The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Rental is hot in fashion right now.

The sharing economy that has recently upended the car and travel industries is starting to make inroads in apparel. Last year, rental platform pioneer Rent the Runway reached unicorn status as it closed a whopping $125 million in funding; while mass brands and department stores, from Ann Taylor to Bloomingdales, have started offering rental services of their own.

Some companies are driven by sustainability concerns, wanting to curb over-production by looking for alternative ways to turn a profit; others are hoping to entice new shoppers or reach a younger customer.

But rental can be a complex business, not least because logistically it’s so different from most fashion business models. For a small label that doesn’t have the cash and infrastructure of its larger competitors, it’s even tougher.

ADVERTISEMENT

So, how does a brand get started? BoF talked to brands, platforms and service providers to break down the different ways to participate in the rental market, weighing up the pros and cons along the way.

Option 1: Going It Alone

Setting up a rental operation in-house is challenging regardless of brand size, not least because there are many costly and time-consuming operational must-haves to factor in. Clothes need to be cleaned; inventory needs storing and tracking; styles need to be insured to protect lenders against accidental damage by borrowers.

But it’s not totally impossible. Farleigh Hungerford set up her direct-to-consumer namesake fashion brand in 2018 after relocating back to London from Los Angeles. As an environmentally-driven designer, she wanted to trial a rental model to give customers the option of accessing items they only intended to wear once or twice.

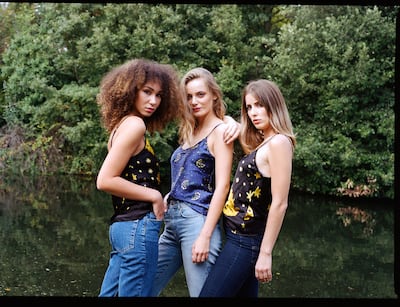

Farleigh clothes | Source: Courtesy

Over the past year, Farleigh has built up a manageable rental client roster, charging customers a one-off fee per item. The brand uses green couriers, and cleans everything in-house.

However, the operation is currently less a business, more of a service. The London-only project is hyper-local, mainly attracting customers through word of mouth and logistically it’s not feasible to scale beyond its current reach. Practically, as the rental market in the UK is very much in its infancy, demand is patchy.

“People often come into the office that we’ve got and try it on to make sure that they’ve got the right size, so it’s a much more catered, personal service than it would be for bigger brands,” Hungerford said. “We’re still working out whether it’s got the potential to grow.”

ADVERTISEMENT

For large businesses, a more complex operation is required to make rental work. Legacy retailer Urban Outfitters, which also owns Anthropologie and Free People, built its own rental platform in-house for its private label brands. It launched last summer as an $88-per-month subscription business under the name Nuuly.

A 300,000 square foot warehouse was built close to its head office along with an in-house laundry facility. It took about a year to put the tech in place and hire a workforce of about 80 people needed to run the operation, said Kim Gallagher, Nuuly’s director of marketing.

“Building it ourselves was the best way to be a big player in the space,” she said. “We thought, this market was really going to grow and expand.” It also helped that they had a number of brands at their disposal; the fact customers could get an offering across a broad assortment would give them an advantage, she added.

Gallagher declined to confirm the size of investment in the project, and wouldn’t disclose how close the company was to profitability. But on an earnings call in August 2019, the company said selling, general and administrative expenses (SG&A) would include about $5 million in costs associated with its Nuuly launch.

Option 2: Partnering With a Rental Platform

A partnership with an established rental platform offers small brands a relatively risk-free option that requires minimal logistic effort. It also offers a marketing and customer acquisition opportunity alongside income, but leaves the brand with no infrastructure of their own to build on.

Rails founder Jeff Abrams explored rental because he wanted his Los Angeles-based brand to be wherever the customer wanted to shop. As it isn’t the brand’s current core focus of growth, it made more sense to partner with an expert. With Rent the Runway the market leader in the US, it seemed like the obvious choice.

It's similar to how you would operate with a wholesale partner.

Typically, Rent the Runway buys in-season inventory from brands. This means that, from the brand side, it’s “similar to how you would operate with a wholesale partner,” said Abrams. “You’re still selling them your inventory at a certain price. The difference is that a traditional retailer is going to mark it up by 2 to 2.5 times the cost. [Rent the Runway’s] model is more to have it rented as often as possible.”

ADVERTISEMENT

With some brands, Rent the Runway operates a revenue share model, with the platform ingesting the inventory upfront and splitting the revenues from subsequent rentals with the brand. They also work with designers to create pieces specifically for the platform.

Rent the Runway oversees all the operational logistics as well as the marketing, garment care and the pricing of clothing. To optimise the buying process, it collects millions of data points, which are regularly shared with brand partners. It also gives brands access to tens of thousands of new potential customers. According to Chief Merchant Officer Sarah Tam, 98 percent of subscription customers discover brands for the first time on the site, while the average unlimited subscriber — a customer base that generates 75 percent of the platform’s business — rents 15 new brands within the first three months.

Source: Courtesy of Rent the Runway

Brands are often concerned that partnering with platforms like Rent the Runway could cannibalise their own sales. But typically, what consumers choose to rent tends to be different from what they would purchase, say experts. Getting onto the platforms’ co-manufacturing programme to create exclusive styles can also mitigate risk.

James Miller, chief executive at The Collected Group, which owns Equipment, Joie and Current/Elliott, has not seen any cannibalisation of the group’s core retail business after three years of working with Rent the Runway. Instead, The Collected Group brands can access customers much younger than those shopping at department stores (aged 45+) or directly in the brand’s shops (aged 35). On Rent the Runway, the average Joie customer is in her late 20s. “You’re actually adding in a new demographic that you wouldn’t be getting otherwise,” he said.

In Europe, where the market for rental is in its infancy, there isn’t a clear market leader at the size of rent the runway just yet. But multi-brand platforms are emerging.

In December 2019, Tina Lake and Sacha Newall launched My Wardrobe HQ’s UK-based rental service, which works on a consignment model. Logistically, it optimises inventory using data and takes care of everything from stock photography to storage and shipping, to garment repairs and dry-cleaning.

At the moment, the platform is focused on the higher-end of the fashion spectrum, as occasionwear rental is currently more popular in the European market than everyday clothing. (It has also seen great success with skiwear.)

“The early adopters have started to use it already, and in 18 months’ time, two years, I think it will start to become much more of a presence,” said retail veteran Jane Shepherdson, who joined the company as chairman in November 2019.

As with any traditional retail partner, consumer demand will determine how much the platform buys into a brand, giving you greater access to the customer, according to Rails’ Abrams. He also recommends brands keep platform partners to a minimum, “because you want to make it feel like a special experience for your customers,” he said.

Option 3: A White Label Solution

Working with a white-label platform is the middle ground between building a rental business in-house and working with a third-party rental site.

Ganni launched its rental platform, Ganni Repeat, in September 2019, partnering with Danish white label platform Continued Fashion and charging consumers a one-off rental fee per item of clothing. The brand decided to trial its own operation because it saw rental as a “potential business model of the future,” said brand co-founder Nicolaj Reffstrup. “We’ve seen the success of products like Rent the Runway — we cannot just sit down and observe that, we want to be part of the game.”

Continued Fashion takes care of the logistics and tech for partner brands, from shipping and dry-cleaning to onsite payment gateways and inventory tracking. The platform also shares anonymised data and learnings gathered from its client base with each brand.

“All the brands have to do is allocate product to us, they ship it to our warehouse,” said co-founder Vigga Svensson, who ran a rental kidswear brand with her husband before selling the company in 2018 to focus on rolling out a rental solution that all brands could use.

You have to go about this in a nimble way and be patient. You need to be in it for the long-term for this to succeed.

Cost-wise, it’s not a huge undertaking; the project has cost Ganni less than $50,000. The real investment has been time dedicated to aligning internal processes, fine tuning pricing and analysing which products perform well.

Marketing the service is also the responsibility of the brand. In markets where clothing rental services are less mature, this can be a tough sell.

Source: Courtesy of Ganni

It’s still very early days for Ganni Repeat. Currently the business only operates in Denmark, but there are plans to roll it out to the UK and the US this year. The brand only expects it to reach profitability within the next couple of years. Reffstrup, however, never expected to see returns overnight.

“You have to go about this in a nimble way and be patient,” said Reffstrup. “You need to be in it for the long-term for this to succeed.”

By Malene Birger partnered with Continued Fashion for the 2019 launch of By Malene Birger Rent the Look, which also rents items using one-off fees. It wasn't expensive for the brand to hook onto the platform, but the time and effort the company put into research and consumer feedback was significant.

“Our main challenge was to make it as convenient for the consumer as possible,” said Chief Executive Morten Linnet. This included figuring out how to integrate the rental model into its physical store experience; and understanding what clothing their customers wanted to rent.

Getting the price right is key. If it’s too cheap, brands won’t make a margin. If it’s too expensive, consumers won’t rent. Brands have to balance the cost of the product with both its lifespan and consumer demand.

Just over a year in, the brand’s rental business is already profitable, but only by a small margin. “It’s not a huge business now, it’s still early days. But it has potential — and we can scale it,” said Linnet. Until now, the project has only been trialled in Denmark and Sweden, but there are plans to roll it out in Norway and the UK this spring.

For the brand, it's definitely a short term success if you consider it a marketing story.

CaaStle, founded by Gwynnie Bee's Christine Hunsicker, is the leading subscription rental white label platform in the US behind services provided by Ann Taylor, Bloomingdales, Rebecca Taylor and Banana Republic, among others.

CaaStle takes a flat fee per rental from its partners every month and requires no upfront capital. “The only cost that the brand incurs is that they have to send us some inventory for the first month of launch,” said Hunsicker. The path to profitability is quick: Hunsicker said it takes 10 weeks to onboard a new brand onto the platform, while the brands she works with are EBITDA positive between three and six months into launch.

Subscription programmes, however, require long term commitment from loyal subscribers. According to Hunsicker, for a subscription rental service to make sense, brands need to meet a $50 entry-level price threshold on its clothes, and have a large breadth of items to offer consumers.

More broadly, when it comes to growing a rental business, brands need to shift their mindset, said Hunsicker. “Everything...is just different to a retail business, down to the fact that the clothing is not a liability on your balance sheet anymore, it’s actually an asset that you’re going to depreciate over time. It’s a different way of thinking and it has a different set of metrics,” she said

Continued Fashion’s Svensson says if brands want in-house rental solutions to work in the long term, they have to treat it as seriously as they would their linear business.

“It’s very important to actually decide if you want this because of a marketing opportunity, or if you want this because you actually want to understand — and have — one of the sales channels of the future,” she said. “For the brand, it’s definitely a short term success if you consider it a marketing story.”

Related Articles:

[ Everyone Is Launching Rental Services. Is There Enough Demand?Opens in new window ]

[ Peer-to-Peer Rental Start-Ups Take on Rent the RunwayOpens in new window ]

[ Mall Brands Are Entering the Rental Market. Can the Model Work?Opens in new window ]

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.