The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

China’s luxury e-commerce business, and indeed, the country’s e-commerce in general, has long been dominated by major platform players, such as Alibaba’s Tmall and JD.com. Sure, luxury brands still operate their own official website e-commerce and many now also sell via WeChat mini-programmes, but platforms have proven key to product and brand research and discovery.

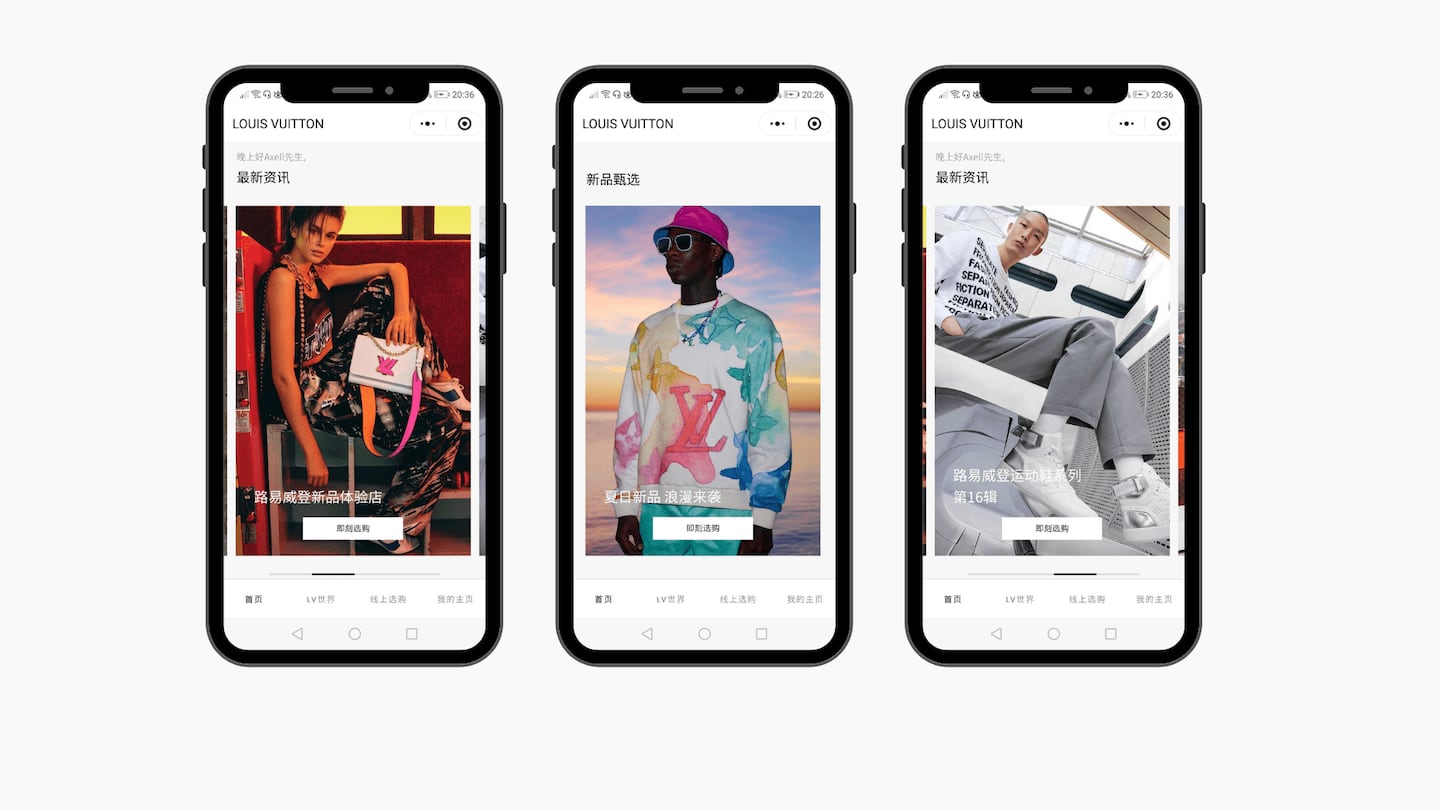

Now digital giant Tencent’s WeChat, with its 1.2 billion monthly active users, is getting into the platform business. The company launched its mini-programme aggregation platform Tencent Huiju in March this year, and recently announced the formation of a luxury channel called Famous Products within Tencent Huiju, which includes major players such as Louis Vuitton, Burberry and Valentino.

The platform has the potential to drive a massive amount of traffic to the mini-programme stores of luxury brands. Unlike on the broader Tencent Huiju platform, consumers cannot make purchases directly within the Famous Product channel, and will be redirected to the brand’s individual mini-programme to buy. This is likely to be a popular choice for brands who can better control their own image and positioning when purchases are funnelled through their own mini-programmes.

In recent years, Tencent has been testing various routes into the luxury business. It announced a strategic partnership with Gucci in 2019 and last year, it opened a high-tech store in Shenzhen with Burberry. At the same time, luxury brands have spent years building their communities and private traffic via WeChat, gradually converting to selling on the app, too.

ADVERTISEMENT

However, the Tencent Huiju model remains a largely unknown quantity. Tencent has previously tried to develop more open social interaction and commerce within WeChat, which is built on closed groups, but none of its previous endeavours in this realm have proven particularly successful.

Learn more:

Five Ways China’s E-Commerce Landscape Is Changing

From rethinking livestreams to doubling down on data in their supply chains, global brands need to keep up with local players to compete for a slice of China’s multi-trillion-dollar e-commerce market.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.