The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowIn the weeks that followed the Russian invasion of Ukraine in early 2022, more than 500 global companies across a range of sectors announced they would cease operations in Russia. Many brands cited trade restrictions and operational difficulties as they began exiting or suspending operations. Some companies chose to also take a side in the war. They issued condemnations of violence or coupled their operational decisions with humanitarian donations. Some brands decided to hold or even expand their businesses in Russia, capitalising on the vacuum left by the departure of brands from Europe and the US. But for most brands that left, curtailing business in Russia was done with the intention of showing solidarity with and support for those calling for peace.

Not so long ago, such a statement would have been considered unusual, even contentious. Fashion brands have long aimed to be politically neutral in order to avoid alienating not only their customers, but also investors and business partners. But in today’s polarised and interconnected world, a global brand’s public, political and social affiliations can impact its relationships with consumers and business partners. In opting to forgo operations within a particular market, companies may lose revenues in the short term, but leaders should weigh up the impact on brand equity and consumer trust in other markets in the longer term.

For fashion executives, the politicisation of the private sector adds a new dimension to how and where they focus on growing their businesses globally. Decisions about whether to invest in a country or region can no longer be confined to its economic potential. Today, fashion leaders should consider the social tensions and political uncertainties that can obstruct business operations or escalate reputational risk. Many of the priorities based on the geographic markets that were central to the fashion and luxury industry in recent years are shifting as a result.

In recent years, many Western fashion brands pivoted their foreign investment to the Chinese market, with good reason. Even during the pandemic in 2020, China accounted for 25 percent of global apparel and footwear sales, ahead of the US and Western Europe with 20 percent and 22 percent respectively.

ADVERTISEMENT

China’s GDP has more than doubled over the course of a decade, from $8.5 trillion in 2012 to $17.7 trillion in 2021, fuelled by urbanisation and increased productivity, alongside a large and growing middle class with disposable income, helping it to grow faster than other major global economies.

Though still a critical market, China is now facing a changing growth trajectory. In October 2022, the International Monetary Fund forecast China’s GDP to grow 3.2 percent for the year, compared with 8.1 percent in 2021, citing a property sector crisis and partial or full lockdowns in response to outbreaks of new Covid-19 variants in more than 70 cities, spanning key fashion shopping hubs like Shanghai, Beijing, Shenzhen, Guangzhou and Chengdu. In the third quarter of 2022, the country’s GDP grew below target, casting a shadow over investor sentiment amid concerns about the country’s longer term outlook. HSBC estimated that retail sales were down 40 percent year on year in April and 50 percent in May due to store closures.

Even without the threat of further Covid outbreaks, the Chinese market presents other challenges specific to foreign fashion brands. For example, some Chinese consumers are starting to favour domestic brands over their foreign counterparts. Sales of foreign-branded sneakers on Chinese online retailer Tmall decreased 24 percent year on year in 2021, while domestic brands’ sneaker sales grew 17 percent. Sportswear apparel saw a similar shift, with foreign-brand sales declining 33 percent compared with domestic brands’ 13 percent growth year on year.

Meanwhile, income inequality in China is widening, nearly reaching 2008 levels, and youth unemployment is rising. In addition, major institutions like the World Bank are concerned that the country is too reliant on debt-financed infrastructure and real estate investment as a means to stimulate growth. As of September 2022, the value of new home sales and levels of property investment were down 29 percent and 12 percent year on year, ominous signs when 70 percent of Chinese household wealth is tied up in real estate.

Amid all this, however, China’s long-term growth projections remain robust. By 2040, its GDP is projected to reach $47 trillion, widening the gap with the US, at $28 trillion, and the euro zone, at $19 trillion. China will likely remain a core market for fashion consumption in the long term, with significant untapped opportunities among a customer base whose sentiment for luxury brands in particular is holding strong.

Fashion brands can adjust their strategies accordingly. Many brands are already directing their investments into China’s shopping hubs where growth appears to be the most robust. Brands opening new or refurbished stores include Hermès in Wuhan, Ralph Lauren and Louis Vuitton in Chengdu, and Marni and Maison Margiela in Shanghai. Others are doubling down on the luxury duty-free opportunity by expanding in the emerging shopping hub of Hainan.

US-based fashion groups Capri Holdings and Tapestry, which generate more than half their sales in North America, delivered strong results in 2022. Overseas brands also fared well, with the Americas being the fastest-growing market for Spanish fashion group Inditex, with sales increasing 45 percent year on year in the first half of 2022, while Swiss sportswear brand On grew sales in North America at 102.5 percent year on year over the same period.

It was not just at home that Americans continued to shop. As pandemic-related travel restrictions lifted, shopping in Europe was made even more attractive to Americans, bolstered by a strong dollar against the euro and pound sterling. Luxury brands in Europe cited American tourists as a key driver of increased first-half sales, including a 47 percent rise at LVMH and 53 percent rise at Kering.

ADVERTISEMENT

With overall US retail sales expected to close 2022 on a two-decade high, the sector will have a strong foundation heading into 2023. Meanwhile, the US has also reclaimed its spot as the largest market for luxury goods in the world in 2022, even if the country will likely concede this position to China again in the near term. “The US is proving to be a long-lasting source of growth for the luxury industry, fuelled by younger generations who are highly engaged with the category,” said José Neves, co-founder and chief executive of luxury e-commerce platform Farfetch, which generated over 20 percent of its revenue from the US market in 2021; further confirming its confidence in the market, it acquired a minority stake in Dallas-based luxury department store Neiman Marcus in 2022.

Some fashion companies are targeting second-tier US cities for new growth, as wealthier demographics have taken advantage of remote work to seek out alternatives to higher-cost cities like New York, Los Angeles and San Francisco. Luxury labels Saint Laurent and Gucci are set to open stores in locations like Detroit, New Orleans and Columbus. MyTheresa and Saks Fifth Avenue, among other luxury retailers, have also begun staging or strengthening VIP events in cities like Palm Beach, Dallas and Miami to deepen relationships with wealthier clients who are not based in the country’s traditional fashion capitals.

However, amid uncertainty in the stock market and rising inflation — as well as the Federal Reserve continuing to hike up interest rates — the US is not immune to economic turbulence felt elsewhere. Credit card data from the autumn of 2022 showed Americans had cut back on buying luxury goods ahead of the holiday season, suggesting shopping sentiment could be petering out. The sharpest cuts were among middle-income customers. Luxury brands may find entry-level customers in particular pull back their spending as economic conditions deteriorate. To be sure, the US may be more resilient than other key markets, but brands should be cautious and be prepared for a potential slowdown in the US market, too.

In the Asia-Pacific region, Japan and South Korea are renewing their reputations as dependable growth drivers, particular in luxury, amid China’s recent slowdown and sustained post-pandemic demand. But both markets require brands to update their local strategies to capitalise on shifting shopping habits.

Consumer demand in Japan and Korea was particularly resilient coming out of pandemic lockdowns, benefitting from an influx of international tourists. Domestic shoppers in Japan and Korea has been driving the countries’ economic recoveries, as they largely filled the void left by home-bound Chinese tourists. Japan’s economy recovered to its pre-pandemic size in August 2022, fuelled by increased consumer spending after Covid restrictions were eased in March 2022, while Korea reached the same milestone in April 2021, and the country’s consumption and GDP growth rates continued to exceed analyst expectations in 2022.

During the pandemic, Western brands in these countries learned how to adapt to Covid restrictions, such as by introducing remote sales strategies. For Italy-based Moncler, private appointments and distance sale transactions, where customers make purchases from home via video calls with sales associates, now account for 30 percent of sales in Korea and 20 percent in Japan. Meanwhile, department store groups Shinsegae, Lotte and Hyundai are expanding in Korea to accommodate global brands’ desire to capture domestic demand. Other brands have laid the foundations for further growth in Japan. For example, foreign luxury labels including Hublot, Zegna and Chanel have opened stores recently in Tokyo’s main shopping districts. Hermès saw sales in Japan increase by 22.7 percent in the third quarter of 2022, with the company citing the loyalty of local customers.

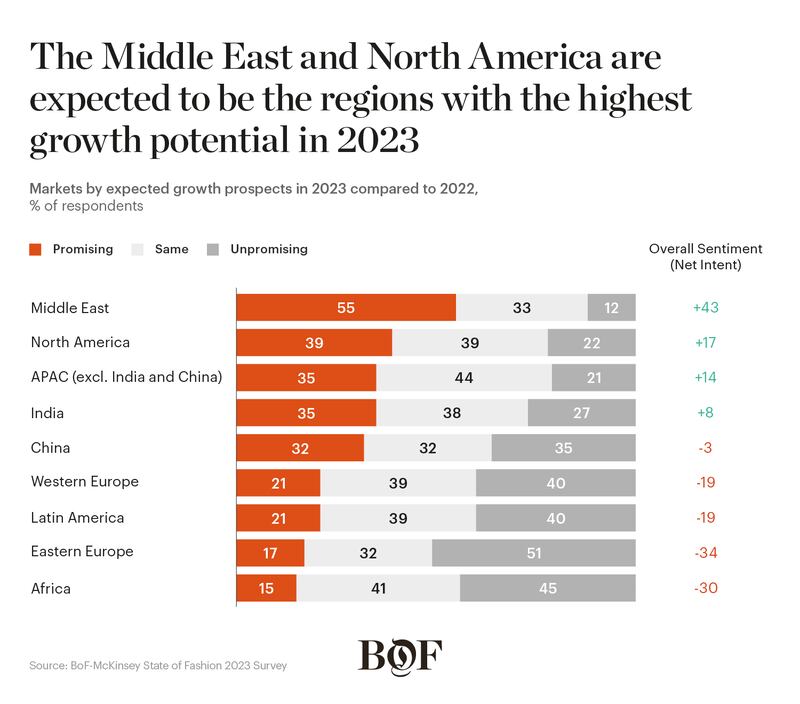

The outlook for fashion in the Middle East in 2023 is more bullish than for many other markets; in the BoF-McKinsey State of Fashion 2023 Survey, 88 percent of executives indicated that they believe the Middle East will have the same or more promising growth prospects in 2023 compared to the previous year. Global energy prices are rising and the Gulf Cooperation Council currencies are pegged to an appreciating US dollar. The GCC luxury market was worth nearly $10 billion in 2021 — a 23 percent increase on pre-pandemic levels — and is expected to grow to $11 billion in 2023.

A significant proportion of Middle Eastern luxury spending was repatriated during the pandemic as luxury consumers were unable to travel to Europe. Now, 60 percent of luxury spending occurs domestically. In addition to opening new stores, luxury brands are finding other ways to home in on the GCC market, such as staging fashion shows locally and creating local content by collaborating with Middle Eastern artists on capsule collections and producing photoshoots in the region.

ADVERTISEMENT

In the year ahead, geographic diversification will likely be as important as ever, but also more complex, as rapidly shifting economic, political and social forces take centre stage. When prioritising regions for global expansion, leaders can review their footprints and identify areas of growing demand while placing greater emphasis on factors beyond revenue potential, such as reputational and other risks.

Alongside an enhanced framework for risk, brands can employ a more nuanced and complex structure to evaluate the effects of political, regulatory and cultural scenarios they may encounter at home and abroad. This may require leaders to assess the interplay between different markets alongside factors within them. They will need to place greater emphasis on developing a local mindset, where on-the-ground know-how will allow fashion leaders to penetrate the market more deeply. Local experts will also be critical for anticipating and responding to any sudden changes to scenarios and will be a point of contact for external stakeholders, such as trade or industry bodies. The deeper the understanding of a region, the more effective a brand will be in doing business there.

This article first appeared in The State of Fashion 2023, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

Opens in new window

Opens in new windowThe seventh annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals the industry is heading for a global slowdown in 2023 as macroeconomic tensions and slumping consumer confidence chip away at 2022′s gains. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

The global economy is in a fragile state. Geopolitical tensions, inflation and the climate crisis are heightening uncertainty and volatility — and weighing on consumer confidence. For fashion leaders, navigating this will require sharpened strategies.

Local streetwear brands, festivals and stores selling major global labels remain relatively small but the country’s community of hypebeasts and sneakerheads is growing fast.

This week’s round-up of global markets fashion business news also features Senegalese investors, an Indian menswear giant and workers’ rights in Myanmar.

Though e-commerce reshaped retailing in the US and Europe even before the pandemic, a confluence of economic, financial and logistical circumstances kept the South American nation insulated from the trend until later.

This week’s round-up of global markets fashion business news also features Korean shopping app Ably, Kenya’s second-hand clothing trade and the EU’s bid to curb forced labour in Chinese cotton.