The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

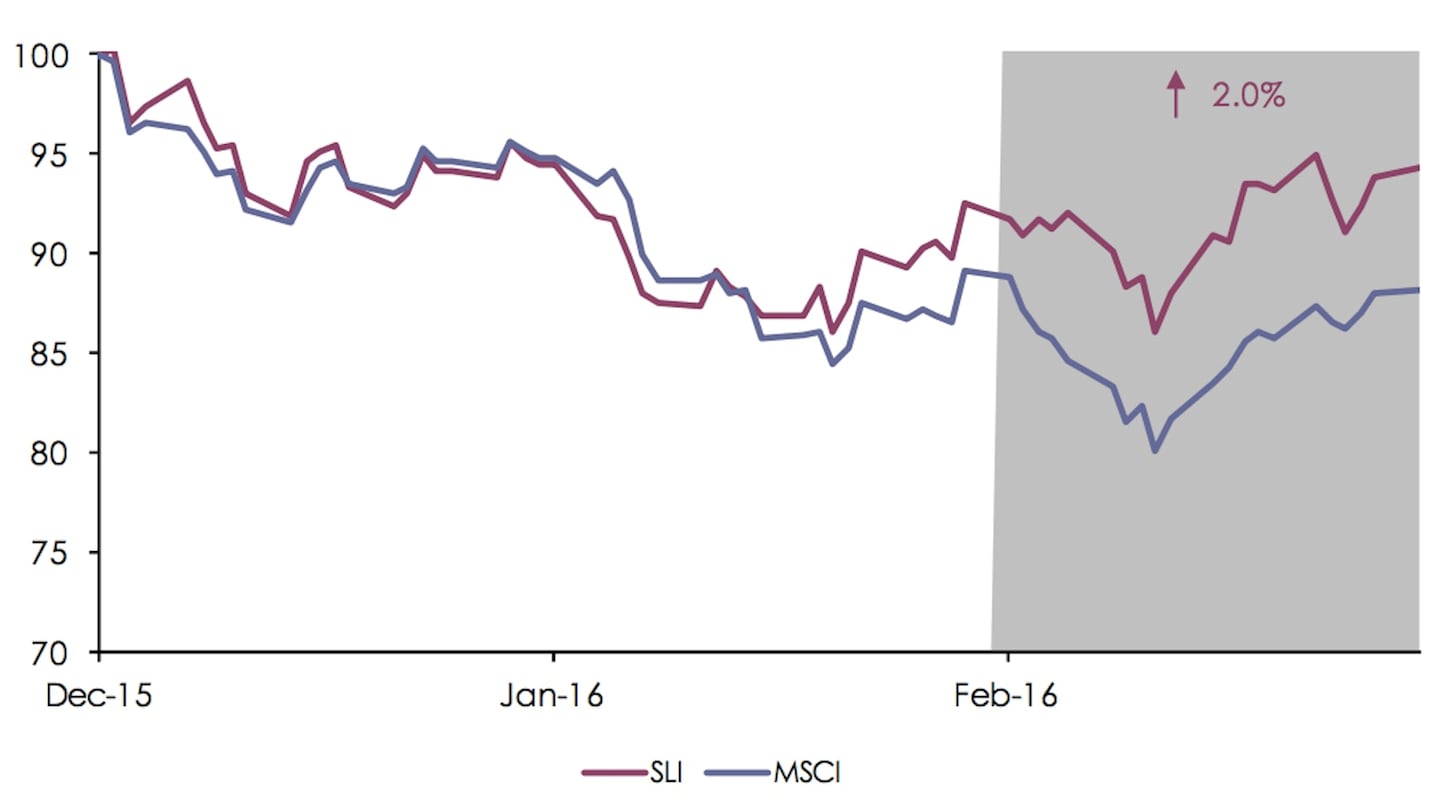

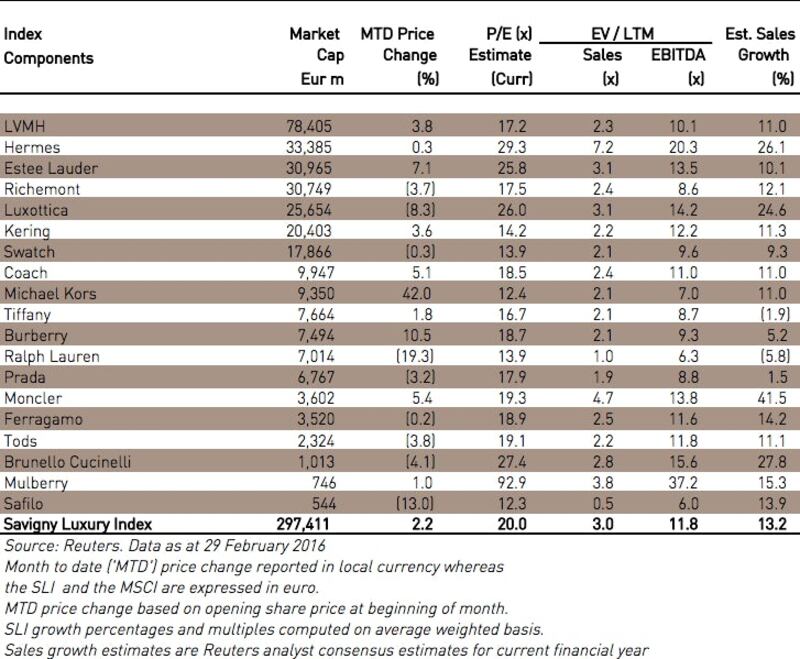

LONDON, United Kingdom — Both the Savigny Luxury index ("SLI") and the MSCI World Index ("MSCI") bounced back in February, buoyed by firmer oil prices and strong US jobs data. The SLI in particular did well, climbing 2 percent on the back of reassuring results from two of the sector's biggest brands, whilst the MSCI recorded a net decrease of 1 percent.

Big news

The fashion calendar saw the biggest challenge since the creation of the fashion system as some industry players announce the move to sell clothes directly off the catwalk to consumers rather than six months after the fashion week presentation. Brands such as Tom Ford and Burberry took the limelight in this shake-up but the industry as a whole reacted diversely, with the tenors of the fashion sector in Paris and Milan rejecting this "see now, buy now" approach. More than ever brands will have to ensure that the three key areas of supply chain, brand positioning/communication and distribution channels are properly aligned and cohesive, with digital playing an increasing role in the process.

Gucci and Louis Vuitton both posted better-than-expected sales performances for the end of 2015, underpinning strong results announcements for both parent companies. Other brands bucking the general malaise seemingly plaguing the sector include Bottega Veneta and Saint Laurent (also owned by Kering), and Brunello Cucinelli. Commentators nevertheless remain cautious about 2016, expecting it to be a challenging year for the sector.

ADVERTISEMENT

Storm clouds continued to gather over the Swiss watch industry, with Swiss watch exports declining a further 10 percent in real terms in January. Hong Kong posted its twelfth consecutive month of contraction, with a dip of 33 percent, whilst the US contracted by almost 14 percent. A silver lining was only to be found in the affordable luxury segment, notably Tissot and Longines, and in connected watches: Tag Heuer’s connected watch supply could not meet demand. The luxury watch sector has probably had one of its most difficult years in 2015, suffering from the very strong Swiss Franc and effectively losing two of its biggest markets (China and Hong Kong); not to mention the rise of the smart watch, most of the contenders being American or Asian electronic giants.

Corporate activity was particularly quiet this month. Estée Lauder added perfumer Kilian to its growing stable of niche brands, and Canados Yachts, a luxury motor yacht company, was bought by a private investor.

Going up

Going down

What to watch

We are sailing into some stormy geopolitical waters this year with tensions building up in the US with polarising presidential candidate nominations and in Europe (immigrants crisis, Brexit). This could again play havoc with currencies. 2016 is shaping out to be a challenging year for the sector.

Though e-commerce reshaped retailing in the US and Europe even before the pandemic, a confluence of economic, financial and logistical circumstance kept the South American nation insulated from the trend until later.

This week’s round-up of global markets fashion business news also features Korean shopping app Ably, Kenya’s second-hand clothing trade and the EU’s bid to curb forced labour in Chinese cotton.

From Viviano Sue to Soshi Otsuki, a new generation of Tokyo-based designers are preparing to make their international breakthrough.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.