The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Despite being urged by the authorities to stay put during this month’s Lunar New Year holiday, many Chinese are travelling domestically to get a much-needed break from their daily routines under the country’s strict zero-Covid policies.

Before the onset of the pandemic, Chunyun, the 40-day travel rush surrounding the Spring Festival period, would see up to 3 billion trips made as Chinese travelled to family homes and holiday hot spots. For some luxury fashion and beauty brands selling to the high-growth market, gift-giving conventions make it an important sales period.

This year, China’s Ministry of Transportation forecasted that a total of 1.2 billion trips would be made during the season, up 36 percent from last year but less than half what it was pre-pandemic. The lure of family reunions and leisure time proved too strong to dissuade many to heed warnings to stay home to minimise the risk of infection ahead of Chunyun and the Winter Olympics — warnings that, in some cities, were accompanied with cash incentives to do so.

One destination slated to reap the benefits is Hainan, China’s much-trumpeted southernmost province, which throughout the pandemic has been a travel mecca and duty-free shopping hub for hundreds of millions of Chinese unable to fly abroad. Last year, Hainan Daily reported that the tropical island welcomed over 4.5 million tourists during the week of Lunar New Year, earning over $900 million in revenues for the local hospitality industry.

ADVERTISEMENT

The influx came just months before Hainan hosted the China International Consumer Products Expo (CICPE), which drew exhibits from almost 1,300 global brands including some from luxury behemoths LVMH, Richemont and Kering.

Since China’s border restrictions are expected to remain in place for most of this year, Hainan, which has become a major focus of investment for both ailing travel retailers and global brands such as Ralph Lauren and Valentino Beauty, will become even more important. “Chinese travellers are going to continue flocking to Hainan,” predicts Michael Straub, associate partner at McKinsey & Company.

Straub believes that beyond 2022 and even beyond the return of international travel, the island will “remain a competitive travel and duty-free destination” thanks in no small part to a major policy change on the horizon.

By 2025 at the latest, Hainan is set to become a fully designated duty free zone, allowing brands to launch and operate their own stores without going through licensed operators. The success of China Duty Free Group, which controls the vast majority of the Hainan market, has already attracted operators such as LVMH’s DFS, Dufry and Lagardère.

How brands make use of this future change will be integral to their success in not only Hainan, but the broader China market in the long-run.

An Island Earmarked for Growth

Beijing’s policies toward the island have, and continue to be, the driving force behind its rise.

At the core of a number of regulatory moves — from tripling the annual allowance for duty free purchases on the island to 100,000 yuan (around $15,720) per person in July 2020, to allowing mainland visitors to spend any of their unspent annual allowance online, for up to 180 days once they return home — is an economic strategy Beijing revealed two years ago.

ADVERTISEMENT

Under its “dual circulation strategy,” China is working to reduce “external circulation” to drive economic development, meaning less dependence on export markets and overseas technology, while prioritising “internal circulation” which consists of domestic production and consumption. This is where making Hainan a more attractive place to visit and shop enters the equation.

Incentivising Chinese to spend more money while they are in Hainan keeps it circulating domestically in the Chinese economy, rather than flowing to foreign travel and shopping destinations. The strategy has driven huge investments in infrastructure and hospitality which explain why “a lot of brands have announced that Hainan is their strategic priority in China,” says Jason Yu, Shanghai-based managing director of the Worldpanel division of global market data group Kantar.

According to the customs office in Hainan’s capital and largest city Haikou, duty free sales hit 26.77 billion yuan ($4.2 billion) in H1 2021, up over 257 percent from the period in 2020. The city on the north coast has long been Hainan’s cultural hub, thanks to national parks, Ming dynasty temples and remnants of the island’s Nanyang (Southeast Asian) culture.

Hainan’s second biggest city is Sanya: the go-to spot for beach holidays and general travel thanks to its picturesque coastline and luxury resorts. “Sanya is already surpassing a lot of the tier two and tier three cities, becoming the fifth largest city in China for luxury shopping,” says Yu, citing a 2021 report by Ruder Finn and Consumer Search Group. “I think that is a very clear indication of Hainan’s place in a rapidly growing offshore duty-free market.”

Some luxury industry leaders, however, are concerned that daigou traders (grey-market surrogate shoppers who buy lower priced luxury goods overseas to resell on the mainland) seem to have shifted their focus to places like Hainan as the repatriation of luxury spend back to the Chinese mainland went into overdrive during the pandemic.

“There is the potential for Hainan to be, at least for duty free shopping, a new Hong Kong, with all the potential that represents [but] I think the current model in Hainan island is going to grow another growth of daigou, which would not be seen very positively by the brands,” predicted Bruno Lannes, a partner at consultancy Bain & Company’s Shanghai office, as early as 2020.

“So how do you maintain price harmony between duty free and duty paid when both of them are in the same country and you don’t need a passport to travel [and] it’s easy to travel? The question for brands is how do you manage this in the context of their overall national footprint in China?”

In a bid to help stem the trade, the Hainan government introduced new regulations last month to punish daigou operators and control “seriously untrustworthy” duty free purchases on the island but it is too early to say how effective they will be.

ADVERTISEMENT

Unpacking Hainan’s Allure

The Hainan government foresees growth in the island’s duty free sales of $46 billion by 2025, of which McKinsey estimates around 85 percent ($40 billion) will be spent on luxury categories. Both luxury fashion and beauty brands, as well as travel retail giants, have invested in the island to make up for sluggish growth elsewhere.

But what makes the Hainan experience so appealing to visitors and can this so-called “Hawaii of China” really live up to its nickname, or indeed compete with other exotic sunshine-and-sand shopping hotspots in the Asia-Pacific region?

In the past, Hainan largely attracted business travellers heading to conferences, as well as domestic tourists after a straightforward relaxing beach holiday without the hassle of going to a foreign country. The island’s burgeoning duty free business now attracts a wider, and increasingly diverse range of customers, but it was an attractive destination to begin with.

Sanya’s Houhai Bay is a popular location for surfing and other water sports. The island’s distinctive cultural heritage is also an increasingly important draw as Hainan’s Hlai or Li people (also known as Lizu) are one of China’s 55 officially recognised ethnic minority groups with their own language and traditions.

Visitors to Hainan can also experience the culture and cuisine of China’s Hakka ethnic subgroup as well as the laid-back Nanyang lifestyle. Alongside a number of new and incoming amusement parks and nature attractions across the island, Sanya is also a golfer’s paradise. Given the variety of attractions, it’s no surprise that its high-end resorts attract couples as well as families.

Yet the majority of Hainan travellers still have two things top of mind: beaches and bargains. In its 2021 survey of 550 Hainan duty free shoppers, McKinsey found that 81 percent of respondents listed beach vacations in their reasons for visiting the island. Notably, 62 percent of respondents to the survey said they would return to it once borders fully reopen.

Shopping, came second. For those visiting Hainan for its retail offering, nabbing a bargain is a major draw. “We always associate duty free with value for money, and that’s the [main attraction] for a lot of people,” says Pablo Mauron, China managing director and partner at Digital Luxury Group (DLG), a marketing research firm with offices in Shanghai and Geneva.

To be sure, those with the means to pay for a luxury experience — staying at the Ritz Carlton in Haikou, or the Rosewood or Edition hotel in Sanya — can do so and spend big on beauty and limited edition alcohol at nearby duty free malls, such as DFS’ sprawling complex in Haikou Mission Hills (where Givenchy beauty, Estée Lauder and La Mer have set up shop in a sprawling 6,300 square metre beauty hall), China Duty Free’s Sanya outpost, or the group’s incoming Haikou International Duty Free City opening in June 2022.

In addition to Hainanese cities like Sanya and Haikou, there’s Boao for instance which is a tourist destination in itself.

There are more secluded and affordable accommodation options just 200 kilometres away from top luxury spots in Sanya and Haikou, says Yu, boasting equally pleasant beaches. Along stretches like Hainan’s east coast, other cities are investing heavily in tourism and real estate. “There’s Boao for instance [of the namesake Boao Forum for Asia], which is a tourist destination in itself,” Yu adds.

Besides Hainan’s increasingly diverse retail offering and tropical climate, convenience and customer service are a major attraction. They also explain why (among many other reasons), once borders reopen, mainland Chinese are less likely to head back to Hong Kong for their duty free shopping needs.

“Hong Kong wasn’t providing a stellar experience for Chinese travellers,” Mauron says, noting tourists would often be spotted hauling their suitcases around with them while out and about. By contrast, another travel retail hotspot, Seoul thrived pre-pandemic by innovating on the duty free experience, with retailers getting purchases made downtown delivered to airport gates.

Amid the pandemic, the lack of Chinese tourists hit both Seoul and Hong Kong hard — shuttering around half of the duty free stores catering to such visitors on South Korea’s Jeju Island — and even local duty free players like Shilla Duty Free have had to invest in Hainan to offset losses. But a lot of the measures developed in Hainan are really taking cues from Korea, and Seoul in particular, says Mauron.

A Future Beyond Bargains

From a luxury brand perspective, Hainan’s biggest limitation lies in the lack of control brands have when working with licensed duty free operators — namely pricing, customer experience and relationship management, and inventory, all of which risk eroding brand equity in the crucial China market.

Even as beauty brands from Augustinus Bader to Frederic Malle continue to pour money into selling on the island through wholesale duty free commerce, many luxury fashion players have held it at arm’s length. Aside from outliers like Cartier, Swarovski and Panerai, McKinsey hasn’t noted luxury brands opening duty free stores en masse, says Straub. Take Louis Vuitton, which does not operate a single store on the island.

Instead, luxury players are focusing more on operating existing stores in airports and marketing through activations like pop-ups and exhibitions, while closely observing performance and policy changes.

When it comes to price and convenience, I think that duty free in Hainan is going to be very hard to compete with.

That will all change after (or perhaps before) 2025, when Hainan’s duty free retail sector becomes a free-for-all. Though the terms and details of this major shift have yet to be announced — apart from vague reports of a list of exempted goods that will require licenses — the opportunity for luxury brands is evident.

As the deadline nears, it will be a growing imperative for duty free operators to show their value to brands plotting a directly-operated experiential shopping environment. But the change isn’t necessarily a death knell. “At the end of the day, they’re not just operators,” says Mauron, noting the infrastructure, such as shopping malls, duty free operators sometimes own alongside local partners. “And we know that a lot of [Chinese] retail happens in malls.”

As such, operators will adapt and increasingly take on the role of landlords, while continuing to manage major strategic assets, he predicts. For brands, there will likely be a change in power dynamics, as parties work to create a win-win partnership model that allows brands to take on more control.

For luxury brands, in particular, this doesn’t necessarily ensure that their challenges will evaporate once operators’ licences are abolished: caution should still be exercised, particularly where the buying behaviour of many tourists to Hainan remains value-centric. Moreover, brands going in alone will have to shoulder more responsibility, and should build Hainan-focused teams and capabilities spanning merchandising, supply chain, real estate, government relations and pricing.

Brands must strike a delicate balance, counsels Straub, in creating a unified experience and view of customers across China locations through both data and customer relationship management, while adequately differentiating their merchandise, services and communications to avoid creating conflicting channels and cannibalising sales.

A Full-Scale Transformation

Hainanese officials have high hopes: they want the island to be a world-class destination for not only Chinese but international travellers, says Yu, likening the vision to a Chinese Dubai. But this has yet to materialise and some construction projects have recently been targeted in the wake of property developer Evergrande’s continuing downfall. Part of the much-anticipated Ocean Flower Island development, which was lauded in local media as China’s answer to Palm Jumeirah, is reportedly due to be demolished.

But the future of Hainan as a luxury travel destination, and as a competitor to regional heavyweights like Seoul, Tokyo, Bangkok and Singapore once borders lift, is dependent on more than its luxury hotels and stores.

Announcing that it plans to transform Hainan into the world’s largest free-trade port by lowering taxes, relaxing visa requirements and loosening restrictions on capital flows and data by 2035, the Chinese government has bigger ambitions for Hainan. Though two previous national-level strategies to stimulate the island’s economy failed to meet the expectations of some local business leaders, the latest plan already appears to be gaining far more traction.

Much of the investment is coming from Hong Kong-based companies. Near Haikou, a Hainan-Hong Kong Cooperation Pilot Zone is under construction where, among other things, a jewellery and diamond processing industrial project will be built to boost the jewellery sector across design, production and related supply chains.

“You can’t just develop one industry in isolation; it has to be part of the broader economic development,” says Yu, who reckons Hainan still lacks in infrastructure, from transport and real estate to service workforce and restaurant offerings. This is crucial, considering the continued localisation of spending and myriad options available to shoppers in Shanghai and Beijing, where experience-led department stores like SKP reign supreme.

Indeed, Hainan’s regular luxury retail landscape is lagging behind duty free. Though high-end malls like The Form Shopping Centre in Haikou exist, they are few and far between. The island is home to around 10 million local residents — around the same, if not more, than many important city markets on the mainland — whom brands should be serving alongside visitors. When brands eventually turn to this demographic, they will require a more nuanced approach. It also means there are opportunities for brands outside tourist-friendly merchandise and luxury segments.

For tourists, however, most who “come to Hainan for shopping… want the full-service, full-scale holiday,” says Yu.

Though infrastructure is being built on a significant scale — Straub notes that 10 duty free malls have already been built on the island, with three in the midst of expansion and two more under construction — the province will need a full-scale transformation to sufficiently upscale and diversify its offerings to compete with other destinations, attract wealth from China and beyond, and convince visitors to stay longer than the typical few days.

To be clear, Hainan is not competing directly with long-haul travel experiences to cities like Paris and London, which will be as popular as ever once borders lift. Rather, it’s the short shopping holidays Chinese used to take to places like Hong Kong and Seoul, where it is gaining market share, says Mauron. “Other destinations will [still be attractive] but when it comes to price and convenience, I think that duty free in Hainan is going to be very hard to compete with.”

CHINA NEWS FROM THE PAST WEEK

By Casey Hall

时尚与美容

FASHION & BEAUTY

Chinese Sportswear Stocks Rise on Bet Winter Olympics Spur Demand

The share price of Chinese sportswear makers climbed as investors bet Beijing’s Winter Olympics will help boost the sportswear sector in the world’s second-largest economy. Anta Sports rose as much as 5.2 percent ahead of the games’ opening ceremony and Li Ning, founded by an Olympic gymnast, jumped 6.8 percent. (Bloomberg)

Korean Beauty Giants Amorepacific and LG H&H Lose Momentum in China

Both firms have mostly lost market share to Chinese brands, which have improved their product quality and design in recent years, but Chinese consumers are also increasingly choosing Western brands such as Estée Lauder and L’Oréal over erstwhile favourites from Korea. The changes in consumer behaviour pushed AmorePacific and LG H&H out of the top 10 skincare brands in China in 2021, according to Euromonitor. (BoF)

科技与创新

TECH & INNOVATION

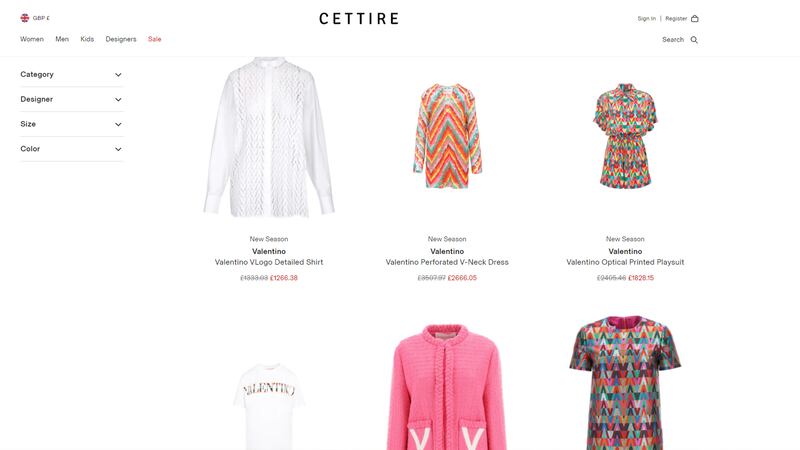

Australian Luxury E-Tailer Cettire to Enter China Market Following JD.com Deal

The luxury fashion platform said in a filing to the Australian Stock Exchange that it has inked a deal to enter mainland China in partnership with e-commerce giant JD.com. Cettire shares jumped 13.25 percent in early trading on Monday following the announcement by the e-tailer, which largely works with wholesalers in Europe to sell luxury goods at VAT-exempt prices. The company said it will launch to mainland Chinese consumers during the second half of 2022, following its alliance with JD.com, which has over 550 million customers. (BoF)

Report: TikTok Owner Launches Fast Fashion E-Commerce Site to Rival Shein

Chinese tech unicorn ByteDance is reportedly behind a new low-cost fast fashion e-commerce site, Dmonstudio, which sells similar (and similarly priced) product to Chinese ultra-fast fashion player, Shein, Chinese media outlet Egain News reported, citing people with knowledge of the matter. Kang Zeyu, head of ByteDance’s e-commerce business, is said to be overseeing the project. Dmonstudio’s site sells clothing and accessories with delivery covering more than 100 countries worldwide. ByteDance isn’t the only Chinese tech giant with designs on Shein’s turf: Alibaba rolled out international fashion app AllyLikes to target overseas consumer markets last October. (Technode)

Chinese Short Video Giant Kuaishou Targets $140 Billion-Plus in E-Commerce Sales

The main local competitor to ByteDance’s Douyin (the Chinese version of TikTok) has reportedly set a target range of between 900 billion yuan ($141 billion) and 970 billion yuan in gross merchandise volume (GMV), the total value of in-app purchasing transactions, for its e-commerce operations. Kuaishou reported 680 billion yuan in GMV last year, surpassing its annual goal of 650 billion yuan and beating market expectations. (Pandaily)

消费与零售

CONSUMER & RETAIL

Swire Properties Sees Luxury Mall Revenue Grow Across China

The Hong Kong-based real estate group saw double-digit gains in retail revenue across its mainland China properties, according to a fourth quarter operating report released Friday. Its two Beijing malls, Taikoo Li Sanlitun and One Indigo saw 27 percent and 11 percent year-on-year growth, while Chengdu’s Taikoo Li shopping centre saw revenue grow 21.9 on the year. Taikoo Hui Guangzhou had the group’s biggest yearly jump in revenue, up 33.4 percent, but Taikoo Hui Shanghai was not far behind it, with revenue growth of 28.8 percent. (BoF)

China’s Lunar New Year Consumption Remains Well Below Pandemic Levels

For the third Lunar New Year running authorities across China urged people not to travel, with some municipalities imposing stringent quarantine measures and offering cash handouts to people who stayed home. During the week-long holiday period that ended Feb. 6, Chinese tourists took 251 million trips and contributed 289.2 billion yuan ($45.4 billion) in tourism revenue — this represents a 26.1 percent and 43.7 percent respective drop compared with the holiday period in 2019 and a decline of 2 percent and 3.9 percent compared with last year’s holiday, according to the Ministry of Culture and Tourism. (The South China Morning Post)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Chinese Social Media Explodes With Accolades for Gold Medallist Gu

At one point following Eileen Gu’s gold medal-winning performance in the women’s freestyle skiing big air event in Beijing, hashtags related to her victory where simultaneously the first, second, fourth, sixth and seventh most-popular topics in China’s Weibo platform. The 18-year-old, US-born skier who decided to represent China at the Winter Olympics, has become a darling of brands both domestic and international in recent years, fronting campaigns for luxury brands such as Louis Vuitton and Tiffany and Co. (Bloomberg)

US Officials Want ‘Concrete Action’ From China on Trade Deal

US officials have called on China to take “concrete action” on its commitment to purchase $200 billion in additional US goods and services in 2020 and 2021 under the “Phase 1″ trade deal struck by former President Donald Trump. As of last November, China had met only about 60 percent of that goal, according to trade data compiled by the Peterson Institute for International Economics. (Reuters)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.