The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Chinese shoppers are no stranger to inventive digital marketing tactics. Brands are leaning into digital livestreaming and have experimented with events like treasure hunts that merge digital and physical experiences to reach the all-important cohort of digitally savvy consumers.

Often, China serves as the testing ground for digital marketing tactics that later become mainstream globally.

For fashion and beauty brands selling to China, keeping up with the growing catalogue of ways to reach prospective customers online — while differentiating between fads and bankable strategies — is no small feat. In an increasingly competitive market, not all attempts to engage with the country’s discerning buyers will pay off.

But as brands pour more money into the market, figuring out the strategies that will resonate is increasingly valuable. Digital marketing firm Dentsu expects that ad spend in China will grow 5.3 percent this year to hit 701 billion yuan ($108.4 billion). Around 70 percent of that will go to digital, which is expected to grow at an even faster rate of 9 percent.

ADVERTISEMENT

“It’s already a huge market, so the base number is already high,” says Ada Luo, head of digital marketing agency Croud’s Asia-Pacific team. “But it’s definitely growing further.”

To be sure, tried and true digital strategies (like tapping key opinion leaders (KOLs), banner and feed ad campaigns and livestreams) haven’t lost relevance. However, drivers like the pandemic, ongoing digitisation and the online gaming boom have unlocked new and inventive marketing channels that brands including Burberry, Swarovski and Louis Vuitton are already experimenting with.

Features like virtual fashion for digital avatars, fashion-forward skins for popular games and branded red packets are emerging ways brands are seeking to reach China’s crucial younger consumer. But do these strategies drive sales, and will they outlast the pandemic?

Dressing digital avatars

Retail giant Alibaba launched a new function for its e-commerce marketplace Taobao’s digital avatar feature in May to coincide with China’s Valentine’s Day. The company worked with the likes of Balenciaga, Alexander McQueen and Marni to fashion virtual outfits; users could dress their Taobao avatars in the pieces, play as their avatars in the online game, Taobao Life, and take photos with their partners’ avatars for social media.

Netizens can choose to buy corresponding limited-edition pieces in real life through Alibaba’s Tmall platform, and Taobao Life players got exclusive discounts on the products.

The aim was more to promote brand awareness than push sales, but participating labels got a generous return on their investment, says Mei Chen, head of luxury and fashion for the United Kingdom, Spain, Portugal, and Northern Europe at Alibaba Group.

Whether such digital fashion becomes a marketing staple or is simply a passing fad remains to be seen. This week, Alibaba will announce a continuation of the branding feature. It’s also contemplating a project for Singles’ Day in November, but some are skeptical about whether the strategy will benefit brands’ bottom lines.

ADVERTISEMENT

It doesn’t seem like the digital avatars do more than pretty simple interactions and as a result, brands can only go so far with it.

“Unless [Alibaba] evolve what the avatars do and the world they live in, I don’t see it being much of a [sales] driver,” says Iris Chan, a partner overseeing international client development at Digital Luxury Group. Though the avatar function could gain popularity, “it doesn’t seem like the digital avatars do more than pretty simple interactions and as a result, brands can only go so far with it.”

Gaming skins

While e-commerce platforms like Taobao are still evolving their digital worlds, brands are increasingly leaning into esports’ and online gaming’s highly engaged audience.

Louis Vuitton designed a capsule collection, gaming skin and trophy case for popular online game League of Legends’ world championship in 2019. The same year, MAC’s first Honor of Kings lipstick collaboration sold out in 24 hours. This March, Burberry debuted two skins for Honor of Kings’ character Yao, with one involving an off-the-shoulder Burberry trench and matching crop top, shorts and tights in the brand’s signature check pattern.

Like fashion for avatars, skins — typically used in more complex blockbuster games and available for in-game purchase — aren’t direct sales drivers. But linking up with hit games allows brands to reach a lucrative, untapped audience in an industry worth $29 billion, according to gaming market research firm Niko Partners.

The wealthy middle-aged shopper is no longer luxury’s sole focus in China, where Gen-Z have become an engine for growth. Brands have realised that to continue growing steadily in the country, they need to engage with a more diverse audience that is no stranger to spending online, says Luo.

While creating branded skins can, on its own, raise brand awareness, Digital Luxury Group’s Chan recommends that brands supplement virtual collectables with dedicated real-life experiences, whether that’s a capsule collection of beauty products, accessories, or an in-store perk. “There’s a tangible component that still needs to exist; [brands need] to see it through beyond this moment in time to connect the dots back to the brand,” Chan adds.

Ultimately, to really capitalise on the opportunity, brands will need to build real, lasting relationships with games and their players. “These are people who are highly engaged with [the game] they’re in, so you have to engage on the same level to show that commitment and resonance to them,” says Chan.

ADVERTISEMENT

Digital red packets

Gifting red packets filled with cash is a Lunar New Year tradition, but digital versions, which brands are designing for their followers to use, have become an increasingly popular way to raise brand awareness.

In the wake of China’s e-payments boom, WeChat’s digital red envelopes, which allow brands to customise designs, link to their e-commerce boutiques and ‘shower’ products across phone screens once opened, have become a hit among luxury players.

This year, brands including Louis Vuitton, Gucci and Versace joined in by designing slogans, cover images, logos and patterned interiors.

While the branded digital red packets are typically free, they are often available for a limited period and quantity, and can boost a brand in WeChat’s search rankings. Swarovski’s red packet, launched in collaboration with celebrity Wang Yibo, led to a 300 percent increase in brand searches on WeChat, according to Croud.

The tactic can also increase brand followers and help brands gather valuable data they can use to target users and grow their owned and private traffic channels; Luo notes that Gucci requested users register as members of the brand’s mini programme store and provide their phone numbers for access to its customised red packet. “They are very cost effective, almost low-hanging fruit. We would say they are a no-brainer,” says Elisa Harca, co-founder and Asia chief executive of Shanghai-based digital marketing agency Red Ant.

While red packets traditionally are closely tied to Lunar New Year, China’s e-commerce giants have already popularised their use for sales events like Singles’ Day. Brands celebrating an occasion or launch can also use them to drive traffic to their mini programmes beyond major promotional periods. Capturing interest and following through — whether that means directing a user to a point of sale, or inviting them to join an online community — is key.

“Culturally, it resonates always,” says Chan. But as with other digital marketing strategies, brands need to find ways to convert flashy initiatives into sales. “It’s about thinking about what you can do with the traffic when [consumers] come to you, knowing they’re quick to leave,” Chan says.

时尚与美容

FASHION & BEAUTY

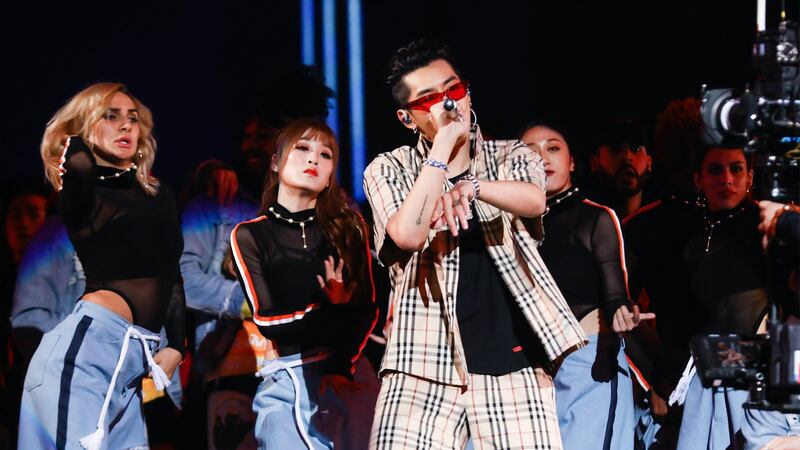

Popstar Kris Wu Detained in China

The artist was detained by police in Beijing on Saturday following reports of sexual relations and predatory behaviour with young women. The detainment comes nearly a month after a public accusation by Du Meizhu, a woman claiming to be one of his victims. Louis Vuitton is among a group of luxury brands to cut ties with the artist, announcing it would suspend its relationship with Wu on Weibo. Wu and his team have denied the allegations. (BoF)

Bulgari Becomes Latest LVMH Brand to Partner With JD.com

The partnership announced on Monday marks the first time the jeweller has joined with a third-party e-commerce partner. The deal means users who search for Bulgari on JD.com will be redirected to a special Bulgari mini-programme operated within the JD.com infrastructure. In essence, Bulgari products will be available in a separate store within JD.com, but not directly on its platform alongside other brands. Other LVMH-owned brands to partner with JD.com recently include Berluti and Givenchy Beauty. Both brands opened flagship stores on the platform in July. (BoF)

科技与创新

TECH & INNOVATION

Chinese E-Commerce Giant Mogujie Acquires RealShark Technology

The Chinese fashion e-commerce company has acquired a 60 percent stake in Hangzhou-based RealShark Technology (also known as Rui Sha Technology) for 50 million yuan ($7.69 million) in cash, according to Mogujie’s latest filing with the US Securities and Exchange Commissions (SEC). RealShark Technology provides digitalisation and customised omnichannel services for brands. Mogujie chairman and chief executive Chen Qi said the acquisition is important to help the company build a stronger livestream e-commerce ecosystem. (BoF)

Shein’s Supply Chain Provider Singbada Secures Investment

The Guangzhou-based start-up raised a pre-Series A investment to develop its supply chain software and management business, according to KrAsia. The total amount of the funding secured was not disclosed. The round was led by Xiang He Capital and existing backer Weed Ventures. The move comes as more companies adopt flexible supply-chain solutions to allow them to be more efficient and responsive to consumer demands. (BoF)

消费与零售

CONSUMER & RETAIL

China’s July Manufacturing Growth Slows to Lowest Level in 15 Months

Supply disruptions and weakening demand for exports dampened growth in the country’s manufacturing sector, two surveys found. Separate purchasing managers’ indices released by business magazine Caixin and the Chinese statistics agency showed growth last month was marginal. (AP News)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Covid-19 Delta Variant Outbreak Spreads to 14 Provinces

Chinese authorities are working to trace and contain the country’s worst coronavirus outbreak in more than a year. A cluster of infections found last month in Nanjing has been linked to 250 cases. The outbreak has spread to at least 14 provinces. Though small compared to case counts in other countries, the outbreak is a blow to Beijing’s campaign to eradicate the virus within its borders. Nanjing health officials have linked the outbreak to the city’s main airport, where it is believed cleaning staff contracted Covid-19 from a plane arriving from Russia. (Financial Times)

China Reaffirms Plans to Strengthen Oversight of Foreign Listings

At its mid-year meeting, the Chinese Communist party’s politburo, a group of the party’s top 25 officials, stated its determination to “improve” its regulatory framework for companies listing shares overseas. The statement follows a volatile week during which signs of intensifying government intervention played havoc with the share prices of Chinese companies. Officials have cracked down on the country’s largest tech groups for allegedly violating monopoly and data security laws. Overseas listings will now require clearance from the country’s internet regulator. (Financial Times)

China Orders Henan Flood Probe After Death Toll Surges Over 300

China’s State Council will launch a “comprehensive and objective assessment” of Henan’s disaster response, according to the official Xinhua News Agency. The majority of deaths occurred in the provincial capital city Zhengzhou, where 292 people died after flooding led to landslides, buildings collapsing and underground spaces to flood, the official Henan Daily reported. (Bloomberg)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.