The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

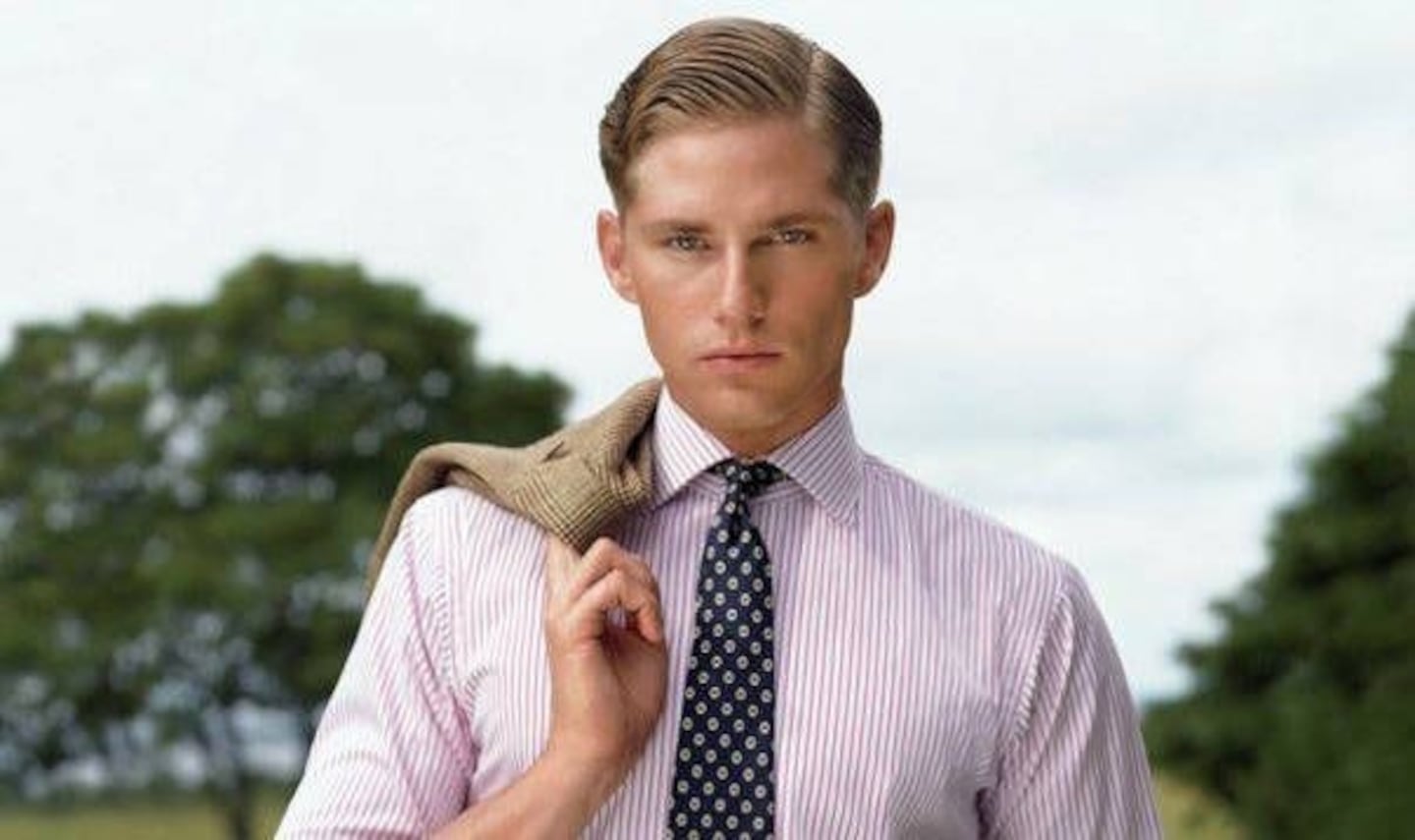

NEW YORK, United States — When Team USA trotted into Maracanã Stadium for the opening ceremony of the 2016 Rio Olympics, they were decked out in a red, white, and blue ensemble from Ralph Lauren Corp. The look was classic American prep: navy blazers, striped shirts, and white denim. Giant Polo labels were emblazoned on their chests for the world to see.

Ralph Lauren built a multibillion-dollar brand by becoming a profoundly American label—the embodiment of various pieces of national identity tinged with a capitalistic bent: country clubs, the Ivy League, and even nostalgia for the Old West. But while the power of prep lives on, the brand has lately ceded ground to newer competitors that have added twists to the old look. Ralph Lauren, thus far, has not been able to cope.

Now it is trying to pull itself out of a rough patch. Sales in North America fell 11 percent last quarter, the company reported Wednesday. In a presentation to analysts in June, chief executive officer Stefan Larsson, hired late last year from Swedish fast-fashion seller H&M Hennes & Mauritz AB, outlined his turnaround plan. He vowed to take Ralph Lauren back to its roots and refocus on core items. Lauren, who retains the role of designer, conceded management has made mistakes in recent times—the company has shed almost half its market value over the past three years. The 76-year-old fashion icon made it quite clear that he was not happy about that. At all.

“Ralph Lauren has become muddled and confused and is simply not competing effectively against brands like Vineyard Vines, which have good traction with younger, high spending consumers,” Håkon Helgesen, an analyst at Conlumino, wrote in a note to clients. “Some action has already been taken to simplify the brand structure, but much more clarity is needed in communicating the various parts of the offer to consumers. At present, the various parts of Ralph Lauren are too hit and miss.”

ADVERTISEMENT

Preppiness, that uniform of class and wealth—not to mention wannabe class and wealth—was long ruled by a few old-fashioned brands. Brooks Brothers and Ralph Lauren helped define the look, while Lacoste came in from France and added European sensibilities. Though preppy clothes may be a lasting look some people want, they eventually realised you do not have to wear the same old brands. Staleness set in.

Upstarts began to gain adherents as shoppers looked for alternatives. Take Vineyard Vines, a label founded in 1998 that may now be valued at more than $1 billion, according to one news report. Its pink whale logo is ubiquitous among today's version of preppy types on college campuses and in country clubs. Smathers & Branson, meanwhile, succeeded in winning a preppy niche—needlepoint belts—when it popped up in 2004. Southern Tide expanded fast once it appeared on the scene in 2006, selling for $85 million earlier this year.

Ralph Lauren seems to know it needs to regain its relevance, if it can. On a call with analysts, Larsson said that, by next spring, shoppers will see the results of his effort to rework the brand’s proven, successful styles.

“We will make sure that we have an updated classic iconic style that has an effortless twist,” he said. “It will cut through and it will be one message and it will be a core that is updated and relevant for today.”

For Ralph Lauren’s sake, his promise best be fulfilled. It’s a long time until the next Summer Olympics.

By Kim Bhasin; editor: David Rovella.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.