The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

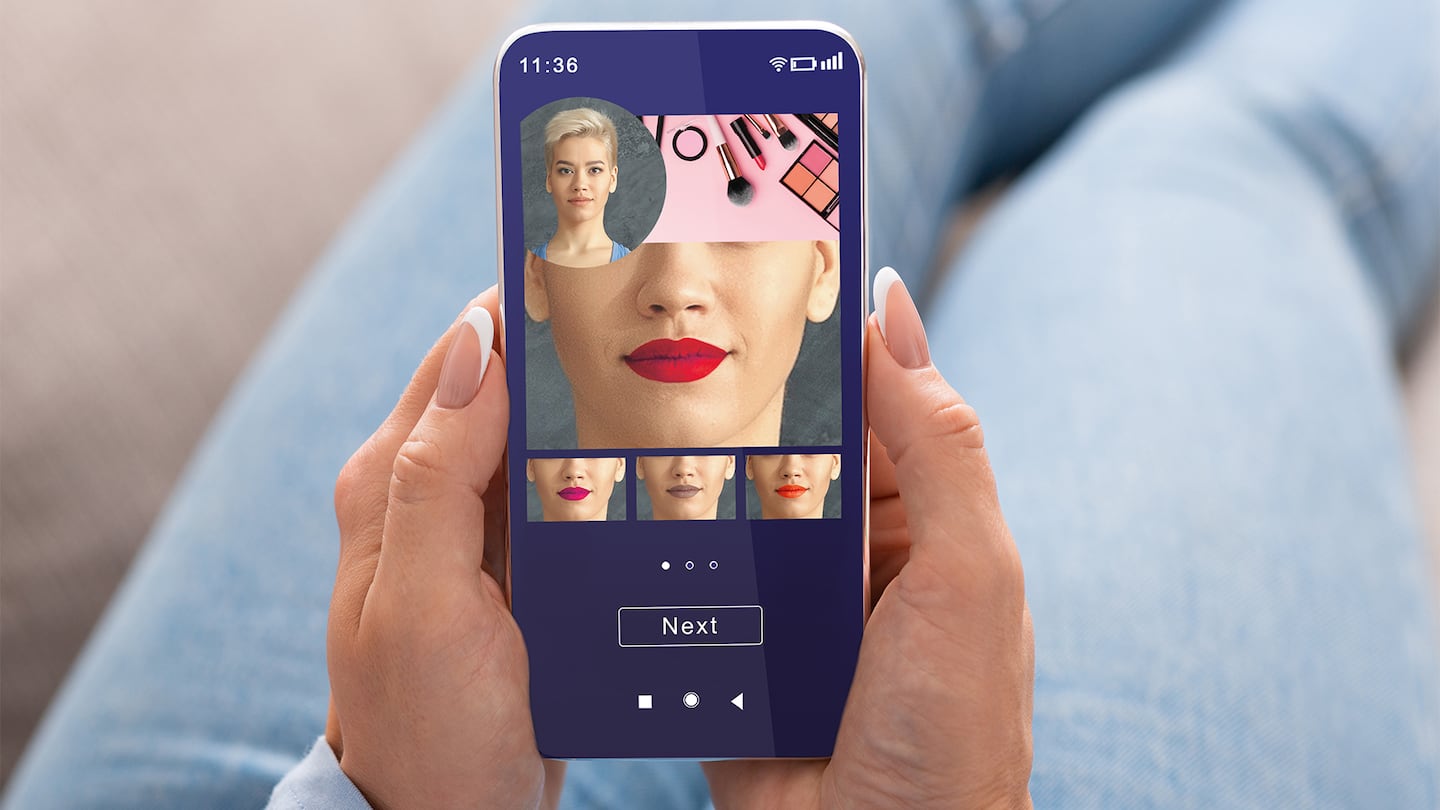

Shares of Meitu Inc. extended their decline into a fourth day after the beauty-app developer disclosed that it expects first-half losses to widen due to soured cryptocurrency bets.

The Xiamen, Fujian-based firm’s stock tumbled as much as 8.7 percent in Hong Kong, the most in over two weeks, after saying it expects impairment from Bitcoin and Ether holdings to triple from a year ago. The loss was disclosed in an exchange filing Sunday, and the company is expected to publish first-half results in August.

The photo touch-up app maker was the first major firm in China to invest in cryptocurrencies, announcing in March 2021 that it made initial trades worth $40 million. Investments in Bitcoin and Ether grew to about $100 million in the following months as the company said that the assets could help diversify its portfolio.

Crypto’s stellar rise in recent years hit an abrupt pause this year after a hawkish Federal Reserve and increased regulatory scrutiny sent prices tumbling. Ethereum’s Ether has plunged over 70 percent so far this year after surging 400 percent in 2021, while Bitcoin is down nearly 60 percent.

ADVERTISEMENT

Meitu has seen increased competition from firms including ByteDance Ltd. and Xiaomi Corp. in recent years. Total monthly active users for Meitu slipped 12 percent in 2021, and the firm now trades just over 10 percent of its debut price. It has yet to turn a profit after its notable initial public offering nearly six years ago. Shares are down nearly 40 percent this year.

Losses for the first half are expected to reach as much as 349.9 million yuan ($52 million), compared with the $45.6 million crypto impairment, which the firm cites as the primary reason for the worsening earnings.

Learn more:

What Brands Need to Know About Accepting Cryptocurrency

Gucci, Balenciaga, Farfetch and others are adopting crypto payments. But before brands follow, they need to consider a number of factors, from how to handle transactions to the risks involved.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.