The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

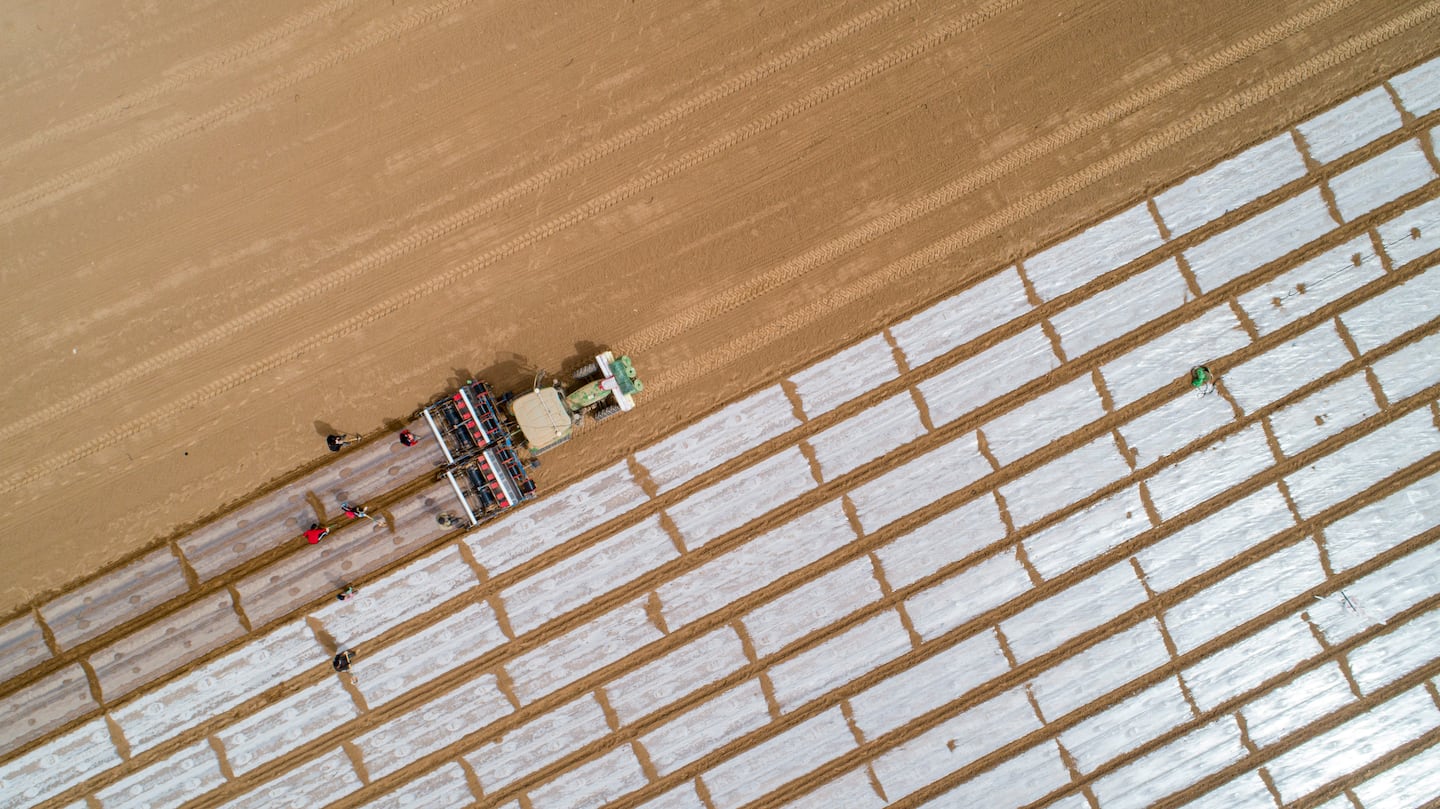

The Berlin-based European Centre for Constitutional and Human Rights (ECCHR) on Sept. 6 filed a complaint to German prosecutors, accusing retailers including Hugo Boss of abetting and profiting directly or indirectly from forced labour in the Xinjiang Uighur Autonomous Region of China’s cotton trade, Reuters reports.

The US has accused China of detaining more than 1 million Uighurs and other ethnic and religious minorities in “re-education” internment camps, where forced labour is reportedly carried out. China continues to deny these allegations. In January, the US banned imports of cotton products from Xinjiang; in July, French prosecutors reportedly launched an inquiry into fashion retailers like Uniqlo’s French unit, Inditex, SMCP and Skechers on the grounds of concealing crimes against humanity in the region.

The ECCHR’s filing is looking to open an inquiry that holds retailers to account and raise awareness of issues among consumers.

“We assume that our values and standards have been complied with in the manufacture of our goods and that there are no legal violations. We therefore reject any other assertions made by ECCHR,” a Hugo Boss spokesperson told Reuters, adding that the brand requires contractors to confirm their observance of fair working conditions throughout its supply chain.

ADVERTISEMENT

Learn more:

What the Latest Clampdown on Xinjiang Cotton Means for Fashion

New policies on both sides of the Atlantic mean businesses will likely have to prove their supply chains do not pass through the Chinese region, where the reported detention of Uighurs in forced labour camps is rife.

Though e-commerce reshaped retailing in the US and Europe even before the pandemic, a confluence of economic, financial and logistical circumstance kept the South American nation insulated from the trend until later.

This week’s round-up of global markets fashion business news also features Korean shopping app Ably, Kenya’s second-hand clothing trade and the EU’s bid to curb forced labour in Chinese cotton.

From Viviano Sue to Soshi Otsuki, a new generation of Tokyo-based designers are preparing to make their international breakthrough.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.