The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

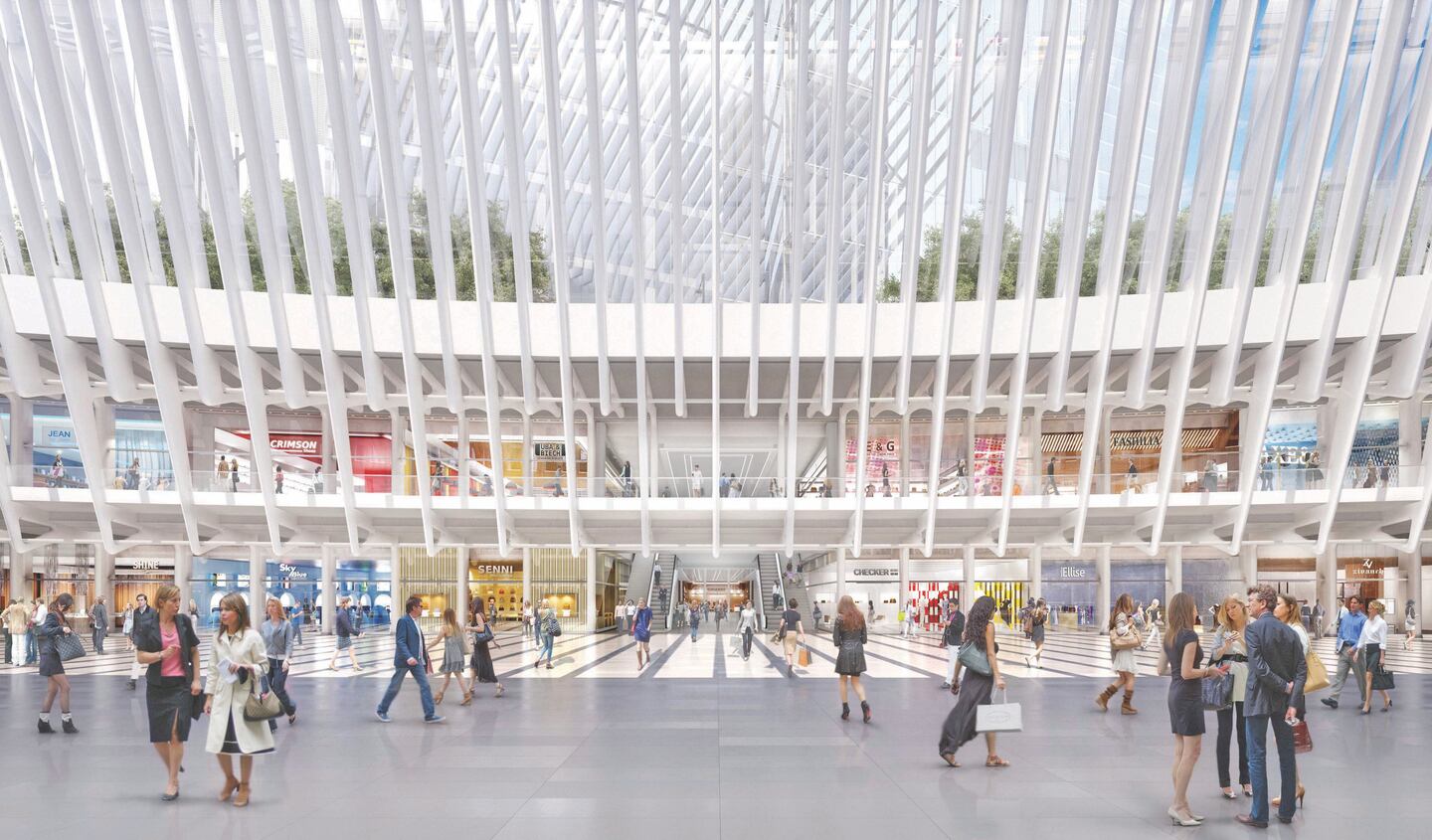

LONDON, United Kingdom — Europe's largest property firm Unibail-Rodamco Westfield raised its full-year earnings guidance on Wednesday after reporting strong first-half growth in tenant sales at its flagship European and American retail centres.

The company, which counts leading European malls like Paris' Forum des Halles and Madrid's La Vaguada among its assets and last year bought Britain's Westfield, now sees 2019 adjusted recurring earnings per share at 12.10-12.30 euros (11.08-11.27 pounds).

That is some 0.30 euros, or 2.5%, above previous guidance.

The brick-and-mortar retail environment has long been considered challenging, facing increased competition from the likes of Amazon as customers move online to do their shopping.

ADVERTISEMENT

Unibail's first-halt net rental income rose 35.9% to 1.25 billion euros, chiefly due to its acquisition of U.S. and UK mall operator Westfield. Recurring net profit rose 30.4% to 916 million euros.

Tenant sales rose across all regions, helped by 5.7% growth in continental Europe's flagship centres, the United Kingdom outperforming its wider market, and the United States posting 4.9% growth at its flagship centres.

However, first-half adjusted recurring earnings per share fell 1.9% to 6.45 euros due to disposals completed in 2018 and the first half of this year.

The company said it had divested 3.2 billion euros in assets above book value over the last 12 months.

Rebased for the assets sold, first-half adjusted recurring earnings per share would have grown 3.7%, despite a share issue following the Westfield acquisition, it said.

Shares in Unibail, whose earnings statement came after trading had closed, were hurt on Wednesday by a downbeat earnings report from British peer Intu Properties .

Intu shares sank more than 21% after reporting a fall in first-half net rental income.

Unibail shares closed 3.4% lower on Wednesday.

By Piotr Lipinski; Editors: Kirsten Donovan and Jan Harvey

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.