The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article appeared first in The Sustainability Gap, an in-depth analysis of BoF’s new report, The BoF Sustainability Index, which tracks fashion’s progress towards urgent environmental and social transformation. To learn more and download a copy of the report, click here.

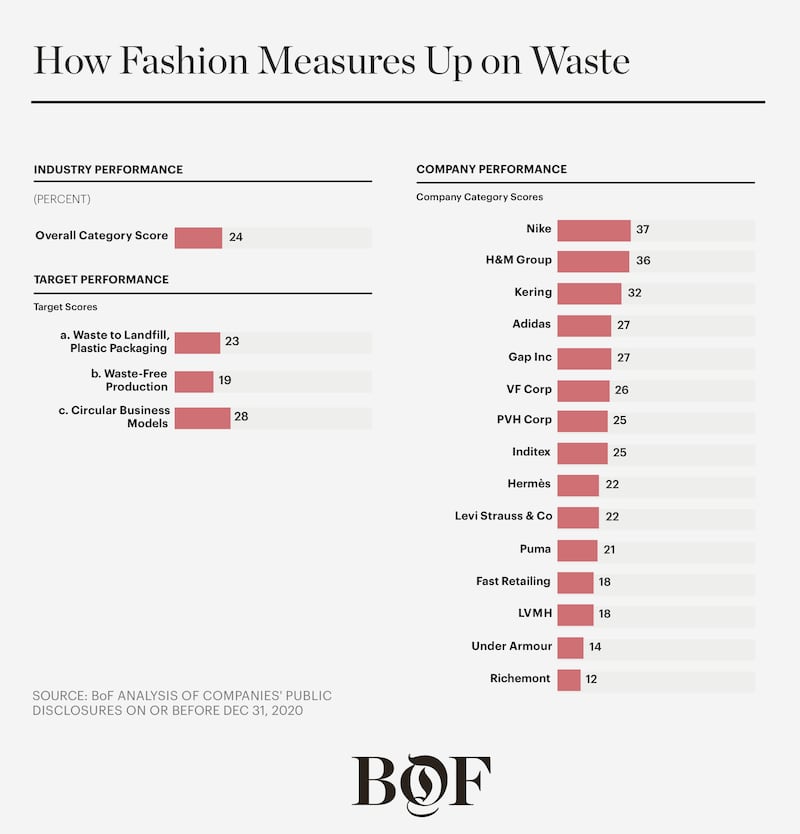

The BoF Sustainability Index Waste Targets:

a. Waste to Landfill, Plastic Packaging — By 2022: Eliminate waste to landfill and virgin and single-use plastic packaging.

b. Waste-Free Production — By 2022: Establish waste-free production.

ADVERTISEMENT

c. Circular Business Models — By 2025: Establish a circular business model.

Every year, roughly 40 million tonnes of textile waste is sent to landfill or incinerated, according to the Ellen MacArthur Foundation. The rise of affordable fast fashion means consumers now buy more clothes, but use them for less time than ever before. But this isn’t just a fast fashion problem. Even before Covid-19, over-production was so prolific that just 60 percent of garments were sold at full price. The excess inventory that piled up during pandemic-induced lockdowns is a recent and visible reminder of the sector’s excess.

Publicly, this is an area that has received significant attention. Circularity has become a popular buzzword, with brands pointing to a utopian future where old products can be recycled into new ones in a virtuous waste-free loop that detaches the industry from an extractive, linear business model and enables guilt-free growth. But it is not easy to walk the talk when it comes to circularity.

Waste is the worst-performing category in the Index.

Companies are talking more about circularity than they are embracing it.

There is an urgent need, and significant opportunity, for transformation.

The Sustainability Council’s Take

“There is a general belief out there that the textile, apparel and fashion industries are not doing enough for the health of our environment. We are seen to be part of the problem. Yet we know there are lots of innovations, ideas and solutions ready to deploy, at scale, to make our industry greener, cleaner and more sustainable. To get the ball rolling, we need to change the ways we grow, process and colour the materials we use, and overhaul the way we manufacture, transport and warehouse the products we sell. We need to minimise waste and stop thinking of old products as disposable. And we need more effective ways to talk about this with our customers.

ADVERTISEMENT

“Courage, wisdom and a sense of urgency are needed in this hour.

“Environmental sustainability is bigger than any one brand, supplier or retailer. We all have to work together. This is not only our shared challenge, it is also the unifying purpose for our industry.” — Edwin Keh, CEO, The Hong Kong Research Institute of Textiles and Apparel

The BoF Sustainability Index is built on over 5,000 data points gathered across the 15 companies included in this year’s edition. To request access to the full underlying data, click here.

The BoF Professional Summit: Closing Fashion's Sustainability Gap

On April 14 2021, BoF will convene leading sustainability experts and global thought leaders for a 3-hour live broadcast of interactive conversations and panel discussions, in which we'll unpack findings from The BoF Sustainability Index and outline the steps that need to be taken over the coming decade to align the industry with global climate goals and social imperatives. Space is limited.

As a BoF Professional member, register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership, including the Summit.

Explore all categories from this year's report:

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until December 31, 2020. There are limitations to this approach and while the assessment was conducted in good faith, the results should be viewed as a proxy for sustainability performance and not an absolute measure. Where BoF was unable to identify public evidence to support a company’s performance relating to the assessment criteria, it does not necessarily mean the company is taking no action at all or that bad practices are present. Read the full methodology on pages 38-41 in the report here or see the FAQs.

Disclaimer: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

The fashion industry continues to advance voluntary and unlikely solutions to its plastic problem. Only higher prices will flip the script, writes Kenneth P. Pucker.

The outerwear company is set to start selling wetsuits made in part by harvesting materials from old ones.

Companies like Hermès, Kering and LVMH say they have spent millions to ensure they are sourcing crocodile and snakeskin leathers responsibly. But critics say incidents like the recent smuggling conviction of designer Nancy Gonzalez show loopholes persist despite tightening controls.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.