The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

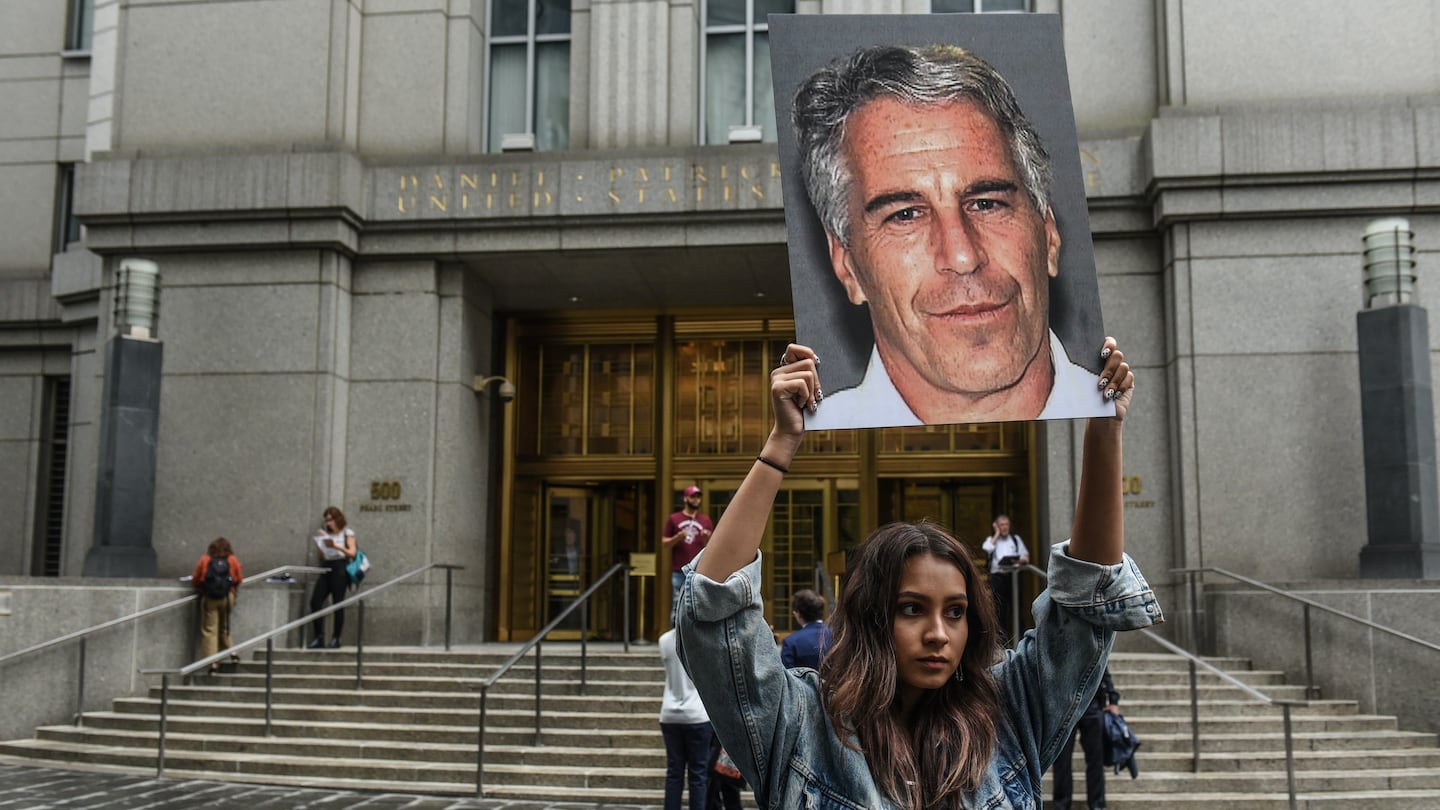

COLUMBUS, United States — Jeffrey Epstein was the elephant in the room heading into L Brands Inc.'s investor meeting, and Chief Executive Les Wexner made the controversy his very first talking point.

“Being taken advantage of by someone who was so sick, so cunning, so depraved, is something that I’m embarrassed I was even close to. But that is in the past,” Wexner, 82, said in his opening remarks at the annual event in Columbus, Ohio.

Wexner employed Epstein as a personal money manager for years, building a relationship close enough for Epstein to buy his Manhattan mansion before severing ties more than a decade ago. In August, Wexner wrote to members of the Wexner Foundation that Epstein had “misappropriated vast sums of money” from him and his family, and an internal investigation into Epstein’s involvement at L Brands remains ongoing.

Although Wexner never mentioned Epstein by name during his Tuesday morning comments to investors, he referenced a personal financial adviser as a “distraction” that “happened a long time ago.” Epstein, who even had the CEO’s power of attorney at one time, was found dead in his jail cell in August after being arrested on federal charges for sex trafficking of minors.

ADVERTISEMENT

“Everyone has to feel enormous regret from the advantage that was taken of so many young women,” Wexner said. “That’s just unexplainable, abhorrent behaviour and clearly something we all would condemn.”

Wexner’s decision to address the issue head on comes as the company tries to move past the controversy and instead focus on the nuts and bolts of a long-promised retail turnaround for Victoria’s Secret. Shares of the company are down about 30 percent year to date despite a continued bull market. While L Brands’ star property Bath & Body Works has been growing, its larger lingerie chain has seen same-store sales contract for five straight quarters, with operating income at the unit tumbling 45 percent last year.

L Brands Chief Financial Officer Stuart Burgdoerfer said during the event that Bath & Body Works is approaching $5 billion in global sales, but that Victoria’s Secret’s profit levels are not acceptable. To turn things around, L Brands has been closing lingerie stores more aggressively and trying new approaches on merchandising and marketing.

Wexner said it’s starting to pay off. “We’ve laid this foundation for future growth,” he said. “The business is feeling very good for me and it feels like we have our feet under ourselves.”

By Jordyn Holman; editors: Anne Riley Moffat, Lisa Wolfson and Jonathan Roeder.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.