The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI, China — Every week, their pore-less faces are watched by millions of young viewers who then follow their every move, outfit change and beauty look on social media apps WeChat, Weibo and Xiaohongshu.

The hottest young Chinese idols are appearing more than ever on the small screen — on mobile and tablet screens to be precise — with video streaming services and local shows driving trends in fashion, music, gaming and beauty that were once the bread and butter of big budget movies or South Korean pop culture.

“[Homegrown] video programs, not specifically watched on television, are becoming more and more popular and influential,” influencer and celebrity TV show stylist Fil Xiaobai tells BoF. Chinese netizens now spend an average of 4.7 hours on their smartphones a day purely for entertainment purposes according to data released in June 2019 by research firm QuestMobile, up from a 4.1 hour average a year earlier.

More screen time means greater marketing opportunities in the mainland’s burgeoning idol culture, where it has become the norm for brands to partner with young stars to reach the fans who worship them. But given the country’s non-stop appetite for fresh content and new celebrities, are brands investing in a passing fad?

ADVERTISEMENT

Old is the New New

Historical dramas are one of China’s oldest TV genres — in a country with thousands of years of history there’s plenty of material to mine. Each year, a breakout series enters the realm of obsession.

A still from "The Story of Yanxi Palace" | Source: iQiyi

Last year, it was “The Story of Yanxi Palace,” which garnered over 18 billion views and famously saw more than half a billion streams in a single day on streaming platform iQiyi — often dubbed ‘the Netflix of China’. The series, centred on a strong-willed young woman caught up in a cavalcade of Qing Dynasty palace intrigue, was credited with driving a trend for traditional Chinese beauty looks, selling out make-up collaborations and reinforcing a taste for traditional Chinese luxury and craftsmanship among the masses.

In fact, the show’s luxe portrayal of Chinese history saw Beijing-affiliated state media turn against Yanxi, condemning the series for being “incompatible with the core values of socialism,” leading to its cancellation on network television affiliates (it remained available on iQiyi).

This summer, iQiyi’s “The Untamed” has taken up the historical drama mantle. Based on a famous Chinese Xianxia novel — an historical fantasy genre which features elements of Chinese mythology, martial arts, Taoism and Buddhism — the series’ pair of leading men have fast become two of the most influential young celebrities in the country.

Topping the Hot List

Although both Xiao Zhan, 28, and Wang Yibo, 22, have been in China’s realm of public consciousness for over three years — via boy band memberships, appearances on variety shows and film roles — “The Untamed”’s popularity has catapulted both into a new stratum of stardom.

ADVERTISEMENT

Since July, the two have been making regular appearances in the top five spots on consultancy R3’s monthly ranking of China’s most influential celebrities, judged by engagement on social media platforms and search engines including Weibo, WeChat, Toutiao and Baidu. In October, Xiao ranked number one and Wang number two.

They’ve caught the attention of global brands, notably Estée Lauder, which announced Xiao Zhan’s ambassadorship on Weibo prior to Singles’ Day. In that post, Xiao posed with a 270 yuan ($38) lipstick and called for his fans to pre-order products for the shopping festival (purchases would include a free calendar featuring the young heartthrob). The move contributed, at least in part, to Estée Lauder’s record-breaking Singles’ Day performance, with $143 million recorded in pre-orders.

A poster for "The Untamed" featuring Xiao Zhan and Wang Yibo| Source: Tencent Video

The company has also tapped Li Xian, star of another iQiyi hit, “Go Go Squid!” — a modern romantic drama in which Li plays the leader of an online squad of video gamers.

iQiyi’s Chief Marketing Officer Vivian Wang explained in media interviews earlier this year that fashion and beauty brands are increasingly tapping the platform to seek out the next hot celebrity faces to sign.

But not everyone is convinced by the wisdom of brands aligning themselves with these idols. Fashion researcher and scholar Christine Tsui, for one, questions the relevance and bankability of streaming stars in the long-term.

“I personally do not see much upside for using TV streaming stars as brand ambassadors,” she said. “I don't think they really drive popularity, they [are popular] for a few months then they are gone. People forget them so quickly.”

The Streaming Scene

ADVERTISEMENT

Streaming is dominated by China’s digital triumvirate, commonly referred to as BAT (Baidu, Alibaba and Tencent). In 2020, iQiyi (which is majority-owned by Baidu) will invest over 20 billion yuan ($2.84 billion) in more than 200 new releases, many of which will be drama series and variety shows. iQiyi, along with competitors Tencent Video and Alibaba-owned Youku are burning through cash in an attempt to grow their subscription audiences.

At present, iQiyi has 99.4 million paying subscribers, Tencent has 94.9 million and Youku has 81.1 million, according to IHS Markit Technology. A recent report by Ampere Analysis estimates, China will have 305 million on-demand subscribers by the end of 2019, almost double that of the US’ 158 million.

Though this subscription boom is a huge turnaround from only five years ago — when almost all of the video streaming industry’s revenue came from advertising — ad revenue is still crucial for these platforms, and a reasonable option for brands looking to align themselves with China’s hottest shows and stars. As of 2019, advertising still accounts for more than half of Chinese streaming platforms’ revenues, according to Screen Daily.

iQiyi is focused on connecting brands with creative content that reflect the values of young Chinese netizens.

At last month’s iJoy Conference (an annual event where iQiyi executives outline their plans for the year ahead), Wang explained that rather than focusing on increasing sales and subscriptions for growth, the platform is focused on connecting brands with creative content (through paid advertising and other partnerships) that reflect the values of young Chinese netizens.

"We are optimistic about the infinite space of content creativity, the power of young people's love … and the growing strength of China's economy,” she said. “We have confidence in the future [that we will] grow together with brand partners.”

Meanwhile, video-streaming services are also facing increasing competition from short-video and live-streaming platforms like Douyin (the Chinese equivalent of TikTok) and Tencent-backed Kuaishou for both screen-time and advertising dollars.

Tsui argues that television dramas of the past “were even more influential” in shaping pop-culture trends for young Chinese consumers than they are today.

“[China’s] young generation are more attracted to [the] Douyin and Kuaishou [apps],” she added.

Back to Reality

Variety shows, alongside historical and so-called “urban” dramas (which reflect modern life in Chinese cities) have become the lifeblood of video streaming services.

Competition shows based on performance — be it singing, dancing or fashion design — have been a staple in China since "Super Girls" launched the career of singer Li Yuchun (aka Chris Lee) more than a decade ago, but the format continues to go from strength to strength. In recent years, mega-hits like iQiyi's "The Rap of China" and Youku's "Street Dance of China" have injected hip-hop-infused sub-cultures into mainstream youth culture and helped drive the country's streetwear boom that is still going strong.

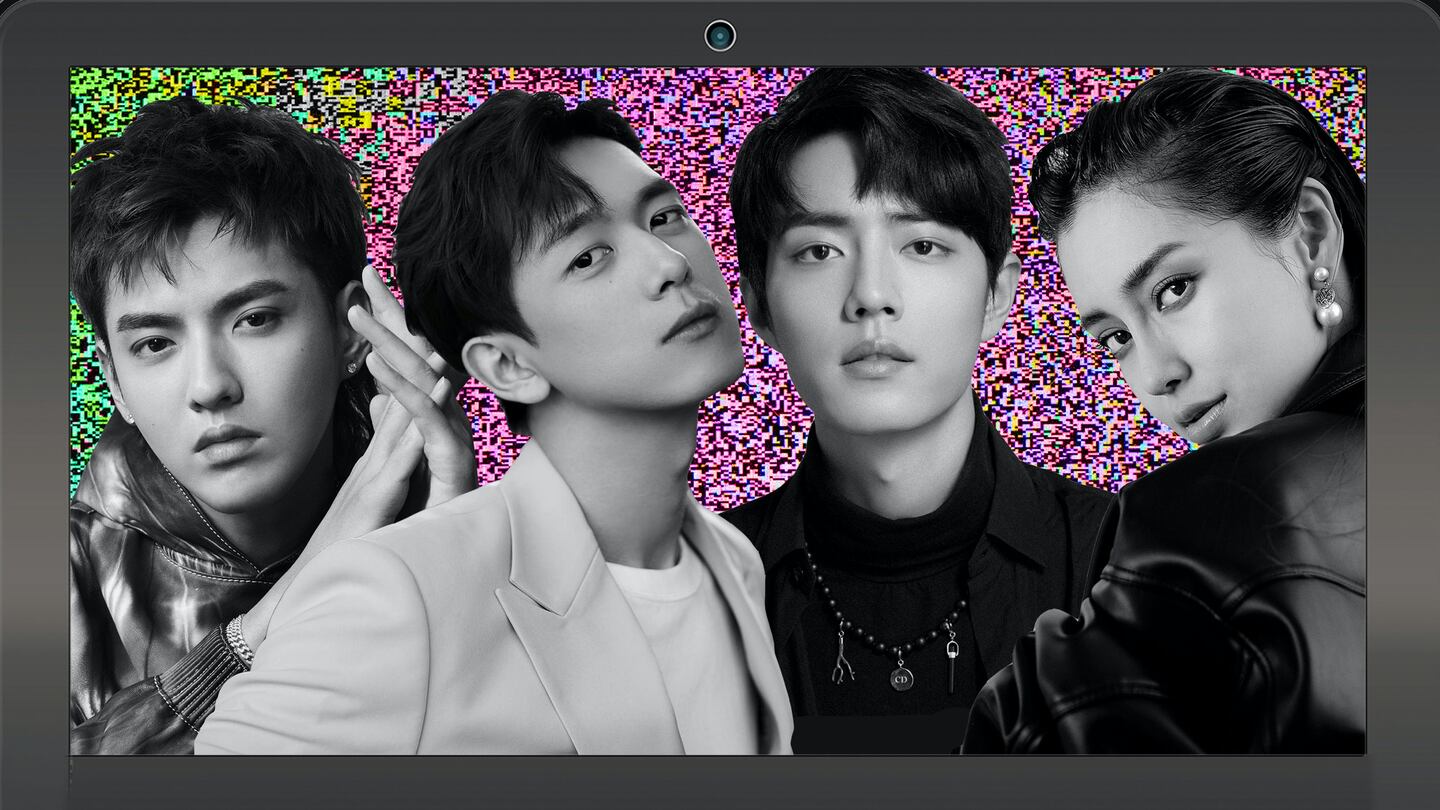

Angelababy and Kris Wu front the "Fourtry" celebrity cast | Source: iQiyi

Now Kris Wu, xiaoxianrou (little fresh meat) celebrity, ex-Burberry and Louis Vuitton ambassador and "The Rap of China" alum, is back with a new show called "Fourtry" on iQiyi. The much-anticipated show sees Wu, alongside Dior ambassador Angelababy and other idols open a multi-brand retail store in Tokyo. The celebrity hosts and store clerks run the store, from product selection to visual merchandising and marketing.

According to Fil Xiaobai, there are solid reasons for China’s biggest celebrities to take part in reality and variety shows, which allow them to “let more people know the real them, apart from the role that they play in movies.”

Indeed, Wu remains one of China’s most sought after brand ambassadors, representing everyone from Louis Vuitton to Lancôme, alongside his own recently-launched accessories brand. These revenue streams make his regular small screen appearances more important, allowing him to spend quality time with his fan base and cultivate an image that is cool but without the unapproachable distance of a traditional superstar.

From a brand point of view, there’s little doubt that partnering with China’s hottest stars on next-gen TV shows is a sure-fire way to create buzz in an increasingly crowded market, but anything beyond that remains a matter of serious debate.

Additional reporting by Nino Tang.

时尚与美容

FASHION & BEAUTY

Queennie Yang and Liang Chao speak during #BoFVOICES | Source: Getty Images for The Business of Fashion

Chinese Heavyweights Take the BoF VOICES Stage

At BoF's annual gathering of big thinkers in Oxfordshire, Liang Chao, the founder of e-commerce and youth culture media empire Yoho!, and Joann Cheng, chairman of Fosun Fashion Group and Lanvin, shared their experiences working in China's complex fashion and retail landscapes. During Liang's session in Mandarin about the Chinese streetwear market, he underscored the importance of "flexibility and agility" in helping brands to keep up with young shoppers, which Yoho! does by using data to monitor consumer behaviour and adjust stock on a weekly basis. Meanwhile, Joann Cheng urged attendees to pay attention to China's "Future Cities" lying outside its top tiers, such as Wuhan, Hangzhou, Chongqing, Xi'an and Nanjing.

China's Top Plastic Surgery App Launches 'WeWork for Procedures'

The sharing economy has found its next landing ground: plastic surgery clinics. SoYoung — the hit Tencent-backed marketplace app connecting prospective patients with clinics and other users — has made its first move into the offline landscape. Last week, the Nasdaq-listed company joined beauty centre chain BeauCare Clinics to announce the launch of a shared medical clinic in Beijing, which will allow patients and certified doctors to rent its eight operating rooms, consultation rooms, patient wards, laboratories, nurses, and anaesthetists at an hourly rate. The shared clinic began accepting bookings on November 8 and the company announced that over 100 surgeons have signed up to use it. According to SoYoung's President and Chief Executive Jin Xing, the efficient shared clinic model could replace most of the mainland's existing small and medium-sized clinics in the next five to ten years. (Sixthtone)

Labelhood to Unveil New Physical Space

On November 30, the Shanghai-based designer incubator will officially open the doors at its new brick-and-mortar retail and social space, A Pebble by Labelhood. Located on Hongwu North Road in Nanjing (a newly-crowned first-tier city), the store will champion local designers from Uma Wang to FFixxed Studios. The incubator has been on the up and up: its designers are taking up a larger share of Shanghai Fashion Week show slots than ever before, with 22 supported brands including Shuting Qiu and Ximon Lee showcasing their Spring/Summer 2020 collections over four days in last season's schedule. (Labelhood)

科技与创新

TECH & INNOVATION

Amazon delivery boxes | Source: Shutterstock

Amazon Links Up With Pinduoduo

After exiting China, American retail giant Amazon has set up a pop-up shop on the country's third largest e-commerce player Pinduoduo, and will sell over about 1,000 overseas products to local consumers until the end of December. In July, Amazon shuttered its Chinese online store amid fierce competition from local firms Alibaba and JD.com, though mainland shoppers could still access its Kindle store via Tmall and purchase from its global platform. Allying with the Nasdaq-listed social e-commerce player (which reported a 123 percent revenue surge to $1 billion in the third quarter of this year but saw losses of over $326 million) will allow Amazon to navigate the market without cosying up to its rivals. However, the pairing is curious given Pinduoduo's reputation as a low-cost retailer and its ongoing struggles with counterfeit products, which in April landed it on the US counterfeit blacklist for violating intellectual property rights. (Reuters)

Bytedance Distances Itself From TikTok as Suspicions Mount

The past year has been a turbulent one for Bytedance-owned TikTok — the latest tech player to be caught in the US and China's geopolitical standoff, as lawmakers in Washington accuse the company of "collecting and sharing user data, tracking American tweens and teenagers, and manipulating children's online purchases," in addition to censoring content about protests in Hong Kong. Just this week, user Feroza Aziz alleged that TikTok suspended her account after she posted a video urging viewers to look up reports of mass detention camps in Xinjiang. Last week, the app's Chief Executive Alex Zhu told the New York Times that in the event President Xi Jinping made a personal request for user data or for content to be removed from the platform, he would "turn him down." Bytedance has reportedly responded by making moves to separate TikTok operationally to assure US government bodies that users' personal data will be stored locally. (New York Times)

Where are China’s Future Tech Hubs?

The Chinese government has allocated 1.39 billion yuan (around $197.6 million) of the country's 2020 fund for science and technology development to local governments, said the Ministry of Finance. The fund will help lower-tier cities catch up with top tier finance and tech hubs, by supporting local basic research, constructing innovation hubs and transferring science and tech achievements. Provincial-level regions will win big, with Jiangsu, Shandong and Guangdong set to receive around $10 million, $9.6 million and $9.2 million respectively. Though Guangdong is already home to Shenzhen (China's equivalent of Silicon Valley), Jiangsu houses up-and-coming hubs like Nanjing and Suzhou, which are promising contenders for the tech hub crown. (Xinhua)

消费与零售

CONSUMER & RETAIL

Alibaba listed on the New York Stock Exchange in 2014 | Source: Shutterstock

Alibaba’s Hong Kong Debut: $4 Trillion HKD in Market Capitalisation

Alibaba Group Holding's second listing is off to a good start. The retail giant's Hong Kong debut completed the world's biggest stock offering of 2019, with shares closing at $187.6 HKD ($23.9) on the first day of trading, 6.6 percent above the offer price. Meanwhile, the company's bet on Hong Kong could give the city's stock exchange the ammunition it needs as local pro-democracy protests quiet down after an especially violent couple of weeks. It has been a good month for Alibaba, which not won big on Singles' Day, but announced during its annual investor day event that among other takeaways, its marketplaces now boast 693 million annual active consumers, meaning around 80 percent of the mainland's netizens are active on one or more of the group's platforms. (SCMP)

Yoox to Shutter China Site as Richemont Shifts Gears

As parent company Richemont hones in on Feng Mao (its joint venture with Alibaba), the e-tailer, which specialises in overstocked or unsold luxury fashion, will cease its operations in the mainland on February 28. The group has long struggled with its outlet businesses in China — in 2015, YNAP's other discount fashion site The Outnet exited the market. Looking ahead, the success of Richemont's remaining multi-brand chips in China (Net-a-Porter and Mr. Porter) will hinge on its local partnerships: luxury e-commerce platform Feng Mao made its first move on September 30, when Net-a-Porter launched on local giant Alibaba-owned e-commerce platform Tmall's Luxury Pavilion. Richemont's Chief Executive Jérôme Lambert said during an earnings call this month that "localised services" are necessary in markets such as China and the Middle East, which are flooded with competing platforms vying to serve sophisticated and spendy consumers. (WWD)

Are Chinese Companies More Willing to Disclose Climate Change Risks?

According to London-based non-profit CDP Worldwide, companies in Hong Kong and mainland China have become more transparent when disclosing their exposure to climate change risks. Its data reveals that around 53 submissions were received from Hong Kong last year, an increase over the 40 and 38 submissions sent in 2017 and 2016, respectively, while submissions from mainland China increased to 960 last year from 759 in 2017 and 653 in 2016. According to experts, companies listed in Asia tend to disclose carbon emissions reduction efforts, but skimp on speaking on their climate risk exposure, mitigation and adaptation plans, though these disclosures can help protect their operations and assets while informing investors' decisions. (SCMP)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Uigur women working in a cloth factory in Xinjiang's Hotan county | Source: Shutterstock

New Leaked Documents Shed Light on Uighur Internment Camps

Following the New York Times' report detailing processes leading up to the imprisonment of ethnic minorities in Xinjiang's detention camps, the International Consortium of Investigative Journalists has published a series of classified documents, coined 'The China Cables," which shed light on how the camps operate and Chinese police use data, artificial intelligence and facial recognition to create lists of "suspicious persons" with the help of Chinese embassies and consulates. The operation manual — originating from the Chinese commission overseeing security in Xinjiang and approved by the region's top security official Zhu Hailun — instructs personnel in the "vocational skills education and training centres" on everything from keeping the camps' existence secret to preventing escapes. Though statements from ex-inmates suggest that the manual (including instructions on ensuring health and safety) is generally ignored, its directives appear to support, in 'doublespeak,' reports that inmates are sent from camps to job sites under constant police watch. (ICIJ)

GDP Revision Means China May Double Its Economy Over a Decade

On November 22, China's National Bureau of Statistics announced the revision of its 2018 GDP upwards by 2.1 percent to 91.93 trillion yuan ($13.1 trillion), meaning it will be easier for the mainland to its reach its goal (originally set by former president Hu Jintao in 2012) of doubling the size of China's economy between 2010 and 2020 with a lower growth rate. The GDP increase of 1.9 trillion yuan ($270 billion) is roughly the size of Vietnam's entire economy and was driven primarily by higher-than-expected growth in the tertiary sector. The revision could allow Beijing to set a growth target as low as 5.8 percent for the fourth quarter and 2020 and still make Hu's goal, which is perceived as a benchmark to judge the success of Beijing's economic policies. (SCMP)

WeWork Reportedly In Talks to Sell China Business

Following its dramatic rise and fall, embattled US co-working space provider WeWork is reportedly looking to sell its business in China to a local rival, Kr Space. According to reports, a deal would see the latter acquire WeWork's offices across 10 cities in mainland China, which would amount to over 100 open locations and 48 offices currently under construction. According to its website, WeWork currently operates 120 buildings in mainland China, a market it entered in 2016, making up around 14 percent of its total number of locations that are open or coming soon. The company has encountered plenty of challenges at home in recent months, but China has proven particularly tricky thanks to slowing economic growth and weak demand, not to mention competition from its rivals such as Kr, Ucommune and Nash. (Tech in Asia)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.