The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In the immediate aftermath of Russia’s invasion of Ukraine on Feb. 24, almost all Western fashion brands suspended operations in Russia. At first, the thinking was that the industry could pause sales to show solidarity with Western customers who overwhelmingly supported Ukraine in the conflict, while leaving the door open for a return once the war was over.

Nearly five months later, experts are giving up hope for a short-term peaceful resolution. This week, H&M said it would wind down its business in Russia, once the Swedish retailer’s sixth-biggest market. The decision means 170 stores will close, and some 6,000 employees will lose their jobs.

“After careful consideration, we see it as impossible given the current situation to continue our business in Russia,” chief executive Helena Helmersson said in a statement. “We are deeply saddened about the impact this will have on our colleagues.”

So far, H&M and Nike, which permanently closed its Russian operations in June, are the exceptions. They will soon be the rule.

ADVERTISEMENT

When retailers like Zara parent Inditex, luxury giants LVMH and Kering, and online retailers Yoox Net-a-Porter and Farfetch suspended sales in Russia, they did so partly to avoid running afoul of Western sanctions, and partly to head off public outcry. It worked — photos of dark Zara and Dior stores inside Moscow shopping malls satisfied most consumers, even if some knew their owners could theoretically turn the lights back on anytime they wanted.

That middle ground is increasingly unviable, as the war drags on and atrocities such as the massacre in the Ukrainian town of Bucha come to light.

Brands now face a choice: they can shut their Russian operations entirely, as H&M and Nike have done. They can sell their Russian businesses, as off-price retailer T.J. Maxx did when it sold a 25 percent stake in the Russian retailer Familia. Or they can continue with a wait-and-see approach.

Leaving Russia entirely comes at a cost: H&M said closing its Russian business will cost 2 billion Swedish crowns ($191.3 million at current exchange rates). It also means permanently walking away from a market that provided 4 percent of the group’s sales in the fourth quarter of 2021.

Those figures are likely higher than at most other retailers, even large ones. Adidas operates 500 stores in Russia and other former Soviet states, but said pausing business there would cut 2022 revenue by just 1 percent. The goodwill generated with many consumers by taking a forceful step to cut ties with Russia is probably worth that, if not more, especially for brands that are early to take the leap.

For brands that operate in Russia via franchisees, selling their business to those partners may be the most practical way out. A former McDonald’s partner now operates the fast food chain’s former Russian locations under a new brand, Vkusno & tochka. However, this isn’t a fool-proof solution: Some of the McDonald’s Russian stores are still using its branding illegally, potentially hurting the company’s image if service and the quality of its food drops. In fashion, where grey market goods are a problem even in normal times, it’s not hard to imagine a future where “Versace” and “Adidas” stores sell fakes and illicitly sourced goods.

Meanwhile, as malls in Moscow sit half-empty, domestic brands are benefiting from the lack of foreign competitors. Reuters reported that sales levels for Russian apparel, shoe and accessory brands were 2.6 times higher in March and April 2022 versus 2021, according to Ozon, Russia’s second-largest e-commerce platform.

THE NEWS IN BRIEF

ADVERTISEMENT

FASHION, BUSINESS AND THE ECONOMY

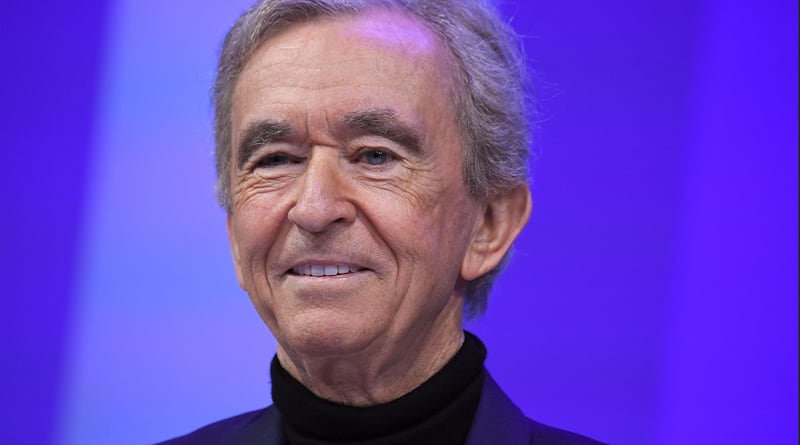

Bernard Arnault reorganises holding company to ensure family control of LVMH. The French billionaire is turning Agache, his family holding company, into a joint-stock partnership to guarantee its “control over the LVMH group will be maintained over the long term,” according to a statement.

Armani returns to profitability, trading above pre-pandemic levels. The closely-held Italian fashion giant reported consolidated revenues of over €2 billion ($2 billion) for 2021, meeting its rebound target a year earlier than owner and chief executive Giorgio Armani had forecast.

Allies could follow US lead on Xinjiang forced labour ban. US allies appear committed to following Washington’s lead banning forced labour goods from China’s Xinjiang region, a senior US official told Reuters on Monday, warning companies they could not maintain “deliberate ignorance” about their supply chains.

Manolo Blahnik wins long-running trademark dispute in China. The conclusion of a 22-year legal battle opens the way for the British brand to trade across the country for the first time since 1999 after the The Supreme People’s Court of China ordered the invalidation of an unlawful trademark registration.

Sri Lankan apparel exports under threat amid economic crisis. The country’s apparel export industry is facing a “serious threat” due to a crippled economy resulting from a sovereign-debt crisis and ensuing political instability, according to a local manufacturing association leader.

Zalando, Yoox Net-a-Porter and About You launch climate strategy platform for brands. Working with sustainability consultancy Quantis, the three online fashion retailers will offer a free service to help brands they stock measure greenhouse emissions, set reduction targets and submit them to the Science Based Targets initiative for approval.

Mike Ashley’s Frasers says profit will rise next year after record-breaking 2022. The company, owner of Sports Direct, forecast adjusted profit before tax of £450 million to £500 million ($600 million) for the next financial year.

ADVERTISEMENT

Activist investor Bluebell Capital Partners wants ex-Bulgari chief executive on Richemont board. The firm is asking the Swiss luxury conglomerate to appoint Francesco Trapani, a founding partner of Bluebell, to Richemont’s board.

THE BUSINESS OF BEAUTY

Halsey Launches a second beauty brand. The new line, called AF94, launches at Walmart this month and targets Gen-Z with products priced at $10 and under.

PEOPLE

Matchesfashion hires chief operating officer from Farfetch as leadership shuffle continues. Stuart Hill, Farfetch’s senior vice president of logistics for four years, will join MatchesFashion as chief operating officer in September. The hire follows the appointment of former Asos chief Nick Beighton as MatchesFashion’s new CEO last week.

Depop chief executive Maria Raga resigns. Kruti Patel Goyal, currently chief product officer, will succeed Raga, who is exiting the Gen-Z favourite site to pursue personal ventures, parent company Etsy Inc. said. Nick Daniel, currently vice president of product management, will assume the chief product officer position.

MEDIA AND TECHNOLOGY

Amazon fails to halt India’s Future Retail going into bankruptcy. An Indian court agreed to send Future Retail Ltd. into bankruptcy, allowing the creditors to find a new owner for the beleaguered retailer that once operated the largest chain of department stores across the country and was the prized trophy for two retail sector giants.

Fashion magazine 032c opens Berlin store. The Berlin-based cult fashion magazine-cum-fashion label 032c will unveil its first stand-alone store, dubbed “032c Workshop,” on Saturday, July 23.

L52 Communications opens in New York. The PR, marketing and events firm, which Adam Shapiro founded in 2016, operates in London and represents brands including Loro Piana, Carolina Herrera and Etro. As part of the New York expansion, L52 will work with brands like Khaite on special projects and events, Ferragamo on its global VIP programme and KNWLS.

Compiled by Joan Kennedy.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.