The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Better Cotton-certified producers linked to H&M and Zara’s supply chains are contributing to large-scale deforestation, land grabbing and violent harassment of local communities in a sensitive eco-region of Brazil, according to an investigation published Thursday by environmental NGO Earthsight.

The organisation tracked hundreds-of-millions of dollars of products sold by H&M and Zara to manufacturers who source cotton directly from two agribusinesses linked to malpractice in the country’s vast tropical Cerrado savanna.

The findings have raised fresh questions about the credibility of Better Cotton, a certification scheme widely used by major brands to assure their cotton is grown responsibly. Zara-owner Inditex slammed the Swiss-based organisation’s response to the investigation in a letter sent to its CEO earlier this week, complaining about a lack of transparency over how the initiative plans to address Earthsight’s allegations. Better Cotton did not comment on Inditex’s letter.

The bigger issue, according to Earthsight, is what its findings reveal about broader shortcomings in big brands’ ability to monitor and prevent environmental and human rights abuses in their supply chains.

ADVERTISEMENT

“There’s no evidence that either H&M or Zara have the slightest idea of what cotton goes into [their] items,” said Rubens Carvalho, head of deforestation research at Earthsight. “These are very high-risk commodities where production has been very heavily associated with indigenous rights violations and deforestation. They should be monitoring closely.”

Caterina Lopes Leite used to pick leaves from the spiky Tucum palms that once grew plentifully on the plateau above her village in Brazil’s northeastern state of Bahia.

Along with her grandmother and aunts, Lopes Leite would weave fibres from the palm fronds into ropes that could be sold as traditional handicrafts at regional markets, she told Earthsight. Now the palms are gone, replaced by a flat plain of sprawling industrial farmland.

Among the crops fuelling this transformation is one of fashion’s most important raw materials: cotton.

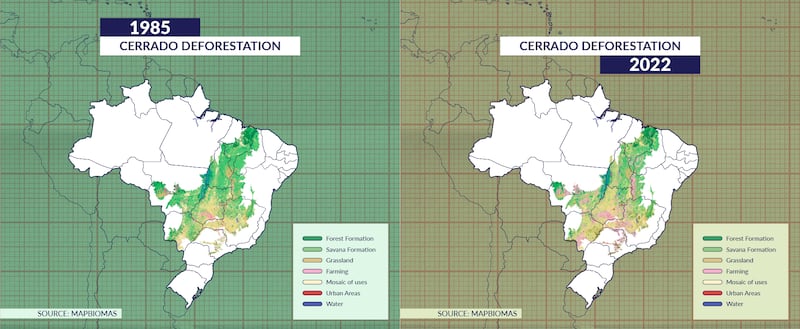

Lopes Leite’s village sits within the Cerrado. The vast tropical savannah spreads across multiple states in Brazil. It’s an important carbon sink, critical water reserve and home to some of the world’s greatest biodiversity. It’s also at the frontier of an agro-industrial boom that has stripped the area of roughly half its native vegetation over the last few decades and spurred contentious and sometimes violent disputes over land and resources with local communities.

In the neighbouring Amazon, landowners are required to maintain 80 percent of vegetation on their land, with only 20 percent permitted for commercial use. But in the roughly two million square kilometres of the Cerrado, these numbers are more or less reversed. A record 7,800 square kilometres of land was cleared in the region last year, up 43 percent from a year earlier, according to official data.

Cotton’s contribution to the problem is difficult to quantify; most of the deforestation has been driven by cattle ranches and soy farms, the key engines of Brazil’s agricultural expansion. Though the country is the world’s second-largest exporter of cotton after the US and the biggest supplier of Better Cotton, the commodity is generally grown in rotation with soy as a secondary crop.

Similar to leather (which is often characterised as a byproduct of the meat industry), this situation has meant that fashion’s links to forest clearing and other environmental and social harms in the region have largely slipped beneath the radar.

ADVERTISEMENT

“Cotton has been under-reported,” said Carvalho. “A lot of research and campaigning has been done on soy and beef. A lot less has been said about cotton.”

What is clear is that cotton production is playing some part in the agro-industrialisation that is eating away at the Cerrado, causing increasing alarm among environmentalists and fueling tensions with squeezed local communities.

The stakes are high. The Cerrado’s native vegetation is characterised by deep-rooted plants that capture water and act as a natural carbon sink, earning it the nickname the “upside-down forest.” Tearing up trees and bushes releases the planet-warming gas stored in the ground and threatens a water source that feeds eight of Brazil’s 12 most important river basins.

Prolific use of hazardous pesticides has been linked to severe health problems among local communities (many of whom dispute the rights of large agribusinesses to land they’ve traditionally claimed). The crop most intensively sprayed with these toxic chemicals is cotton.

Two of the country’s largest cotton producers are the agro-industrial giants SLC Agricola and Horita Group. Both companies have been linked to allegations of corrupt land dealings and environmental destruction, according to civil society groups, government agencies, and court and land documents reviewed by Earthsight.

Both companies denied the findings in correspondence with Earthsight. Horita Group did not respond to BoF’s requests for comment. SLC said its cotton production is carried out based on strict standards. The company adopted a zero deforestation policy in 2021.

Together, the commodity producers exported at least 816,000 tonnes of cotton from Bahia to international markets in the decade between 2014 and 2023, according to Earthsight. Those tainted crops are leaking into supply chains that feed shop floors in the US and Europe with hoodies and T-shirts, it found.

Tracing cotton from farm to shop floor is notoriously difficult. Much of the world’s production is sold through networks of traders who buy a mix of bales from different producers effectively obscuring the commodity’s origin.

ADVERTISEMENT

But SLC and Horita Group ship at least some of the cotton they produce directly to apparel manufacturers in Asia, whose key customers include H&M and Inditex, according to Earthsight’s investigation. Last year, the two fast fashion giants bought millions of jeans, hoodies, socks and T-shirts from suppliers with links to tainted Brazilian cotton, it found.

In a statement to Earthsight, Inditex said its suppliers don’t source directly from any Brazilian producers and that cotton from the country makes up at most a quarter of their total cotton purchases. H&M said it requires all its suppliers to “only source sustainable cotton from credible and robust standards and certifications.”

Both companies lean heavily on Better Cotton.

The certifier was founded in 2005 by an international group of environmental organisations, brands and trade representatives aiming to increase access to cotton produced with lower environmental impact and higher social standards.

Its standard was designed to scale swiftly and efficiently, mostly relying on a system known as “mass-balance” to sidestep the complexity of tracing cotton back through the supply chain. That means that when brands source Better Cotton, they are effectively buying a credit that guarantees a certain volume of certified production has entered the market, but that may not be the material they ultimately receive.

The system has worked to rapidly increase supply of certified cotton. Better Cotton now accounts for more than a fifth of global cotton production. Organic cotton remains around just one percent.

But critics have long complained that the organisation’s standards are not robust enough. In Brazil, the programme is administered by the Brazilian Association of Cotton Growers, or Abrapa, a link that has raised concerns about conflicts of interest. (Abrapa told Earthsight that all certification assessments are carried out by independent third-party auditors).

Brazil now accounts for roughly 40 percent of Better Cotton-certified production, with more than 80 percent of the country’s growth covered by the certification scheme. Almost all of it takes place in the Cerrado.

At least some of the cotton farms where Earthsight identified issues with land rights and environmental abuses in Bahia are Better-Cotton certified, though Abrapa, Better Cotton and the producers did not agree on how many.

In response to Earthsight’s investigation, Better Cotton launched a third-party audit of three implicated farms. Inditex, at least, has taken the view that the organisation has not moved swiftly enough to address alleged shortfalls that also reflect on the fast fashion giant’s ability to responsibly manage its supply chain. In its letter to Better Cotton’s CEO, the company said it has waited more than six months for results of the internal investigation that were expected in March.

The allegations “represent a serious breach in the trust placed in Better Cotton’s certification process by both our group and our product suppliers,” the letter said. “The trust that we place in such processes developed by independent organisations, such as yours, is key to our supply chain control strategy.”

The contents of the letter was first published by Modaes, a fashion trade publication based in Spain.

In a statement shared earlier in the week, Better Cotton said it has completed its investigation, but is still in the process of analysing the results. It will share further information once this review is complete, it said.

Toughening supply-chain regulations are upping the pressure on brands to get a better handle on exactly where their materials come from.

In the European Union, new rules banning imports of products linked to deforestation will come into force at the end of this year, with similar policies under consideration in both the UK and the US. But the regulations in their current form don’t cover the cotton supply chain or the savannah landscape of the Cerrado.

Brazil’s president, Luiz Inácio Lula da Silva, has moved to crack down on illegal deforestation in the country since taking office in 2022. But clearing large tracts of land in the Cerrado is permitted under Brazilian law. These legal loopholes are part of the problem, campaigners say.

“It is often said that the Cerrado can be sacrificed so that agribusiness can expand without threatening the Amazon,” André Sacramento, coordinator for the Brazilian non-profit the Association of Rural Workers’ Lawyers (AATR), told Earthsight.

Nonetheless, with Brazil set to host the UN’s annual COP climate summit next year, brands with supply chains that touch sensitive areas in the country are likely to continue to face scrutiny.

There are no simple solutions and tougher regulation is hardly a silver bullet either. Some developing countries have expressed outrage at laws they say will hurt their economies. Some companies have said they will simply pull out of areas considered at high risk of deforestation, creating little incentive for improvement. Smaller farms, that often operate the most responsibly, are struggling to compete with big players that can afford investments to comply with incoming traceability requirements.

It’s both a challenge and an opportunity.

“[Many] companies look at these issues as if it’s the only thing we have to offer,” said Mariana Gatti, a partner and project director at Farfarm, which works with brands and farmers to build regenerative supply chains. “There’s potential for Brazil to be a huge producer of regenerative fibres or even just organic fibres produced by family farmers with huge positive environmental and social impact.”

Brands are turning to AI-powered analytics tools to improve their ability to measure environmental impact in the face of new government regulation. But getting hold of accurate data to support these assessments remains a difficult and largely manual challenge.

A cluster of high-profile scandals over working conditions have revealed the extent to which fashion’s efforts to improve standards in its supply chain are failing. Here’s how things need to change.

This week, the Sustainable Apparel Coalition suspended the use of its product labels, employed by companies like H&M and Amazon, as concerns over greenwashing engulfed one of the industry’s top sustainability tools.

Sarah Kent is Chief Sustainability Correspondent at The Business of Fashion. She is based in London and drives BoF's coverage of critical environmental and labour issues.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.

Fashion’s biggest sustainable cotton certifier said it found no evidence of non-compliance at farms covered by its standard, but acknowledged weaknesses in its monitoring approach.

As they move to protect their intellectual property, big brands are coming into conflict with a growing class of up-and-coming designers working with refashioned designer gear.

The industry needs to ditch its reliance on fossil-fuel-based materials like polyester in order to meet climate targets, according to a new report from Textile Exchange.