The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

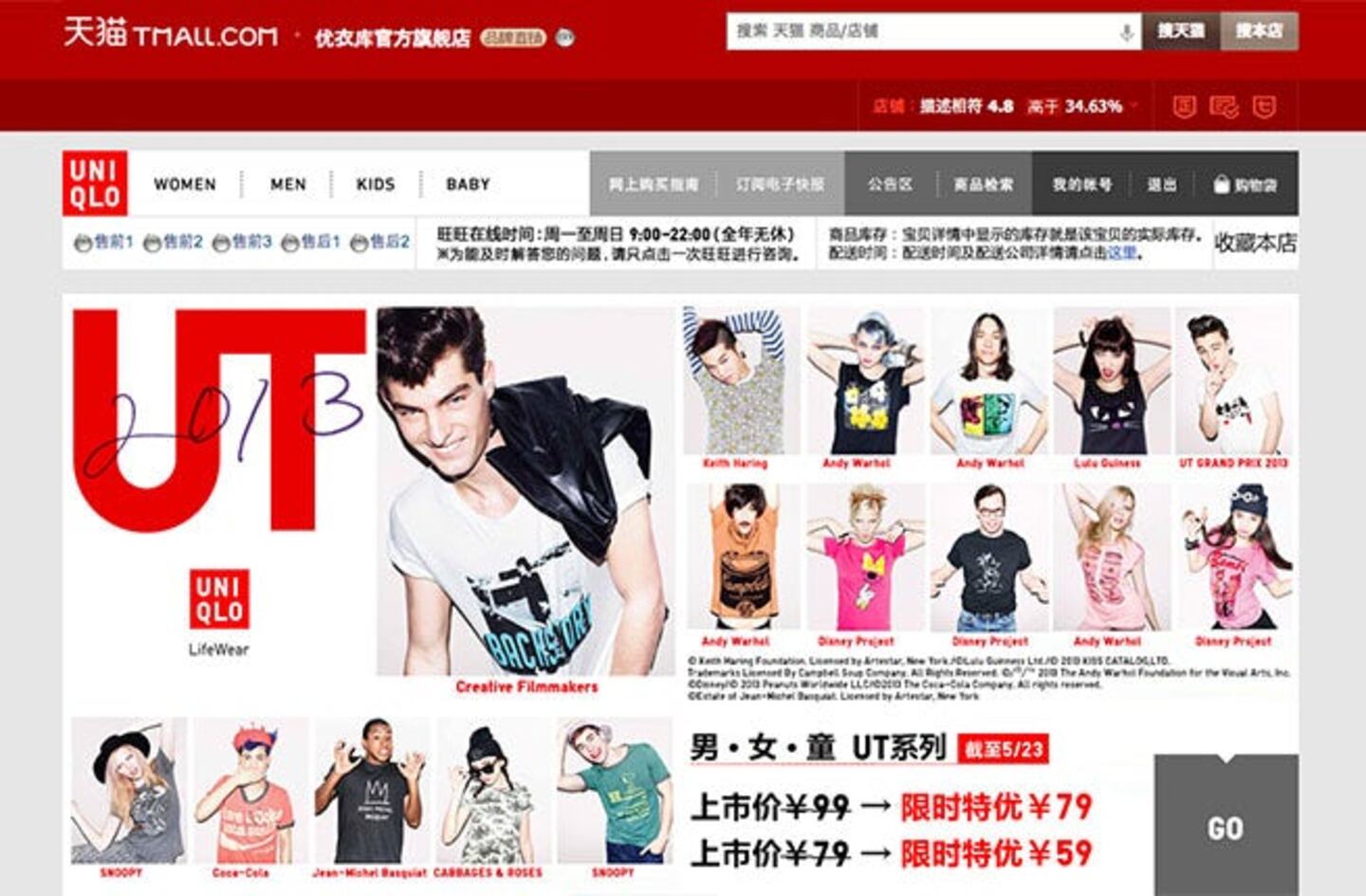

BEIJING, China — When Uniqlo opened its first online store in China, back in 2009, it launched a second store, the very same day, on Tmall.com. A year and a half later, not long after opening its first China e-commerce site, Gap, too, launched a presence on Tmall. Indeed, for a large number of low- to mid-priced international apparel brands, from Espirit to Levi's, the chosen route into China's fast-growing e-commerce market — worth as much as $210 billion in 2012, according to McKinsey & Co — often involves Tmall.

Tmall, formerly known as Taobao Mall, is a business-to-consumer retail site on which brands can open and operate their own e-commerce stores. The platform is owned by China’s largest e-commerce and online payments firm, Alibaba, which, if the rumours are true, seems set to create a Facebook-like frenzy when it IPOs sometime in the second half of the year. Together with its sister site, Taobao Marketplace, a consumer-to-consumer marketplace that is China’s answer to eBay, Tmall has more than 500 million registered users, with transactions for 2012 totaling 200 billion yuan ($32 billion), double that of 2011.

“On November 11, 2012, a special shopping day like Cyber Monday in the US, Tmall.com had more than 250 million visitors, almost the entire online shopping population of China,” said Florence Shih, head of international public relations for Taobao Group. What's more, sales across Taobao marketplace and Tmall on that day exceeded $3 billion with Tmall making up the majority at $2.16 billion. By comparison, sales for the whole of the United States on Cyber Monday, in 2012, were less than $2 billion.

Importantly, Tmall provides international apparel brands with a ready-made service infrastructure that's already in sync with Chinese consumer behaviour and preferences. In China, the number of credit cards is rising. So are trust levels in online payment systems. But the majority of Chinese still prefer to pay in cash. “China is still a cash society, not offering cash on delivery (C.O.D.) service is not an option if you want to enter the market,” said Madden.

ADVERTISEMENT

What's more, Chinese consumers like to examine their purchases before paying and allowing couriers to leave, a service that Tmall enables. “Consumers can request that the courier not leave until the products are inspected,” confirmed Shih. “It is not uncommon to see same-day deliveries for same-city transactions. The average is between 1 to 4 working days," continued Shih.

But Tmall's appeal isn't about sales or customer service alone. Indeed, for companies like Gap and Uniqlo, perhaps more than anything, a presence on Tmall is a powerful way to lift brand awareness. “Gap decided to launch on Tmall in 2011 to expand the brand’s reach to Chinese consumers. Tmall is one of the most trafficked e-commerce sites in China and this partnership supports our goal of building our brand presence in China,” said Edie Kisski, a spokeswoman for Gap.

“Tmall occupied the biggest market share of the whole consumer e-commerce market, so working with Tmall was a good choice for us. Tmall also helped Uniqlo to setup the official website, which is the only case in China. From Uniqlo's official website, if a customer wants to place an order, they have to log into their Tmall account first,” said a spokesperson for Uniqlo.

A presence on Tmall can also help international brands quickly learn what the Chinese market wants before investing additional resources. “What sites like Tmall offer to brands is an ability to test product and price and consumer response at an incredibly low cost,” said Sonya Madden, a retail consultant. “Brands gain direct access to consumer data and are enabled to operate their e-shops in a cost-efficient and effective way,” added Shih.

But not all international players choose to partner with Tmall. UK-based online fashion juggernaut ASOS is poised to make its China debut early next year, for which, according to statements released by chief executive Nick Robertson, the company is completely re-thinking its operating model. But critically, ASOS will not be working with Tmall. Instead, according to market sources, ASOS is considering a partnership with yohobuy.cn, a multibrand platform with a stronger fashion focus and a content-meets-commerce model (the site has its own online magazine at yoho.cn), giving it more in common with ASOS. Nonetheless, when ASOS enters China, one of its first tasks will, no doubt, be to draw the eyeballs of millions of consumers away from Tmall, which may prove a real challenge.

The app, owned by TikTok parent company ByteDance, has been promising to help emerging US labels get started selling in China at the same time that TikTok stares down a ban by the US for its ties to China.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.

Four years ago, when the Trump administration threatened to ban TikTok in the US, its Chinese parent company ByteDance Ltd. worked out a preliminary deal to sell the short video app’s business. Not this time.

Brands are using them for design tasks, in their marketing, on their e-commerce sites and in augmented-reality experiences such as virtual try-on, with more applications still emerging.