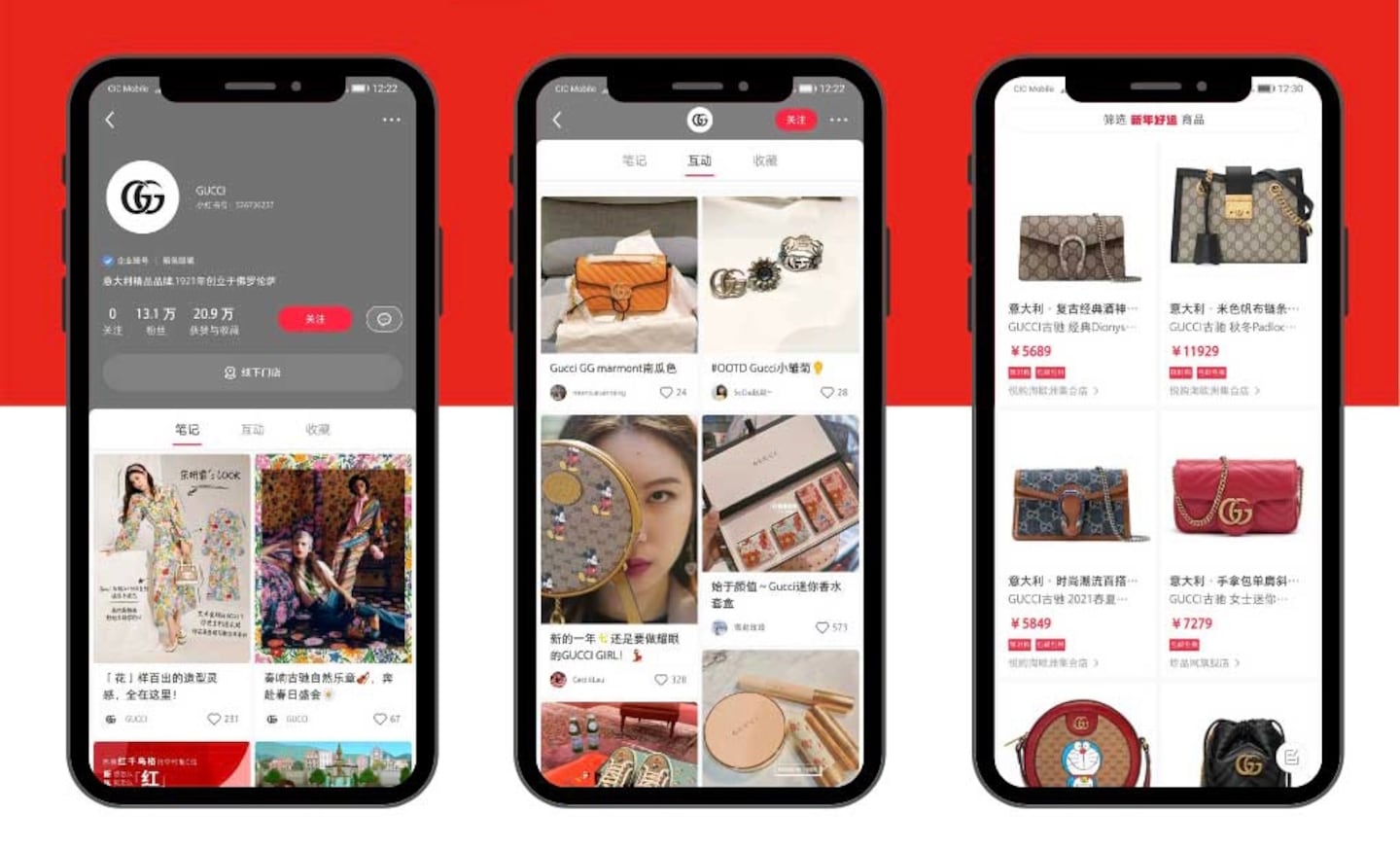

Followers of official Xiaohongshu accounts for luxury brands such as Louis Vuitton, Gucci, Celine, Saint Laurent and Givenchy, can now directly click through from Xiaohongshu to those brands’ WeChat mini-programmes to purchase and pay for goods.

The move marks the beginning of a shift in China’s social media sphere, which has long been made up of separate closed eco-systems, to a more open and collaborative environment. It also makes the integration of online retail channels more streamlined for luxury brands.

Xiaohongshu now has more than 300 million users, according to third party data. More than 95 percent of the active users are young people under the age of 34, and more than 90 percent are female living in China’s top-tier cities. The platform has become one of the most important destinations for fashion lovers to research and discover different styles and trends.

From May 2019 to March 2020, nearly 30 luxury brands opened official Xiaohongshu accounts, according to Chinese business media outlet, Jiemian.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.