The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

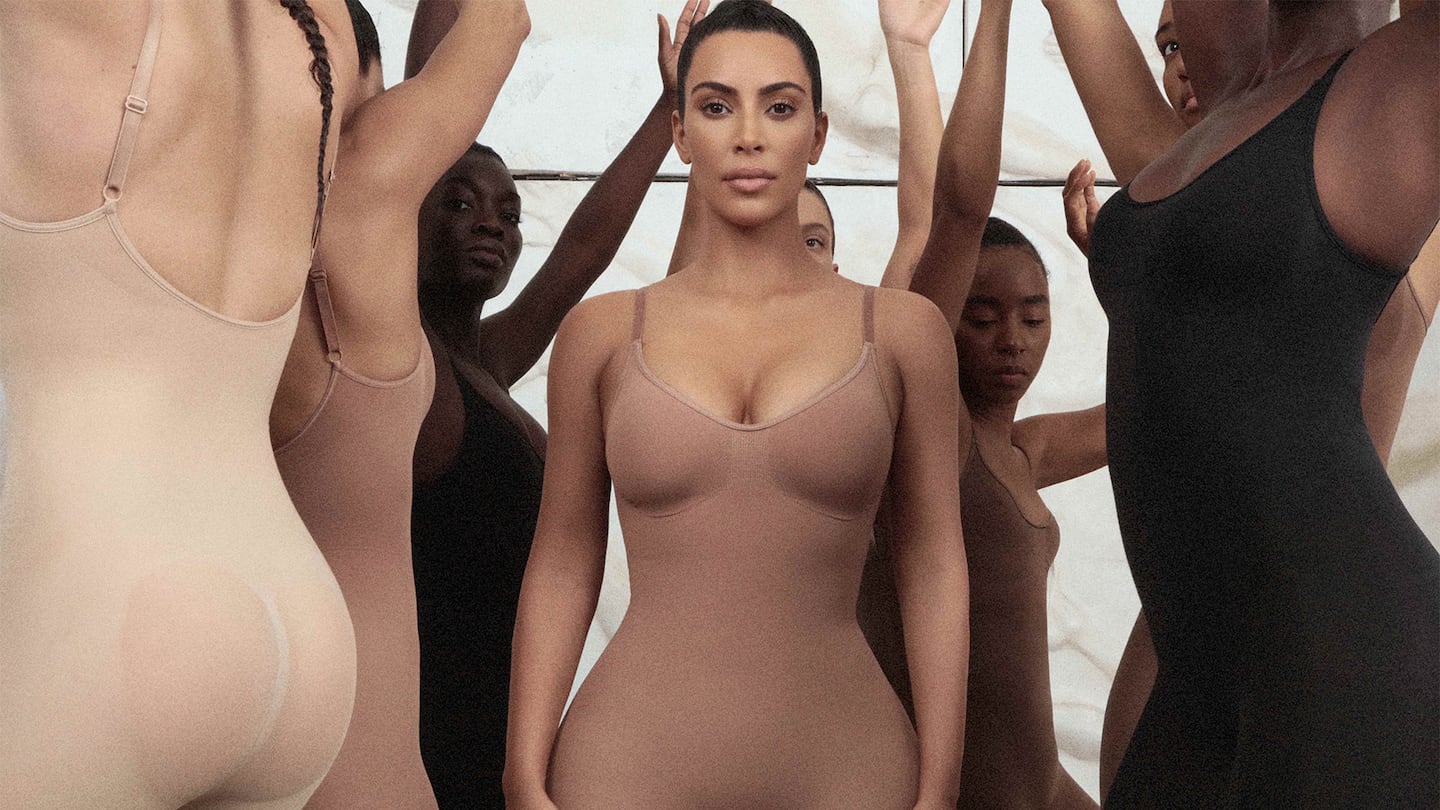

Skims, the shapewear and intimates brand created by Kim Kardashian, has raised $270 million in a Series C funding round that values it at $4 billion, the company announced Wednesday. That’s up from its previous valuation of $3.2 billion in 2022.

Led by Wellington Management with participation from Green Oaks Capital Partners, D1 Capital Partners and Imaginary Ventures, the new funding will go toward product innovation, category expansion and retail expansion, Skims said in a statement.

The company is on track to reach $750 million in net sales this year, up from about $500 million in 2022. Since its founding in 2019, Skims has raised a total of $670 million.

The funding round comes on the heels of the news that Kardashian is currently fundraising for her new private equity firm SKKY Partners, which will focus on consumer media and investments.

ADVERTISEMENT

Learn more:

Report: Kim Kardashian’s Skims Targets $4 Billion Valuation in New Funding Round

Investment firm Wellington Management is in talks to lead a new funding round for Skims, which could value the underwear clothing company owned by Kim Kardashian at about $4 billion, according to people familiar with the matter.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.