The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BEIJING, China — At first blush, the heroic progress of Shandong Ruyi Technology Group Co. looks like the same old, same old story of an once-obscure Chinese firm on the M&A warpath.

With its origins in a Cultural Revolution-era woollen mill in the northern coal town of Jining, Ruyi's busy acquisitions of luxury-goods businesses over the past few years might seem a triumph of hope (and debt) over financial reality.

The company is the leading bidder for Bally International AG, the Swiss luxury leather-goods brand owned by closely held JAB Holding Co., and has been discussing a price of around $700 million, according to people with knowledge of the matter. Ruyi already owns British trenchcoat brand Aquascutum, controls tailors Gieves & Hawkes and Kent & Curwen via its majority share in menswear group Trinity Ltd., and spent more than $2 billion last year buying the owner of Lycra.

Ruyi's published cash-flow statements show there's a thin reed of operating cash and a fat dollop of finance capital supporting all that investment. That would suggest a bumpy journey, like those followed by Anbang Insurance Group Co., Dalian Wanda Group Co., Fosun International Ltd. and HNA Group Co. as the bills for a debt-financed acquisition strategy inevitably come due.

ADVERTISEMENT

There's a Brand New Dance

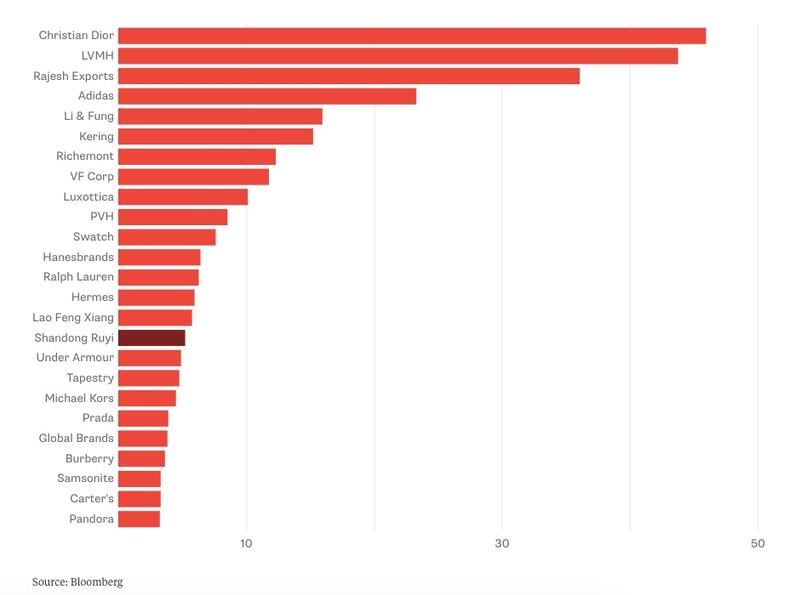

Were Shandong Ruyi listed, it would already be among the top 20 global fashion and luxury groups by revenue.

There may be more to this latest case than meets the eye, though. The traditional flaw of the Chinese way of M&A is a tendency to focus more on buying a collection of trophy assets than on building a cohesive company. Operational synergies and market timing — the traditional ways acquisitive companies extract returns — rarely get a look-in. Fosun, which at one point mixed steel, insurance, pharmaceuticals, real estate and entertainment, is a classic example.

That's less of a problem in the luxury businesses Ruyi is targeting. Indeed, synergies can be a positive disadvantage in the sector, where brand value can depend on heritage qualities that risk being destroyed by attempts to squeeze more cash out of supply chains. Shoppers attracted to the Savile Row values of Gieves & Hawkes would probably be turned off if it started sourcing its wool from Ruyi's own mills in Shandong.

The strategy of Qiu Yafu, the chairman and controlling shareholder, has instead been to get stakes in every stage of the supply chain and clip the ticket each time. In Australia, where Gieves & Hawkes sources its wool, Ruyi's CS Agriculture Pty unit owns the vast Cubbie Station cotton farm and half of Lempriere (Australia) Pty, one of the country's largest wool suppliers. In Scotland, it bought a stake in the Carloway Mill, one of three working producers of Harris Tweed.

Judging by its access to finance, Ruyi has Beijing's blessing to build a domestic luxury powerhouse. There's potential in that ambition: China accounted for three-quarters of luxury spending growth in the eight years through 2016, according to McKinsey & Co., and will have 44 percent of the global market for such products by 2025.

Moreover, while China's acquisition machines tend to underperform when they're asked to drive down costs, in luxury goods the key competitive advantages tend to be the availability of capital to develop brands and diverse global operations to inculcate and retain internal talent.

There's no intrinsic reason why Ruyi should struggle there. It's already learning how to play up those heritage values, judging by its website: for all Jining's unglamorous present, it's also the birthplace of Confucius and Mencius and a long-standing port on China's Grand Canal.

ADVERTISEMENT

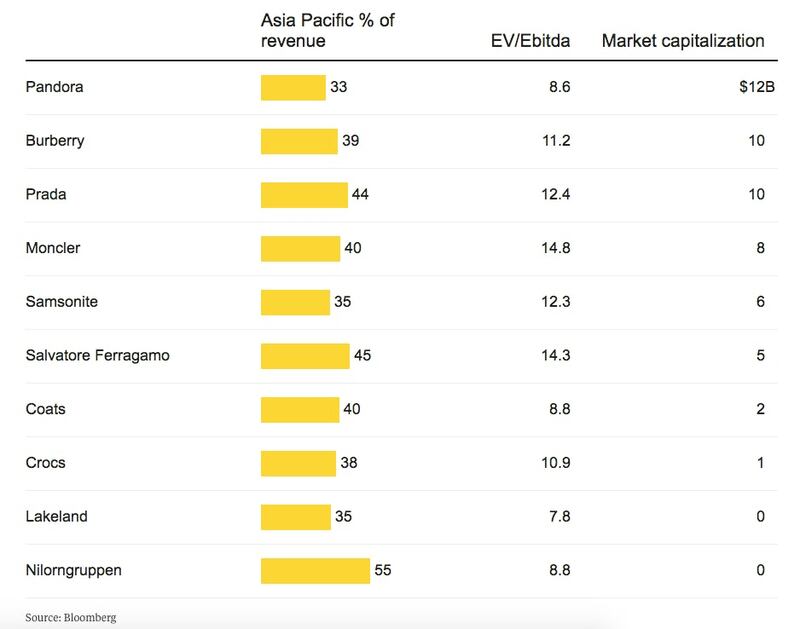

Target Practice

These 10 companies have the market position and size to appeal to an acquisitive Ruyi.

Note: Based on companies in the apparel and luxury industries with at least 25 percent of their revenues in Asia-Pacific and with market capitalisations between $100 million and $20 billion.

The global luxury industry should take notice. If you're an underperforming brand with strong recognition in Asia (Prada SpA, say, or Salvatore Ferragamo SpA) it might be time to start primping for a takeover. And the three groups that dominate the industry — LVMH Moet Hennessy Louis Vuitton SE, Cie. Financiere Richemont SA, and Kering — should start worrying. China Inc. is coming for you, and it's got its checkbook out.

By David Fickling; editor: Paul Sillitoe.

The views expressed in Op-Ed pieces are those of the author and do not necessarily reflect the views of The Business of Fashion.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.