The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

During the pandemic, many luxury brands pledged to rein in – or even end – discounting, which had become a year-round habit in many corners of the industry. Sticking to that promise has proven harder than expected. To understand why, it would be helpful to look back at how the industry has navigated the last few years:

Starting in the 2010s, the luxury calendar morphed from two seasons to numerous drops throughout the year. Online, brands and retailers competed for attention by sending out email blasts and updating their landing pages to hype new products. These tactics have proven a great way to drive sales, but they have made planning a challenge: how much to buy, and in which colourways, is more complicated when there are more and more products hitting the market at any given time. The likelihood of over-ordering a particular item is multiplied by this approach, hence the need for discounting to convert that excess inventory into cash. In other words, as a direct result of the world of luxury chasing its tail in the name of innovation, in-season markdowns have become more commonplace.

The pandemic, which forced immediate and drastic discounting to get rid of excess inventory, felt like a tipping point in this race to the bottom. A group of fashion designers, retailers and executives led by Dries Van Noten penned a heartfelt open letter to the fashion industry advocating for a realignment of seasonal deliveries and sale periods, the production of fewer goods as well as less travel for fashion weeks and buying appointments. Dries pointedly described in-season markdowns as “a knife in my heart”.

Big brands for the most part weren’t signatories to that letter, but around the same time they were undertaking their own efforts to take back control of pricing, including exiting wholesaling or switching to concession formats. Prada had in fact announced in early 2019 that the group would stop doing markdowns and re-focus on full price sales. From the first half of 2019 to the first half of 2022, the group’s wholesale sales have indeed decreased by 39 percent whilst its direct-to-consumer sales have gone up by 38 percent. The group was praised in the aftermath of its 2021 results for its shift towards full-priced sales contributing to a 41 percent turnover growth.

ADVERTISEMENT

These moves have come at the expense of multi-brand online retailers such as Yoox Net-a-Porter, Matches and Farfetch (the latter of which is nevertheless running an up to 60 percent off sale at the time of this publication, which happens to feature 38 Prada items).

A Necessary Evil

This holiday season, discounting appears poised to make a comeback. There is no global supply chain crisis keeping products off shelves, as there was in 2021. In its place there is a growing fear that 2023 will be a challenging year, with fears of a global recession perhaps prompting companies to fill their coffers even at the sacrifice of margin. Looking further ahead, McKinsey also estimates that off-price sales are likely to grow five times faster than full-price from 2025 to 2030.

There are however a few tricks brands can play to minimise the impact of discounting on brand perception and ultimately company valuation.

The first is to contain off-price sales to outlet destinations such as Bicester Village. These have the advantage of being a destination format so customers have to choose between shopping at full price stores in luxury shopping districts or travel to an outlet in the hope for a bargain. The latter choice frequently means that the customer is already primed to spend money.

Another strategy is to have more targeted discounting initiatives such as rewarding higher spending customers with early or exclusive access to certain discounted items. Dior Beauty, for example, has a loyalty programme whose four tiers provide exclusive benefits that reward members’ interactions with the brand.

A common practise within beauty is to offer bundles or kits coupled with a price incentive as a means to increase average customer spend or to offer gift with purchase incentives, again to increase average customer spend. This is a great way to attract custom while preserving brand cachet in what is becoming an increasingly competitive brand landscape.

Finally, there is a strong sustainability message associated with discounting rather than destroying, which could be targeted at the up-and-coming, more socially conscious consumer. Just as in the case of second-hand luxury, this could be managed in a way that there is little overlap between a brand’s core full-priced consumer and a consumer that doesn’t yet have the means to buy the brand but aspires to in the future.

ADVERTISEMENT

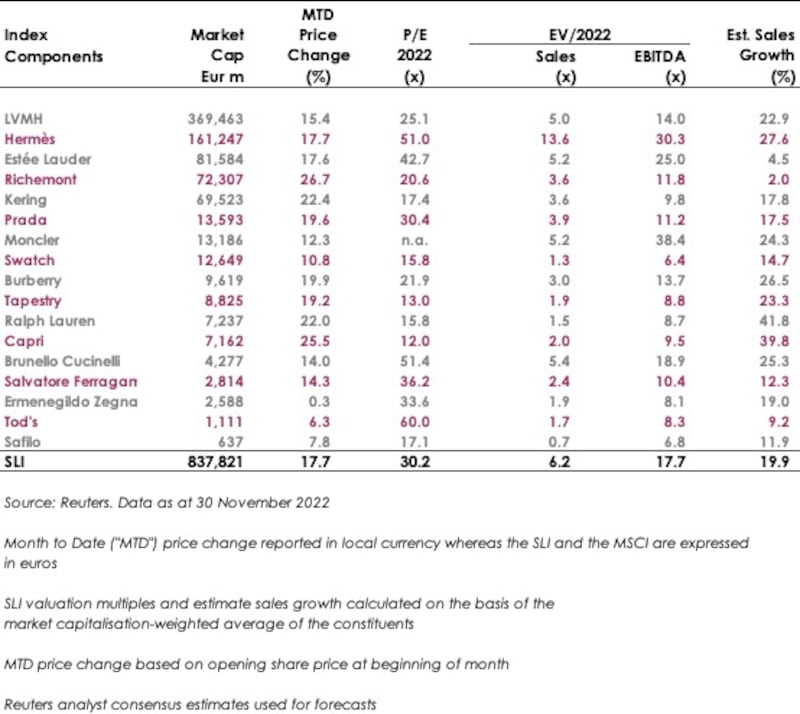

The Savigny Luxury Index (“SLI”) gained 15.5 percent in November as China eased Covid 19 restrictions and the sector looked forward to a strong holiday sales season, outperforming the MSCI by 9 percentage points.

Going up

Going down

What to watch

While luxury brands are still counting the cash in their tills from the holiday sales season in the Western Hemisphere, there is still Lunar New Year and, to a lesser extent, Valentine’s Day to come. Lunar New Year may not be the discounting bonanza that is Singles Day, but it is nevertheless an additional sales period that luxury brands can bank on.

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

The luxury goods maker is seeking pricing harmonisation across the globe, and adjusts prices in different markets to ensure that the company is”fair to all [its] clients everywhere,” CEO Leena Nair said.

Hermes saw Chinese buyers snap up its luxury products as the Kelly bag maker showed its resilience amid a broader slowdown in demand for the sector.

The group’s flagship Prada brand grew more slowly but remained resilient in the face of a sector-wide slowdown, with retail sales up 7 percent.

The guidance was issued as the French group released first-quarter sales that confirmed forecasts for a slowdown. Weak demand in China and poor performance at flagship Gucci are weighing on the group.