The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

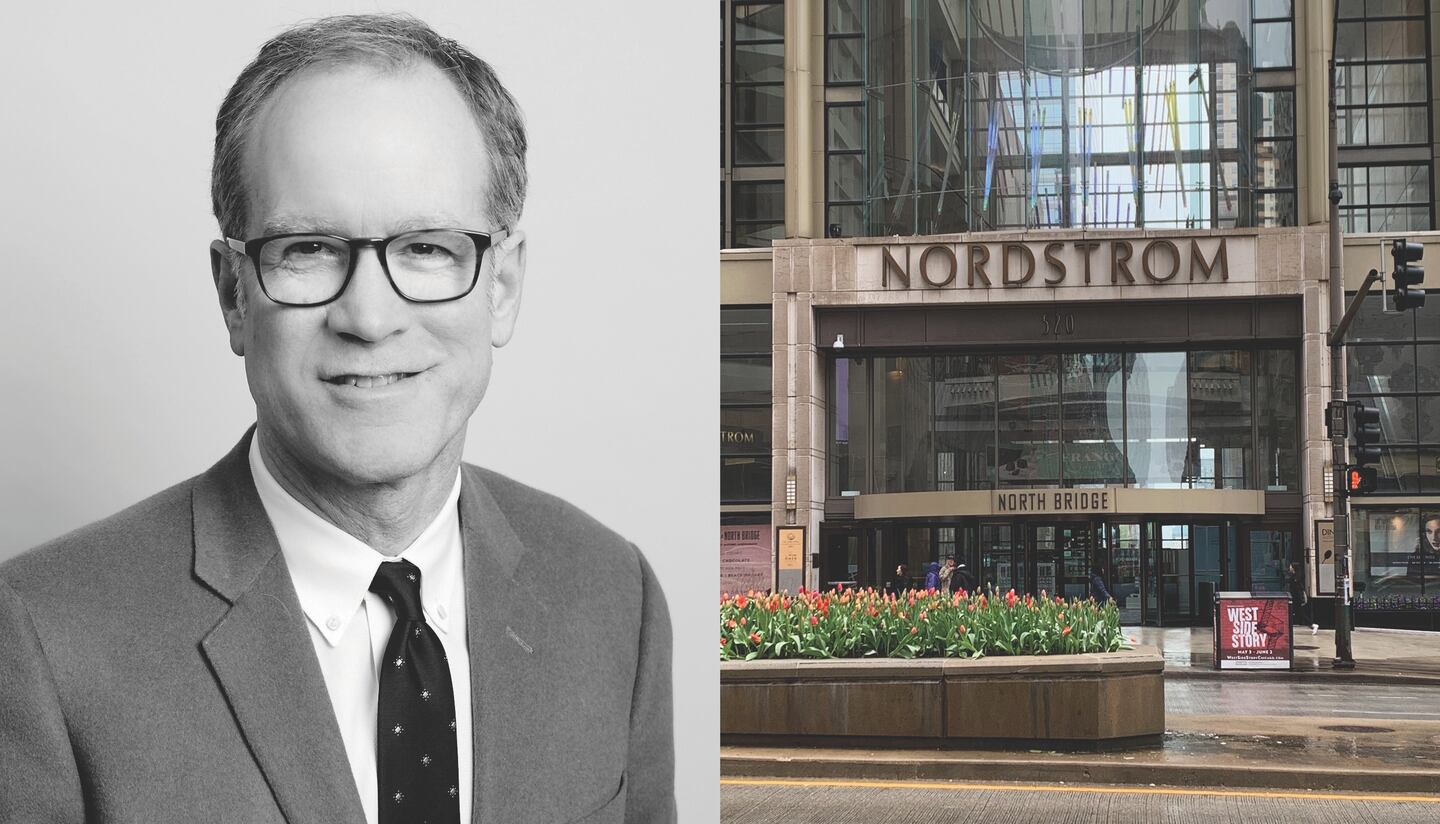

NEW YORK, United States — Nordstrom Co-President Pete Nordstrom started working at his family's downtown Seattle store as a stock boy when he was just 12 years old. By the time he turned 16, he was selling shoes out on the shop floor. Over the years, Nordstrom has become known as the concept guy, campaigning in the early 2000s to bring more avant-garde and cool young designers into the retailer's high-low fold, enlisting industry insiders like Jeffrey Kalinsky and Olivia Kim to modernise the operation.

Now, Nordstrom is embarking on his most challenging concept yet: opening a colossal full-price women’s store on the island of Manhattan, the most competitive retail market in the US. Central to his New York strategy is the roll-out of smaller formats across the city in upmarket residential neighbourhoods like the West Village and the Upper East Side that will be virtually anchored by the new Midtown location. Not to be confused with Rack, the company’s off-price chain, these smaller Nordstrom Local outlets don’t hold inventory. Instead they are service hubs for online pickups and returns, alterations and personal styling.

With proof of concept from the three Local outlets he opened in Melrose, Brentwood and Downtown Los Angeles between 2017 and 2018, Nordstrom feels ready for New York. At a time when multi-brand retail is in major flux, the department store veteran seems confident in the new format as more Local stores are in the pipeline for both cities. Harnessing the convenience of local neighbourhoods to boost the omnichannel experience sounds sensible enough, but has Nordstrom really discovered the missing link in the fashion store network of the future?

BoF: What was the thinking behind your strategy for the smaller Nordstrom Local format?

ADVERTISEMENT

Pete Nordstrom: To do it in one place [or] a couple places and if we get proof of concept, then we can learn fast [and] roll it out.

BoF: What did you learn after opening your first couple of Local outlets in LA?

PN: What we found was that if we could bring our services to people and connect the digital and the physical store world, that would increase engagement — and that would increase wallet share with customers. That, in fact, was exactly what happened in our LA store.

BoF: So you saw an uplift when you began opening the Nordstrom Locals?

PN: Yes, what we saw first was when people engaged with it, we got quite a bit more spend, more wallet share from them. Then it was like, how can we get more people through? Ultimately, the way we're going to define success with this whole strategy is: can we gain market share? That's the outcome we're looking for and it's been just really in the last handful of months where we've moved the needle on that. We've got a fairly high degree of confidence that it will work in New York as well.

BoF: In terms of Local stores and how they drive revenue online, can you tell us how that interplay actually works?

PN: Our experience is if we add a physical store to a market that we're not in, the online business grows by 20, 25 percent… Physical stores make for a better online experience rather than having to ship stuff back through the mail, [and it] creates trips to a physical store, so you get a chance to sell [customers] something else if they're returning it or changing it.

If we add a physical store to a market that we're not in, the online business grows by 20, 25 percent.

BoF: Are services at Nordstrom Local stores tailored to each location?

ADVERTISEMENT

PN: In New York, for example, one of the things we do on the Upper East Side is we've got this stroller cleaning thing. I have a little kid, so I get it. It turns out that's really popular and makes sense, particularly in New York where people are walking around all the time. I don't know if that would make as much sense [in our Melrose Avenue Local store] in LA, but it certainly has worked really well in New York. [Another example is] on Melrose, we have nail services. That's not unique to LA, but that's one that worked pretty well there.

BoF: Are there things that you have done in LA that have been particularly successful that you’re bringing to New York?

PN: People like… the ability to return or exchange an online purchase, that's a big one. One of the benefits [of] Local [is that] we take the friction out of the returns and the benefit to us is we get returns back faster. If you think about the transit time of mailing around returns, particularly of unworn goods, that's inventory for us and, if it's out in the mail system somewhere or on the road, it's inventory we can't sell. If it's going to come back, we want to get it back soon. If we make it convenient for people to return stuff, we get it back sooner and it enables us to be able to sell it.

BoF: Anything else?

PN: The alterations [service] is a big one [because] people are buying a lot of stuff online and a fair amount of people require some kind of alteration. I think we're the largest employer of alterations tailoring people in the country, because we have them in every store. We also have them in the Locals. We provide that service for not only Nordstrom purchases but if they have stuff they bought from other places. We charge for that service and we're good at it.

BoF: Is it true that you allow customers to drop off returns of merchandise from other retailers too?

PN: Yes, I think you'd have to look at it in the way that a UPS store [operates]. It's not that we're taking back [other retailers'] returns, it's just you've got to get this thing mailed [so] we'll do it [for you]. We've got all those carriers coming through that store every day and we'll act as an intermediary to facilitate your return.

We're learning [and] we're nimble enough to try stuff and if it doesn't work, we try something else.

We have a clothing take-back [service too]. If customers are cleaning out their closets and want us to donate the clothes, we do that. We’re learning [and] we’re nimble enough to try stuff and if it doesn’t work, we try something else and empower our teams to come up with good ideas. It’s been a pretty fun process [and] we feel like we have a good understanding of what we need to do with these Local outlets in New York.

ADVERTISEMENT

BoF: How does your inventory management system work within the same city? For example, what happens when a customer bought something at one of your full department store locations like Nordstrom The Grove or Nordstrom Rack in LA but then returns it to a smaller Nordstrom Local store in LA? Can you just move it across the city, or does it need to be processed through a central distribution centre?

PN: It kind of depends. A lot of the stuff that we take, if we take it back in a Local, we don't keep the inventory there because we don't really have the inventory, but we would keep it probably in the [local market] ecosystem. The idea of all this is utilising our local, physical assets to be more than just a store, but actually, to be a facilitator of moving inventory around in an efficient way.

BoF: I know you’ve recently opened your full-price women’s store in Manhattan. How do you envision this store interacting with and feeding off the Local stores in New York?

PN: It's almost the perfect environment for those highly-concentrated areas where literally you can move stuff around with a van, and you can have stuff for customers in a matter of hours rather than days. It's just, again, the perfect marriage of physical assets and the digital online business, which [although] it's not unique to us, it's a competitive advantage that we would have over a pure online [player] that doesn't have physical assets that they can utilise in this way. [It will also] make for a better customer experience.

BoF: "The third place" concept for retail has been around for decades. How do you feel about this in terms of both your small-format stores and your large-format stores? Do you want people spending extended periods of time there?

PN: Yes, we're keenly aware of that concept. Our deal's a little bit different. I don't think we necessarily expect that people are just going to be hanging out at the store. However, there are reasons to be there and they're not just about buying a pair of shoes. For example, what we have in the women's store is seven different places where you can eat or drink. Some are bigger or smaller than others [but] food… is a great reason to be able to stick around and not have to leave.

There are reasons to be [at the store] and they're not just about buying a pair of shoes.

BoF: How much of your thinking is about the practical solutions that retail can provide versus the fun or cool factor of the retail experience?

PN: We've got a big culture around customer service and every good comment we get is [about] a customer who came to us with some kind of problem or situation [that] we solved for them. It's not like, "I came in on the best day of my life and I was so happy, and I was going to buy a lipstick and I bought it. Thanks for selling me a lipstick." It's like, "Oh my God, I only had five minutes," or, "I forgot to pack my shoes and I'm in New York and I had to get some shoes at 10:00 at night and you guys picked up the phone, [so] I was able to get them."

BoF: Can you give an example?

PN: When a customer walks into a store and they've got an old Nordstrom bag or a brown box or something, your first reaction as a sales person is "I'm going to have to facilitate a return, but I'd rather be selling something." We turn that around, we say, "embrace the brown box, embrace the bag" because the customer is coming in and they need help and we're there to provide it.

It creates a great opportunity to create a relationship, to create an experience for a customer that may or may not pay off in that moment but plants the seed that if I’m going to go to a store like this, Nordstrom is the best place to go because they’ve taken the friction out of it.

BoF: "Embrace the brown box" — that’s a good motto. How does your localisation strategy play out in terms of the wider company goals?

PN: All this stuff is somewhat new. There's not a blueprint for this because our business has evolved and changed so much, and the industry has [too, but] it's got to score on a lot of different levels. The greater New York City market is the biggest retail market in the country.

We have Long Island or New Jersey and the surrounding areas, [but] if we’re going to be a success in Manhattan, it’s got to be more [than] just the nice new store in the neighbourhood. It’s got to connect the digital and physical world. It’s got to serve more broadly [and] because we have these Locals — these other places to interact with Nordstrom — it allows us to cover the whole island.

How does doing neighbourhood retail well in New York, for example, impact the picture nationwide?

PN: If the only thing we do by opening a physical store there and connecting all the dots… is make the New York market our number one market, that's big. That's a lot. We can see what the size of the prize is; we know what we're trying to achieve. Currently, our number-one market is Los Angeles, just in terms of total revenue. But if we can fulfill the promise of what New York has to offer in terms of market size, then that will be a big lift to the top line of our business.

This interview has been edited and condensed.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.