The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

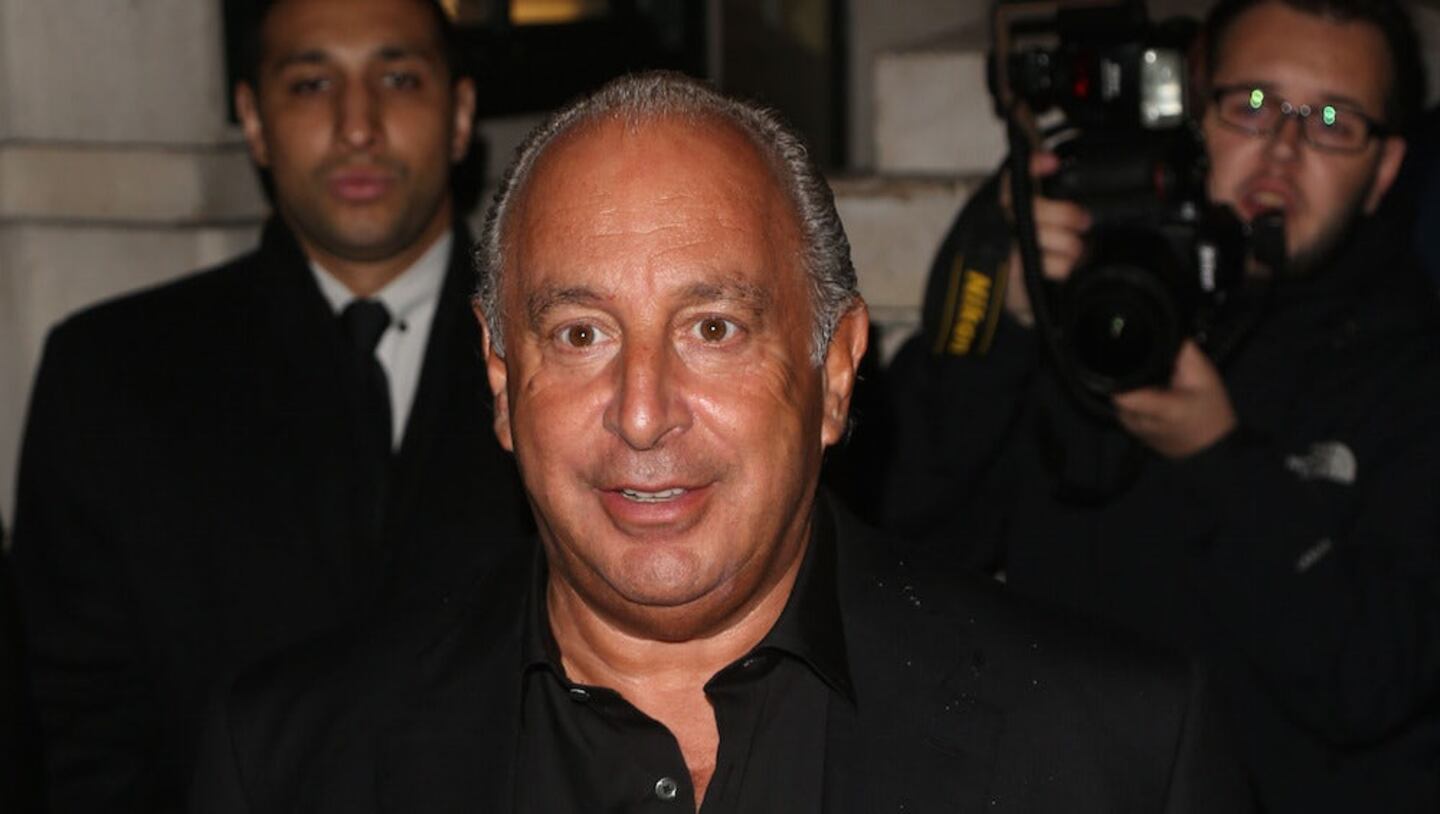

LONDON, United Kingdom — British retailer Philip Green's Topshop-to-Dorothy Perkins fashion empire reported an after-tax loss of £169 million for the year to September 1 2018, which it blamed on a trading environment that had changed dramatically.

Arcadia Group, which is ultimately owned by Green's family, staved off collapse in June when its creditors narrowly approved a plan to close stores, cut rents and change pension scheme funding.

Accounts filed by holding company Taveta Investments Ltd showed turnover fell 4.5 percent to £1.81 billion, while operating profit fell to £78.1 million from £124.1 million a year earlier.

It recorded exceptional items of £217 million, contributing to the £169 million loss, which compared to a profit of £49 million a year earlier.

ADVERTISEMENT

"The retail landscape has changed dramatically over recent years and the increased competition from other high street and online retailers in particular has had a significant impact of our performance," the company said.

However the group said that after coming through a challenging year, it was very clear on its strategic direction.

Auditor PWC noted in the accounts there were a number of matters, including for example external market conditions that could potentially be impacted by Britain leaving the EU, that might cast "significant doubt" about the group's ability to continue as a going concern.

By Paul Sandle; editor: James Davey.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.