The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

ROME, Italy — Search for 'Italy' on Xiaohongshu — Millennial China's favourite app for fashion, beauty and lifestyle recommendations — and the platform returns over 300,000 results.

Top performing posts include a photo-taking plan for Audrey Hepburn wannabes looking to recreate iconic scenes from “Roman Holiday,” and tips for scoring deals via loyalty programmes at Italian department stores. One user gives a lesson in avoiding thieves in Italy — the key, according to @qveve, is to avoid wearing showy accessories and to take luxury shopping bags back to hotels immediately after each shopping spree.

Itay travel tips from Xiaohongshu users @羊小咩的小本本 @小美游 | Source: Xiaohongshu

According to Chinese travel service provider Ctrip, Italy came second among countries for customised tours and general European destinations last year, outranked only by World Cup destination Russia. Violence seen at the "gilets jaunes" protests in France likely boosted Italy in the rankings for many Chinese tourists.

ADVERTISEMENT

"More Chinese tourists are visiting Italy as we don't have any intense political issues right now," says L'Officiel Italia Contributor Giorgia Cantarini. While the country's economic stagnation and populist divisions are very serious, they haven't yet negatively impacted tourism. This is in stark contrast to other popular travel destinations for Chinese shoppers.

"Tourists [in other locations] have surely been affected by the fact that there has been instability," says Mario Ortelli, managing partner of Ortelli & Co.

It's not just European cities. Earlier this month, Beijing issued a US travel warning due to alleged reports of interrogation and harassment of Chinese tourist at US customs. Meanwhile, anti-extradition protests continue on the streets on Hong Kong — one of mainland China's preferred shopping haunts. For many, such circumstances could prompt a change of plans: according to Nielsen and Alipay's survey on outbound Chinese tourism and consumption trends, 47 percent of Chinese respondents stated that safety would affect their choice of destination.

When faced with a choice between comparatively risky or hostile destinations, Italy is emerging as the tonic that many Chinese luxury consumers need.

When in Rome

According to Buzz Travel, the total number of transactions by Chinese consumers in Italy has increased by 188 percent between 2017 and 2018. Data from Planet Payment pertaining to Chinese New Year shows that while both France and the UK saw 9 percent decreases in in-store sales year-on-year, Italy saw a 22 percent boost.

Beyond travel and retail, bigger forces are at play. In March, Italy became the first G7 nation to endorse Beijing’s $1 trillion Belt and Road initiative — President Xi Jinping’s mega-plan to build a new Silk Road with Chinese investment muscle. Days later, Ctrip, which boasts three million registered users, inked a deal for strategic cooperation with the Italian tourism board, as well as regional Italian destinations and tourism associations. The company’s Chief Executive Jane Sun called the company a modern day “Marco Polo,” bringing the world’s most financially powerful outbound visitors to Italy’s cultural offerings.

8.7 percent of the Chinese population held passports in 2018, but passport holders are expected to double by 2020.

The same month, Italy’s search popularity in China increased 28 percent month-on-month, data from Chinese online travel platform Mafengwo shows. “We remain positive with growth [in Italy], especially after Xi's visit earlier this year,” a Ctrip spokesperson tells BoF.

ADVERTISEMENT

Buoyed by Chinese spending across luxury and tourism sectors, visits are expected to increase in the coming months. While Ctrip recorded almost two million Chinese tourist visits to Italy last year, numbers are expected to soar — it was estimated that 8.7 percent of the Chinese population held passports in 2018, but passport holders are expected to double by 2020.

And as more Chinese tourists head to Italy, retailers and luxury brands are set to reap the rewards — according to Bain & Company, Chinese are behind around one-third of global luxury purchases, and 73 percent of this happens outside the country.

Italian retailers are already responding to this appetite for luxury, with the likes of La Rinascente introducing WeChat accounts, Mandarin-language services and adopting mobile payment platforms Alipay and WeChat Pay. Even online players are also hoping for a slice of the action: last month, Florentine luxury e-tailer Luisa Via Roma inked a partnership with Chinese e-commerce giant Secoo — a key step in the company’s expansion into China’s luxury market.

A Two-Way Street

Though it has dominated the dialogue so far, Chinese luxury consumption is only one part of the equation in the relationship between China and Italy. Some players are hoping to balance out the scales.

“We usually talk about China in terms of how it’s a key market for Italian and global fashion, but it’s not only a market of consumers interested in Western fashion,” says Pitti Immagine’s General Manager Lapo Cianchi. “The conversation has become too simplified.”

Guest Nation China designers at Pitti Uomo | Source: Courtesy

This month, menswear tradeshow Pitti Uomo hosted 10 emerging Chinese menswear brands to Florence as a part of its Guest Nation project in partnership with Shanghai Fashion Week and local designer incubator Labelhood.

ADVERTISEMENT

“This debut proved that the Chinese are ready for the international market,” says the Riccardo Grassi showroom’s eponymous founder. “China will show the world that they’re able not only to be a production and manufacturing country but also the nest of cool designers that [are] beloved by young clients.”

In the Guest Nation space, designers on show to global press and buyers included BoF China Prize finalists Pronounce and Staffonly and up-and-comers 8on8 and Danshan, which along with an exhibition featuring the works of photographer Leslie Zhang drew over 3,000 people to the space daily.

A runway show by Pronounce marked the first time a Chinese designer took the stage at Pitti. In the show, models sported silks and denims printed with Xian’s terracotta warriors, and updates of the brand’s signature denim.

Alongside Labelhood's Tasha Liu, the project was conceived by V/Collective's Managing Director Vito Plantamura as an antidote to the Italian fashion industry's lack of knowledge of Chinese talent. "I've lived in China for years and grew tired of talking about the local fashion industry only to be told that it's not on the same level as Europe." Plantamura thought that the time was right for Pitti Uomo to pave the way for a stronger China-Italy bond given wider global currents. "When you host a country, it's not just about design or fashion...there are several elements that made it the right moment for this project."

Pronounce's runway show at Pitti Uomo | Source: Courtesy

Cianchi reckons that this change has already taken place. “The Italian fashion community has developed a deeper awareness of the fact that China’s production landscape isn’t singular, and I think that’s become clearer to us over the past three, five years.”

But outside of this community, many still subscribe to outdated generalisations. “There’s still stigma around the ‘Made in China’ label, and I think it’ll be a couple of years before people can realise that Chinese designers aren’t working with bad materials and production methods,” says Cantarini.

In the meantime, events such as Pitti could be the key to ensuring that the China-Italy axis benefits Chinese designers as well as Italian brands. “There’s a lack of information between the two countries,” adds Plantamura. “We need to create more connections between them, and I think that events like these are the solution.”

时尚与美容

FASHION & BEAUTY

A guest outside Dolce & Gabbana's show in Milan | Source: Getty Images

Dolce & Gabbana Falls 140 Places in Asian Brand Ranking

Chinese consumers haven't forgiven or forgotten. Dolce & Gabbana's reputation in the mainland still hasn't recovered from last November's marketing faux pas and Stefano Gabbana's alleged racist comments, and the brand has dropped from No. 360 last year to No. 500 in this year's Asia's Top 1000 Brand Ranking. D&G is still absent from retailers including Alibaba-owned Tmall, JD.com and Lane Crawford, and experts reckon that it'll be another two or three years before it can redeem itself. In terms of names that came out on top, Samsung, Apple and Panasonic maintained their top spots in the rankings; In China, Chanel took home first place. (Campaign Asia)

China’s Largest Down Jacket Maker Embroiled in Fraud Allegations

Hong Kong-listed outerwear brand Bosideng's shares plummeted 24.8 percent on June 24, following allegations by short-seller Bonitas' that the company was involved in financial fraud. In a report, Bonitas questioned the company's revenues and profits, and accused Bosideng fabricating its reported net profits of ¥807 million ($117 million) since 2015 and overstating figures by 174 percent. Bosideng has since said the report contains "untrue and misleading information" and that it would clarify matters soon. (BoF China)

Can Asia Get Down With CBD Beauty?

Beauty products infused with cannabidiol (CBD) — the non-psychoactive compound found in cannabis plants — have already gone mainstream in the US, and the market for CBD beauty is expected to reach $25 billion by 2029. While cannabis is illegal in most Asian countries (including China), experts reckon that Eastern markets will follow in the US' footsteps. Not only is China the world's largest producer of industrial hemp, its CBD market is projected to hit $15 million by 2024, with beauty and wellness sectors becoming main growth drivers. And as cannabis was previously used as an herbal remedy in traditional Chinese medicine, local shoppers embracing CBD doesn't seem too far fetched. (SCMP)

科技与创新

TECH & INNOVATION

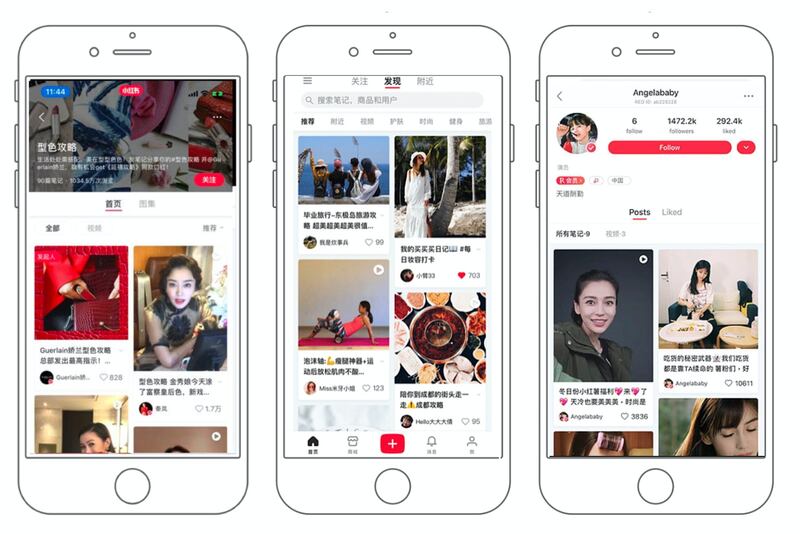

Xiaohongshu's user interface | Collage by BoF

Xiaohongshu Demands $29,000 Deposit From Partners

Local media has reported that, according to a company working with social e-commerce app Xiaohongshu, the platform has issued a set of management rules for brand partners to sign. The rules require partners to pay a ¥200,000 deposit fee ($29,000), following changes implemented in May, when the platform raised its bar for KOL certification and over 2,000 influencers lost their badges as a result. These new rules are leaving Xiaohongshu's partners feeling unsatisfied and many have spoken out against the app's stricter regime, but with it becoming Millennial China's favourite platform for fashion and beauty recommendations, do they have a choice? (36Kr)

Sneaker Resale App Nice Closes Series D Funding Round

China's white hot sneaker market is getting crowded with promising tech players. According to tech site 36Kr, Chinese sneaker resale and social media platform Nice has raised "tens of millions of [US] dollars" in its Series D funding round, co-lead by TPG and Softbank. Founded in 2013, Nice was originally launched as a social media app but expanded into resale last year, and hit a monthly gross merchandise volume of over ¥100 million ($14.5 million) in just five months, according to the app. Even so, it's not yet clear which of the sneaker trading companies targeting China — US-based Stadium Goods and local players Douniu, UFO and Du, to name a few — will win over its consumers. (BoF China)

Alibaba, JD.Com Seek to Lock in Merchant Loyalty with Data

As China's e-commerce growth nears its peak, the mainland's top two retail giants are looking to diversify their revenue streams. With their respective programs, Alibaba and JD.com are gunning for closer relationships with merchants by offering them a wealth of consumer data. Packages include facial recognition-linked data tools and retail 'heat maps' to help stores better design their store layouts. Though both Alibaba and JD.com execs say they are not charging companies for data tools at the moment, it's unclear whether this will continue to be the case as more companies join in. (Reuters)

消费与零售

CONSUMER & RETAIL

A shop selling bags in Namdaemun Market in Seoul | Source: Adli Wahid

“Korean” China-Made Fashion Sees Price Multiplied By Seven

South Korean media reported that despite sourcing its apparel from mainland China, a Seoul-based fashion brand was advertising its goods as Korean-made, and hiking prices up by seven times that of similar items with a "Made in China" tag. South Korea's customs agency has since fined the designer 44 million won ($37,000) for faking the goods' place of origin, and selling 6,946 items worth about 700 million won ($605,000) in major department stores across the country. As "Made in Korea" products aren't plagued with the stigma surrounding their Chinese equivalents, consumers' willingness to pay extra for locally-made fashion makes sense: since the '90s, South Korean companies have outsourced low-tech and heavy-duty industries such as garment OEMs to foreign countries, increasing domestic labour costs and the quality of locally-made goods. (Jiemian)

China's E-Commerce Growth Is Slowing

According to the latest report on Chinese consumers released by Bain & Company and Kantar Worldpanel, growth of China's e-commerce penetration has slowed to 30.6 percent in the last two years, a decrease from the average annual growth of 35.1 percent between 2014 and 2018. In first-tier cities, penetration has stabilised at around 80 percent, while in low-tier cities, penetration growth is expected to continue for at least three to four years, which will drive the expansion of up-and-coming digital channels. The figures go some way to explain Chinese retailers' recent efforts to upgrade shopping experiences and hold events to push consumers to shop, but even top players will face challenges as the e-commerce market gets oversaturated. (BoF China)

At 6.18 Shopping Festival, Chinese Consumers Opt for Domestic Brands

Amid escalating tensions between Beijing and Washington, the recent 6.18 shopping festival (spearheaded by the likes of JD.com, Alibaba and Pinduoduo) saw Chinese consumers favour homegrown companies. Compared to last year's 55 percent, 60 percent of brands that reached the ¥100 million ($14.5 million) sales milestone were Chinese. Local home appliance brands saw combined sales increase fourfold, and domestic smartphone brands rose 71 per cent year on year. Reasonable pricing, improved product quality and service are also fuelling the advancements of mainland companies. (SCMP)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Wall Street | Source: Jennifer Bonauer

Stocks Rise in Anticipation of US-China Trade Deal

On Wall Street, tech companies' stocks reflected a growing optimism in the resolution of Beijing and Washington's long-running trade dispute. Investors are hopeful ahead of President Trump and President Xi's talk at this weekend's G-20 summit in Japan: while US Treasury Secretary Steven Mnuchin has told the press that a deal was "about 90 percent complete," people close to the matter have told Bloomberg that the US is willing to suspend further tariffs on an additional $300 billion of Chinese imports. However, Trump has also warned of a "Plan B," where tariffs will be greenlit if there's no progress on a trade deal at the summit. (AP News)

City Government Shows Rare Support for LGBT Community

Netizens have lauded China's Qingdao Municipal Government for supporting China's LGBT community on its Weibo account, which has over 3.8 million followers. Commenting on the recent news of a 15-year-old who came out as gay and later posted a suicide note on social media, the account said, "let all people turn away from homophobia...as the International Day Against Homophobia nears, let's express our love of equality and kindness." Considering the frequent censorship of LGBT content on social media, the government account's message didn't go unnoticed: the post prompted thankful replies from LGBT community and allies, and has since been shared over 30,000 times and received more than 23,000 likes. (What's on Weibo)

BAFTA Links Up With Yu Holdings

China's growing role in the global film industry is hard to ignore. At the Shanghai International Film Festival, British actor Tom Hiddleston, BAFTA Chief Executive Amanda Barry and Yu Holdings Chief Executive Wendy Yu came together to announce mainland-focused talent initiative "Breakthrough China." The scheme is an extension of BAFTA's "Breakthrough Brits" program — which has helped further the careers of the likes of Letitia Wright of "Black Panther" fame and Tom Holland of "Spider-Man: Homecoming" — and aims to support five Chinese creatives in film. (BoF China)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to zoe.suen@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.