The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowFast fashion and sustainable fashion are two concepts that are difficult to square.

Low prices and fast-changing styles can quickly translate into insecure working conditions, low pay and labour abuses within the supply chain. Meanwhile, the fashion cycle churn feeds a culture of over-consumption that drains resources and literally creates mountains of waste. But at a time when even luxury moves fast, are low-cost brands really fashion’s worst offenders?

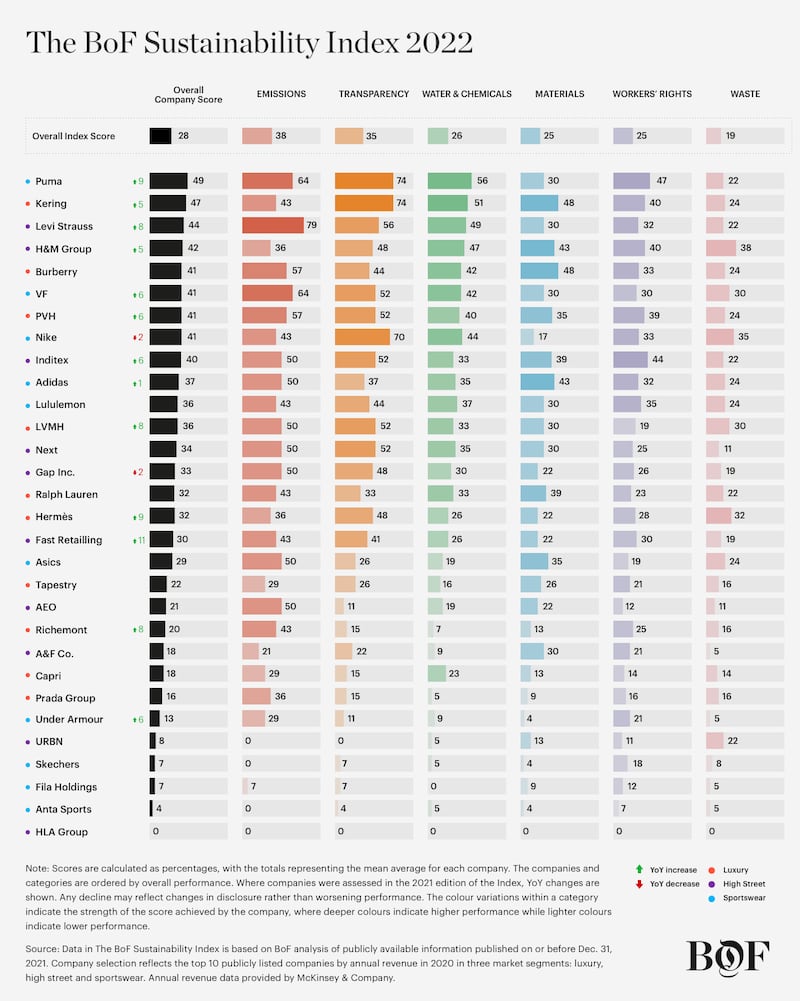

Every year, BoF Insights benchmarks the sustainability efforts of fashion’s biggest companies within the luxury, high street (or mass market) and sportswear segments to understand the answers to just these kinds of questions. The BoF Sustainability Index assesses fashion companies’ progress towards ambitious environmental and social targets across six impact categories, designed to align with the UN’s Sustainable Development Goals and efforts to curb global warming by 2030.

The 2022 edition of the Index analyses sustainability performance at 30 of fashion’s largest public companies, addressing the 10 biggest by 2020 revenue in each of the three segments. Performance is assessed using a framework of more than 200 different questions, with companies gaining a point if their public disclosures indicate they meet the required criteria. The results enable like-for-like comparisons and in-depth market segment analysis on fashion’s sustainability performance.

ADVERTISEMENT

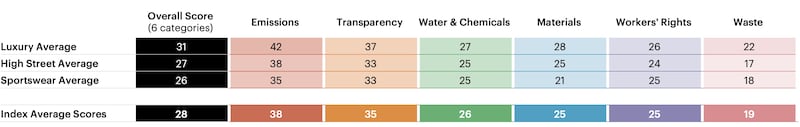

As a group, the high street segment slightly underperforms the overall Index average, but it also contains the greatest concentration of companies scoring in the assessment’s upper band.

The overall average score for the segment comes in at 27 points out of 100, compared to 28 points for the complete Index of 30 companies. Within the individual impact categories, the segment performs on par with the overall Index average in Emissions and Materials, but slightly underperforms in the four other impact categories assessed.

Nonetheless, more than half of the companies assessed in the high street vertical (six) score 30 points or above, compared to four in the luxury segment and five in the sportswear segment. However, the segment also contains the only company (Chinese retailer HLA Group) in the Index to score no points at all, making it one of two in this group of companies to score less than 10 points overall.

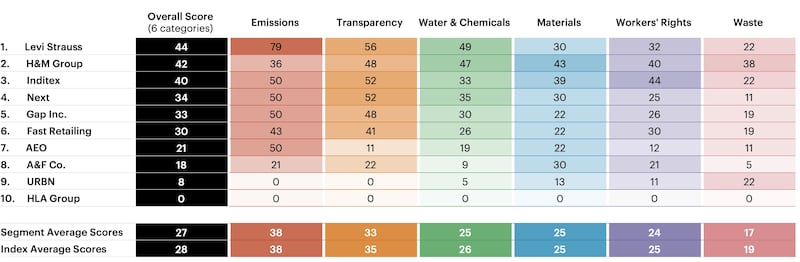

Levi Strauss & Co. tops the high street segment’s rankings with an overall score of 44 points out of 100, closely followed by H&M Group with an overall score of 42. Both companies place in the top five when ranked against all 30 companies assessed in this year’s Index.

LS&Co.’s leading position was driven by particularly strong scores in Emissions and Transparency, while H&M Group led the segment in Materials and Waste.

Inditex, Next, Gap Inc. and Fast Retailing all score an average of 30 points or above.

HLA Group is the only company in the Index to score zero in every category. A lack of disclosure of its sustainability policies and practices resulted in the retailer coming in at the bottom of the high street segment and in the complete Index of 30 companies.

Urban Outfitters Inc. also is at the bottom of the high street rankings and in the bottom five for the overall assessment. The company’s average score of 8 points reflects scores of zero in both Emissions and Transparency and below 20 in every other category except Waste.

ADVERTISEMENT

No company is doing enough to tackle fashion’s sustainability challenges. But as a group, lower-cost retailers do not meaningfully underperform rivals in other market segments. Instead, the segment’s performance largely aligns with the overall findings of the Index: with just eight years left to reach targets, inaction at many of the industry’s biggest players is eclipsing incremental progress among frontrunners, leaving the industry with the need to urgently improve in every area of analysis.

The BoF Sustainability Index examines the 10 biggest public companies by revenue in 2020 in three fashion industry segments: luxury, high street and sportswear. It assesses performance across six impact categories: Emissions, Transparency, Water & Chemicals, Waste, Materials and Workers’ rights.

Within those categories, the companies are benchmarked against 16 ambitious environmental and social targets established by The Business of Fashion in consultation with a group of respected global experts. Each target contains a series of binary metrics (201 in total), which BoF researchers scored “yes” or “no” based on information that was publicly available on or prior to Dec. 31, 2021.

More information on the methodology is available in our FAQs, or purchase the report from BoF Insights to review it in full.

This article forms part of a series that also addresses the performance of the luxury segment, with the sportswear segment available on June 13.

For more BoF sustainability coverage, sign up now for our new Weekly Sustainability Briefing by Sarah Kent.

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until Dec. 31, 2021. It should be viewed as a proxy for sustainability performance and not an absolute measure. BoF accepts advertising arrangements from a range of partners, some of which may appear in The Sustainability Index. Such advertising arrangements and the Index are handled by separate parts of the business. LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

Efforts to transform the fashion industry in line with global ambitions to curb climate change and establish more responsible business practices by 2030 have yet to gain sufficient momentum, The BoF Sustainability Index 2022 finds.

Kering and Burberry top the luxury ranking in this year’s BoF Sustainability Index, while Prada, Capri, Richemont and Tapestry lag.

Sarah Kent is Chief Sustainability Correspondent at The Business of Fashion. She is based in London and drives BoF's coverage of critical environmental and labour issues.

The fashion industry continues to advance voluntary and unlikely solutions to its plastic problem. Only higher prices will flip the script, writes Kenneth P. Pucker.

The outerwear company is set to start selling wetsuits made in part by harvesting materials from old ones.

Companies like Hermès, Kering and LVMH say they have spent millions to ensure they are sourcing crocodile and snakeskin leathers responsibly. But critics say incidents like the recent smuggling conviction of designer Nancy Gonzalez show loopholes persist despite tightening controls.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.