The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") rallied 7.3 percent during the month, outperforming the MSCI Word Index ("MSCI") by over 5 percentage points. The sector seems to have reached a turning point, having weathered the crises that beset it all year and buoyed by more benign currency trends.

Big news

• Whilst this month's gain is impressive, the SLI is now at the same level it was in early January. It has indeed been a tough year for the sector, which has been hammered by the slowdown of its biggest growth engine, political instability and currency headwinds.

• A string of strong results announcements has left a positive sentiment, including Hermès which is forecasting a record margin this year and posted double-digit sales growth for its third quarter, boosted by demand for its new leather offering such as the Halzan collection and the Mini Convoyeur bag, and Moncler, which announced nine-month profits ahead of expectations. Overall, European-based luxury companies are benefitting from the double positive of growth in the US market and the rise of the dollar.

ADVERTISEMENT

• Even negative news had a silver lining. Richemont's sales in China and Hong Kong, which together represent a quarter of group revenues, fell in the six months to September and the trend continued in October. However, it wasn't the bloodbath many investors expected and the share price rose as a result. The company also said it will increase dividends every year in good and bad times, which pleased investors.

• Swiss watch exports have risen in October by over 5 percent, driven mainly by the top and bottom segments as well as growth in the US. Analysts are nevertheless expecting to see an impact from the Hong Kong protests in November’s sales report. Hong Kong remains one of the most important luxury watch markets, alongside the US and China.

• Estée Lauder acquired niche fragrance brand Editions de Parfum Frédéric Malle, its third acquisition in a month. Richemont’s IWC acquired the world timer patents and intellectual property of Vogard for its unique world timer technology, which allows the wearer to adjust the time zone via the bezel as opposed to using a crown or pushers.

Going up

• Salvatore Ferragamo's share price leaped over 16 percent this month after it published strong third-quarter results and announced that it would match its 2013 core profit margin this year.

• Brunello Cucinelli also rose by almost 16 percent as its nine-month profits were boosted by higher revenues and a better sales mix.

• Tiffany’s shares have hit record highs, gaining more than 12 percent over the month as it reported better-than-expected third quarter results, fuelled by strong demand in the Americas.

• Richemont’s share price was boosted at the end of the month by rumours of an IPO of its e-commerce subsidiary Net-a-Porter. The share ended the month over 12 percent higher.

ADVERTISEMENT

• Ralph Lauren's shares traded up 12 percent on the back of improved outlook for US demand.

Going down

• Michael Kors' share price went down by 2.4 percent after it warned of slowing growth in same-store sales ahead of the holiday shopping season, citing muted spending in North America and a drop in mall traffic.

• Estée Lauder shares fell by 1.4 percent after the company lowered its guidance for the fiscal year, due to the effects of a strong dollar and weaker demand for its skin care products in the USA and China. The company’s first quarter sales fell by 1.6 percent with skincare, its largest category, falling by 6.8 percent.

What to watch

The currency environment has turned from headwinds to tailwinds, with the inexorable rise of the dollar against all currencies in general but the euro in particular, favouring European-based groups which constitute the bulk of our index, as well as those with good exposure to a growing US market. Areas of concern remain (anaemic Europe, political instability in some important markets) but have stabilised. Luxury managers are expecting a more benign environment in the months to come. Fingers crossed!

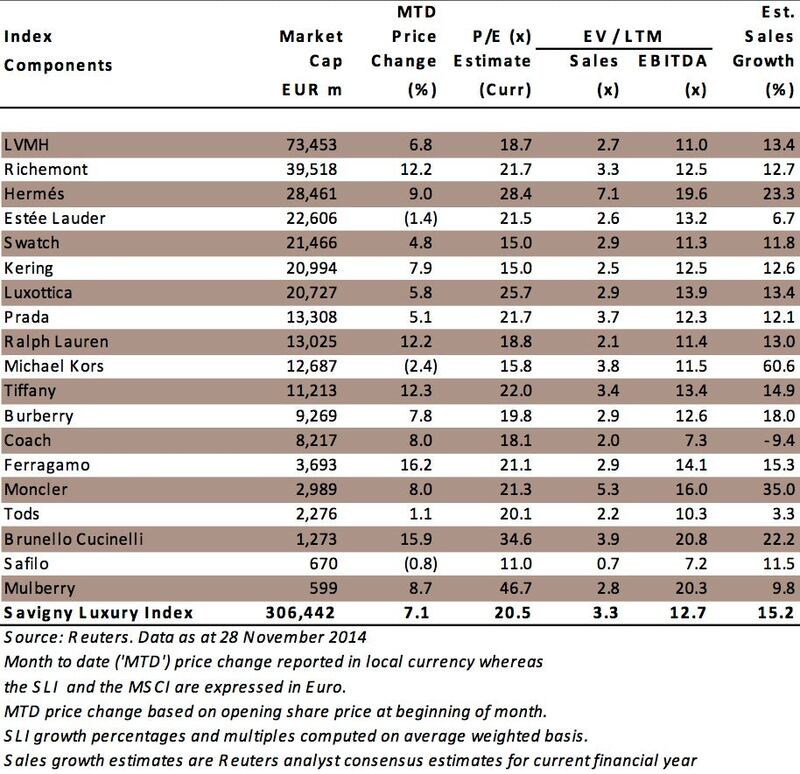

Sector Valuation

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.