The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

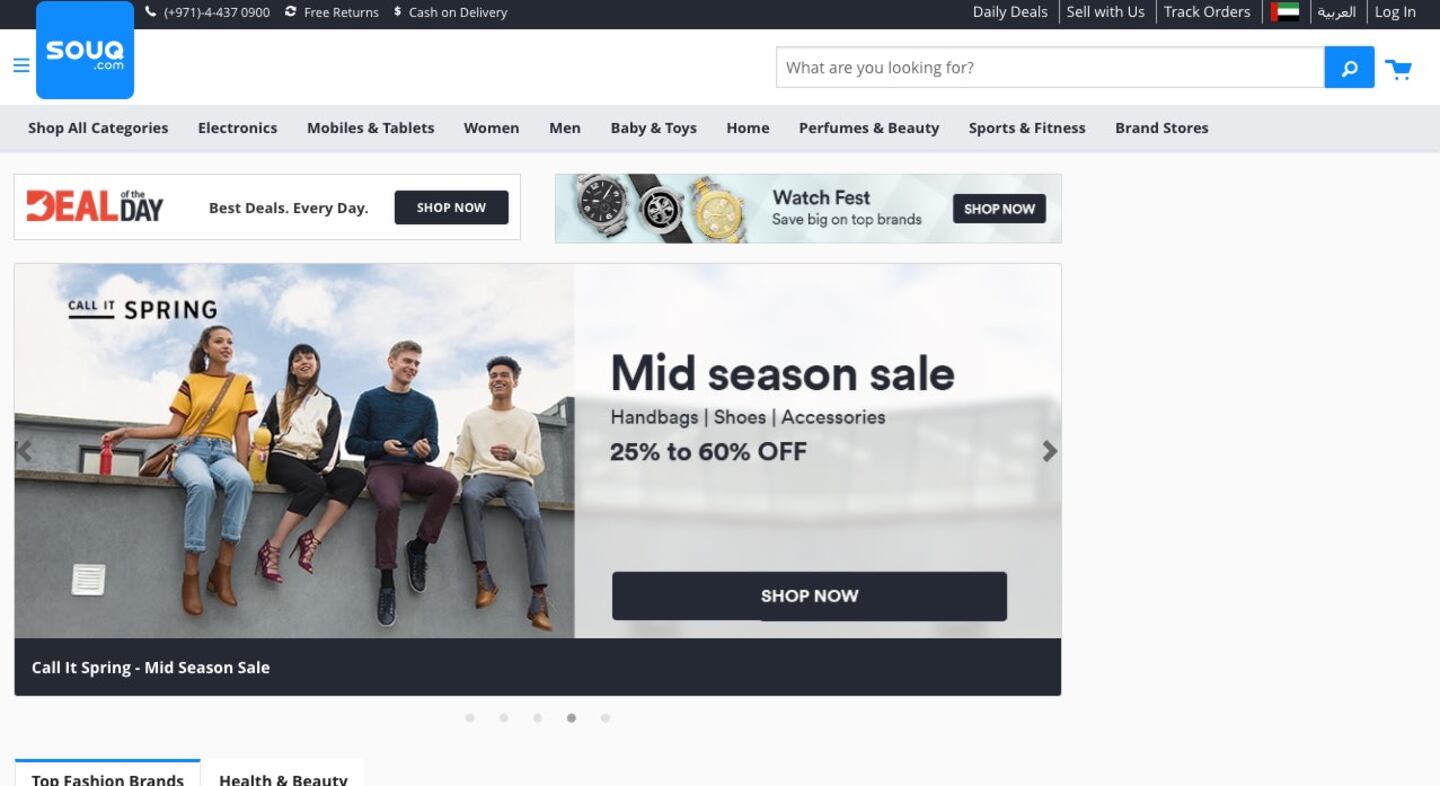

DUBAI, United Arab Emirates — Amazon.com Inc. is in talks to acquire Dubai-based online retailer Souq.com FZ for about $1 billion in a deal that will give the e-commerce giant a footprint in the high-growth Middle East market, according to people familiar with the matter.

Seattle-based Amazon is considering a bid for all of the site, which had initially planned to sell a stake of at least 30 percent, the people said, asking not to be identified as the information is private. No final agreements have been reached and negotiations could still falter, the people said.

A spokesman for Souq.com declined to comment. A representative for Amazon didn’t respond to calls and an e-mail seeking comment.

Souq.com appointed Goldman Sachs Group Inc. to find buyers for a share of the company, people familiar with the matter said in September. The company’s existing investors — Tiger Global Management and South Africa’s Naspers Ltd. — were also weighing selling their holdings, the people had said.

ADVERTISEMENT

Souq.com sells more than 1.5 million products online to customers in the United Arab Emirates, Egypt and Saudi Arabia, according to its website. The company secured $275 million from investors after Tiger Global and Naspers, among others, boosted their investments in February. Chief Executive Officer Ronaldo Mouchawar said in an interview at the time that the company would be open to selling shares to the public in the future.

By Dinesh Nair and Matthew Martin, with assistance from Spencer Soper; editors: Aaron Kirchfeld, Amy Thomson and Vernon Wessels.

Related Articles:

[ Decoding Amazon's Fashion AmbitionsOpens in new window ]

[ Is E-Commerce Really Better For the Environment Than Traditional Retail?Opens in new window ]

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.