The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing. China’s colossal size and dynamism makes it a top priority for any global business, but it remains opaque to many in the fashion industry. Leveraging our rare access and local knowledge, the BoF China team demystifies the Chinese market with weekly industry analysis and the wider socio-cultural context you need to sharpen your focus.

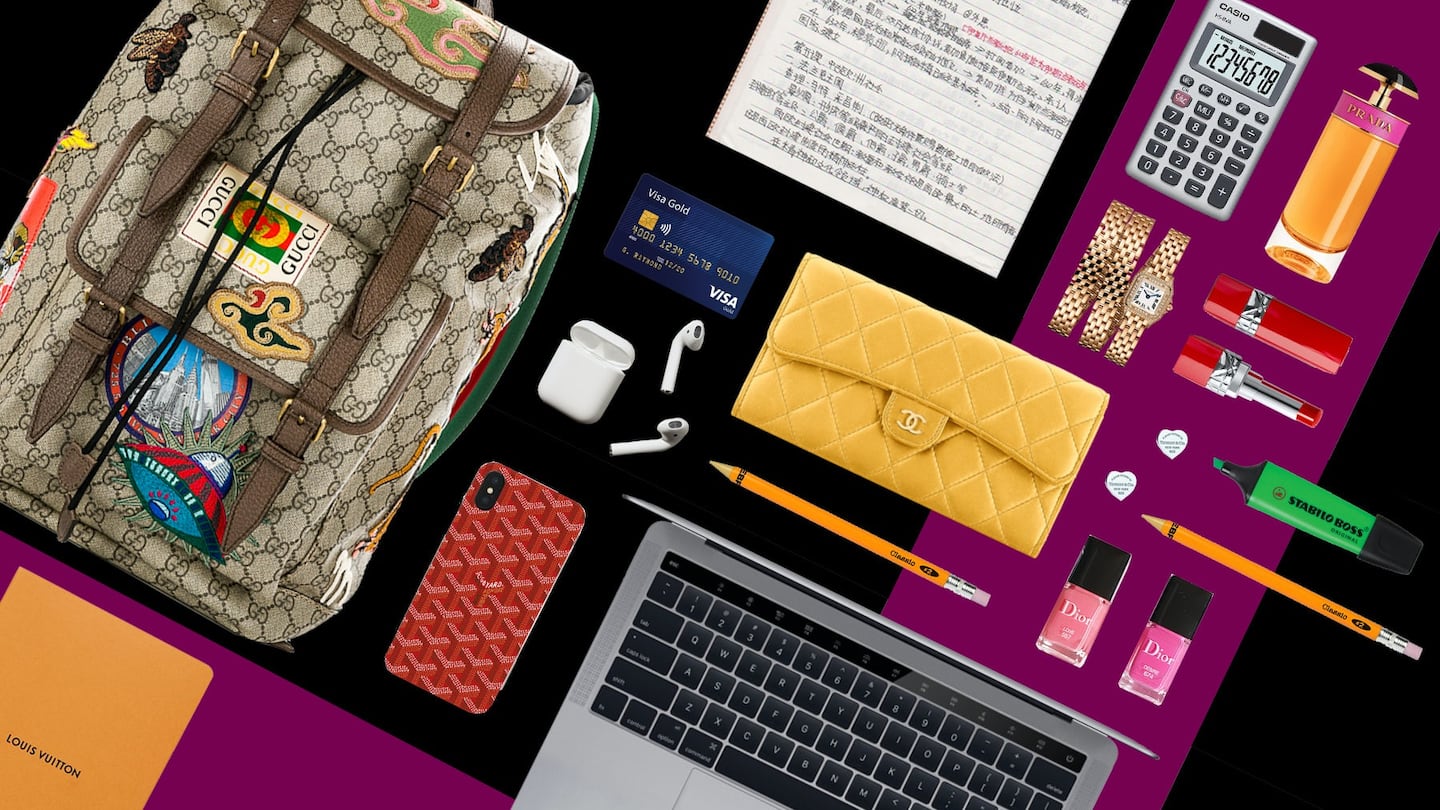

Luxury Brands Target Chinese Teens to Keep in Touch

The global luxury industry has been focused on China’s free-spending "Post-'90s" generation, but a new report suggests that brands need to start seeding channels where an even younger demographic is forging their identity.

SHANGHAI, China — Yang Chenchen, 18, has just completed high school in Shanghai, where she has grown up in a city obsessed with economic development, soaring real estate prices and luxury goods. Though she acknowledges a lot of pressure from parents with high academic expectations and is aware of the general apprehension of economic malaise pervading China, she is bullish about her own luxury consumption and that of her peers.

ADVERTISEMENT

"My mum has [luxury] handbags, like LV and Chanel bags, and I like those things too, but I also like younger brands, [especially] Balenciaga and Vetements," she says, pointing to Instagram, which is accessible in China using a VPN, as a major source of fashion inspiration.

“I am not worried about spending money, I don’t have kids, I don’t have to pay for a house, but I would like to have a nice car [a more luxurious option than the mid-range vehicle she believes her parents would be happy to pay for on her behalf]. [So] I think now is the right time in life to spend money on myself.”

Known in China as the "Post-'00s," the generation this year starting to celebrate their 18th birthday are going to be key in driving continued growth in the Chinese luxury market in coming years, according to Bain & Company’s latest luxury report.

Released last week, the global study predicts that China will account for 46 percent of luxury purchases worldwide by 2025, up from 33 percent today. One major driver of the continued strength of luxury spend from China will be the acquisition of new luxury consumers. China boasts 147 million people born since the turn of the millennium and many of Yang’s cohorts have just started purchasing luxury goods over the past year or two.

I am not worried about spending money, I don't have kids, I don't have to pay for a house ... I think now is the right time in life to spend money on myself.

“Demographically, there will be more consumers to buy these products [in China], particularly from the younger generation, not only the Millennials, but also Gen-Z, teenagers who are super positive towards these luxury goods. So, we have a very positive outlook for the midterm [in spite of macroeconomic trends],” explains Claudia D'Arpizio, a partner at Bain & Company and lead author of the report.

China’s luxury consumers have long skewed younger than their peers in Europe and the US, and the trend for teenage luxury consumption is particularly pronounced here, according to Bain & Company.

For brands, this means a greater need in China than in other markets for segmentation in messaging and product assortment. China has evolved so quickly in recent decades that each “generation” (which only span 5-10 years among younger consumer cohorts) has developed quite specific characteristics. Even among the Post-'90s, Post-'95s and Post-'00s, there are differences in prevalent consumption habits, attitudes and identities.

Although all generations have grown up entirely in economic boom times, they are digital natives with no hesitation consuming online, and desire to cultivate an individual sense of style that will set them apart from their peers, one major difference, according to D'Arpizio, is the more prominent nationalistic tendencies of today’s Chinese teens.

ADVERTISEMENT

“The youngest consumers have very strong Chinese pride, they are very willing to buy luxury products, even if they are made in China. This is very different from even the generation before, which values western brands and made in Europe,” she says.

This presents opportunities for Asian brands — as well as high-end American brands — that are more likely to manufacture in China (for now, anyway, barring further pressure from tariffs instituted as a result of the China-US trade war, due to be implemented January 1).

“They are very aware that China is important from an economic and political perspective in the world and very important as a consumer of these products. They think that they deserve the best and that kind of approach is important for the brands to take into account,” D'Arpizio adds.

Younger consumers will come to luxury, not necessarily via handbags and hard luxury, as Chinese luxury consumers of the past have, but via what D'Arpizio calls “hero products” across price and product categories.

These pieces are attractive because they convey an understanding of what makes a brand cool, and of course, they also stand out on social media. This might mean Balenciaga sneakers, or a graphic print t-shirt from Supreme or Gucci. But in the future, brands might be smart to develop hero products with sophisticated Chinese cultural references in order to attract the country's nationalistic youth.

Younger Chinese consumers will come to luxury via "hero products" across price and product categories.

"The Chinese have taught brands about the importance of local customisation and tailoring the approaches to the local traditions," D'Arpizio says. "This will be even more important for the Gen-Z.

Brands will also need to be mindful of the differing attitude teens have to influencers, known in China as key opinion leaders (KOLs), with research from tech giant Tencent showing Post-'00s are much less trusting of information coming from KOLs than the Post-'90s consumers who have whole-heartedly embraced recommendation from their favourite online idols.

Only 16 percent of the 15,000 Post-'00s surveyed by Tencent indicated they trust KOL recommendations, with most sceptical about the motivation of content produced by KOLs, which they believe to be commercially motivated. Celebrity idols, however, remain important authority figures.

ADVERTISEMENT

The most bankable influencers also differ. Whereas alumni of Korean boy band EXO, such as Kris Wu and Lu Han, have been the celebrity favourites of Post-'90s consumers, the Post-'00s are all about China's TFBoys — members Wang Yuan and Jackson Yee were both themselves born in 2000.

As the lines draw between these demographic cohorts become increasingly bold and assertive, the challenge for luxury brands will be to hold onto established consumers while simultaneously attracting this new generation, with their different idols, ideas and evolving sense of style identity.

时尚与美容

FASHION & BEAUTY

A screenshot from the brand's now-deleted video, including instructions on how to use chopsticks | Source: Youtube

Racism Accusations Force Cancellation of Dolce & Gabanna Show

Dolce & Gabbana caused an uproar when it posted a video on its Weibo account on November 18, which featured an Asian model struggling with her chopsticks while attempting to eat cannoli, pizza and pasta. Netizens were quick to deem the video, which aimed to promote D&G's upcoming#DGTheGreatShow catwalk presentation in Shanghai on November 21, as racist and enforcing stereotypes, and the brand deleted the video less than 24 hours after it was published. The backlash worsened after derogatory comments about China and Chinese commentators were attributed to co-founder Stefano Gabbana and Dolce & Gabbana's official Instagram accounts on Wednesday, the day its show was scheduled to take place in Shanghai. Though the brand claims that the accounts were hacked and the posts were quickly taken down, screenshots were widely shared on Chinese social media, along with the trending hashtag #BoycottDolce. Guests have now been informed that the event will no longer go ahead, and reports are circulating that the brand was forced to cancel by local authorities, but that has yet to be confirmed. (BoF)

Male Shoppers’ Sneaker Stampede Goes Viral

Sneaker fever spiked ahead of Singles Day. On November 9, a stampede of Chinese men were filmed rushing through a shopping mall in China's Jiangsu province to purchase a limited edition release of Nike's Air Jordan sneakers. The male shoppers ran through the department store and up escalators, which became severely damaged after glass was shattered, leaving a trail of destruction. According to Sina, the shoes in question had a resale value that would earn 3,000 RMB ($431) in profit, and the clip, posted on social media site Weibo on November 13, went viral soon after. (SCMP)

Dior’s Livestream Debut Draws 3.2 Million Views

On November 16, Dior led the charge in becoming the first luxury brand to use WeChat's live-streaming feature to promote its products. The hour-long makeup demo — hosted Dior Beauty's creative director Peter Philips — harnessed the platform's 'see now, buy now' feature to facilitate purchases through Dior's mini program, WeChat's 'app-in-app' platform for brands. The session attracted over 3.2 million viewers, 38 percent of whom were born between 1990 and 2000, and 20 percent of whom were born after 2000, also known as the "Post-'90s" and "Post-'00s" generations respectively. Dior's endorsement is undoubtedly a harbinger of luxury livestreams to come, and signals more to come in the rivalry between WeChat and Alibaba, who champions livestreams and 'see now, buy now' functions across platforms and events including the company's Singles' Day shopping festival. (Jing Daily)

科技与创新

TECH & INNOVATION

Pinduoduo's website | Source: Pinduoduo.com

Pinduoduo Accused of Inflating Revenues

Pinduoduo is in hot water: according to American investment firm Blue Orca, the $19 billion three-year-old group-buying platform and wunderkind of China's start-up scene is inflating its revenues, among other things. In a 42-page report, the firm details the reasons why it believes "that PDD's [Pinduoduo's] business is worth considerably less than it claims," from analysing the 36 percent difference in revenues reported to the US and Chinese State Administration of Industry and Commerce by the company's subsidiaries. Blue Orca also claims that Zheng is using a third party to advertise Pinduoduo's jobs and keep costs off-book. The report, which concludes that "PDD is simply uninvestable," means that the Chinese company has a lot of explaining to do. (Reuters)

Brace Yourselves, China Tech Giants

Though China's tech sector has sought to rival Silicon Valley with companies such as Tencent leading the charge, the country's tech industry is primed for pain amid new regulations, censorship efforts, and blocked contracts. A few cases in point: the US-China trade war has dampened consumer spending to the detriment of Alibaba; super app WeChat's parent company Tencent's market value plunged by 38 percent due to a slew of video game-targeted regulations, and hardware maker Huawei has been blocked from making sales in Australia, missed out on a Korean contract and faces US-led competition worldwide. Meanwhile, smartphone giant Xiaomi — once valued at $100 billion — went public at a disappointing $54 billion in July, and hardware manufacturer ZTE is expecting 2018 losses to hit $1 billion due to blocking efforts in Washington. (Bloomberg)

Louis Vuitton Steers Chinese Bike Riders to Exhibition

Louis Vuitton is appealing to experience-loving Chinese consumers, their commutes included. On November 15, Beijing-based bike-sharing company Mobike announced its partnership with the brand, and Shanghai's Mobike users will receive an invitation to LV's new "Volez, Voguez, Voyagez" exhibition at the Shanghai Exhibition Centre when they open the bike-sharing app, which features graphics from the travel-focused showcase. The partnership marks a milestone in Mobike's commercialisation efforts and the company's first luxury collaboration following projects with Google and Coca Cola — though the partnership may strike many as off-brand for Louis Vuitton, time will tell whether its localised strategy boosts the bottom line. (iYiou)

消费与零售

CONSUMER & RETAIL

Vipshop debuts on the New York Stock Exchange in 2012 | Source: NYSE

Vipshop Shrugs Off Slowdown

Despite Wall Street's doubts, Chinese e-commerce platform Vipshop's third quarter results exceeded expectations. The company reported that revenues hit $2.6 billion —a 16.4 percent growth that hints at slowing sales, but beat forecasts nonetheless. The growth can be credited to Vipshop's active user base, which grew by 11 percent year-on-year and reached 25.6 million by the end of the quarter. Order volume surged by 29 percent, a result of frequent promotions, and members of the platform's Super VIP paid membership program, which offers exclusive early access to perks and promotions, are up 21 percent. Time will tell whether the country's retail players can continue to resist the slowdown, as the looming trade war casts a dark cloud on consumer appetites. (Sina Tech)

Hong Kong Retail Mecca One-ups New York’s 5th Avenue

For the sixth time in 30 years, Hong Kong's Russell Street has been ranked number one in the world's most expensive retail streets by rental value — outranking New York's Upper 5th Avenue, according to property consulting firm Cushman & Wakefield. With annual rents in the surrounding Causeway Bay area averaging at $2,671 per square foot at the end of the second quarter, Russell Street is currently home to the Times Square shopping mall, and street-level boutiques such Burberry, Cartier, Rolex and Omega. Upper 5th Avenue has fallen to second place with rents averaging at $2,250 per square foot annually, and London's New Bond Street comes third at an average of $1,744. In the last year, Hong Kong's retail market has bounced back due to an influx of mainland Chinese tourists, whose share of global luxury spending is on the rise at an estimate 33 percent, according to Bain & Company. (SCMP)

Meitu to Shutter E-Commerce Attempt

With likes of Alibaba, Tmall and beauty-centric platforms such as Xiaohongshu leading the pack, China's cut-throat e-commerce climate isn't for the faint of heart. Meitu, the Xiamen-based tech company behind a series of selfie-friendly apps and smartphones, is closing down its e-commerce app Meitu Beauty this month, the company's chief operating officer Bryan Cheng announced on November 14. The app, which has been in operation for two years, was the tech company's attempt at commercialising its tech offerings, through using phone cameras to analyse skin concerns and sell beauty products to users through tailored recommendations. Meitu has stated that it will be shifting its focus "back to the nature of [the] mobile internet" and its platform businesses, and aims to scale its user base and increase gross margins. (36Kr)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

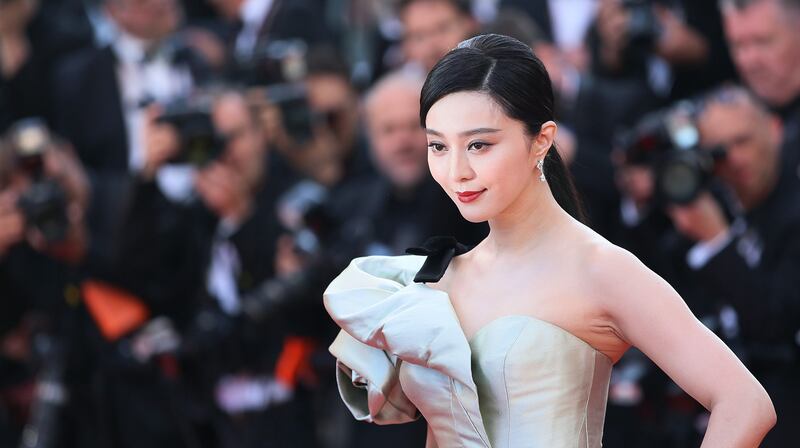

Fan Bingbing | Source: Shutterstock

Fan Bingbing Resurfaces on Weibo

Chinese actress Fan Bingbing — who disappeared this summer after being fined $129 million for tax evasion — returned to Chinese social media on November 17 following an apology letter published in October. The starlet reposted a pro-China image from the state-owned Communist Youth League of China account to her 60 million Weibo followers, and declared her stance on the controversial dispute surrounding Taiwan's political autonomy with the phrase "China cannot lose out on an inch." Though Montblanc abruptly cut ties with Fan following her fall from grace, and jeweller De Beers has reportedly replaced Fan with actress Gao Yuanyuan, Louis Vuitton's new Shanghai exhibition features an image of the "brand ambassador" in a gown designed by Nicolas Ghesquiére at the 2017 Cannes Film Festival — a bold bet on Fan's comeback to Chinese stardom. (UDN)

Trade War Could Send VCs Packing

Will trade tensions rob US of its innovators? Lee Kaifu — the former Google China president and current chairman and chief executive of VC firm Sinovation Ventures — has said that his firm will lure US talents east to China if trade tensions escalate. Lee intends to scale back on investing in American businesses if Presidents Xi and Trump fail to de-escalate mounting conflicts at the G20 Summit in Buenos Aires scheduled for November 30 and December 1 — echoing sentiments common to Chinese investors in the US, as Washington continues to block cross-border tech deals between the two countries. This outcome is more likely than not: according to analysts at Moody's Investors Service, a G20 breakthrough is unlikely considering tensions are deep-seated and go beyond tariffs. As a prelude, the annual Asia-Pacific Economic Cooperation Summit ended on November 18 without an agreement for the first time in its history due to the two countries' disagreements regarding World Trade Organisation reforms. (Bloomberg)

Chinese Cyber Authority Scrubs 9,800 News Accounts

Almost 10,000 independent news providers have had their social media accounts deleted after being deemed sensational, vulgar or politically harmful by the Cyberspace Administration of China (CAC), as announced by the organisation on November 12. The CAC also used the campaign, launched on October 20, to call on social media platforms from Tencent's WeChat to Sina's Weibo and to prevent "all kinds of chaos" among media users and their followers. It's been over a year since Harper's Bazaar China had its entertainment news focused WeChat account shut down twice for violating online regulations on celebrity gossip, but the CAC's latest crackdown suggests that the media's censorship woes are far from over. (Reuters)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.