The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Editor’s note: This article was amended on 29 July, 2022. A previous version of this article stated Galaxy had raised $7 million in new funding, including Snap Inc.’s participation in this round. This is incorrect. Snapchat invested in the start-up three years ago but was not involved in the most recent round of $4.5 million.

Could resale be recession-proof?

Investors venture firms Floodgate and RGH Capital seem to think so. Earlier this year, contributed to a $4.5 million funding round for Galaxy, an app that allows influencers and store owners to sell secondhand clothing and accessories, the startup announced Thursday. Its total funding since its launch in 2021 amounts to $7 million, and counts Snapchat-owner Snap Inc. as an existing backer.

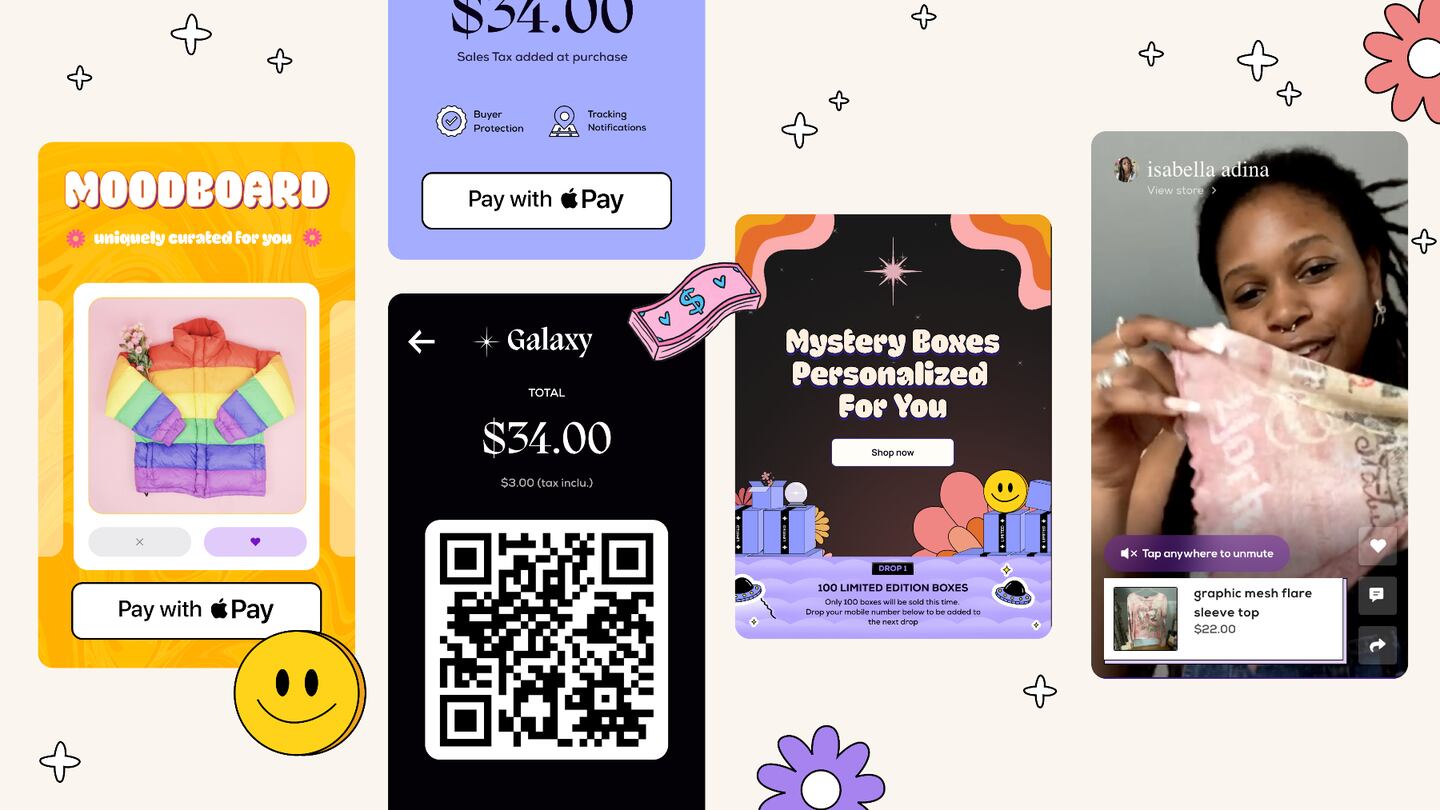

Like Depop, Galaxy allows individuals to create stores on the platform. But rather than photos, each listing features a video of the seller showcasing the product. Already, the platform has brought on TikTok influencers like Maddie White who want to monetise their audience.

ADVERTISEMENT

The video-centric model borrows from China’s playbook for successful livestream commerce, where streams are typically hosted by influencers, drawing sales from their engaged online communities and fans. The Lobby, a multi-brand online retailer, also leverages video content from influencers as the main media on its website.

The concept blends shopping and entertaining, “making the experience of the resale more enjoyable,” said founders Danny Quick, Nathan McCartney and Brandon Brisbon.

Sellers can go live on the app and users tuning can purchase pieces in real-time, or they can upload pre-recorded videos showing off their clothing on offer.

Galaxy will use its recent funding to scale the business, developing its machine learning capabilities to improve personalised product recommendations. It also wants to recruit more sellers, including brands.

The service will compete with Depop on lower commission fees per sale, McCartney said. It doesn’t yet charge its 500-plus sellers to use the platform but plans to drive revenue by charging a flat fee of $15 to $20 per month.

Galaxy has also found success in growing its network of sellers and customers through hosting in-real-life retail events too, Quick added. It hosted “closet cleanout” pop-ups in New York and Los Angeles, where high-profile sellers call out their followers to come to shop their wardrobes, with the added draw of being able to meet their favourite influencers in person.

These events are designed to draw new customers into Galaxy’s resale platform — attendees are encouraged to bring their own clothes and sell them in person, either for cash or credit on the app.

Opens in new window

Opens in new windowLive selling via streaming video is a smashing success in China but has yet to catch on with consumers in Europe and the US due to several pain points.

Hundreds of fashion companies are looking to build their own resale channels, giving rise to a new class of B2B start-ups that aim to help them navigate the nascent industry.

The operator of South Korea’s online resale marketplace for limited-edition sneakers and streetwear said existing shareholders Musinsa, South Korea’s largest multi-brand online fashion retailer, and Dunamu participated in the investment round of 40 billion won.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.