The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

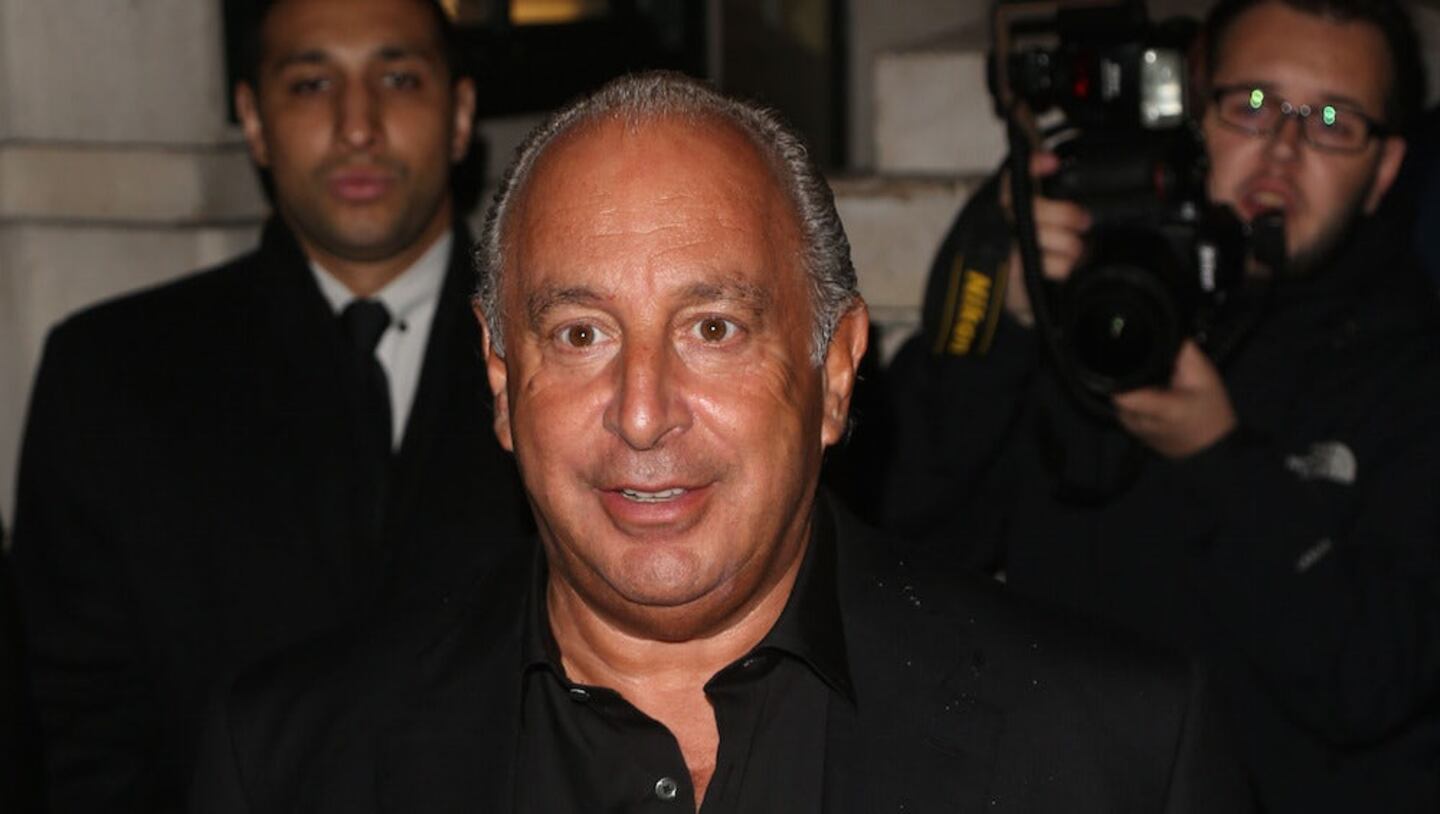

LONDON, United Kingdom — Retail tycoon Philip Green's Arcadia group was warned by a senior Goldman Sachs banker that a possible suitor of its BHS department store chain had a history of bankruptcy, MPs were told on Monday.

The 88-year-old, 164-store, BHS was placed into administration, a form of creditor protection, by owner Retail Acquisitions last month, putting 11,000 jobs at risk.

Green owned BHS for 15 years before selling it in March last year for a nominal sum of one pound to Retail Acquisitions, a group of little known investors led by Dominic Chappell.

The collapse of BHS is being investigated by MPs, Britain's Insolvency Service and its Pensions Regulator.

ADVERTISEMENT

The latter is investigating whether BHS's previous owners sought to avoid their responsibilities and should be pursued for a contribution to make good its 571 million pounds pension deficit.

Anthony Gutman, co head of UK investment banking at Goldman Sachs, told a joint session of parliament's Work and Pensions and Business, Innovation and Skills select committees, that he provided Green unpaid "informal assistance" as the billionaire was a former client.

He said he was asked by Arcadia to provide "observations" in December 2014 concerning takeover proposals for BHS received from Retail Acquisitions, which was called Swiss Rock at that time.

"We indicated to them (Arcadia) that clearly the potential buyer here did not have retail experience, we indicated that the proposal was highly preliminary and lacking in detail," said Gutman.

"We also indicated that the bidder here (Dominic Chappell) did have a history of bankruptcy."

Arcadia finance director Paul Budge told the committees he knew of Chappell's bankruptcy but said Retail Acquisitions provided proof that they had lines of funding for 120 million pounds. He said that showed "their intentions were serious in terms of they wanted to run this business as a going concern."

Anthony Grabiner, non-executive chairman of Green's Taveta Investments vehicle, told the committees failure to do a deal with Retail Acquisitions would have meant BHS falling into administration in 2015.

"If this deal had not been done with this particular buyer the BHS business would have gone into administration 12 or 13 months earlier than in fact it did," he said.

ADVERTISEMENT

The select committees will hear from BHS pension trustees on Wednesday, Retail Acquisitions directors on June 8 and Green on June 15.

By James Davey; editor: David Evans.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.